How are Asian markets staying resilient despite Trump's tariffs?

This year the Hang Seng Index has soared, beating the US markets and its global peers. Chinese companies delivered strong 4Q24 results with a solid 8% net beat for MSCI China. This was the second-best earnings beat result among the major global equity markets, after only Japan (13%), with MSCI EM at 0.8% and the S&P 500 at 1.3%.

With ongoing concerns on global trade and the introduction of Trump's reciprocal tariffs during April, sparking a sharp 13% sell-off in one day, the Hang Seng index remains up 7.5% YTD, becoming the highest performer in the 2025 global equity market. This resilience is underpinned by remarkable value opportunities in China, where many high-quality companies remain significantly discounted.

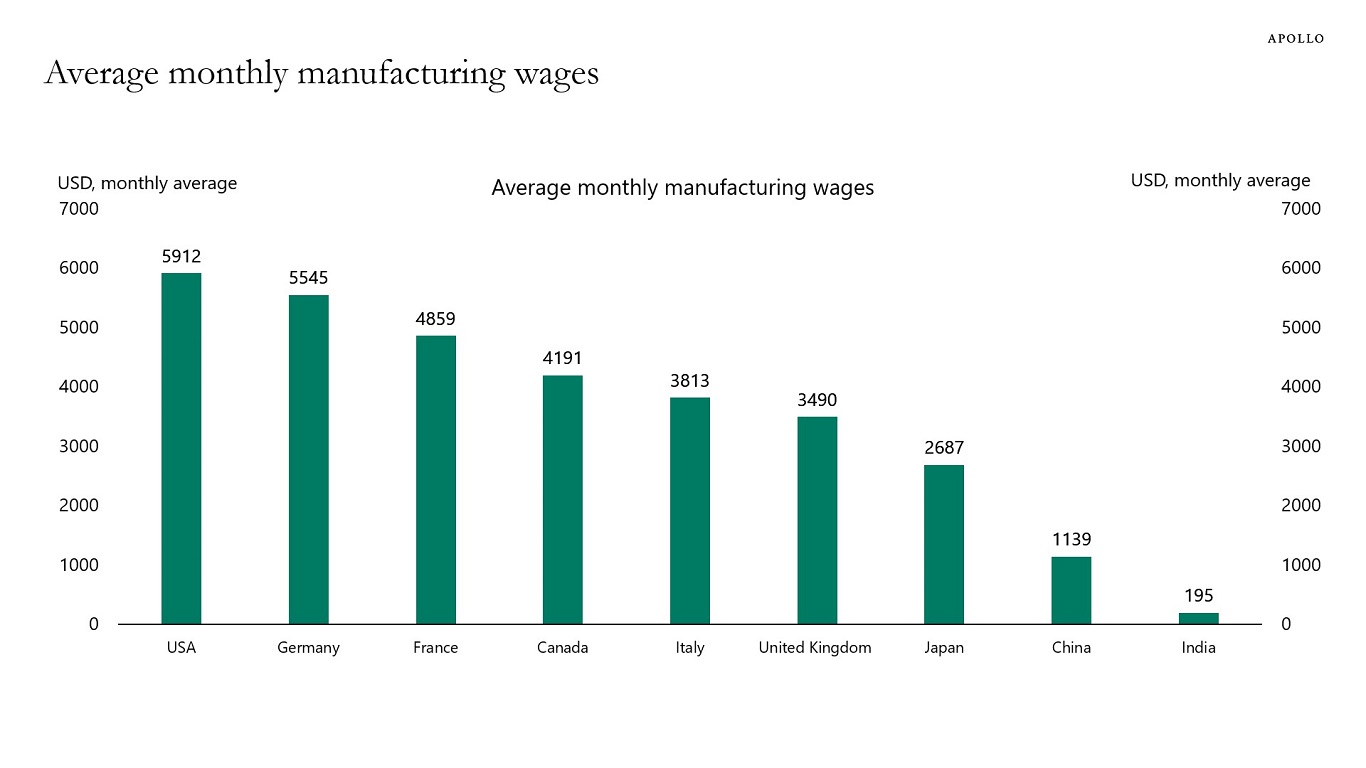

China’s counter-tariff response stirred a global storm. After Trump imposed the 145% tariffs on Chinese imports, China maintains its high negotiating power by mandating a 125% tariff on American goods while exposing the manufacturing process of “Made-in-US” brands. China’s transparency war, fuelled by social platforms like TikTok, is sparking satirical comments about US companies, creating real conversation on the cost disparity of US products.

China’s manufacturing labour costs are approximately 20% of the US. Its economies of scale ensure many US imports will continue to be sourced from China.

China’s export strengths lie in rare earth minerals, textiles, semiconductors, and electronics. Its exports remain critical for the US as the US continues to be heavily dependent on Chinese suppliers in these sectors. In response to US tariffs, China’s reliance on US commodities can be easily substituted by imports from other countries like Brazil, minimising China’s domestic price impacts. Consequently, this tariff war poses fewer issues for China than for the US.

Domestic consumption is the primary source of China’s economic growth, accounting for 55% of China’s GDP in recent years. Additionally, the Chinese government has announced significant stimulus measures to support household spending and boost domestic demand.

China’s exports to the US make up just around 3% of its GDP, highlighting the limited impact of US tariffs on China’s economy.

The International Monetary Fund (IMF) warned that rising tariffs will slow global economic activity. Its 2025 global growth forecast dropped to 2.8% from 3.3%. The US economy is expected to bear the brunt of the impact, with growth now projected at 1.8% for 2025, down from 2.7% in the IMF’s previous January forecast, and 1.7% for 2026. China is predicted to suffer from higher tariffs, though to a lesser extent, with its 2025 and 2026 growth projections lowered to 4% from 4.6%.

In response, Trump remarked that the 145% tariff on Chinese imports will “come down substantially”, while semiconductors and electronics will be subject to separate and smaller tariffs.

Japan faces export pressure, with domestic growth remaining resilient

Meanwhile, Japan’s Nikkei 225 has fallen 14% YTD, opposing the Japanese yen’s 9% appreciation against the U.S. dollar. The strengthened yen value imposes challenges for Japanese exporters as their goods will be more expensive abroad, and their foreign earnings value will be reduced. This conflicting situation is exacerbated by Trump’s tariffs of 25% on auto exports, resulting in a dilemma for Japanese firms reliant on U.S. demand.

Despite market concerns and fluctuations, Japan’s macroeconomic signals are encouraging. The nominal wage growth in Japan rose 3% in January after a decade of stagnation. The current job market is tight, with a 1.26 job-to-seeker ratio. The national unemployment rate is only 2.4%. This means Japan has the perfect backdrop for rising household income and sustained domestic consumption.

Focusing on Asia’s Companies

As the US is experiencing political risk, trade volatility and recession fears, we are positioning ourselves away from the US markets and strategically investing domestic-centric companies around the world. We don’t expect our domestic-focused companies to be overly impacted by Trump’s tariffs. Our companies are leaders or emerging leaders in their domestic industries rather than being exporters into the US.

Our core position in JD.com (China) has delivered exceptional results amid the political backdrop.

JD.com

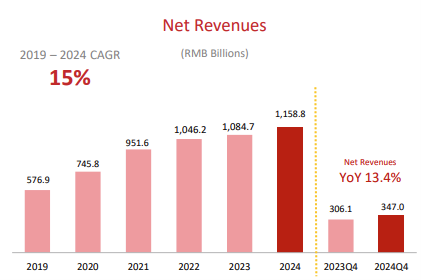

JD.com delivered a strong 4Q24 result and FY24 result. Revenue grew 13.4% for the quarter and 7% for the full year. Earnings per share increased by 40% and EBITDA grew 30% in the quarter, benefiting from margin improvement.

As one of China’s largest e-commerce companies, JD continues to leverage its robust direct sales model (warehouse-to-consumer), extensive logistics network (over 1400 warehouses) and strong market position (competing primarily with Alibaba). These characteristics position JD as a high-quality investment opportunity within China’s economy.

We see a lot of operating leverage ahead with the EBITDA margin still at only 3.6%. JD’s revenue returned to double-digit growth in the final quarter, driven by its double-digit growth in active users and shopping frequency. JD is benefiting from consumer sentiment picking up in China as well as expanding market share. Over the past five years, JD has delivered a 15% compound annual revenue growth rate (CAGR).

Their upgrades to their “PLUS” membership have given the company a continued edge over its competition. Their “PLUS” membership introduces a lifestyle service package that allows members to redeem credits for services including home cleaning, laundry, car wash and a “180 day replacement over repair” policy for electronics and home appliances.

3 topics

1 stock mentioned