(Global) forecasts are too high. Why?

The August corporate reporting season is now mid-month in Australia, but in terms of actual numbers the harvest to date is still tiny. FNArena's Corporate Results Monitor still only has 63 results (as at August 17), and we are expecting that number to grow to 350 by the first week of September.

I am not trying to be the early party-pooper, but there hasn't been much as yet to draw a lot of positive inspiration from.

Up until a few years ago, reporting seasons used to take off with a number of positive results, but this year's early-season sentiment boost clearly has to come from the likes of BlueScope Steel (ASX:BSL): companies whose share price had been pulled down too far.

In terms of released results to date, the FNArena Monitor has 39.7% (25) as reporting in line with forecasts, with beats (19) and misses (19) on an even keel. Too early to draw any firm conclusions.

****

UBS strategist Richard Schellbach is more optimistic. He sees early indications of corporate Australia proving more resilient than the sceptics are forecasting. Market updates by the major banks are one prime example of this thesis.

Of course, the obvious contra-comment to make here is the true impact of RBA tightening has yet to be felt, and CBA head honcho Matt Comyn, for one, is preparing for a rough twelve months ahead.

To Schellbach's credit, confession season has been fairly mild prior to August and most companies, though they may not inspire higher forecasts or increased enthusiasm, they are still predominantly performing in line with guidance and market expectations.

As expected, analysts are busy downgrading forecasts for the year ahead; a process that already started in the months leading up to August. Schellbach predicts such downgrades are likely to persist over the next six months.

Traditionally, and all else remaining equal, this would form an extra headwind for the market in the coming months.

Market strategists at Macquarie are equally positive after the first two weeks of corporate financials in Australia, noting large caps and financials, in particular, have managed to generate more positive earnings surprises while free cash flow has generally been better-than-forecast.

Macquarie does acknowledge the low sample to date, plus the fact discretionary retailers and industrial companies have yet to report in large numbers. Inventories could be the extra sting on top of rising costs.

Macquarie also observes that 35% of reporting companies to date have guided to growth below 6% in the year ahead. This, the broker highlights, would be below inflation if its own inflation projection for 2023 comes to pass.

One early observation worth highlighting is Macquarie pointing out that stocks with high short interest have thus far experienced the best post-result returns.

In contrast to its early reporting season assessment, Macquarie doesn't like the market's set-up with valuations considered high, in particular if that US recession arrives next year, as is the broker's in-house prediction.

Macquarie thinks a lot more downgrades will be needed to pull profit forecasts in line with next year's reality on the ground.

The combination of still-high valuations and forecasts cum further downgrades elicits a rhetorical question from Macquarie: how can this be a new bull market?

****

Even more worried than Macquarie about analysts' overly optimistic forecasts is the team of US strategists at Citi.

On their observation, present bullishness in analysts' forecasts globally has only been matched twice; in 2000 and in 2007. Of course, we all know what subsequently happened; a big bear market opened up and share markets halved in value.

Citi runs a regularly updated Bear Market Checklist, with the strategists explaining this is exactly why (too) bullish analysts' forecasts are one of the warning signals on the checklist.

The discrepancy between top-down forecasters and the bottom-up projections by analysts could hardly be more different: the first group is seeing ever more signs of recession ahead, but there's currently no room for such economic contraction in bottom-up forecasts.

Just to be sure: peak bullishness in forecasts does not by default mean share prices will halve in the months ahead. Citi's historical data going back to 1994 shows one other example: 2010-2012. Back then, remind Citi strategists, peak bullishness proved a false signal. Global equities merely traded sideways over the following 12 months.

How do we explain this wide divergence and why is it that bottom-up forecasts are the ones most likely out of sync with reality?

From Citi's report:

"Notably, analysts get the beginning of bear markets very wrong. Instead of turning cautious, they turn even more bullish.

"Even though they are starting to revise down earnings forecasts, falling share prices and cheapening valuations keep them positive.

"They do eventually turn more cautious as earnings forecasts fall further, but it is a slow process."

Here's the official warning:

"With prices falling further than EPS downgrades, PE multiples are contracting.

"Surely the bad news is already priced in?

"History suggests that investors should be wary of following this logic."

.jpg)

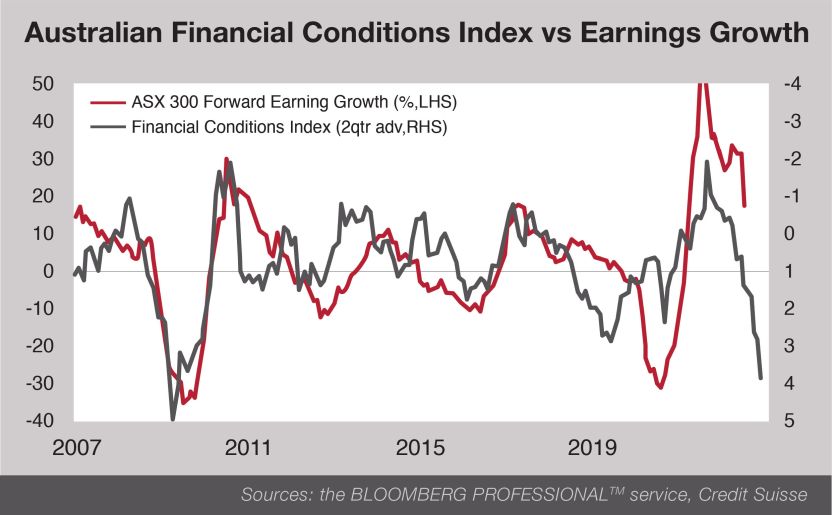

Citi's assessment, albeit global, receives two thumbs up from Credit Suisse's in-house assessment of financial conditions in Australia. The RBA's tightening thus far in 2023, explains Credit Suisse, has already amounted to one of the fastest periods of financial tightening for the country.

Now for the bad news (supporting the views of UBS, Macquarie and Citi): history shows financial tightening precedes actual GDP by two quarters, or half a year. This signals domestic GDP in Australia will shrink to below 2% growth by early 2023, and thus forecasts for corporate profits will prove too high.

Credit Suisse estimates the risk to corporate profits in Australia is circa -15% over calendar year 2023. The broker also thinks the RBA is ready to turn more dovish in Q4, which will provide market support when analysts should be busy further reducing forecasts.

.jpg)

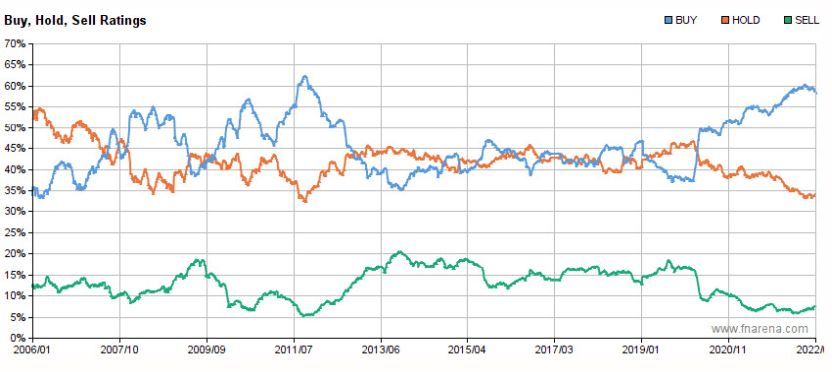

FNArena is in the unique position of having our own data, and history going back to early 2006, which allows us to check data assessments such as the one highlighted by Citi.

On FNArena's Buy-Hold-Sell data, the percentage of Buy (and equivalent) ratings in Australia has seldom been as high as this year, which is one reason why I personally have been warning about a bear market this year.

As also expected, with more than 59% in positive ratings, local analysts are issuing more downgrades than upgrades, with downward adjustments to valuations outnumbering increases, as underlying growth projections are coming under pressure.

I can confirm Citi's general observation: these are slow-paced processes. Analysts are using the relative resilience in FY22 performances as a general sign to go slowly on paring back next year's numbers, also supported by relatively upbeat comments from management teams at companies.

While none of these statistics tells us anything about the likely trend in markets in the days, weeks, or even months ahead, they do raise serious questions about today's valuations and calls for a new bull market having commenced.

As always, successful investing is not about constantly making accurate forecasts. It's about making sure that if a forecast proves wrong, you're not losing your shirt and trousers in the process.

****

FNArena offers impartial, ahead-of-the-curve share market commentary and analysis, on top of proprietary data, tools and applications for self-managing and self-researching investors. The service can be trialed at (VIEW LINK)

4 topics

1 stock mentioned