Goldman, JPMorgan and Citi earnings: A window into markets and the economy

The earnings transcripts and C-suite letters from major US banks provide valuable insights into current economic trends and market conditions.

Most major US banks have reported their September quarter results. In this wire, I summarise some of the key takeaways from major banks including:

- Goldman Sachs (NYSE: GS)

- Citi (NASDAQ: C)

- JPMorgan (NYSE: JPM)

- Morgan Stanley (NASDAQ: MS)

- Wells Fargo (NASDAQ: WFC)

- Bank of America (NYSE: BAC)

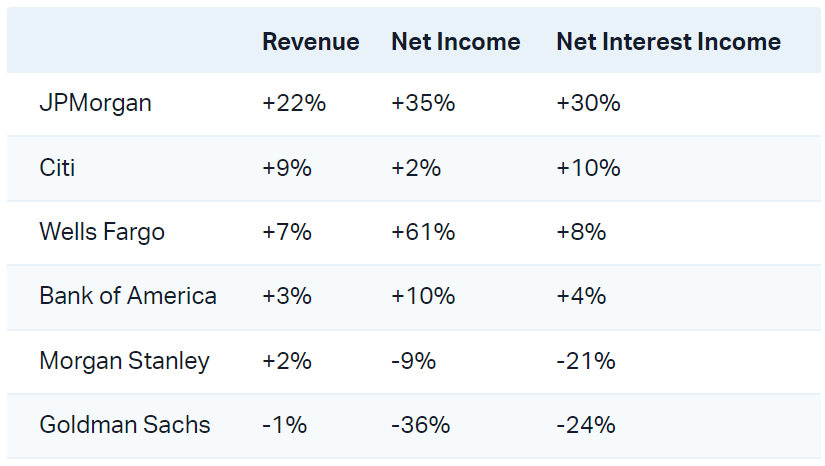

September Quarter At a Glance

Most major banks topped earnings expectations and upgraded their full-year outlook.

The main anomaly was Morgan Stanley, where earnings came out slightly ahead of consensus but wealth management and investment bank revenue fell short of estimates. Its shares fell 6.8% on the day of the results.

Macro Talks

CEOs expressed cautious optimism about the economy, with the possibility of a mild recession.

- JPMorgan CFO Jeremy Barnum: “Our US economists had their central case outlook to include a very mild recession … Two quarters of negative 0.5% of GDP growth in the fourth quarter and first quarter of this year.”

- Citi CEO Jane Fraser: “Recent data implies a soft landing but history would suggest otherwise, and we are seeing some cracks in the lower credit score consumers.”

- Wells Fargo CEO Charlie Scharf: “Our base case remains a continued slowing of the economy, but we remain prepared for a wide range of scenarios, given there is still significant uncertainty ahead.”

- Bank of America CEO Brian Moynihan: “Our team of economists predicts a soft landing, with a trough in the middle of next year. We see that in our customer data, our 37 million checking customers, we see their spending slowing down.”

- Goldman Sachs CEO David Solomon: “I'm still of the belief that there's been a lag with this tightening and across a broad swathe of the economy, we will see more sluggishness … I do think over the next two to four quarters, the impact of that tightening will be more evident and will create slowdowns in some areas.”

State of the Consumer

There’s a slowdown in consumer spending, with growth rates backtracking towards pre-pandemic levels.

- JPMorgan CEO: “Consumer spend growth has now reverted to pre-pandemic trends with nominal spend for customer stable and relatively flat year on year. Cash buffers continue to normalise to pre-pandemic levels with lower income groups normalising faster.”

- Goldman Sachs CEO: "As I interact with CEOs … particularly around consumer businesses, in some softness, particularly in the last 8 weeks in some of their behaviours. I don't want to over-amplify that because I think the economy and the consumer has been more resilient.”

- Bank of America CEO: “"... another strong quarter ...We did this in a healthy but slowing economy that saw US consumer spending still ahead of last year but continuing to slow.”

Credit Quality

Banks continue to see high credit quality that’s below pre-pandemic averages. They are not seeing any signs of rapid deterioration in charge-off rates and delinquencies.

- Bank of America CFO: “Charge off rate was 35 basis points, that's 2 basis points higher than the Q2 and still below the 39 basis points we saw in Q4 2019. And as a reminder, that 2019 was a multi-decade low.”

- Wells Fargo CEO: “Delinquencies have continued to deteriorate at a relatively slow, consistent rate without signs of acceleration across our portfolios.”

- Bank of America CEO: “We continue to see the asset quality metrics come off the bottom. And for the most part, they remain below historical averages … 30 and 90 consumer delinquencies still remain below the fourth quarter of 2019.”

Commercial Real Estate

- Wells Fargo CEO: “Vacancy rates continue to be high, and the office market remains weak …We have not seen significant increases in charge-offs in our commercial real estate office portfolio yet … we do expect higher losses over time.”

- Goldman Sachs CEO: “To clarify, for our CRE in the office space, we’ve either marked or impaired that down by ~50% I think that’s quite significant.”

Net interest income

JPMorgan, Wells Fargo and Bank of America all lifted their full-year net interest income outlook. But expect such tailwinds to begin fading in the fourth quarter.

- Bank of America CFO on NII drop from Q3 to Q4: “First is you’ve got a little bit of deposit pricing lag here … Second is we’re sort of baking into some continued normalisation of consumer balances … Third, we had hoped for loan growth in Q3, we just didn’t see that.”

- Morgan Stanley CEO: “Looking towards the rest of this year, based on where we exited the quarter, we expect NII to trend lower.”

Deposits

Banks are reporting a decline in average deposits as clients shift their money to higher-yielding investments.

- JPMorgan CEO: “Average deposits were down 7% year on year and 5% quarter on quarter primarily driven by lower non-operating deposits as clients opt for higher-yielding alternatives.”

- Citi CEO: “Average deposits decreased 2%, largely reflecting our clients putting cash to work in investments on our platform.” – In the context of Personal Banking and Wealth Management business

- Wells Fargo CFO: “Average deposits declined 5% from a year ago, predominantly driven by deposit outflows in our consumer and wealth businesses, reflecting continued consumer spending and customers reallocating cash into higher-yielding alternatives.”

- Goldman Sachs CFO: “Deposit balances were down slightly sequentially … reasonably in line with the industry, given some migration to other higher-yielding opportunity sets.”

Capital markets

Capital markets activity remains subdued and volatile.

- Goldman Sachs CEO: “Since Labor Day, there have been four marquee IPOs priced in the United States, Arm Holdings, Instacart, Klaviyo and Birkenstock … If conditions remain conducive, I expect the continued recovery for both capital markets and strategic activity.”

- Morgan Stanley CEO: “Investment banking revenues remained depressed on lower volume …While increased confidence supported early September issuances, a hawkish tone from the Federal Reserve, and resulting moves in interest rates serve as a reminder that this market remains window-driven.”

5 topics

6 stocks mentioned