Gold vs Bitcoin: Which is the better investment?

Both Bitcoin and gold have been described as a store of value, a way to protect investors from currency depreciation given they are not tied to central bank policies, and both have had an exceptional 12 months - with Bitcoin and gold prices rising 121% and 26% over the past 12 months.

But according to Robin Tsui, APAC gold strategist at State Street Global Advisors, the similarities stop there.

While he notes that flows into Bitcoin ETFs and gold-backed ETFs have been ramping up on expectations that central banks - and particularly the Fed - will cut rates in the fourth quarter, he recommends investors don't just invest in Bitcoin ETFs, arguing there are three key reasons why gold is a better diversifier.

In this episode of The Pitch, he takes investors through them, and shares some of the global trends he is seeing in terms of flows into Bitcoin and gold-backed ETF products.

Note: This episode of The Pitch was recorded on 15 July 2024. You can watch the video or read an edited transcript below.

Edited Transcript

Robin Tsui: Thanks for having me.

Ally Selby: Gold and Bitcoin have been quite divisive asset classes. Both have been described as a store of value and both have done really well over the past 12 months. Can you take us through the similarities and differences between gold and Bitcoin?Bitcoin and Gold: Similarities and differences

Robin Tsui: The similarity between Bitcoin and gold is the independence from the government. So Bitcoin and gold can potentially protect investors in terms of currency depreciations because both asset classes are not tied to a government's monetary policies. So that's the similarity between Bitcoin and gold.

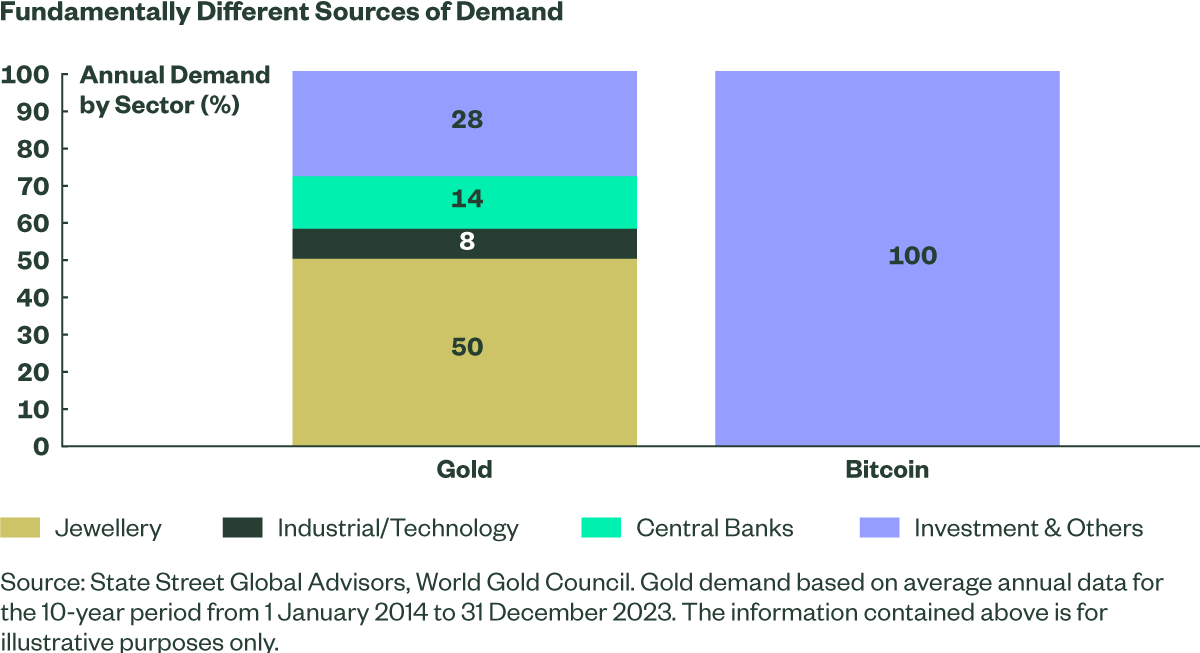

There are three key differences between Bitcoin and gold. The first difference comes from the fact that the real-life demand is quite different. So if you look at gold, what drives gold prices is demand, which comes from the jewellery sector, the investment sector, central banks and also the industrial sector. But if you look at Bitcoin, it's purely driven by the investment sector.

The key difference between Bitcoin and gold is that central banks around the world do not invest in Bitcoin, but they invest in gold as a way to diversify their foreign exchange reserves. The second reason is liquidity. Gold is traded around $163 billion a day on average. That's about nine times larger than Bitcoin.

So in terms of the liquidity profile, gold has much more liquidity than Bitcoin. That's why central banks, and institutional investors, prefer gold over Bitcoin because of this liquidity profile. And thirdly, the ability to hedge against equity risk. Gold is a proven asset to do that. But if you look at the past 15 years, when the S&P 500 is down by about 10%, Bitcoin's average drawdown is about negative 37%*. So that factor alone does not provide a perceived benefit in terms of diversification.

*Source: Bloomberg, State Street Global Advisors. Data as of 31 December 2023.

How are Bitcoin and Gold valued?

Ally Selby: How do you value these asset classes?

Robin Tsui: Both Bitcoin and gold don't have cash flows, so we can't adopt a discount cashflow model to value Bitcoin and gold. But one way we can look at the trends of Bitcoin is to look at the currency market and look at the underlying demand through investment. We'll look at some of the positioning in Bitcoin and gold as well. We can get a gauge in terms of where the money is heading. So we can look at the investment flows in Bitcoin and gold to gauge the direction of both asset classes. But in reality, it's very difficult to value Bitcoin and gold because they don't provide any cash flows.

Why has Bitcoin outperformed?

Ally Selby: Bitcoin has delivered five times the performance of gold over the last 12 months. Why do you think that is?Robin Tsui: Bitcoin, from our perspective, it's quite speculative. Obviously, the price performance has gone up by five times more than gold. But if we look at volatility, it's actually quite high as well. So if we look at the annualised volatility of Bitcoin, it was about 93% last year compared to gold, which was about 15% per annum. So the price is up five times more, but volatility is about six times more as well. So the risk and return profile of Bitcoin is extremely different to gold as an asset class.

Bitcoin and gold outlook over the next 12 months

Ally Selby: What's your outlook on the two asset classes over the coming 12 months? What do you think we'll see in terms of performance?Robin Tsui: We think both asset classes have more room to run in terms of demand. From what we're seeing now, the flows into both Bitcoin ETFs globally and also the flows into gold back ETFs have been returning, because we expect central banks around the world, especially the Fed, will start to cut rates in the fourth quarter. And potentially, that will be beneficial to non-cash flow assets like Bitcoin and gold. But from our perspective, we do encourage diversification. So it's okay to have some Bitcoin, but it's more important to use gold as a diversifier, as a defensive asset to hedge against your exposure to equities and bonds.

Ally Selby: Can we get a little bit more granular, what are you seeing in terms of preferences on gold and Bitcoin for different regions around the world?Robin Tsui: So this year we've seen quite strong inflows into Bitcoin ETFs in the US because recently they launched the first Bitcoin spot ETF. We've seen close to about A$23 billion in net inflows that have gone into the Bitcoin ETFs. So it's quite a substantial investment in terms of the flows.

From a gold perspective, it's quite interesting, if we look at different regions we're seeing different sentiments. In the US and EMEA, we saw outflows in the first half. That's because the interest rate environment is a lot higher than in Asia or even Australia.

But in APAC, we're seeing very strong inflows into those gold-backed ETFs, because the interest rate environment in Asia and APAC is a lot lower than in the West. Also, the need to hedge against the local currency depreciation in Asia is becoming a more important factor in Asia as well. So in the first half, we've seen very strong inflows into Bitcoin ETFs, but also very strong inflows in Asia for gold-backed ETFs.

Ally Selby: Well, thank you so much for your time today. It was awesome to feature you on the Pitch. If you enjoyed that, don't forget to subscribe to Livewire's YouTube channel. We're adding so much great content just like this every single week.A portfolio diversifier with staying power

Robin and the team have recently produced a whitepaper looking at the primary benefits and drawbacks gold may offer portfolios relative to other major asset classes over the long run. He also presents a case study to examine how including gold in a hypothetical multi-asset portfolio would impact its risk-return characteristics. You can read the report here.

5 topics

1 contributor mentioned