Healthcare stocks shine in a dimming economy

In recent months, as uncertainty about the economy has grown, healthcare has benefited from a rotation into more defensive stocks. In our view, the setup for the sector remains attractive. Still-reasonable valuations, falling interest rates, a quiet U.S. election cycle (at least for healthcare), and rapid innovation all make the case for the sector’s momentum to continue.

A good starting point

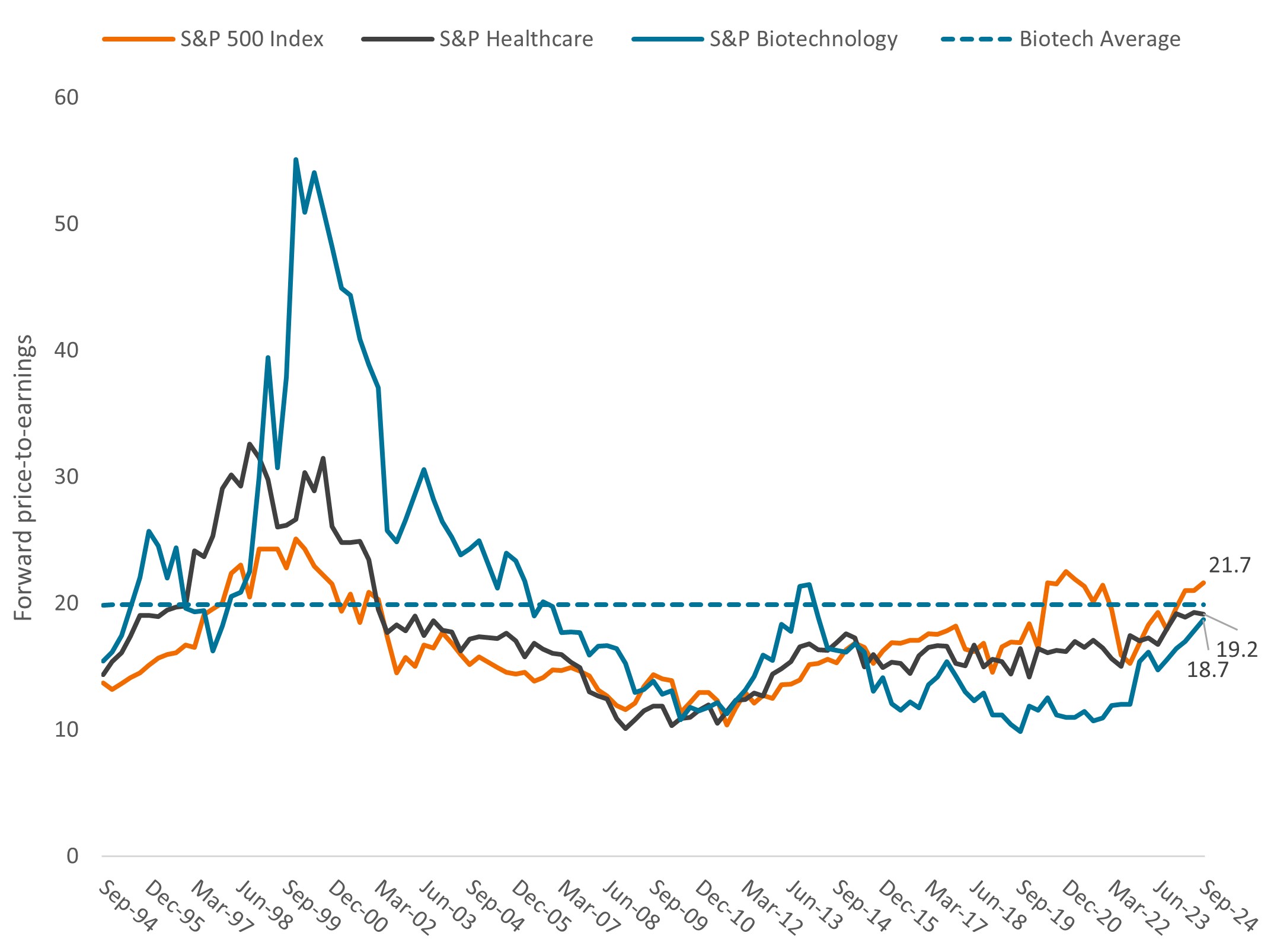

As some areas of the market saw rapid multiple expansion during the first half of 2024, the healthcare sector often traded at a discount to the S&P 500® Index. The underperformance reflected investor preference for high-flying areas such as AI and came amid a resetting of supply/demand dynamics in healthcare following the pandemic. Persistently high interest rates also weighed on long-duration stocks, such as biotech.

Figure 1: Healthcare valuations vs. the broader market

Source: Bloomberg, as of 30 September 2024. S&P Healthcare = S&P 500Source: Bloomberg, as of 30 September 2024. S&P Healthcare = S&P 500® Healthcare Sector, which comprises those companies included in the S&P 500 Index that are classified as members of the GICS® health care sector. S&P Biotechnology = S&P 500 Biotechnology Sub Industry, which comprises those companies included in the S&P 500 Index that are classified as members of the GICS® biotechnology sub-industry. The forward price-to-earnings ratio (P/E) is based on estimated earnings for the next 12 months.

Since then, healthcare valuations have started to normalize, but some areas of the sector — including those that traditionally hold up well amid economic uncertainty — have not rebounded as much. That includes managed care. The industry was weighed down in 2024 by rising costs as pent-up demand drove a resurgence in medical utilization after the pandemic. A cut in reimbursement rates for Medicare Advantage, a private option for the government insurance program for the elderly, was another headwind.

But we think the industry’s long-term fundamentals more than compensate for these near-term challenges.

For one, medical utilization looks set to moderate over the next 12 months as procedural backlogs ease. At the same time, membership volumes are rising: An aging population is expected to drive steady growth in Medicare Advantage over the next decade while enhanced subsidies made available through the Inflation Reduction Act have helped to nearly double the number of people covered by the public insurance marketplace since 2020.(1)

Insurers can also adjust benefits annually to offset higher costs, aided by industry consolidation that has reduced irrational underwriting cycles. The net result should be less earnings volatility over the long run and a recovery from currently depressed operating and profit margins, which makes a compelling case for the stocks, in our view.

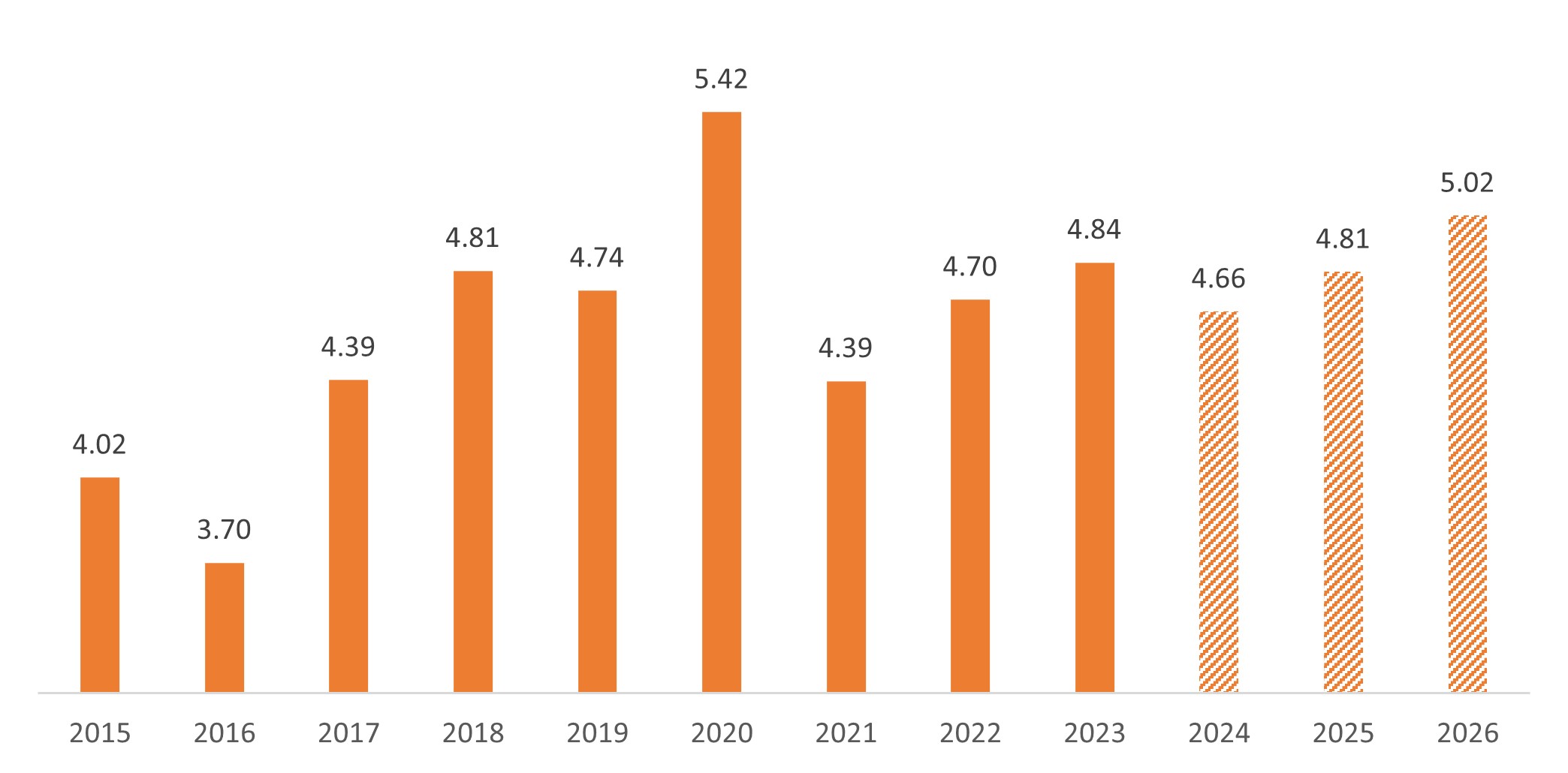

Figure 2: On the upswing: managed care profitability

Net profit margin (%)

Source: Bloomberg, as of 30 September 2024. Data are for the Managed Health Care Sub Industry of the S&P 500 Index, which measures performance of companies classified within the GICS sub industry. Figures for 2024, 2025, and 2026 are estimated. There is no guarantee that past trends will continue or forecasts will be realized.

Falling rates, future earnings

Another area of the sector that has lagged — biotechnology — could also be due for improved performance. The industry’s small- and mid-cap stocks suffered a roughly three-year bear market in the wake of Covid-19 and amid rising interest rates. But with the Federal Reserve (Fed) now embarking on a rate-cutting cycle, the industry’s prospects could improve.

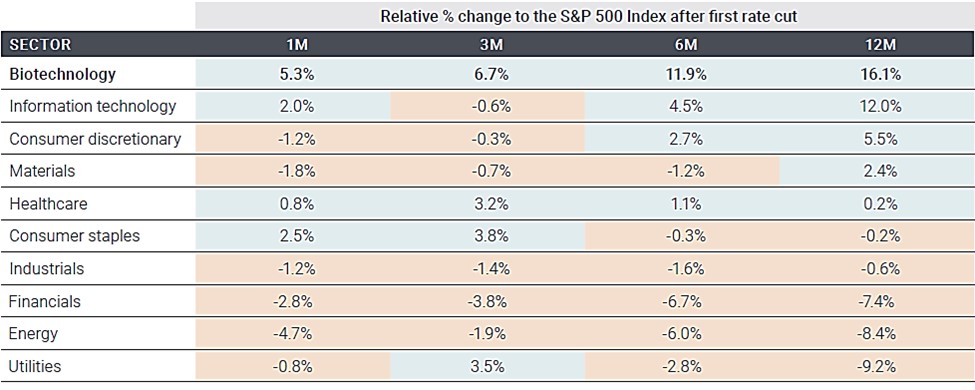

Indeed, biotech has typically outperformed during periods of declining rates since low interest rates increase the net present value of future earnings, which in biotech can take years to be realized. As such, the industry has historically delivered gains seven out of eight times in the six months after the Fed’s first rate drop(2) and outperformed the S&P 500 by an average of 16% over the following 12 months (Figure 3).

Figure 3: Historically, biotech has delivered outperformance during rate-cutting cycles

Source: Redburn Atlantic. Data based on sectors in the S&P 1500® Index. The S&P Composite 1500® combines three leading indices, the S&P 500®, the S&P MidCap 400®, and the S&P SmallCap 600®, to cover approximately 90% of U.S. market capitalization. It is designed for investors seeking to replicate the performance of the U.S. equity market or benchmark against a representative universe of tradable stocks. Data from 1995.

We see potential for the pattern to continue. Today, many small- and mid-cap biotech stocks still trade at depressed valuations. Meanwhile, the industry logged a record number of Food and Drug Administration (FDA) drug approvals in 2023, which could drive revenue expansion for the respective companies for a decade or more. And the pace of innovation continues, with companies reporting clinical progress for the next wave of medical advances in cancer, neuromuscular disease, and autoimmune conditions. In our view, this growth potential could come into sharper focus for investors amid declining rates and a potentially slowing economy.

A quiet election

As the Fed cuts rates, the U.S. presidential election also approaches. In years past, healthcare has been a target on the campaign trail, with candidates often proposing reforms that created uncertainty for the sector. But this year, recent legislative progress has helped to keep healthcare out of the political spotlight.

The Affordable Care Act (ACA), for one, substantially expanded healthcare insurance coverage and has survived repeated calls for its repeal since the law first passed in 2010. With the ACA now firmly engrained in the healthcare system, its dissolution has become more unlikely. Meanwhile, proposals for universal health insurance have been abandoned after they failed to gain traction with voters.

And starting this year, the Inflation Reduction Act (IRA) gave the government authority to negotiate drug prices in Medicare, a major political win. But less well recognized has been the benefit of capping out-of-pocket pharmaceutical costs in Medicare — which previously had no limit — to $3,500 per year in 2024 and $2,000 per year in 2025. The cap has improved access to medicines and made them more affordable for seniors, finally addressing a longstanding political concern. As such, while the election could create volatility for equity markets overall, we do not think healthcare will be especially burdened.

Long-term growth drivers

Without the political overhang, we think the sector’s innovation could be allowed to shine. Here, momentum has been accelerating. This September, for example, marked 10 years since the FDA approved the first PD-1 inhibitor, Keytruda. Since then, Keytruda and other checkpoint inhibitors — immunotherapies that take the brakes off the immune system to kill cancer cells — have become some of the most successful drugs on the market, with sales reaching $52 billion in 2023 and growing at a double-digit rate annually.(3) (In June, Keytruda was approved by the FDA for its 40th indication in cancer.)

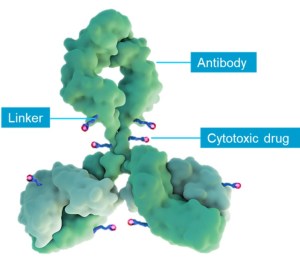

But checkpoint inhibitors are just one tool in a growing arsenal of novel treatments for cancer. Antibody drug conjugates (ADCs) are targeted therapies that deliver chemotherapy directly to cancer cells, sparing healthy cells in the process. These drugs have the potential to replace the more toxic chemotherapy we have been using for decades and improve outcomes. More than a dozen ADCs are now on the market — many approved in just the last few years — and their potential for growth has spurred multiple mergers and acquisitions, including AbbVie’s purchase of ADC maker ImmunoGen for $10 billion in 2023.

Figure 4: A promising new type of therapy

Antibody drug conjugates consist of three main components: an antibody, a payload (the cytotoxic drug, or chemotherapy), and a linker

Source: Evercore ISI.

In the field of diabetes and obesity, GLP-1 agonists are achieving unprecedented weight loss and have the potential to reverse the global obesity epidemic while also lowering the risk of comorbidities such as cardiovascular disease. As such, as of the second quarter this year, GLP-1s were annualizing at over $50 billion in sales and growing more than 50% per year.

In medical devices, pulsed field ablation is emerging as a new paradigm for addressing atrial fibrillation (a type of irregular heartbeat) that is safer and faster than prior methods. Meanwhile, the adoption of robotic surgery is allowing procedures to be completed with more accuracy, less pain, faster recovery times, and better outcomes. And the latest robotic surgery systems have 10,000x the processing speed of prior generations.

Many more examples exist throughout the sector, with important clinical trial and product updates expected in the months to come for cancer, obesity, lupus, and schizophrenia. In our view, it all makes for an exciting setup for healthcare no matter what comes next for the global economy.

Invest in a world of opportunity

By investing in the best ideas from each global research sector team, the Janus Henderson Global Research Growth Fund seeks long-term capital growth. Find out more below.

1 topic

1 fund mentioned