Home Bias in securities markets

International Investment Research LLC

In what seems now like another life, I was an adviser at Ord Minnett where I still do Australian business and keep in contact with friends and colleagues in the securities industry in Australia.

In the many years I followed stocks and local analysts on the desk at Ord Minnett, I realized that other markets widened my choice of asset classes and helped clients to improve returns and reduce risk.

These days at Independent Research we provide independent research and analysis on a wide variety of Australian stocks. My role in the United States is for our Australian clients in the US markets and lately providing information and guidance on US stocks suitable for Australian investors.

During my time in Australia I too was guilty of Home Bias, but fortunately, I have remedied the situation and am now guilty of Home Bias in the United States.

An authoritative voice at Independent Research in Sydney suggested I title this report “Letter from America” which immediately reminded me of Alastair Cooke who retired in 1994 and died in 2004, who I do remember as a young lad, but would have dated me terribly.

So we decided on “Home Bias” which these days seems to resonate with all those who have studied and measured the subject and we hope will flock to this column each time it is published.

Home Bias

Home bias is the human tendency in the financial markets to magnify the familiar and comfortable and trivialize the less obvious and often imposing elsewhere.

It happens in every marketplace in the world where the familiar ends at the Brooklyn Bridge in New York and at the Paris end of Collins St in Melbourne or Circular Quay in Sydney.

If a stock is not listed on the NYSE, it does not exist for Americans and for most Australians the ASX is the beginning and the end.

This is entirely understandable but a bit short sighted and may explain sometimes why recommendations are blindsided because of something predictable which had it been noted could have been avoided.

And before anybody asks, there are strong commercial incentives to stay at home where funds managers and the advisors who use their products have a real comparative advantage.

Home Bias also explains why most investors would prefer to use funds to invest outside their own marketplace and level of comfort.

Yet few investors (both managers and the retail public and their advisers) take the next step to discover how much value there may be in doing a simple comparison of the stocks available in the local market with their peers elsewhere

After all, as every fund manager who looks at the Dow Jones Index first thing in the morning knows, there is a tidal influence on stock prices in this globalised world

This report is an attempt to bring some knowledge to the table about what constitutes real value by comparing valuations on the ASX with those on the NYSE.

We make no attempt to normalize for different tax rates, the impacts of exchange rates, tariffs, politics, or any other differences in asset classes.

We simply compare the numbers at the spot rate of exchange.

It is a snapshot in time which makes no predictions about exchange rates which we regard as a separate asset class.

The other factors mentioned above and must be considered independently and later.

The Deplorables

We are moving into a world where Brexit and the Deplorables rule (those ignoramuses according to Hillary Clinton who voted for Trump).

This means that home bias will become even more dominant. Just ask Mr. Trump.

As the tide runs out for globalization, readers of The Economist and followers of the mainstream media, we will find who has been swimming naked and what home bias really looks like before the tide comes back in.

Fortunately, we know that anomalies do not last forever and at the very least knowing the differences usually leads to a better strategic outcome elsewhere.

For example, some participants may simply opt for a fund or an ETF in another market or devise an options strategy around a portfolio.

For those like me, addicted to stocks and outperforming my peers, buying a fund is a prophylactic which is why I hope at least one fund manager will call me after reading this report.

In the many years I followed stocks and local analysts on the desk at Ord Minnett I realized that other markets widened my choice of asset classes and helped clients to improve returns and reduce risk.

Are you going to be better off in an Aussie stock or its North American listed equivalent?

Investment Criteria

We select the best US stocks in the top ten performing sectors out of 197 US sectors, we then screen these stocks by our definition of value.

Our best stocks trade at or near the 50-day moving average which needs to be trending above the 200-day.

If this sounds like momentum trading, it is, but only after screening for value and comparing these stocks with their Australian equivalents to make the selections relevant for an Australian audience.

Our value criteria are what you would expect. In addition, we are fortunate to have access to earnings research which allows us to screen for outstanding performance. We can provide our data on request on individual stocks without cost or obligation.

As it turns out, Home Bias may actually be quite a good look and offer better value. Here are some examples of the numbers.

A basic comparison

Let’s start with two ETFs both in US Dollars which are a proxy for the respective Indexes.

You can access an Excel file of this comparison here: (VIEW LINK)

So, on the face of it Australia with its high payout ratios (franking) looks like a great place for income so long as you don’t mind the volatility, lower corporate returns (ROE) and higher levels of debt.

These differences create problems but they also create opportunities for those that recognize that anomalies do not last forever.

A closer look

There are times when my golf swing looks like a dunny door on a prawn trawler (apologies to Phil Coorey at the AFR) and there are times when the gallery applauds. A good swing comes down to having a good routine and following it.

So here is the routine we follow for the best US stocks:

The current top ten US performing industry sectors.

Which sectors have an Australian peer group

The best stock in these sectors ranked by earnings momentum, relative strength, and institutional following.

Closest proximity to the 50-day moving average which is trading above the 200-day moving average.

How do these stocks compare with their Australian peers?

Keep in mind we are looking for some of the best performing US stocks and as a final look seeing what the comparison is with the ASX listed peer.

(By the way, knowing what is performing in the US gives us a clue like hoola hoops, roller skates and yo yo’s to what is coming next).

We could do a lot more screening and end up with a “perfect stock syndrome” and sometimes we waste hours of time looking for stuff that does not exist.

So how does it all look right now?

Top US industry groups (year to date)

- Coal

- Steel producers

- Computer data storage

- Semiconductors fabs

- Retail department stores

- Telecom fibre optics

- Heavy construction

- Semiconductor equipment

- Education

- Mining metal ores

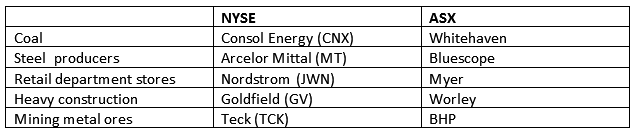

Australian industry peer group comparison

Best stock in each sector (earnings/RS/MA proximity)

(You can see how the list shrinks in Australia)

Conclusion

Of all these stocks the undervalued standout is BHP which in US Dollar terms is up 36 percent in 12 months versus 121 percent for Vale and 524 per cent for Teck.

BHP may or may not be a Buy a Sell or a Hold however its performance is undervalued in relation to its peers.

And when you start checking these figures and struggle to find codes/symbols/earnings/RS/ etc. I guarantee you will agree, at the very least, that a home bias does exist.

1 topic

5 stocks mentioned

Over 30 years in Australia, South Africa, London and the United States John Kimber has worked in investment research, advisory, and corporate finance at Prudential Securities, BT Alex Brown and Ord Minnett. He completed his series seven...

Expertise

No areas of expertise

Over 30 years in Australia, South Africa, London and the United States John Kimber has worked in investment research, advisory, and corporate finance at Prudential Securities, BT Alex Brown and Ord Minnett. He completed his series seven...

Expertise

No areas of expertise