Gold Market Déjà Vu – Why Gold Could be the Commodity Dark Horse of 2018

MineLife

There’s an overwhelming sense of déjà vu as far as the gold market is concerned. Two years ago during December 2015, we witnessed the first US Fed rate hike since the 2008 GFC – a 25-basis point increase. This followed years of promises, threats and jawboning by the US Federal Reserve with respect to interest rates.

Back then, gold finished 2015 in limp fashion, as market experts fully expected the Fed to follow through on its stated commitment at the time of 3–4 rate planned rate increases during 2016. Gold however did the exact opposite – it surged out of the blocks during early 2016, as it became obvious that the Fed’s rate talk was exactly that – all talk and no action – and it sustained its positive performance right up until the election of Donald Trump as President in November 2016.

Gold was again strong out of the blocks in early 2017, once more defying the skeptics. And so here we are again, with the Fed raising rates this month by 25 basis points. Gold weakened in price in anticipation of the rate rise announcement, before a subsequent recovery.

Surprisingly for some, gold has performed really well in comparison with the broader US share market, as well as the US currency, so far during 2017. This is clearly illustrated in the graphic below.

The chart below might surprise also, as it shows that since 2000, the gold price has beaten the S&P 500 Index, which has undergone two 40% corrections so far this century.

US Dollar Weakness to Continue

I expect US dollar weakness to continue – and this of course has major implications for gold’s future direction, as the two typically move inversely to each other.

A strong US dollar represents a major negative for US manufacturing and exports in particular. Trump himself has said that the strong US currency is “killing American exports.” Emerging markets in particular will shy away from purchasing from the US when their own currencies are weak relative to the dollar. In my view there is likely to be a focus on ensuring that the dollar trends lower.

President Trump's pick to lead the US Federal Reserve after Janet Yellen steps down in early 2018, Jerome Powell, has pledged to support the Fed's dual goals of stable prices and maximum employment. Reading between the lines, I don’t see an aggressive program of rate increases anytime soon.

Markets have factored in a Trump growth explosion, with a heavy emphasis on job creation, a renaissance in manufacturing and export growth. None of this has actually happened yet, even after almost 12 months in the job, however the Dow Jones keeps hitting record highs – and potential bubble territory.

The Debt Dilemma

Markets have also failed to take into account the impact that rising interest rates would have on the US economy, in terms of servicing the enormous level of debt that has built up. The graph below shows the amount of federal debt outstanding over the past 40 years. As is clearly evident, federal debt exploded upwards with the financial crisis of 2008 and began its meteoric ascent to US$20 trillion presently.

Given its sheer size, if the interest rate on that debt were to rise by even 1%, the annual federal deficit rises by $190 billion. A 2% increase in interest rate levels would up the federal deficit by $380 billion and if rates were 5% higher, the annual federal deficit rises by $950 billion.

Trump’s recent tax amendments could send deficits ballooning by $1.7 trillion over the next 10 years, according to a projection from the Congressional Budget Office (CBO). U.S. debt would rocket to 97.1% of GDP in 2027, up from 91.2% using the CBO's prior projections. The deficit spike could slowly undermine confidence in the US dollar, sending investors into gold as a safe-haven.

It’s Not about Higher Rates, but Real Interest Rates

History shows us that when the ‘real’ interest rate is negative, gold performs well. The real interest rate (the interest rate after taking into account the rate of inflation) in the US has been in negative territory since 2008 (i.e. well below the inflation rate) - and even if we see further interest rate increases, the likelihood is that the ‘real’ underlying interest rate in the US will remain in negative territory.

There are numerous recent examples of a rising rate/rising gold environment. In fact over the past five decades the rising rate/rising gold scenario is common, with the last four raising cycles accompanied by a stronger gold price. The most recent was when the Fed increased interest rates between 2003 and 2007 - with rates rising from 1% to over 5.5% and gold rallying by 150% to $800/oz.

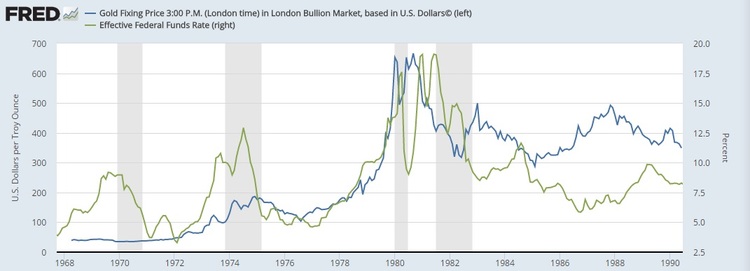

Another significant period was from the 1970s, when the Federal Funds Rate rose from below 4% in 1971 to over 18% in 1980 - while gold rose by 2,400% from $35/oz to $850/oz.

Gold prices have been much more likely to rise if interest rates go up than if they stay the same, according to data from the Federal Reserve Bank of St. Louis. Between 1986 and 2016, the chance of gold rising in the months the Fed raised rates was 55%. The chance of gold being higher 12 months after a Fed hike was 61%. On average, gold prices moved 0.7% in months where the Fed hikes, versus 0.4% in months where policy stays the same. The average price change 12 months later was 7.2%.

This data essentially shows that a rising interest rate environment led to gold prices increasing, a fact that will be lost on many investors who assumed otherwise. A rising interest rate environment in the three decades following the 1950s was the largest precious metals bull market in modern history. Below is a comparison of the Federal Funds rate and gold prices between 1968 and 1990.

Gold’s Supply Side Challenges

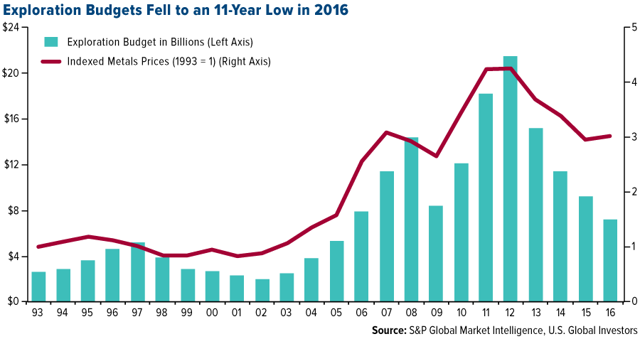

Let’s not forget that there are significant supply side challenges impacting the gold industry. Major gold miners face a dilemma - robust demand for their product, but question marks over how they will meet demand. Annual gold production is currently running at record levels, but will it be able to sustain itself - given slashed exploration budgets, falling levels of new discoveries and declining reserves.

The industry is not finding as many new deposits as they need to in order to maintain current production levels. Although we can expect incremental technological improvements in processing, mining, and exploration, there is nothing revolutionary on the horizon. Reserves from aging deposits are not being replaced by new discoveries, a situation exacerbated by rising exploration and development costs, as well as development hurdles like sovereign risk and project financing.

Bitcoin

The mainstream and alternative media have been propagating the idea that the frenzied capital flowing into Bitcoin is affecting the price of gold negatively. The idea is that Bitcoin is an alleged safe haven asset (very unproven and so far untested) that is diverting capital away from the precious metals.

Demand for gold is determined primarily by the large eastern hemisphere countries in which the populace and Central Banks continuously accumulate gold for investment, consumption in the form of jewellery, as well as bank reserves. Bitcoin is hugely speculative and has done nothing to displace this demand - demand which, at the margin, exceeds mined supply.

Conclusion

Real interest rates are likely to remain negative in the years to come, even if we do see further rate rises. Gold has finished the past three calendar years in the relative doldrums, but burst out of the blocks at the beginning of both 2016 and 2017 – and I believe we’ll see a similar performance during 2018.

I also believe we’ll see further curbs on the rise of the US dollar during 2018 in order to maximise the performance of US trade and minimize the impact of servicing the country’s extraordinary debt burden that has escalated enormously since the GFC. This will continue to provide impetus for commodities, including gold bullion.

Accordingly, we maintain confidence in our base-case gold price target range for the yellow metal during 2018 of between $1200 and $1500/oz.

11 topics

Gavin has been a senior resources analyst following the mining and energy sectors for the past 25 years, working with Intersuisse and Fat Prophets. He is also the Executive Director, Mining & Metals with Independent Investment Research (IIR).

Expertise

Gavin has been a senior resources analyst following the mining and energy sectors for the past 25 years, working with Intersuisse and Fat Prophets. He is also the Executive Director, Mining & Metals with Independent Investment Research (IIR).