Heading for “QE: Infinity” -- reactions to the RBA this week

Livewire Markets

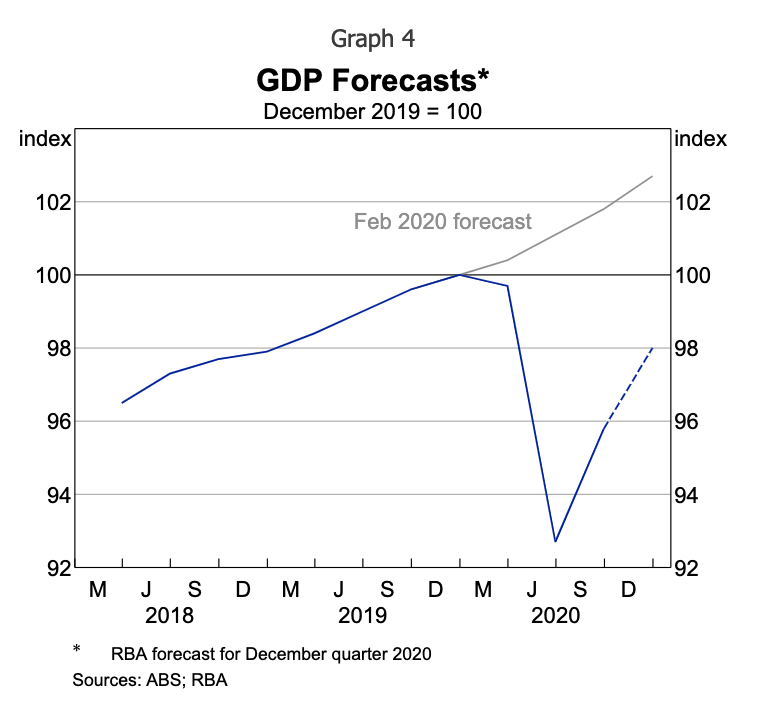

This week the RBA Governor Philip Lowe has delivered his outlook for the year and an additional $100 billion in QE, bringing the total expanded balance sheet to over $200 billion. Even so, today the Governor has delivered some fresh confidence to the market in the Statement on Monetary Policy (SoMP), predicting GDP to return to pre-COVID levels about 6-12months earlier than expected.

We asked leading Australian economists and investment strategists to weigh in on the latest announcements from the RBA, including Shane Oliver, chief economist at AMP Capital, Charlie Jamieson chief investment officer for Jamieson Coote Bonds, Jasmin Argyrou, director and portfolio manager at Credit Suisse and Kieran Davies, chief macro strategist at Coolabah Capital Investments.

Key points

- The domestic economy has proven resilient and is recovering well.

- Unemployment is falling, GDP growth is recovering with inflation remains benign.

- The strength of the local currency is problematic for the RBA.

- QE is here, there’s more coming and it may never end.

Unemployment falling

Overall, the Governor’s SoMP today continues along a similar vein as the past few policy announcements with a low inflationary environment for the next three years. The SoMP notes the labour market has recovered well with record participation levels, job vacancies above the long-term trend and unemployment levels forecasted to decline over this 2021 and 2022. Despite this, wage growth is expected to remain soft, especially in the public sector.

The RBA expects GDP to recover to its end CY19 levels by mid-2021, which is 6-12 months earlier than originally forecast, with the forecast GDP to grow by 3.5% over both 2021 and 2022. The contraction from COVID-19 was lower than expected at 2%. Spending habits remain very strong, albeit redirected toward home modifications rather than tourism or hospitality.

“People have built up very substantial financial buffers… This buffer will support spending over the year ahead,” said Gov. Lowe at this morning’s Parliamentary Standing Committee.

The economy is expected to operate with spare capacity for some time, but headline inflation has been described by the RBA as “volatile” over the past year, with bounces in CPI attributed to free child-care policies, which were a temporary pandemic response.

With optimism abound in the Governor’s SoMP, we wanted to determine the sentiment for the RBA’s policy settings and outlook for the years ahead. While the majority were surprised by the timing of the QE2 announcement, none were surprised to hear the Governor announce further quantitative easing for the economy following the end of QE1 in April this year.

Hear from the experts

Shane Oliver, head of investment strategy and chief economist, AMP Capital

On policy and the economy:

“In Australia, the RBA remains ultra-dovish and focussed on getting inflation sustainably up… The RBA’s latest dovish moves came despite revisions to its economic forecasts in its February Statement on Monetary Policy to show slightly stronger growth and inflation in the near term and a faster decline in unemployment and reflects concern that if it doesn’t match bond buying by other central banks there would be an “unwelcome” rise in the $A and that despite the improved economic outlook the RBA will still be short of its inflation and jobs goals for the next two years. Of course, this does not mean that there won’t be any fine tuning to monetary policy.”

On QE2:

“The clear message from the RBA is that it won’t rush into a rate hike or broader monetary tightening until it sees actual inflation sustainably back in the target range. So, a spike in headline inflation to say 3.5% due to the return of child care fees and higher petrol prices as last June quarter’s deflation drops out won’t cut it! All of which points to continuing low rates and the risk that bond buying may even be extended again beyond September.

"I think extending QE was the right move. To not so would at a time when other central banks are extending it would see the $A a lot higher than otherwise. The only surprise was that I thought they would wait until around April before announcing it!”

Charlie Jamieson, chief investment officer, Jamieson Coote Bonds

On policy and the economy

“I think it’s interesting in Lowe’s comments today that he hasn’t ruled out doing additional bond purchases… Clearly the market has been more than willing to take bond yields on and there has been rising expectation of a very large supply from the US Treasury, as a result of a reconciliation spending bill coming out of the Democratic Senate. That's a one-time passage of legislation that should give the bond market huge amounts of US Treasuries to digest. Whilst at the same time, Australia is going into negative net supply which should ultimately drive that spread materially tighter, over time, but it will take time.

On QE

“There is no active QE programme working in the world that's ever been successfully put back in the box. Once the policy exists as a solution it never stops existing. So, there could yet be many different iterations of this.

So far, the policy has been an abject failure. The currency is materially higher, and the bond markets spread to other markets is materially higher.

Both of those were stated in November as the core objectives of QE – to lower bond yields on a relative basis, and lower the currency. Lowe has made comment that things would be worse had they not participated."

Jasmin Argyrou, portfolio manager & director, Credit Suisse

On policy and the economy

“Since late last year, we have become a lot more optimistic about the Australian economy. Economic data has been rapidly improving and it’s been improving across most areas of the economy, from the housing markets to consumer spending. I think the progress to full employment and full capacity will be swifter than it was following the global financial crisis of 2008.

“What’s been really important for the success of the Australian economy in recovery and rebounding is, first and foremost, the health outcomes success in managing the pandemic, but also the resilience in consumer sentiment and consumer confidence. Confidence is important because it has meant that the fiscal stimulus in place and the monetary policy stimulus in place as well has flowed through to the real economy more quickly, more effectively. When consumers are more confident these the multiplier effects are bigger than they otherwise would be.

On QE

“A lot of the rapid improvement in the economy might be behind us. I think it will still be an above trend growth economy, but it might start to go from fourth gear to third gear. It will still take time. I think it’s excessively optimistic to think that the labour market will be tight in three years’ time and that will enable the RBA to start raising the cash rate. The RBA has other tools it has implemented which they can start removing, including the QE package which can be tapered and eventually stopped long before the cash rate increase.

"The timing of the tapering of QE depends on what the US Fed does. The second quantitative easing package, which targets longer maturities, exists because central banks around the world have also implemented such packages.

For the RBA not to do so would put more upward pressure on the currency. So, the outlook for QE depends in a large part on the outlook for QE overseas.

I think the conditions of tapering will be met far sooner than the conditions for cash rate lift off.

Kieran Davies, chief macro strategist, Coolabah Capital

On policy and the economy

“The economy is a long way from full employment and, by definition, therefore a significant distance from finally returning inflation to the 2-3% target band. Unemployment has likely peaked at a less disastrous level than feared, but Governor Lowe has previously characterised full employment as an unemployment rate in the 4s, which history suggests will be very difficult to achieve. Indeed, we have not seen it since the pre-GFC era. Governor Lowe’s parliamentary testimony implied that it may take 5-6 years to return inflation to target.”

On QE2

“QE is the obvious option left to the RBA given it is reluctant to adopt negative rates. The cash rate is at the RBA’s effective lower bound of 0.1% and Governor Lowe continues to strongly push back on the negative policy rates adopted in Europe and Japan, arguing they could cause problems in the banking sector and prove ineffective. Coolabah said they have:

“... updated its forecast outlook to formally include “QE3” with a six-month, $100bn extension into 2022 followed by additional purchases likely next year with the size depending on the path of the virus and the state of the economy.

Conclusion

So, there is much speculation about when and how QE will end once its begun, and expectations for QE3 and QE4 are still quite high. Whether for or against QE, it looks like it’s here to stay. There’s an underlying sentiment the RBA has taken us through the looking glass and now there’s no turning back.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

3 contributors mentioned

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...

Expertise

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...