How 146 years of market data can save you money and help you sleep

The ASX has only once dropped by 30% or more in a calendar year – and that was during the GFC in 2008. It's easy to overlook such things, especially during periods of sharp equity market declines and economic volatility such as we're experiencing currently.

“Volatility is normal and timeframe is everything,” says Romano Sala Tenna, co-founder and portfolio manager of Katana Asset Management.

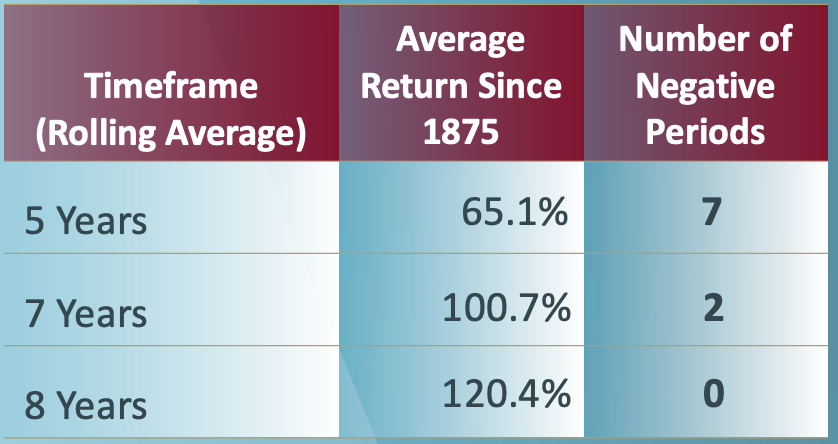

Analysis of data from the past 146 years shows that on average the index has returned 65% over rolling 5 year timeframes - with only seven negative periods. Over seven years and eight year rolling periods, the average return grows to 100.7% and 120% with negative years falling to two and zero respectively.

Key points

- Big equity market falls are rare

- The ASX has risen more than 80% of the time over almost 150 years

- Negative returns have resulted only seven times over any five-year period

- The ASX has never produced a negative return for an eight, nine or 10-year plus period

Average ASX returns over 146 years

Why does the market move?

The price of any asset – including equity in a company – is a combination of the fundamental value and investor sentiment.

Sala Tenna uses the example of a house, which comprises the land on which its built, the bricks, timber, land rates and other establishment and ongoing fees

“In the short term, sentiment is the strongest factor. But over the medium term, underlying fundamentals drive prices,” he says.

“It might have cost you half a million dollars to build the house, and in a red hot market, if you sell it for $700,000, the sentiment value you’ve realised is $200,000.”

He alludes here to a famous Warren Buffett quote:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Using an example from the stock market, Sala Tenna compares two automotive companies: Volkswagen and Rivian Automotive. The contrasts are stark: VW is the third-largest automotive manufacturer globally, while Rivian has only sold a handful of vehicles. VW generated profits of $20 billion in 2021, while Rivian is loss-making.

Regardless, when Rivian IPO’d in 2021, it had a valuation of $90 billion straight out of the blocks – just $50 billion shy of VW’s $139 billion market cap. And Rivian’s value grew to $160 billion in the space of a week.

“It became the third most expensive automotive company in the world and had only sold a couple of cars. This is how sentiment drives markets,” Sala Tenna says.

Investor emotion is also cyclical

In the world of finance, we often hear about economic cycles and market cycles – but Sala Tenna refers to investing emotion as a cycle too. The four stages of this cycle are:

- Optimism

- Exuberance

- Euphoria, and

- Complacency.

Then on the other side of the curve, we see denial, fear, despair, panic, depression, and capitulation set in. “The emotional impact is what drives share prices,” he says.

And where do we currently sit within this cycle? Back in June, when the local market was down around 9.5%, “we saw some characteristics of capitulation,” Sala Tenna says.

How to pick a fund manager

Using his own inside knowledge of the investment management industry (he is a fundie himself, after all!) Sala Tenna is well aware of the tricks some use to pump up their performance figures.

One of these is the reporting of annualised return figures to distort the real result, particularly when there has been a negative annual return followed by a strong positive result.

Sala Tenna also refers to one well-known, large fund manager – which he declines to name – that presents stellar performance figures every year. But with around 20 funds in the portfolio, the managers cycle through different funds each year, cherrypicking the best performer for its presentation.

“Make sure fund managers are consistent in how they present their return figures,” he cautions.

Fee structure is another crucial yardstick for comparing fund managers, with management fees and performance fees almost universally adopted.

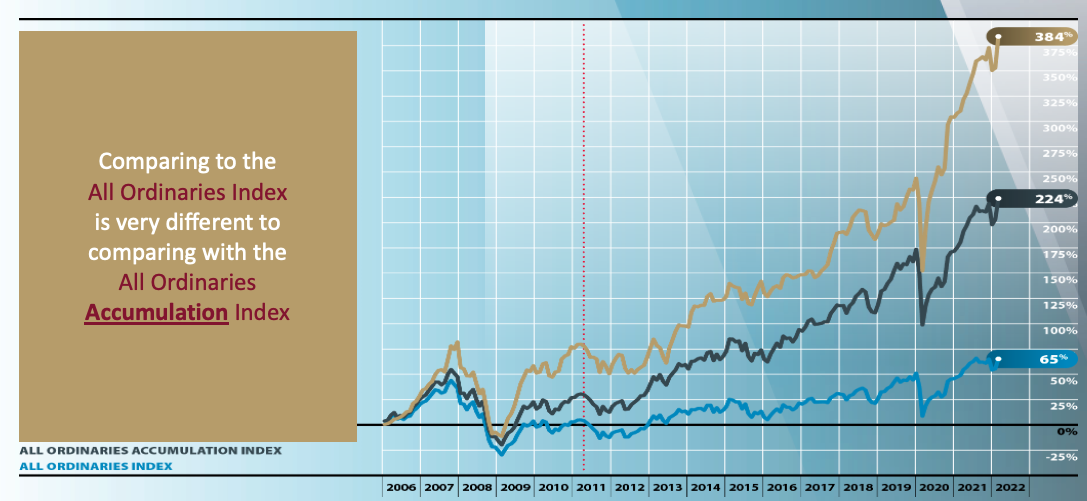

Things to watch out for here include ensuring the fund reports its return net of fees – as these can substantially change the real return a fund delivers to end investors. And ensure that any benchmark comparison the fund uses are appropriate.

As an example, he alludes to a Perth-based fund manager that reports its return over a 20-year timeframe, which beats the benchmark by 3.9%. But over each of the three, five, 10 and 15-year timeframes the return was below the benchmark.

“If returns aren’t consistent, it further reduces the confidence that they’ll be able to replicate them,” Sala Tenna says.

More information

This article was produced from a recording of a Katana Asset Management investor seminar. You can learn more about the Katana Australia Equity Fund by visiting the profile below.

3 topics

1 fund mentioned