Getting 'pushed out the risk curve'

Innova Asset Management

As interest rates have fallen globally, first in response to economic and market conditions post the GFC and more recently due to the COVID-19 pandemic, returns from low-risk assets and yields on higher-risk assets (such as share dividends and high-yield bonds) have become both harder to come by and more risky in nature. This means the forecast for a typical 60/40 portfolio of 60% so-called ‘growth’ assets and 40% so-called ‘defensive’ assets are for lower returns and higher risk. The degree to which is the case differs for different regions and asset classes, but is nowhere more evident than the largest and most liquid non-derivative based asset classes in the world – sovereign bonds and US equities. For this reason, investors are having to look elsewhere and therefore are getting “pushed out the risk curve”.

Sovereign Bonds

The three largest bond markets in the world are the US Treasury market, the Japanese Government Bond (JGB) market and European Bond markets. Trillions of dollars of bonds in these markets are trading on negative or zero yield all the way out to 30 years of duration. The US is probably the most attractive here, with the 10-year Treasury yield currently at a positive 0.7% at the time of writing. Not exactly an attractive yield, however compared to JGB’s and German Bonds it looks like an absolute bargain, with those instruments yielding 0.02% and -0.5% respectively. The fact remains that they are still expensive and unattractive assets – and assets that have acted as a key anchor in portfolio construction over the last 30 – 40 years. Investors have been able to rely on a consistent relationship of bonds increasing in price when stocks fell. That relationship could be called into question in the future, yet at a minimum the return from these assets will be paltry at best.

US Equities

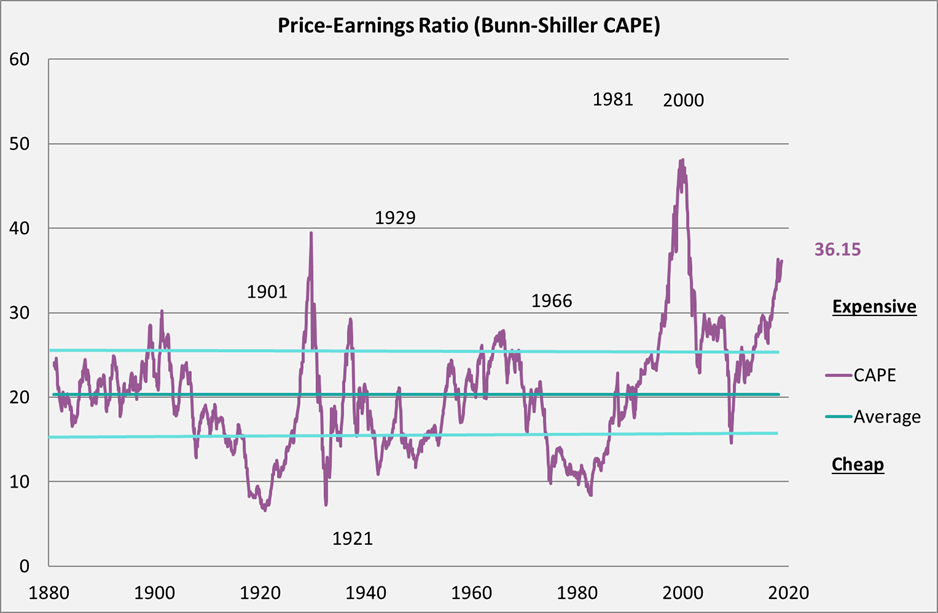

When we turn to equities, the US market is the 800-pound gorilla in the room – being bigger than the entire rest of the world’s stock markets combined. The US market, the S&P500 to be specific, has a very long-term data set that we can look at. Many valuation measures can be used to judge whether the market is cheap or expensive, but we will look at just 2. The first is the famous Shiller PE, or cyclically adjusted price earnings ratio (now adjusted for share buy-backs and dividends). This we have data for back to 1870 and averages earnings over a 10-year period making the first data point being in 1880:

Source: (VIEW LINK)

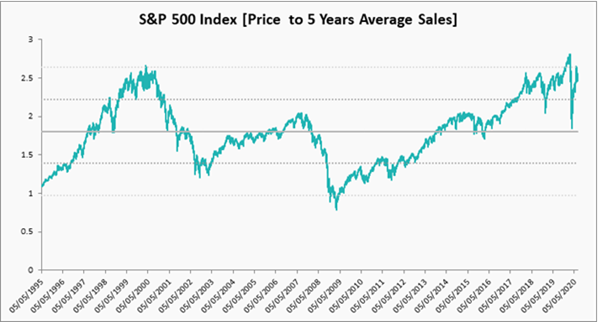

The second is price to 5-year average sales, but this can only be tracked back to 1990:

Source: Bloomberg

The two charts are self-explanatory. Whenever the S&P500 has been over the first band above the average, subsequent returns over 10 years have been poor. Unfortunately, we can throw a third issue into the mix, one we alluded to above. That is the protection role long duration bonds have played over the last 30 – 40 years. What if that relationship breaks down? It has before, with the most recent example being the 70’s, and returns from a traditional 60/40 portfolio were poor.

What does this mean?

This means investors have been chasing return and yield by ‘going out the risk curve’ – this is finance speak for taking more risk in search of return. This has been done by increasing equity allocations or buying high-yield bonds instead of sovereign bonds. Is this appropriate? Some would argue that with cash rates paying 0%, it isn’t a matter of being appropriate, but instead a matter of necessity. In other words, investors and advisors have no choice.

At Innova, we don’t believe this is necessarily the required course of action, and is why we take a very different approach to asset allocation – within bonds, we own more high quality credit instruments, combining these with sovereign bonds paying a real yield (that is a positive yield when adjusted for inflation). This combination is lower risk than the higher-yielding end of the spectrum, and has less inflation risk, but greater correlation to equities (because of the credit risk, though small it may be). Therefore, within equities we have tilted away from expensive markets such as US equities to compensate and towards cheaper markets, faster growing markets or ideally, markets that have both qualities. Additionally, we recognize that inflation fears could lead to the double whammy of falling equity and sovereign bond prices, so we hold a large proportion of floating rate instruments that, if inflation fears cause interest rates to rise, will increase with those rising rates.

These are just some examples of how taking a more nuanced approach to debt and equity investing can yield a more positive outcome, without having to take on excessive amounts of risk. Returns will be lower in the coming years across the board, of that we have little doubt, however we think they’ll still be reasonable, and it will certainly be interesting to look back in 2030 and see what’s transpired.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

Dan is the Managing Director & Co-CIO of Innova Asset Management, a boutique asset consultant and investment manager specialising in multi-asset, diversified investing with a particular focus on managing risk to create robust portfolios for clients.

Expertise

Dan is the Managing Director & Co-CIO of Innova Asset Management, a boutique asset consultant and investment manager specialising in multi-asset, diversified investing with a particular focus on managing risk to create robust portfolios for clients.