Glasgow’s climate moment: Key goals and opportunities

The 26th United Nations Climate Change Conference, commonly known as COP26, has begun in Glasgow. This month, we take a look at the key goals for the conference. We also highlight where some of the most important investment opportunities will be, from renewables and battery storage to adaption and financing.

So, what’s it all about? What are the primary goals?

The recent Intergovernmental Panel on Climate Change (IPCC) report pulled no punches in its conclusions: the planet is warming at an unprecedented rate and is hotter than at any other point on record. This warming is clearly caused by human activity.

Climate change is already wreaking havoc across the world, costing lives, destroying biodiversity, rendering large parts of the world unliveable and, on the current trajectory, things are going to get worse.

It is within this context that the 26th United Nations (UN) Climate Change Conference (COP26) — delayed by the COVID-19 pandemic and complicated by the ongoing energy crisis — began in Glasgow on 1 November (through to 12 November).

The event is being attended by an impressive line-up of world governments, business leaders, and scientists, and is viewed by many as the last chance for coordinated, immediate and widespread action to prevent the direst consequences of climate change.

Australia heads to COP26 with a ‘just announced’ net-zero 2050 target, after Prime Minister Morrison secured an agreement with his coalition Nationals party. The plan involves modest upgrades to 2030 emissions reduction targets (arguably still vulnerable to claims of being insufficient by our COP26 partners).

The Government’s roadmap places a strong reliance on technology, some of which has yet to be fully developed, and ranges from ultra-low-cost solar, hydrogen, batteries to carbon capture and storage.

As COP26 gets underway, four primary goals have been outlined for the conference: mitigation, adaptation, finance and collaboration, all of which have both vast socio-environmental implications and associated economic and investment considerations.

“We must work to unleash the trillions in private finance that are needed to power us towards net zero by the middle of the century. To do this, every financial decision needs to take climate into account.” - COP26 explained, United Nations, UK Government, July 2021

Goal 1: Mitigation—how to secure net-zero and keep 1.5 degrees Celsius within reach?

Countries are being asked to come with ambitious 2030 targets for reduction, or National Determined Contributions, that outline a credible path to achieving net-zero. The Paris Agreement aimed to keep warming well below 2.0°C, conceding a 1.5°C future is a far more desirable outcome.

The 2021 IPCC report found that while this remains possible, enormous efforts are required — and immediately. Some argue this is already not feasible. The Glasgow COP26 may see countries agreeing to set 1.5°C as the objective, instead of planning to remain within the more feasible 2.0°C scenario.

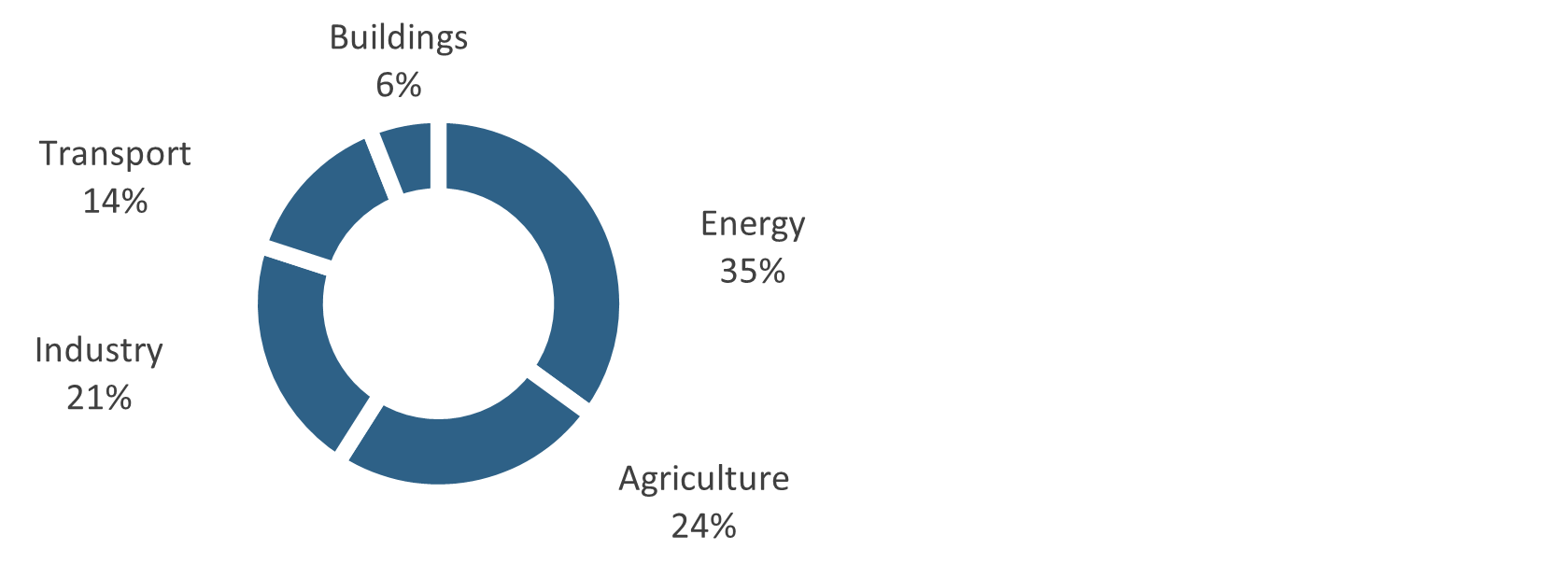

Such ambitions will focus on areas of big emissions, such as energy (currently responsible for 35% of global emissions). COP26 attendees are expected to come with clearer plans to phase out coal and other fossil fuels.

The recent energy crisis has reinforced the need for a coordinated, more orderly transition and far greater investment in the new energy mix.

As such, we expect to see further commitment to non-correlated renewable energy generation, short and long-term storage (e.g. batteries and pumped hydro) and, critically, grid infrastructure (transmission lines, interconnectors etc).

Other areas of focus will include electric vehicles, curbing deforestation, other biodiversity protection measures and, in many ways the most important but elusive issue of all, carbon pricing via emission trading schemes or carbon taxes, which are increasingly being adopted by a range of countries.

Greenhouse gas emissions by segment

Source: SG Cross Asset Research/Global Asset Allocation/IPCC.

Goal 2: Adaptation — how to protect communities and natural habitats in response to the already changing climate

The climate is already changing and will continue to do so (even if the emissions ‘tap’ were to be turned off now, temperatures will continue to increase).

Extreme weather events are becoming more common and more costly and are likely to continue on our current trajectory. As such, our societies and economies need to become more resilient to climate impacts, to avoid further loss of life, livelihoods and natural habitats.

Adaptation activities will focus on resilient infrastructure, enabling buildings, bridges and roads to withstand higher temperatures and more powerful storms. Coastal cities will have to invest in systems to prevent flooding and mountainous regions will have to find ways to limit landslides and overflow from melting glaciers.

Protection and restoration of biodiversity will also be a focus. Ecosystems provide invaluable services, from carbon sequestration to storm protection, from clean water to fertile soil, medicines, food and pollution absorption.

Preservation of the world’s biodiversity will require significant investment (estimated by the UN to be US$140–300 billion annually). As such, we see a significant opportunity for companies offering climate adaptation solutions—from agritech, to building materials—and for the development of new and existing markets, including biodiversity and water.

Goal 3: Finance — mobilising global finance to ensure rapid but equitable action (including for developing countries)

There will be a focus on financial strategies to support the necessary adaptation and mitigation activities and develop new markets to de-risk investments. This will require all forms of finance from public, private and blended investment.

The COP26 Private Finance Hub, led by Mark Carney (UN Special Climate Envoy and Vice-Chair of Brookfield Asset Management) will focus on mobilising private finance to support the “re-wiring” of the economy in line with net-zero. Its work will focus on:

- Reporting—improving the quality and consistency of disclosures, based on recommendations of the Taskforce for Climate-related Financial Disclosures

- Risk management—enabling the financial sector to understand adequately and accurately (and price) climate-related financial risks

- Returns—helping investors quantify the significant opportunities within the transition to net zero

- Mobilisation—connecting capital with investable projects and encouraging new market structures and increasing flows to emerging and developing economies.

The needs of emerging economies will be a particular focus. In 2016, developed economies committed US$100 billion annually in climate financing.

According to the Organisation for Economic Co-operation and Development (OECD), the amount raised has not yet reached the target. Ahead of Glasgow, the UK has doubled its commitment to GBP 11.6 billion and the European Union (EU) has committed EUR 28 billion, both over the next five years.

Goal 4: Collaboration — how to ensure there is global coordination for what is clearly a global issue

Climate change is a global issue, which requires a global solution. A lack of co-operation has contributed to the problems that now urgently need to be solved.

As articulated in the Tragedy of the Commons or the Prisoner’s Dilemma, each country or jurisdiction tends to exploit common resources to its own advantage (typically without limit and potentially leaving everyone worse off). It remains to be seen whether China will be participating in Glasgow, and it is anticipated that Russia’s Putin will be ‘Zoom-ing in’.

The goal of the collaboration will infuse every discussion at the summit. The UN negotiations are consensus-based and the attendees have committed to remaining at the table until all views have been aired and understood.

Much of the focus of the collaborative efforts will be on the development of the rules now needed to achieve the Paris Agreement, the so-called ‘Paris Rulebook’. Areas of focus include climate financing, innovation, transparency and disclosure, global carbon markets, effective relationships between the private and public sectors, carbon credits, all of which have investor implications.

“The investment opportunity for the clean energy transition is significant," Brookfield Asset Management reported in July. "The IPCC estimates that almost $3 trillion of annual investments are needed to limit warming to 2°C by 2050, or $3.5 trillion annually to limit warming to 1.5°C.

"Goldman Sachs sees a total investment opportunity of up to $16 trillion by 2030 in a scenario that would be consistent with the global ambition to contain global warming within 2°C."

A focus on creating momentum. As the IPCC report identified, the next decade is decisive, and whatever COP26 brings during November, momentum will only grow to deliver the markets and solutions needed to give any hope of achieving the 1.5°C scenario.

Source: Crestone.

Climate investment themes from COP26

As we wrote back in 2020 in A warming world, “as governments and businesses grapple with the reality of our changing climate, there will be a range of risks and opportunities that investors need to navigate”.

The beneficiaries of the transition to a low-carbon economy are wide-ranging and include sectors such as renewables and sustainable transportation, as well as resource efficiencies and waste and water management. “Financing has already been identified as a key accelerator of the transition to a net-zero economy”, as recently noted by Société Générale.

The COP26 event is only likely to encourage and highlight an increasing cohort of opportunities across asset classes, from managed funds to individual securities, listed and unlisted.

But it will also be important for investors to be keenly focused on understanding precisely where they are investing capital, the true nature of underlying investments, while also being valuation-aware as flows may potentially lead to periods of exuberant price gains.

Equities — gaining exposure across a broad range of themes

Equity investment, both direct and managed, will continue to provide largely unconstrained access to a broad range of climate-related themes. In advanced economies, attention will focus on mitigating technologies, whereas, in emerging economies, rapidly growing incomes and populations will require substantial capital to underpin the growing demand for cleaner technologies.

For direct equities, the transition to a lower-carbon economy is expected to present opportunities across a broad range of sectors, many of which have been mentioned earlier. These include energy efficiency, green infrastructure, electric vehicle, battery technology and the like.

The journey to net-zero 2050 has also seen the development of a range of exchange-traded funds (ETFs) that provide active and passive exposure to climate-related investments.

There is also a range of equity managed funds targeting climate-related outcomes, ranging from single thematics to investments across the broad spectrum. These thematics include clean energy, waste management, recycling, sustainable transport, water efficiency, and healthcare technology.

Fixed income — green and sustainable bonds

Green bonds, where capital is used for climate-related projects, have been a rapidly expanding investment opportunity. In 2021, USD 1.46 billion of green bonds were issued, up from USD 1.04 billion in 2020. Recent estimates suggest this could rise to USD 2.5 trillion by 2025 (according to Société Générale). Energy, buildings, transport and water were the top recipients of green bond proceeds in 2020.

Sustainability linked bonds (SLBs) differ from green bonds. These are financial instruments that oblige companies to stick to their carbon neutrality targets (without necessarily using the funds for climate-related projects).

Investors can typically garner access to green and SLB bonds, as well as sustainable credit, via fund managers focused on these types of investments.

Alternatives — from unlisted credit to renewable infrastructure

Alternative investments are likely to play a key role in the transition to net-zero. This will cover a range of investments from venture capital to funding new technologies, unlisted credit and debt for companies operating in climate-related industries, and the funding of clean or green capex.

As Brookfield notes, the “electrification of industry and transportation is also a huge driver of the net-zero transition, but only to the extent that clean forms of energy are used. The resulting increase in demand for electricity worldwide redoubles the need for investment in clean energy technologies."

Real assets should be a significant attracter of capital in the period ahead. Brookfield notes that in regard to infrastructure, many companies will need to partner with solutions providers to help put them on a net-zero trajectory. Decarbonisation solutions include renewable power generation (mainly wind and solar, but that also include distributed generation), green hydrogen and battery storage.

This wire was co-written with Rachel Etherington, investment adviser at Crestone.

Learn what Crestone can do for your portfolio

With access to an unrivalled network of strategic partners and specialist investment managers, Crestone Wealth Management offers one of the most comprehensive and global product and service offerings in Australian wealth management. Click 'CONTACT' below to find out more.

3 topics