How ex-RBA Governor Phil Lowe would fix Australia's broken tax system

As the man who headed up the Reserve Bank of Australia Board from 2016 to 2023, Philip Lowe is used to fielding tough (and occasionally, hypothetical) questions about whether interest rates will be moving up, down, or nowhere at the next meeting. But now that Lowe is moving into a new role as chair of Future Generation Australia, he is more free to speak about the bigger issues within the Australian economy.

Those issues - six of them in all - don't just pertain to the current cycle. In fact, the most notable change is the one that AMP Chief Economist Shane Oliver also noted in his recent appearance on The Rules of Investing - our tax system.

In this wire, I'll share the six things Lowe would change about our economic policy - as shared in a recent panel session at the Wilson Asset Management and Future Generation Shareholder Presentation in Sydney.

The biggest issue for right now: Getting inflation back to target

Lowe still believes the Australian economy is still on course for that cherished soft landing - but that policymakers can't let up.

"We've got further work to do. The main challenge will be now to make sure that inflation stays back in that 2-3% range," Lowe said, adding that cost pressures do remain in the background.

As for whether he thinks interest rates should be cut - or even increased again - Lowe joked that he had "given up answering questions like that" but said:

"It's possible that interest rates have to go up again but I think it's more likely the next move will be down," Lowe said. "If wages are going up at [say] 4%, that doesn't make for 2.5% inflation unless productivity growth picks up."

The biggest issue of the last 15 years that needs lasting change: Increasing productivity

One reason cost pressures have remained strong, in Lowe's view, is not just to do with factors that the RBA cannot control. The RBA has no control over increasing worker productivity but it has argued for years that decreasing productivity while demanding higher wages will cause inflation to stay higher for longer.

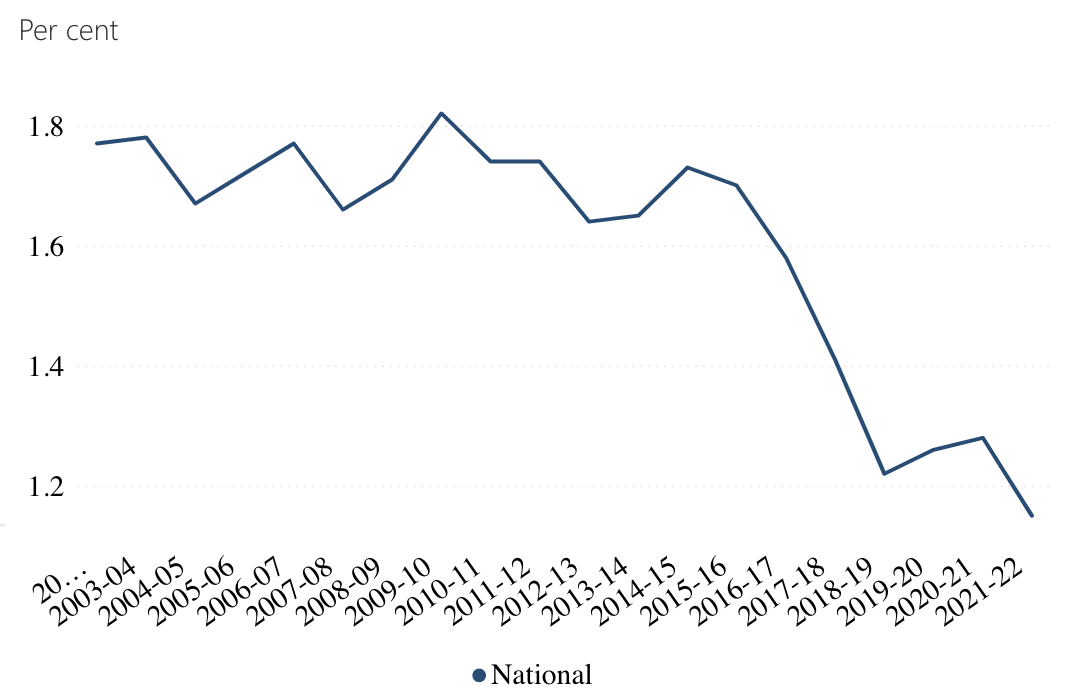

"The Intergenerational Report is predicting growth of 2.2% on average over the next 40 years - 1.2% of that comes from productivity growth and 1% from the increasing size of the labour force. 1.2% a year for productivity growth is much, much better than what we've done over the last decade and a half," he noted.

It is also worth noting that the Intergenerational Report actually decreased its forecast for productivity growth from 1.5% in 2022 to 1.2% in 2023 - and for good reason, as the chart below shows:

"If we can't get stronger productivity growth, everything is going to get harder. You will get lower returns on your investments, real wages won't be able to go up as quickly, and the budget position will be challenged. We need to get better at doing stuff and if we don't do that, our living standards will stagnate," Lowe added.

So how can policymakers step in to encourage the innovation and up-skilling that will be required to increase productivity? The former RBA governor says it's all down to the politicians - and specifically, the next section of this wire.

The change that will take the most courage: Change the tax policy

Ask any economist what they would like to change about the Australian economy and chances are they will mention Australia's tax system. It's not the progressive structure they would change or the things we tax. But it is how much we tax certain areas of our lives.

"The tax system is not fit for purpose," Lowe said. "We tax income and wealth generation too heavily and consumption too lightly. But if you say that in the political world, you're in trouble," he admitted.

"This is a political problem, not an economic problem. How does our society build the consensus to deal with the tax, education, and energy issues? At the moment, we are stuck and if we're stuck and we keep staying stuck, our living standards will stagnate and we'll all be stuck," he added.

This is a view that Dr Oliver would 100% agree with, considering he told our own James Marlay that "the current tax system is way beyond its use-by date and no longer fit for purpose." Oliver says policymakers rely too much on income tax - with the problem that it distorts the economy too greatly. In response, Oliver said he would raise the GST to 15% on all items, among other amendments:

"I would then push out the tax-free threshold, lower all the tax scales and push out all the thresholds. And hopefully, GST revenue would also pay or enable another change, which would help the states eliminate stamp duty on residential property."

How would Lowe fix the tax system?

This was a question posed to Dr Lowe by our own Ally Selby. Here is what he said:

"The GST is too low and income and wealth taxes are too high. Politicians can't say that but that is what the advice to them would be from the various think tanks. There are a lot of individual distortions in the tax system that we could simplify while keeping the progressive nature of the system. It's one of the great things about our society that post-tax income inequality is low. That can be preserved while addressing these other issues in the tax system. But which political party wants to take that on?"

Finally, Dr Lowe also argued that changes need to be made in other policy areas. Briefly, he touched on the following:

- The energy transition is "not working well", adding "it should be an asset for Australia"

- There is further work to be done on the way Australians are up-skilled

- And... Australia is not doing enough to prepare itself for a rapidly growing population, noting "The capital stock is not rising quickly enough to deal with the rapidly rising population. It's most evident to most Australians in the housing market - where the number of houses and apartments we're building is not fast enough for the rapid growth in population."

4 topics

1 stock mentioned

2 contributors mentioned