High stakes for the Ethereum Merge

I wrote last week about the US government blocking the cryptocurrency mixing service Tornado Cash. As a quick recap, a mixing service co-mingles digital assets to make ownership and provenance hard to identify. This wasn’t such a big deal to begin with - all the US government did was block a list of Ethereum addresses they believed had been up to no good.

What we did not anticipate at the time was the cascading sequence of events this would set off across DeFi.

Many of the so-called decentralised platforms have rushed to comply with the US government’s mandate. To name a few:

- Circle (operator of the largest stablecoin on eth) complied immediately by freezing associated accounts that used the service

- Centralised exchanges Coinbase and Binance froze accounts

- POKT Network, a “decentralised” node provider, complied

- AAVE, a “fully decentralised” community, complied and froze accounts

- Trading platforms dYdX, Maker, Balancer Labs, Uniswap did the same

- Node operators Infura and Alchemy complied

In fact, nearly every well-known company that builds or transacts on Ethereum has complied. Who could blame them either? The penalties for non-compliance are extreme.

Merging with censorship

This has brought the upcoming Ethereum merge into sharp focus. The merge will change the consensus mechanism through which transactions on the blockchain are validated.

Under the new consensus mechanism, we now know the US government can censor any transaction they want.

Currently, blocks of transactions are confirmed by the miners through the application of computing power. In the case of eth, the largest miner is Chinese and has equipment located all over the globe. Many other miners contribute as well.

The physical decentralisation of the miners matters a great deal because it is extremely hard to censor entities who are hard to identify and reside in other jurisdictions. Particularly when those jurisdictions might not be favourable to the censoring government's cause.

Ethereum co-founder Vitalik Buterin posted this earlier in the week. In English, it translates to the merge happening on or around 15 September.

The merge is somewhat technical but the new proof-of-stake chain, currently in ‘test mode’, is going to merge with the existing Ethereum protocol (hence "the merge"). Going forward those entities and individuals who have already staked their ethereum into the new chain will essentially be the block validators (the miners).

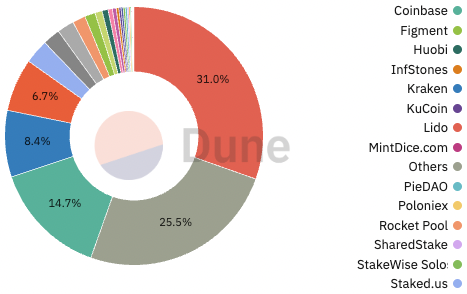

So far, so good. Except that when you look at the list of who those entities are, 66% of them by value have complied with the OFAC sanctions on Tornado Cash.

What does it mean?

Simply that under the new consensus mechanism, we now know the US government can censor any transaction they want. No more than three or four of the large holders of ETH are required.

Proof of Stake is actually the thing at stake

Many people have argued for a long time that this is exactly the reason that Proof of Stake is vulnerable to censorship. Simply, it is a naturally centralising mechanism because the largest entities firstly will have the most assets, and secondly have the most to lose. Consequently they are the most likely to comply.

If you’re in it for the decentralisation you might need to look elsewhere.

Paradoxically this might be very good for the ETH price, given there is now no reason for governments to aggressively regulate it. Control and censorship, should they wish to have it, are 10 minutes away at the most.

This is very much not decentralised though. Increasingly, it’s a database controlled by US-based entities. Plenty of those have performed spectacularly, so if you’re in it for the money it might be good. If you’re in it for the decentralisation you might need to look elsewhere.

This whole thing is a big test for eth, but what’s really at stake is consensus mechanisms. Does Proof of Stake work? The early signs are not good. This is not trivial either: Ethereum is a $200 billion asset with at least another $100 billion built on top of it. Aside from consensus, a lot of money is at risk too.

Crypto watchers are in for a treat next month. This is a massive technical challenge already. Firstly, will it work at all? Then we have the forks to contend with. We know that ETHW will fork immediately and continue a Proof-of-Work consensus on the chain. Will ETHW garner any value?

If this is all double-dutch, stay with us over the next month and we’ll narrate the flow of events, which are actually fundamental to what succeeds and fails over the next decade.

5 topics