How merger arbitrage drove returns north of 50%

Australia has proven a fertile environment for merger and acquisition activity in recent months. As other nations continue to grapple with the pandemic fallout, Australia’s relatively low COVID case numbers – thanks in large part to our geographic isolation – has seen our economy reopen and rebound quicker than many. This in turn means company executives and M&A dealmakers alike are confident plenty more activity is yet to come.

Coca-Cola Amatil’s (ASX: CCL) sale to its European counterpart, Vocus Group’s (ASX: VOC) agreement with Macquarie’s Infrastructure arm, and interest in Crown Resorts (ASX: CWN) from Blackstone (among others) are just some of the recent, high profile activity taking the ASX board by storm.

What is less well understood is how investors can take advantage of the current environment, and how an M&A-focused strategy can complement a broader portfolio of investments.

The strategy in a nutshell

An announced takeover offer can typically take several months to complete. Through both the time value of money and execution risk (the vast majority of offers are subject to conditions), shares will typically trade in the market at a discount to the offer price once a takeover transaction has been announced, and the strategy is to arbitrage the price differential. That is, buy the shares today at a discount and then sell them to the bidder at a higher price at completion.

It sounds simple enough but does involve some risks. Deals can (and do) fail to complete, and a deal break sees the share price fall as the control premium is no longer baked in.

Having a strong grasp of the embedded risks in every transaction is crucial, helping reduce exposure to deals that fail, along with the associated losses, and also helping to ensure entry prices accurately reflect the underlying risk.

How can the strategy complement others within a broad portfolio?

The biggest benefit of a strategy targeting mergers and acquisitions is the uncorrelated nature of returns. Share prices of target companies move independently from broader market movements.

Once an offer is announced, shares begin trading based on the probability of a deal completing and whether the market is up or down on any given day has little (if any) influence on this probability.

The benefits of uncorrelation here are two-fold. Within the portfolio itself, one transaction has very little ability to influence the outcome of another. A portfolio full of live takeover transactions exhibits minimal correlation amongst itself and against the market.

The concept of arbitrage is not new. We have previously written about Warren Buffett’s use of arbitrage to temper the desire to chase returns in the absence of compelling opportunities. As a refresher;

“In past reports, we have told you that our insurance subsidiaries sometimes engage in arbitrage as an alternative to holding short-term cash equivalents. We prefer, of course, to make major long-term commitments, but we often have more cash than good ideas. At such times, arbitrage sometimes promises much greater returns than Treasury Bills and, equally important, cools any temptation we may have to relax our standards for long-term investments,” according to Berkshire Hathaway.

The important thing to note is that targeting these arbitrage opportunities is not intended as a substitute to equity market exposure, but rather a complement. Returns are not dependent on correctly assessing whether the dominant market theme will be growth or value. It can help temper excessive risk-taking when the risk versus reward is not skewed in the investor’s favour.

The strategy in action

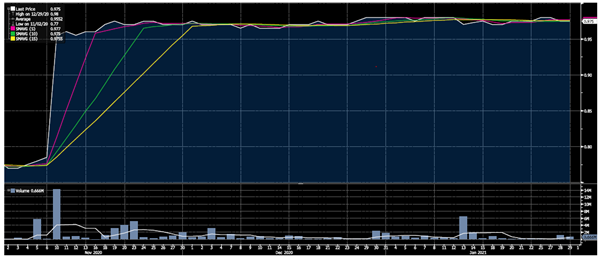

On 9 November 2020, it was announced that Macquarie Infrastructure and Real Assets (MIRA) had made a conditional offer to acquire all outstanding unit in the Vitalharvest Freehold Trust (ASX: VTH) at $1 per share in cash. A week later, a binding agreement was announced. Shares quickly moved from the undisturbed price of 78.5 cents to trade between 96 cents and 97.5 cents, from which it barely moved for the next two months.

Buying shares once the deal was announced at 97 cents would return a gross 3.09% should the deal complete and shareholders receive the consideration of $1 a share. Assuming a standard 120 days between the agreement being struck and the transaction closing, that gross 3.09% would annualise out to a respectable 9.41%. The deal was not onerously conditional, the bidder was highly credible, and key shareholder support had been attained. Relative to the embedded transaction risk, a 9.41% annualised return was certainly favourable.

In early February, the scheme consideration was amended to allow a 2.5 cents a share interim distribution, to be paid without reducing the $1 consideration payable. Rental income for the period was higher than probably anticipated when the agreement was struck, and the permitted distribution was a relatively straightforward sweetener to encourage investors to part with their units and get ahead of any agitation for a higher offer. Immediately, this lifted our total expected gross return to 5.67% and the annualised return to 17.25% assuming no delays to the timetable.

It's not over 'til it's over.

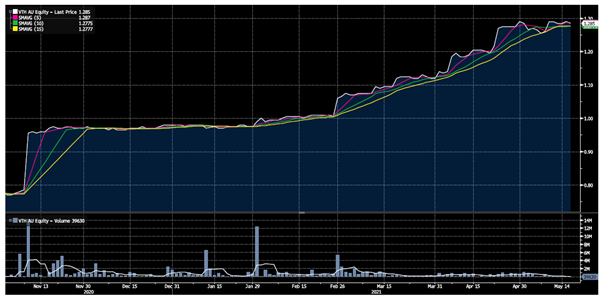

However, in mergers and acquisitions, it’s never over until it’s over. Enter counterbidder, Roc Private Equity (ROC).

Just one week prior to unitholders voting on and approving the transaction, ROC would submit a non-binding offer of $1.08 per share on substantially the same terms as MIRA’s, along with a permitted 2.5 cents a share distribution for a grossed up $1.105. The initial mooted purchase of 97 cents would now be grossing 13.92%, well above even our expected annualised returns on the initial entry. Such is the potential upside to the strategy.

MIRA would quickly go on to match the $1.08 offer in an attempt to fend off the competition, but ROC returned with an even higher bid ($1.12) while it worked away to table up something firm. After four weeks, ROC’s higher offer went binding.

What has transpired since is two equivalent, binding offers on the table being revised ever higher? As of the time of writing, MIRA is in front offering $1.28 per share with the $0.025 distribution already received.

At completion, the expected gross return on the 97 cents entry is 34.54%. The timetable has been extended but based on the current expected completion date the annualised return is north of 55%. Any further extension to the timetable from here is likely to be due to a higher competing offer – an adequate compensation for an extension in our view.

Three lessons from the Vitalharvest transaction

1. There was ample opportunity to initiate a position with attractive risk adjusted returns – There was a whole two months from the first announcement where the share price was trading at a discount to the consideration price.

2. Until a deal officially completes, anything can happen – The last 12 months has seen a large number of corporate transactions with multiple bidders, many of which have offered initial opportunities to purchase shares at an attractive discount to the offer price. Purchases have been paid well to wait out the transaction through until completion, but have also retained a free look at any competitive tussles.

3. Positioning in the trade does not have to remain static – A less obvious lesson is that at each new development of the transaction, positioning can be reassessed. “When the facts change, I change my mind. What do you do?”.

Two binding offers with very favourable risk profiles, and at ever-higher prices, warrants greater exposure. On a risk-adjusted basis, even buying slightly above the highest current price can be justified when the downside is very limited and the potential further upside large. One need only look at the current takeover contest for Mainstream Group Holdings Limited (ASX: MAI) to see this in the extreme. More on that one to come.

Tying it all together

A merger arbitrage strategy has the potential to offer attractive risk-adjusted returns uncorrelated to the market. One feature of the strategy though is that absent any counteroffers, the targeted upside is limited to what the current bidder is willing to pay. The uncorrelation works both ways; it can prove advantageous in times of market turmoil but is neither largely influenced by rising equity markets. Thus, in our view the strategy is better viewed as a complement to existing market exposure rather than a substitute. It can help prevent a portfolio from shifting higher up the risk curve to “juice” returns in an era of low cash returns on investment.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

3 stocks mentioned