Has crypto unravelled?

During May, bitcoin and crypto markets suffered one of the worst weeks in recent memory with many sceptics (again) declaring that bitcoin and crypto are dead. The website 99 Bitcoins tallies Bitcoin ”obituaries”. To qualify, the content of an article “must be explicit about the fact that Bitcoin is or will be worthless” and must be “produced by a person with a notable following or a site with substantial traffic”. According to these criteria, Bitcoin has “died” 449 times since inception.1

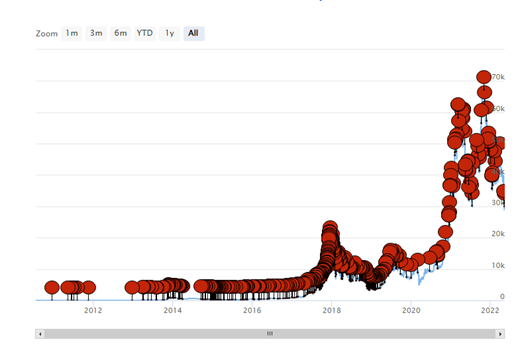

Bitcoin “obituaries”

As of 6 June 2022, Bitcoin was down -54.7% from its all-time high in November 2021. This drawdown does not even qualify for the top five worst drawdowns of bitcoin’s history. Bitcoin has suffered much worse and has (to date) bounced back.

Throughout bitcoin’s 13-year history, purchasing at the highest price of any year and experiencing any drawdown, if you held for a minimum of four years, the position would have been well ahead. Of course, it’s important to remember that past performance isn’t necessarily indicative of future performance.

There are currently over 19,000 cryptocurrencies. It’s possible that 99% of them will end up being worthless over the long term. However, the technology and the 1% that may survive have the potential to have a meaningful impact and may be worth paying attention to.

For my examples below, I mainly refer to bitcoin and not the entire crypto market. It has the largest market cap by far, over 150 million people have used bitcoin in some capacity, its use case is different to altcoins, and it is the longest-running crypto asset. Altcoins effectively compete with one another, are not as decentralised, not as secure, and have not been in existence for the same length of time.

Five crypto use cases

Bitcoin has been often pitched as a hedge against inflation. Generally, the objective of a hedge is to offset potential losses or gains that may be incurred by a “companion” investment.

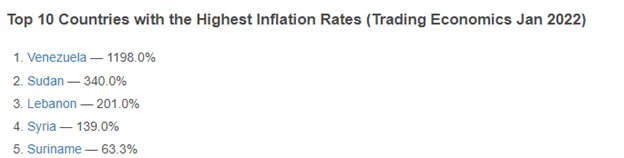

As a real-time hedge, bitcoin is not seen as effective. But as a hedge against the debasement of fiat currency through (for example) reckless government spending or poor stewardship of economies, it could be more effective, even taking its volatility into account. Keep in mind that citizens of some of these countries may not be able to hold alternative fiat currencies like the US dollar for fear of confiscation.

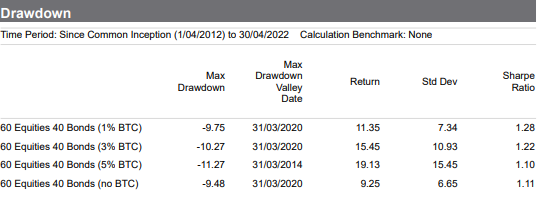

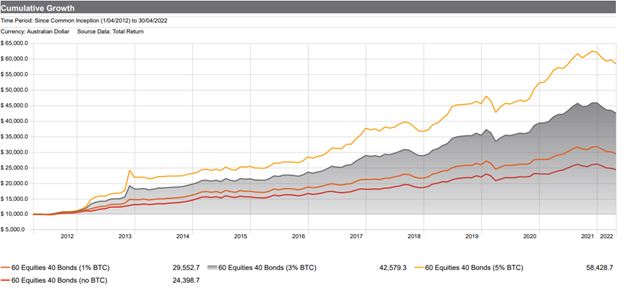

As seen in the following chart, even with the most recent correlation to equity markets, bitcoin can act as a portfolio diversifier. For example, a small allocation of 1% to 3% could help to improve the Sharpe ratio and risk-adjusted returns on a hypothetical 60:40 portfolio of equities and bonds.

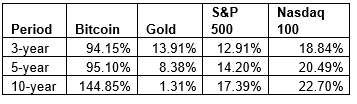

Bitcoin may be considered an alternative store of wealth for investors with a longer investment time frame and higher risk tolerance. For taking additional levels of risk, investors should be compensated with higher levels of return. Bitcoin is volatile, but longer-term investors have, to date, been rewarded with higher returns compared to many other asset classes. From July 2010, when bitcoin started to price at $0.05, its returns have outperformed traditional asset classes such as gold and equities over various time periods (see table below).

Annualised returns of bitcoin, gold, and equities, as at 30 April 2022

Cumulative growth of 60/40 portfolio with 0,1,3,5% weighting to bitcoin

Bitcoin is increasingly being accepted as a means for payment. Throughout the US, fashion houses such as Gucci, Phillip Plein and Off-White accept crypto as payment, as do AMC movie theatres. Announced in April, major payment networks NCR, Shopify, and Blackhawk will allow major retailers to accept bitcoin payments. (2)

Bitcoin became legal tender in El Salvador in 2021. And this year, the Central African Republic became the second country to adopt bitcoin as its official currency, alongside the regional Central African CFA franc. It would not be surprising to see more countries follow in the footsteps of El Salvador and the Central African Republic within the next couple of years.

Even if bitcoin is not used as a currency, it is accessible to anyone who has a low latency internet connection. It can be transferred seamlessly and without friction. Unless someone gains access to your private keys, it can’t be confiscated.

Debunking popular Bitcoin myths

Arguably one of the worst ways to hide criminal activity may be to use bitcoin, a blockchain that is immutable, transparent and where activity can be traced. For example, suing bitcoin led to the bust of the web’s biggest child abuse site. (3)

It was recently reported by Chainalysis that, in 2021, transactions involving illicit addresses represented just 0.15% of cryptocurrency transaction volume. That's despite the raw value of illicit transaction volume reaching its highest level ever (though it is expected that this figure will rise as Chainalysis identifies more addresses associated with illicit activity and incorporates their transaction activity into historical volumes – for example, in 2020, the figure was revised up from 0.34% to 0.62%.(4))

Most of the crimes that crypto historically has been used for are low-level types such as scams, hacks, and rug-pulls - currently, when it comes to criminal activity, cash is king.

Recently, Russian oligarchs have not been able to use crypto to evade sanctions. Exchanges have been able to identify their users and they have found it difficult to get actual money out at the other end. Additionally, the volume of the crypto economy is just too small at its current size.

Some ordinary Russian citizens have turned to crypto in efforts to protect their wealth from a collapsing ruble. It has also been utilised by Ukraine citizens that have decided to flee. One example involved a Ukraine refugee who took 40% of his life savings in bitcoin on a USB stick with him across the border to Poland. It was key to his financial survival. (5)

At the same time, crypto has helped the Ukraine Government to raise funds for their fight against Russia, when it would not have been possible using centralised organisations such as GoFundMe.

The number of bitcoin users has been growing quicker than the use of the internet. From 100 million users, it is currently on pace to hit 1 billion users in half the time. Bitcoin took 12 years to reach a market cap of US $1 trillion, while Google, Amazon, and Apple took 21, 24 and 42 years respectively (6).

If the market cap of bitcoin was considered its GDP, bitcoin would currently be in the largest 20 countries.

More than US$33 billion went to crypto and blockchain startups in 2021. (7) Excluding bitcoin, crypto has been a “playground” for venture capital. Of course, it is expected only a small percentage will survive and most will fail, but there may be a few unicorns.

Non-fungible tokens (NFTs) have also created opportunities for new business models that didn’t exist before, benefiting not just artists around the world, but also consumers who can be certain of authentication because of the blockchain.

There’s also the potential for NFTs to transform property and vehicle markets. NFTs could also be part of the solution in resolving issues with land ownership. And with the internet moving to Web3 and people spending more time in the metaverse, it may be NFTs that will be following us around there.

There will be many other developments in this decentralised economy that have yet to be imagined. It’s likely that it’ll be a much more transparent and direct type of market than we have ever had. Those who think they are seeing a flash in the pan, a bubble, fad or Ponzi scheme, may not be prepared when it arrives.

How should we look at crypto?

One of the best explanations for cryptocurrencies is that they are digital protocols or software systems. Digital protocols that can be built on top of.

Analogous to the early days of the internet, there were dozens of protocols. But over time the internet narrowed to a few main protocols that most of the internet is built on, including:

- TCIP,

- HTTP,

- SMTP,

- FTP, and

- the base layer WWW.

The cryptocurrency landscape could potentially shape up in the same way with these open decentralised digital protocols being the driver of the future of the internet.

Over its history, Bitcoin has shown it could potentially be used as a long-term store of value. It may help to improve risk-adjusted returns in portfolios and has (to date) been one of the best-performing assets over various time periods. Bitcoin is also seen as a cheap and easy way to transfer value around the world and could also provide benefits in protecting property rights.

The next generation is incredibly interested in digital assets and technology. Much of society is now mobile-native and crypto-native. Games, mobile devices, the internet – this is what most of us know and, as it currently stands, bitcoin and crypto seem likely to continue to be a significant part of this.

Learn more

BetaShares offers the broadest range of technology-focused ETFs in Australia providing access to global tech giants, cybersecurity, Australian technology and more. To stay up to date with my latest insights into the digital assets market click FOLLOW below, find out more about investing in crypto with BetaShares here.

References:

1. (VIEW LINK)

2. (VIEW LINK)

3. (VIEW LINK)

4. (VIEW LINK)

5. (VIEW LINK).

6. (VIEW LINK)

7. (VIEW LINK)

3 topics

1 stock mentioned

1 fund mentioned