Hoping the Fed hasn't made a policy mistake

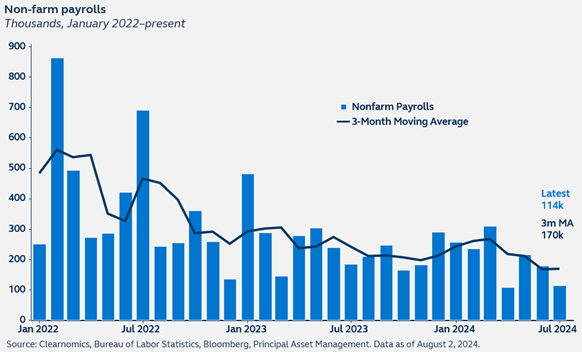

Today’s jobs report for July confirms that the labor market is slowing, all but ensuring a September rate cut. The 114,000 new jobs added last month missed consensus estimates of 175,000. June’s 206,000 figure was also revised down to 179,000. The unemployment rate jumped to 4.3%, inevitably triggering recession concerns, and wage growth came in below expectations. With both sides of its mandate justifying a rate cut, the data raise the question of whether the Fed has been too slow to act.

Report details

- The BLS categories of Healthcare, Construction, and Transportation and Warehousing accounted for much of the increase in jobs, while Information saw a loss of 20,000 jobs in July, though it has not changed much over the year. Leisure and Hospitality was also relatively flat, remaining close to its level just before the pandemic.

- The weakening in jobs growth was clear across the spectrum, with private payrolls only rising 97,000 versus 140,000 expected and 136,000 in June.

- Average hourly earnings increased only 0.2% on the month, below estimates, bringing the year-over-year rate to 3.6%, the smallest gain since May 2021.

- Unemployment rose to 4.3% in July, above expectations that it would remain at 4.1% after rising slightly the previous month. While unemployment is still relatively low by historical standards, it is the highest since the pandemic years and mid-2017 before that. The “under-employment rate” (U6) also jumped to 7.8% from 7.4%, the highest level this cycle.

- However, it’s important to note that a rise in labor force participation was partly responsible for rising unemployment. This dulls the recession signal from the newly-triggered Sahm Rule, which states that historically, a 0.5% increase in three-month average unemployment over 12 months indicates that recession has begun.

Policy outlook

The July jobs report suggests that a September rate cut is in the bag. Following rising weekly jobless claims and a notable downside surprise to the latest ISM survey, the Fed will be nervously watching to see how economic data evolves over the coming month. Already several market commentators have warned that the Fed has waited too long before easing policy, raising the risk of a hard landing. However, a key question facing the Fed will be whether the level, versus magnitude of change, matters more.

Markets

have responded very negatively to today’s report. But just as markets

over-reacted to Powell’s dovish remarks last October, and then once again in

April as inflation numbers came in hotter than expected, this is likely an

exaggerated reaction too. The labor market is clearly cooling but, with

payrolls above 100k, talk of recession is premature. And although the

unemployment rate has risen, it is partially due to rising labor supply. Much

will depend on how the incoming economic data evolves and, with two more

inflation prints and a payrolls print still to come before the FOMC meets again

in September, the Fed will have much to consider. At this stage, however, the

very negative market response looks overdone. We continue to expect rate cuts

in September and December— however, a further deterioration in the broad

inflation and labor market data may also add a November cut to the mix.