Housing market is turning

There are signs the modest COVID-19 induced housing correction may be coming to an end in all cities save Melbourne according to the latest daily CoreLogic index data. The risk to this nascent recovery is a second wave emerging in New South Wales. I wrote about this in the AFR this weekend with the following excerpt enclosed:

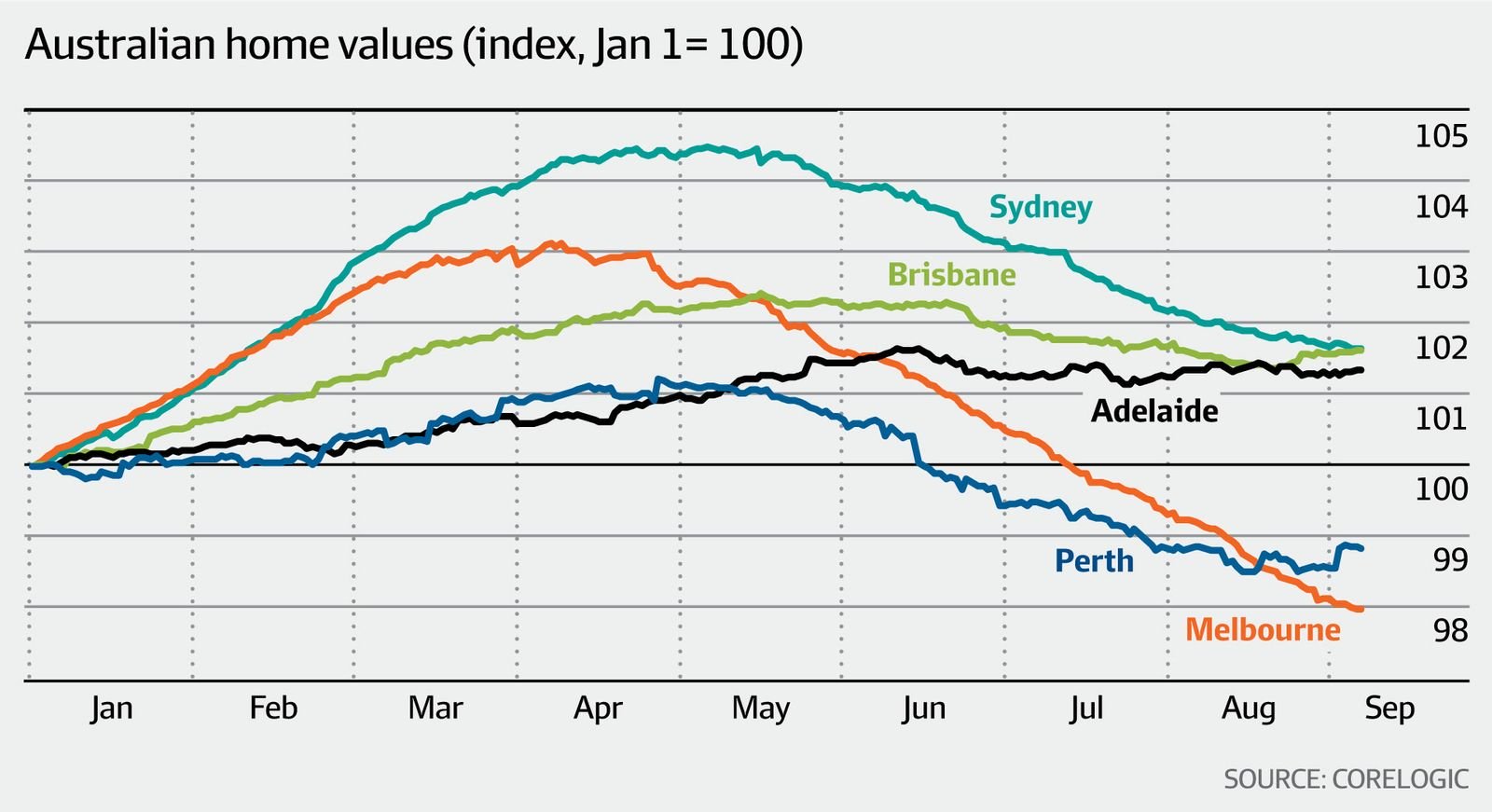

Since the end of July, home values in Brisbane, Canberra, and Adelaide have all increased very slightly. Dwelling prices in Perth started stabilising in early August and have not fallen since. There is also evidence of a significant deceleration in losses in Sydney. This coincides with an improvement in auction clearance rates on strong volumes that are noticeably much higher than 12 months ago. The big exception is the Melbourne market where prices continue to fall as a result of the lockdown, albeit at a consistent rate (auction clearance rates are also abysmal on very low volumes).

Remarkably across Australia’s eight capital cities, home values have only declined 2.5 per cent since their peak in April 2020, which is consistent with our projection that the COVID-19 shock would induce only 0 per cent to negative 5 per cent move in prices. Consensus expectations have centered around much larger price falls of between 10 per cent and 30 per cent nationally.

The resilient local housing market performance correlates with what is happening overseas. On the back of cheap money, house prices have been climbing in recent months in the US, UK and Canada, and flat-lining in New Zealand.

With term deposit rates below 1 per cent and mortgage rates only 2.5 per cent, the investor market should start showing signs of life given the opportunity to positively gear. According to CoreLogic, gross rental yields on apartments in Canberra (5.7 per cent), Adelaide (5.4 per cent), Perth (5.3 per cent), Brisbane (5.2 per cent), Hobart (4.8 per cent), Melbourne (3.9 per cent), and Sydney (3.4 per cent) are all significantly higher than the interest repayments on home loans. In Australia we are used to debating "negative gearing"—the prospect of "positive gearing" (ie, actually making money from rental tenants) is a novel conception.

Real estate agents also report a significant uptick in interest from expatriates and foreign buyers looking for a relatively safe haven to park cash.

Any prospective recovery in home values should be amplified by supportive measures in the upcoming federal budget and the government’s desire to attract top global talent and capital in the context of the political chaos and COVID-19 related turbulence in the US, Hong Kong, Europe and China.

There are nonetheless threats to this outlook, including a second wave in New South Wales and the potential for a tsunami of mortgage defaults next year. But on the balance of probabilities, our March forecast for a modest correction followed by strong house price appreciation in the order of 10 per cent to 20 per cent in the years thereafter remains intact.

The Reserve Bank of Australia’s decision to increase the size and availability of its Term Funding Facility (TFF) for banks is important in this context. This innovative policy measure provides all banks with access to about $200 billion of 3-year funding at a cost of just 0.25 per cent annually. The TFF makes it much easier for banks to offer cheap loans to both businesses and households, and is replacing dearer funding the banks used to source via the wholesale debt markets.

And to the extent the TFF furnishes banks with cash in excess of what they need to make cheap loans available to the private sector (and replace existing debt instruments), they have the ability to earn positive returns through investing the TFF money in AAA and AA rated bonds issued by government agencies such as the National Housing Finance and Investment Corporation (NHFIC) and Export Finance Australia (EFA), and the various state governments.

Market participants speculate that this might have been part of the reason behind RBA’s surprising decision to increase the TFF this week by $57 billion and extend the time over which banks can tap this cash even though larger lenders say they do not need the liquidity. Both the federal government and the RBA have made it clear that they think states can do more heavy-lifting with fiscal policy, focussing on investments in infrastructure and other productivity-enhancing supply-side initiatives.

While the RBA’s bond purchasing program has helped reduce the federal government’s cost of capital, it has done less for the states. In fact, the credit spread that state government bonds pay above the swap rate is near all-time highs (and the spread over government bonds is still wider than the recent historical tights between 2016 and 2018). Oddly, the safest and highest-rated state, New South Wales, has of late had a larger cost of capital than Victoria, Queensland, and Western Australia. (We’ve actually bought some of their bonds because they appear cheap.)

If surplus TFF cash is parked in NHFIC, EFA and state government securities that pay a decent spread above commonwealth government bonds, it could reduce their cost of capital and encourage extra spending. At the same time, the spread above the cost of the TFF should be return on equity accretive for banks given the zero risk-weight applied to AAA rated government securities.

This prompts an interesting segue into a prescient October 2019 paper authored by, among others, Philipp Hildebrand, the former head of the Swiss National Bank, and Stanley Fischer, the former vice chair of the US Federal Reserve and boss of the Israeli central bank. Fisher supervised RBA deputy governor Guy Debelle’s PhD at MIT.

Months in advance of the 1-in-100 year pandemic, the authors wrote that “unprecedented policies will be needed to respond to the next economic downturn” because “monetary policy is almost exhausted as global interest rates plunge towards zero or below”. “Fiscal policy on its own will struggle to provide major stimulus in a timely fashion given high debt levels and the typical lags with implementation,” they said.

The authors proposed “an unprecedented coordination through a monetary-financed fiscal facility”, which basically involves the central bank printing money and giving it to the government to spend via a “standing emergency fiscal facility”. In concept, this is identical to so-called Modern Monetary Theory (MMT) save for the governance restrictions that the authors recommend. These include the central bank controlling the amount of money printing (and hence fiscal funding), and turning the taps off once inflation moves back to its desired level.

The risk with this path is that the central bank becomes politicised and increasingly non-independent, subjugating itself to populist imperatives to promote short-term growth at all costs, including long-term productivity trade-offs. By disintermediating the private sector and enabling the government to avoid issuing bonds to raise money, the central bank also stifles market discipline. At the extreme, the central bank could flip a freshly-minted trillion dollar coin to the government and allow it to repay all its debts instantaneously.

One might counter that the coin is still a liability of the central bank and consolidated public debt has not changed. The truth, however, is that the state is simply borrowing from itself, which it can do in unlimited quantities. By eliminating reliance on external creditors, it has unambiguously improved its solvency, albeit with nontrivial costs.

The most obvious cost is that these policies seriously debase the value of money, and could end up being very inflationary. This type of debt monetisation is already happening in developed countries today, and is likely to become increasingly common. It may be one reason why hard assets such as gold have been appreciating as investors pre-emptively seek an inflation hedge.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

1 topic