How did my Crazy-Eight A-Shares go?

Contrarian opportunities are my favorite.

Here is where you get to bet against the crowd and (perhaps) be proven right.

This time last year, the consensus view on China was that you did not need to be there, and the place was headed for economic collapse. You know the genre.

Economic collapse is possible.

I am impatient. Investing on a collapse thesis requires one very patient short and hold. I suck at short selling, so I prefer to play "imminent collapse" to the upside.

Humans have a tendency to form a "watching crowd" whenever it looks like there may be blood in the streets. This is the origin of Rothschilds' famous contrarian dictum.

The above is the most quoted form. Here is the full quotation:

The time to buy is when there's blood in the streets, even if it is your own.

There are many ways to interpret that, but I view it as a reminder to exercise patience for a contrarian bet to fully play out. The instincts of the crowd are not all wrong.

If you are nursing lithium industry losses through the year end, take heart.

The industry will turn, and the lows are probably in. However, the trajectory will depend on what happens in China. With that let me segue to our Crazy-Eight A-Share report.

The Crazy-Eight China A-Share Picks

This time last year I published: Why I like these Crazy-Eight China A-Shares.

The context was general investor enthusiasm for the Magnificent Seven US technology names and all intelligence of an artificial kind. The popular press was also breathless in reportage of (yet) another imminent collapse in the Chinese economy.

Since I had previously named The "Magnificent Seven" of EV metals, before Wall Street came up with theirs, and since my Mag Seven had, by then, a horrid outlook, the Crazy Eight was apropos of the state of the market, and my state of mind.

Through most of 2024, there was blood in the streets, including my own.

However, by September the China A-Share market started to turn around.

I was pleasantly surprised by October: How are my Crazy-Eight A-Shares doing?

After that I got sick and spent two months on a drip in hospital.

Now I am better, and the Crazy-Eight consolidated to finish well.

The Crazy-Eight A-Share Picks 28-Dec-2023

300750.SZ Contemporary Amperex Technology Co Ltd

002594.SZ BYD Co Ltd

002371.SZ NAURA Technology Group Co Ltd

601899.SS Zijin Mining Group Co Ltd

000333.SZ Midea Group Co Ltd

600584.SS JCET Group Co Ltd

688012.SS Advanced Micro-Fabrication Equipment Inc China

300760.SZ Shenzhen Mindray Bio-Medical Electronics Co Ltd

I gave my reasons in this wire:

Why I like these Crazy-Eight China A-Shares

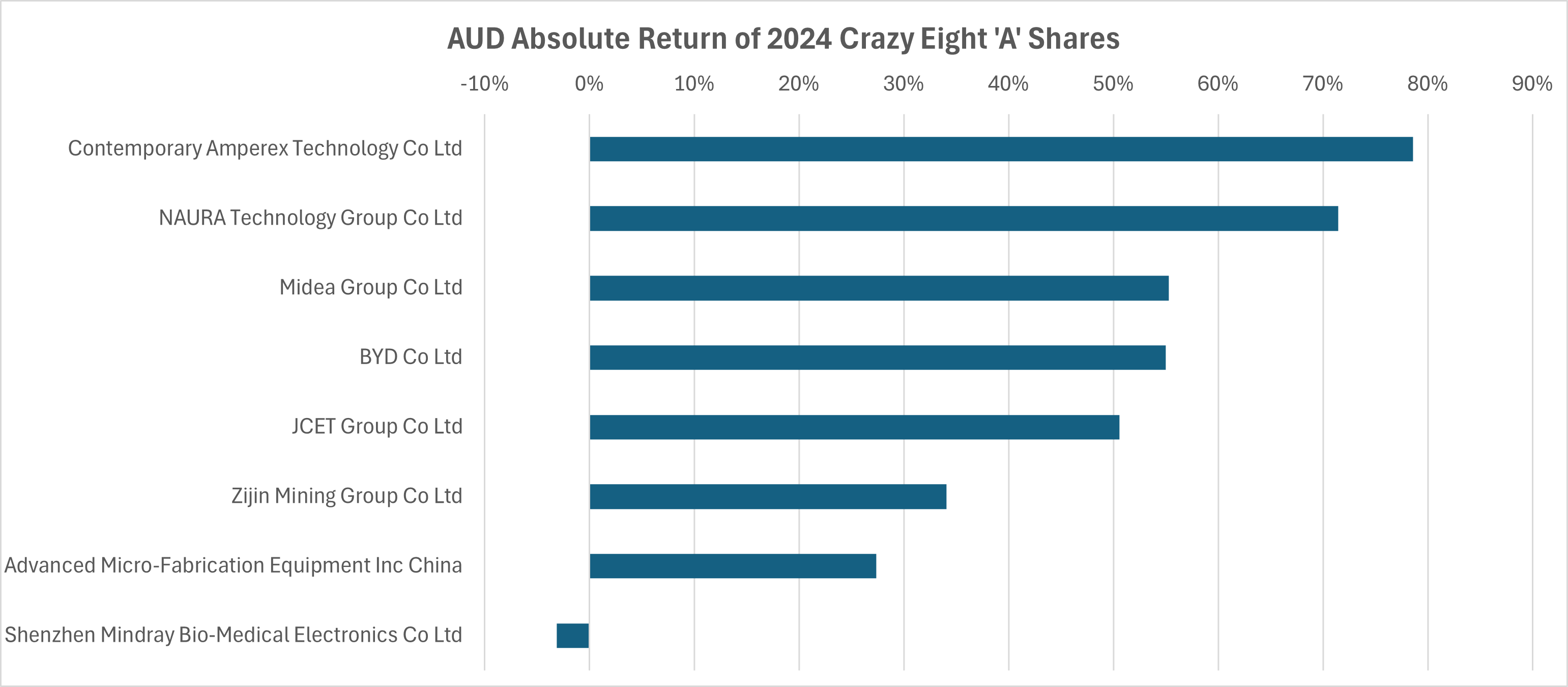

Here is the result in AUD.

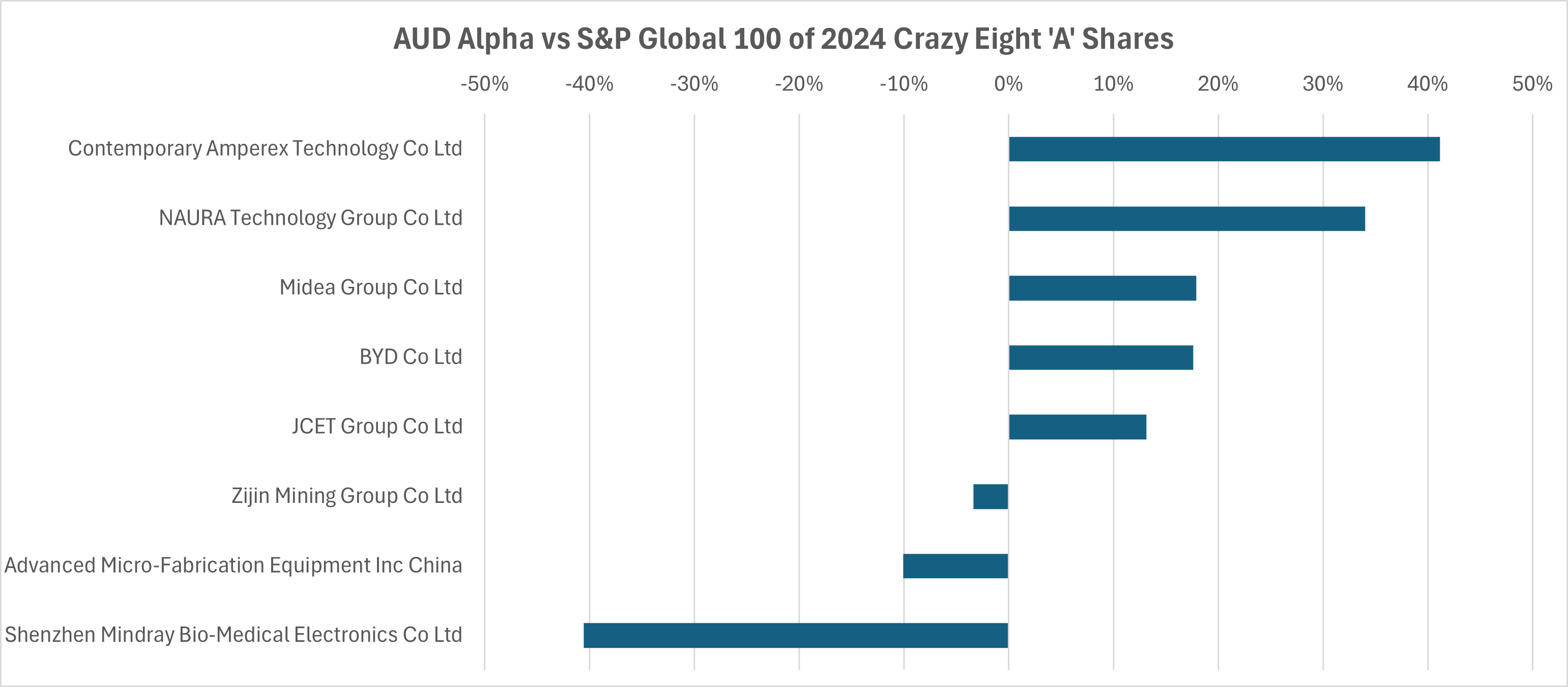

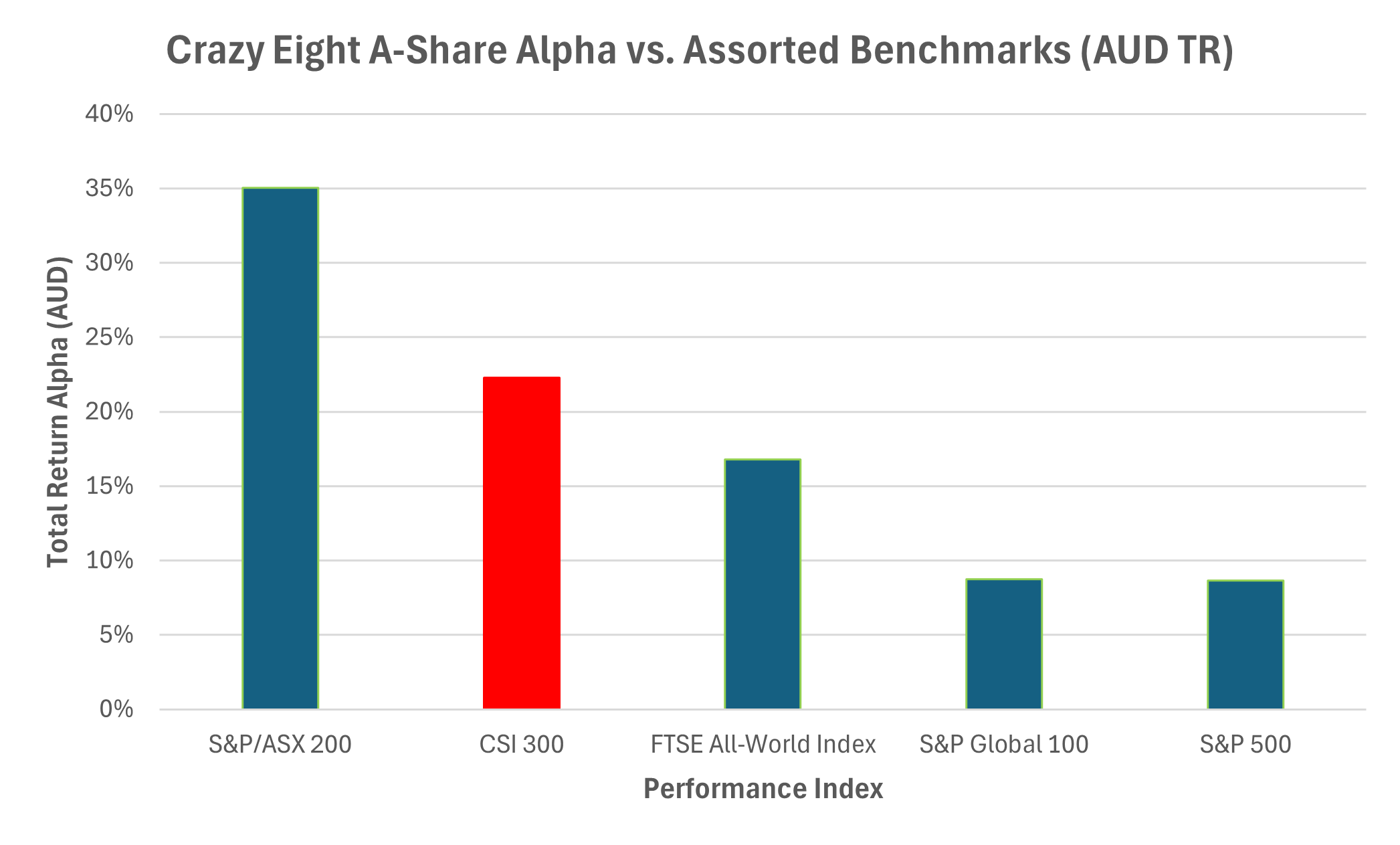

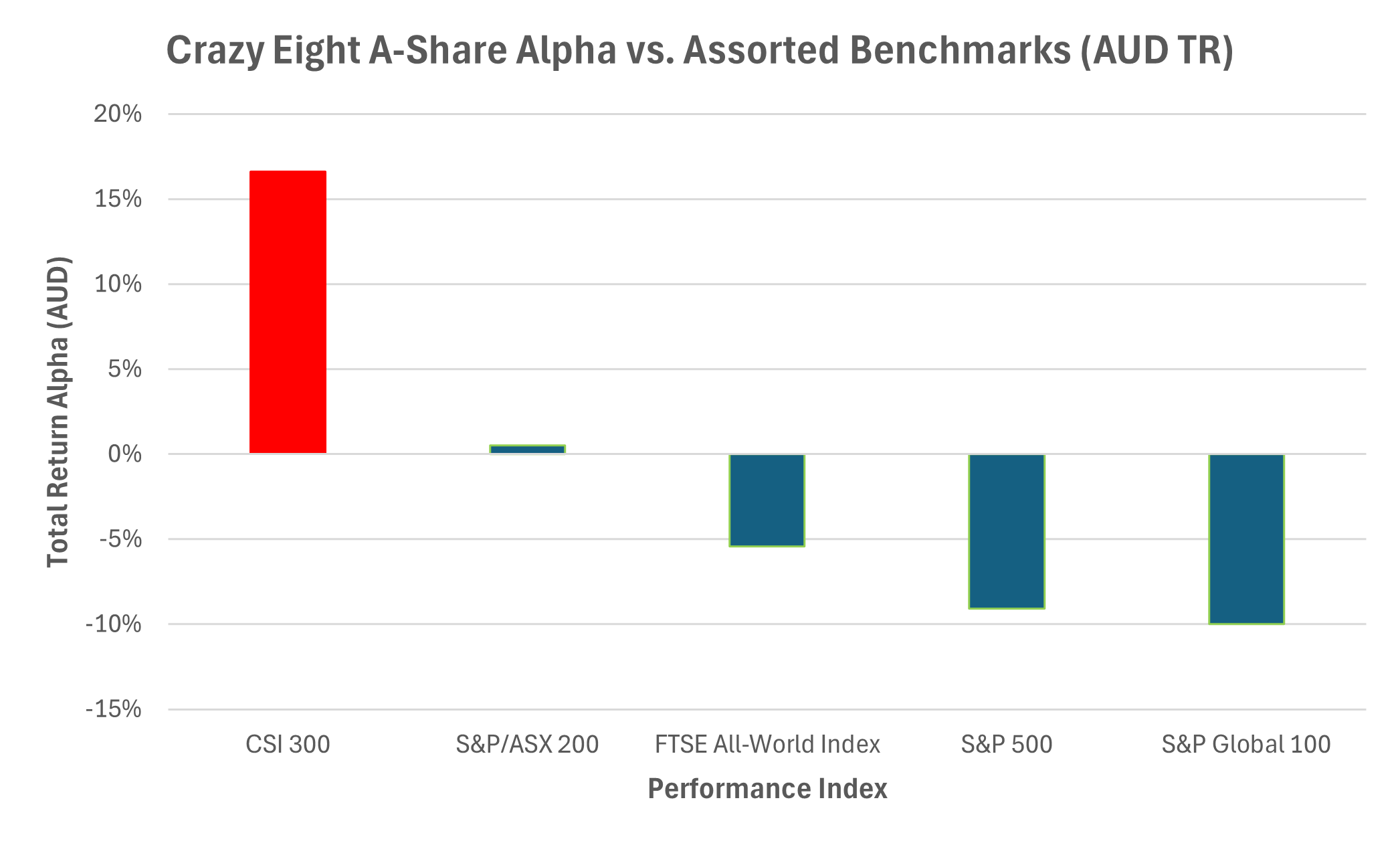

Good absolute returns should properly be qualified with a benchmark comparison.

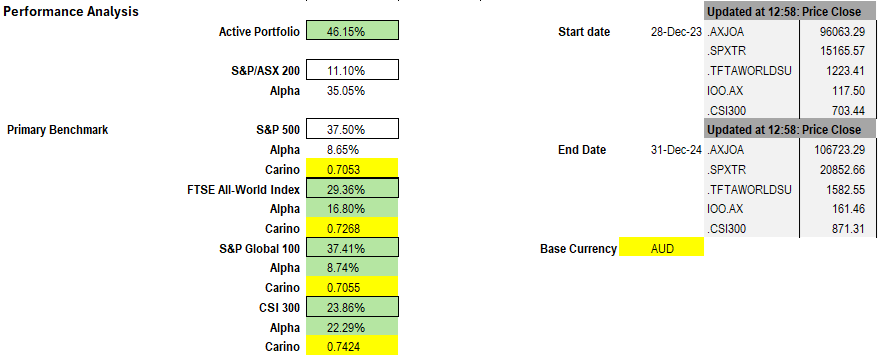

Let us look at performance numbers for an equal-weighted portfolio.

This is more obvious in graphical terms.

It is worth pausing here to record *why* I was motivated to write my provocative piece.

Note that our weighted portfolio beat the S&P/ASX 200 by 35%.

Does contrarian opinion work?

Obviously, it works sometimes. Generally, at extremes and turning points.

However, in the spirit of 1st Baron Rothschild I would advise strongly not to adopt this way of investing unless you are inured to the sight of blood, especially your own.

You had to be patient as the CSI 300 did not hit a low until 18-Sep-2024.

There is an old adage that you cannot time markets. The counter is that time-in-the-market is the antidote to any lack of market timing prowess.

Where I would nuance such advice is that you can generally time when market sentiment is the most negative.

That is when the negative headlines peak, which is not likely the ultimate low.

However, if you believe in the recovery thesis, the peak in negative sentiment is usually a fair guide to when you should allocate some capital.

I say some capital, because it is also a good idea not to go full freight early.

How did conventional wisdom work in 2024?

The crowd is right most of the time in a financial market.

Upwards moving stocks generally reflect a positive fundamental outlook.

Downwards moving stocks generally reflect a negative fundamental outlook.

The difficulty arises at turning points.

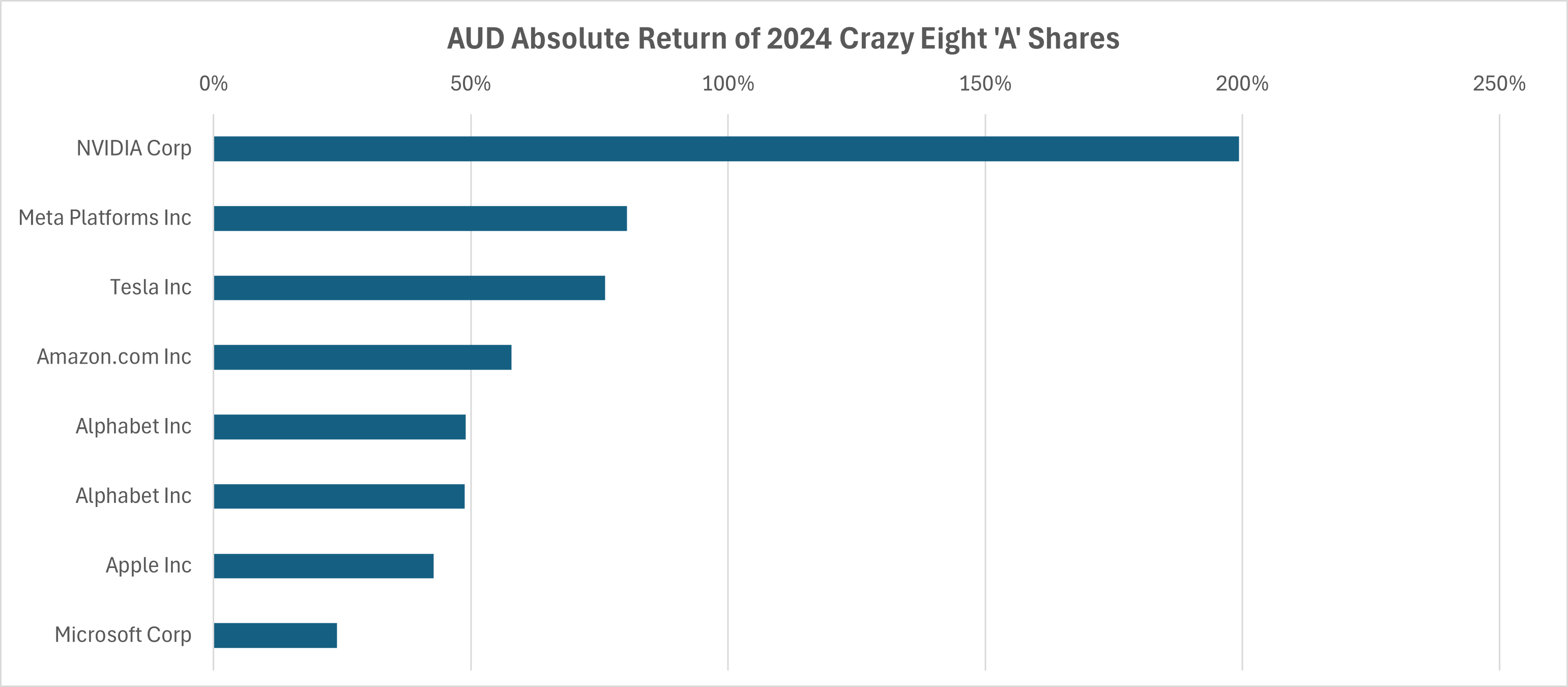

Last year the conventional wisdom was to bet on the Magnificent Seven.

The average performance of those seven stocks (eight tickers) was 72.27% in AUD terms, whereas the Crazy-Eight A-Shares averaged 46.15% in AUD terms.

The S&P/ASX 200 posted 11.10% in AUD terms.

Contrary opinion, expressed in my Crazy-Eight, beat the conventional wisdom of a buy and hold on the Australian bourse. However, it was itself beaten by US Exceptionalism.

I note this for two reasons:

- There is no reason to view this as an either-or choice

- The margin between conventional wisdom and a contrarian view is not so wide

In short, you can run a diversified portfolio and one scenario, China recovers, does not imply a zero-sum game where the natural alternative, the US market, does poorly.

This is the main takeaway I would offer from this exercise.

Conclusion

Personally, my SMSF owned three of the eight picks during CY 2024.

These were BYD Co 1211.HK, Zijin Mining 2899.HK and Midea Group 000333.SZ.

I would have owned all eight if they were easy to buy.

However, there are risks associated with the semiconductor equipment names and the expanding list of US sanctions. I did mention this last year.

The semiconductor sanctions the USA has imposed upon China are ostensibly to stop modernization of the PLA and the military. They will achieve no such result. Military applications of semiconductors are generally based on legacy nodes.

There is a popular nonsense that military computers are leading edge.

They are not. The L3-Harris ICP in the F-35 pumps out >2900 DMIPS with a whopping 512MB of DRAM. Ho hum. This is upgraded over time but is not leading edge.

The military prefers reliability, durability, and life-of-type serviceability.

You will find more cutting-edge processing in a civilian DJI Drone.

However, that is not because of some super-secret nefarious activity of the PLA.

It is purely the innovation dynamic and scalability economics of serving a large and demanding market of civilian customers looking for the latest and greatest.

The military does not offer this development equation to any engineering team.

That is why US semiconductor sanctions are ultimately counterproductive.

They will only provide an incentive for Chinese engineers, who are very good, to find new and better ways to achieve commercially relevant Artificial Intelligence (AI) in vehicles, robots and consumer appliances.

That is what is happening now, and the trend will only accelerate.

I would not place so much emphasis on the Chinese semiconductor equipment sector going forward. It will do very well, but you don't know when your investment may get hit with the ugly stick of U.S. Sanctions. You could pick stocks well and have Uncle Sam destroy your investment with some completely arbitrary extraterritorial edict.

The U.S. semiconductor sanctions game will be perma-whack-a-mole.

The better course is to stick with obviously consumer-oriented firms, such as the EV car makers BYD Co 1211.HK, Xiaomi 1810.HK and CATL 300750.SZ, assuming that the latter becomes available to retail investors through a mooted Hong Kong listing.

The overall conclusion of this note is two-fold.

China will be there tomorrow as will the China collapse theory pundits.

Neither is going away anytime soon. They are part of the global furniture.

I am a global investor, and so I find the collapse theory foolish.

However, I also acknowledge that the USA is presently committed to containing China.

In my view, this is a fool's errand, but it will cause many potholes on the global road.

This is why my 2025 pick is the contrarian bet on Japan.

With this goes my holiday contrarian reading Has China Won?.

Kishore Mahbubani is the Singaporean contrarian who looks to be on the right track.

He has many critics. Finding those is very easy. Have an open mind. Read them.

I read their critique. It made no sense to me, so now I am reading Mahbubani.

The upshot of this investing piece is that I am bored by Western Think Tanks.

They have nothing interesting, original, or useful to say.

Western think tanks have all the hallmarks of intellectual dead wood.

To a contrarian investor, that spells huge future opportunity.

In my view, Western conventional wisdom is about as wrong as it is possible to be.

Picture: CATL

4 topics