He backed Pilbara, Mineral Resources, and WiseTech. He's now backing these stocks

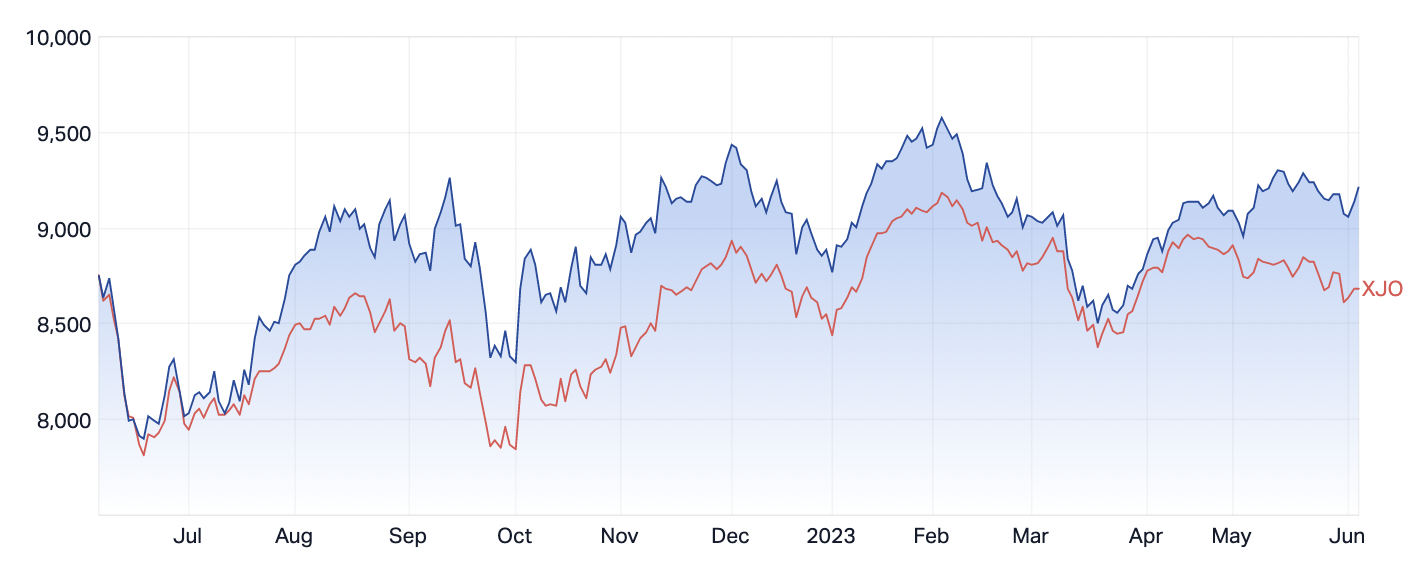

Just as small and micro-cap investors long for the 10-bagger, mid-cap investors long for their chosen stock to become the next large- or mega-cap. And although the ASX Mid-Cap Index has outperformed its large cap counterparts over the last year, it remains an under-researched area of the market. Mid-caps also receive far less attention from equity fund managers than their large- or small-cap counterparts.

Brenton Saunders, portfolio manager of the Pendal MidCap Fund, knows all about the space, owning the firm's coverage of mid-caps since early 2022.

In the 18 months he has been in the role, Saunders has already seen a few ASX mid-cap stalwarts go the distance. Among them, Mineral Resources (ASX: MIN) and Pilbara Minerals (ASX: PLS). And he has his sights set on many more.

In this feature interview, I sit down with Saunders to discuss the ASX mid-cap space, his investment process, and why the fund is fully invested. And, because he's a stock picker, he rattles off no less than 13 stock ideas for your consideration.

Note: This interview was taped on Wednesday 31 May 2023. You should also know that one of the stock codes in the video is incorrect. It's been since pointed out to me that Brenton was likely talking about Patriot Battery Metals, and not Patriot Lithium. I've corrected the edited transcript to reflect the change - and my sincere apologies for confusing the two!

EDITED TRANSCRIPT

Why do you think mid-caps are overlooked by equity fund managers, and what attracts you to that space?

And it's during that time when they populate the mid-cap space. The great thing about them is they are still fairly high-growth companies. They're very focused businesses, but they have well-established capital structures. Most of them pay dividends. They're just higher growth, fairly good quality companies as they migrate from the small-cap to the large-cap space.

And that's where we focus, trying to find our best ideas in that space. Stocks that are either still emerging, stocks that have been ignored for a while, or stocks that really just excite us.

What's an example of a company that you invested in from the mid-cap stage that ended up graduating to large-cap status?

Sadly, there are a couple of those. The reason I say sadly is because it always frustrates me when they leave our investment universe because eventually, we have to sell them. But that happens all too often.

And a couple of examples are companies like Mineral Resources (ASX: MIN). It grew very quickly. We've owned it since it was a small cap, in our business more broadly in the mid-cap space, since we became eligible to own it. It's grown right through our space now and blown out the top into the ASX 50. So at some stage, we'll have to look to exit that.

Pilbara Minerals (ASX: PLS), a related stock, has done exactly the same in the last 12 months. And we are strongly expecting that WiseTech (ASX: WTC), which our business has owned since it was tiny, will head into the ASX 50.

But the growth companies, particularly the ASX internet stocks, like Seek (ASX: SEK), Xero (ASX: XRO), REA (ASX: REA), Carsales (ASX: CAR), have either come straight through our space, grown out the top of it, or are heading towards the top of that space now, for all the right reasons.

.png)

Talk us through your dual mandate and your investment process.

It's always a blend of both. Arguably in a higher interest rate environment, income becomes more important. This part of the market yields about 4.5% and most of that is franked. So it's not a bad yielding part of the market, so that looks after the income aspect.

The tax efficiency comes from the fact that we typically have fairly long holding periods for most of our companies. They're fairly high conviction companies we're happy to own over a fairly long period of time and that minimises capital gains tax. Then, the growth part is just a function of where they are in the market. That part of the market historically, if you go back over 2, 5, 10, 15 years, is just the higher growth part of the market.

Because these companies are not nearly as binary an investment consideration as some of the small-cap companies, which are much earlier in their life cycle, they typically are less risky as well.

At Pendal, we don't have what we call a style bias. That just means we don't necessarily focus our investments on any one part of the market. We are happy to pretty much go everywhere, and we are called a core manager. That in itself is quite specific. There are not too many managers that are happy to go to any part of the market.

So, that's part of our process, which we use not only to find good opportunities across the market, but for us, the most effective way to manage risk and to be able to balance the portfolio so that we don't have any undue exposure to any one or other sector, or macroeconomic risk.

The other part of our process is deeply fundamental. We have the benefit of the largest research team in large-cap managers and small-cap managers in Australia. We've been together for a very long time. I've been with the business for just over 10 years now and I'm one of the newer members. We're a very cohesive bunch of individuals that have long experience in our respective industry segments, and we package that together in an asset management process that allows us to balance the risk, find the opportunities, and ensure that income remains at a reasonable level.

Where are the biggest opportunities in the mid-cap space right now?

Mid-caps have two very interesting sectors at the moment that are not necessarily heavily tied to the domestic economy, and offer a lot of both medium and longer-term growth potential. So the first one is in the tech space, we have the benefit of some very high quality, fairly high growth companies in the tech space.

Companies like WiseTech, NextDC (ASX: NXT), TechnologyOne (ASX: TNE), really typify some of the best-in-class tech offerings. A lot of them are (software-as-a-service) SaaS offerings, or in NextDC's case, it is one of the DC companies that services the SaaS space. And all have high growth, are not terribly correlated to the current economic environment, and have global application.

The other space is closer to home in terms of it being the tailwind behind the decarbonisation theme, which is also a global theme. It has regulatory tailwinds, so governments are requiring companies and countries to decarbonise, and that really is just in the electric vehicle space. So quite simply the lithium companies, particularly some of the emerging lithium companies, offer good value, likely takeout potential, and a fairly long-lived investment thematic.

So, Materials has been the biggest growth part of the mid-cap space. The second has been tech with companies like WiseTech, Altium (ASX: ALU), Seek, Xero, that have grown up in that space. But definitely, the advent of electric vehicle materials has seen that part of the market grow. It also has some of the best longer-term opportunities in the resources space.

26% of the fund is invested in materials stocks. What is the attraction and can you give us some names you like?

So unlike, say, the large-cap space, that is heavily biased towards iron ore, and a little bit of copper, this space is much more focused in basic materials. Outside of energy, it is pretty much focused in electric vehicle raw materials like lithium, like rare earth elements, some copper. Those are the principal components of that.

So in the mid-cap space, some of the more developed companies in that space, companies like Allkem (ASX: AKE). So Allkem has just announced a merger with a US competitor called Livent. They have assets next door to each other in Argentina.

There's an enormous amount of operational synergy between those two companies. And they also, for companies that are effectively self-funding now, so they're not reliant on markets for funding anymore, they have by far the highest growth rate, in combination, of all the producing lithium companies.

So that's one we really like. Elsewhere in the raw material space like companies like Patriot Battery Metals (ASX: PMT). Now Patriot is also a lithium company. It's at a much earlier stage. It's effectively still an exploration company in Canada, but it's emerging to be probably the biggest, highest-quality new lithium find globally.

It recently listed in de jure listing on the ASX, and can be found here for investors too. We think that company will most likely be bought by one of the incumbent producers, and/or develop its own deposit over time, but a highly valuable proposition.

9% of the fund is in tech stocks but Wisetech (ASX: WTC) is your second largest holding. How do you view the tech sector as an opportunity set?

I think it remains emerging. One of the most frustrating things for me is, as a mid-cap investor, these companies grow so quickly that they exit my investment space sometimes almost as quickly as they come into it. But those are really good first-world problems, because it means they've done really well in the interim.

We have a great pipeline of small-cap tech stocks that are growing quickly and coming into our space. Some of those are already in our space and emerging.

So, I think it'll continue to be a large and vibrant part of our market that will likely be the subject of corporate activity, or partake in corporate activity on a go-forward basis. And typically that can be fairly value-add to shareholders.

Tell us about a recent inclusion in the fund.

One that we've spent quite a lot of time on more recently is Viva Energy (ASX: VEA). So Viva Energy, as you're probably aware, is involved in refining. It's involved in wholesale fuel supply, but more recently it has purchased both the Coles Express business from Coles, which is a portfolio of service stations and convenience retail.

More recently, it announced a transaction to purchase the On The Run business, which originated as a South Australian convenience retail and service station business. We think that provides an enormous opportunity for a number of reasons.

One, the increase in convenience retail in their portfolio means we think it means there's a bigger part of this portfolio that deserves a higher rating. It sits on top of its complimentary refining and fuel supply business, which is highly cash generative. So it's an opportunity to reinvest earnings out of the older part of their portfolio into higher returns in the new part of their portfolio.

And we think in On The Run, which is arguably the best run convenience retail and service station business in the country, applying that model to the very large Coles Express and existing Viva service station and convenience retail network has a huge opportunity to unlock 20 to 30%, or maybe more, of increased profitability from those individual service stations. We don't think the market is pricing it.

We don't have much exposure to pure-play energy. Most of our exposures to energy outside of Viva are fairly tangential. Things like Worley (ASX: WOR), which does a lot of contracting and servicing into the energy space. And then some of our companies will tangentially have some kind of exposure, either directly or in a secondary sense to energy.

But most of our exposures, outside of Viva, to the energy sector per se, are second derivative kind of service businesses to energy.

Why does the fund have only 3% in cash? Are you concerned you won't have enough dry powder if the market takes a turn for the worse?

No, because we have daily liquidity. We have to carry some cash, but we tend to carry fairly low levels of cash.

One reason is that investors pay us to invest their money and not keep it in cash. But the other thing is, and I guess more importantly, the largest part of our holdings are fairly liquid. This is another great characteristic of the mid-cap space. You can liquidate fairly large positions fairly quickly if you need to, and redeploy either into cash or into other parts of the market.

More ideas. More potential

The Pendal Australian midcap fund targets the sweet spot of ASX-listed companies offering the potential for strong growth and diversification.

.png)

2 topics

14 stocks mentioned

1 fund mentioned