How Metrics is navigating a rising interest rate environment

In June 2013, a group of former-NAB executives built upon their lengthy careers in banking to open the doors to a new boutique investment firm. Following the GFC, the Managing Partners identified a trend that would see Australia's major banks scale back their direct lending to certain sectors of the corporate loan market, creating an opportunity for a new breed of private lenders to step in.

That firm is Metrics Credit Partners, which started with a single investor with $75 million to get the firm rolling. Under Managing Partners Andrew Lockhart, Justin Hynes, Graham McNamara, and Andrew Tremain, Metrics has established itself to become the largest non-bank lender in Australia.

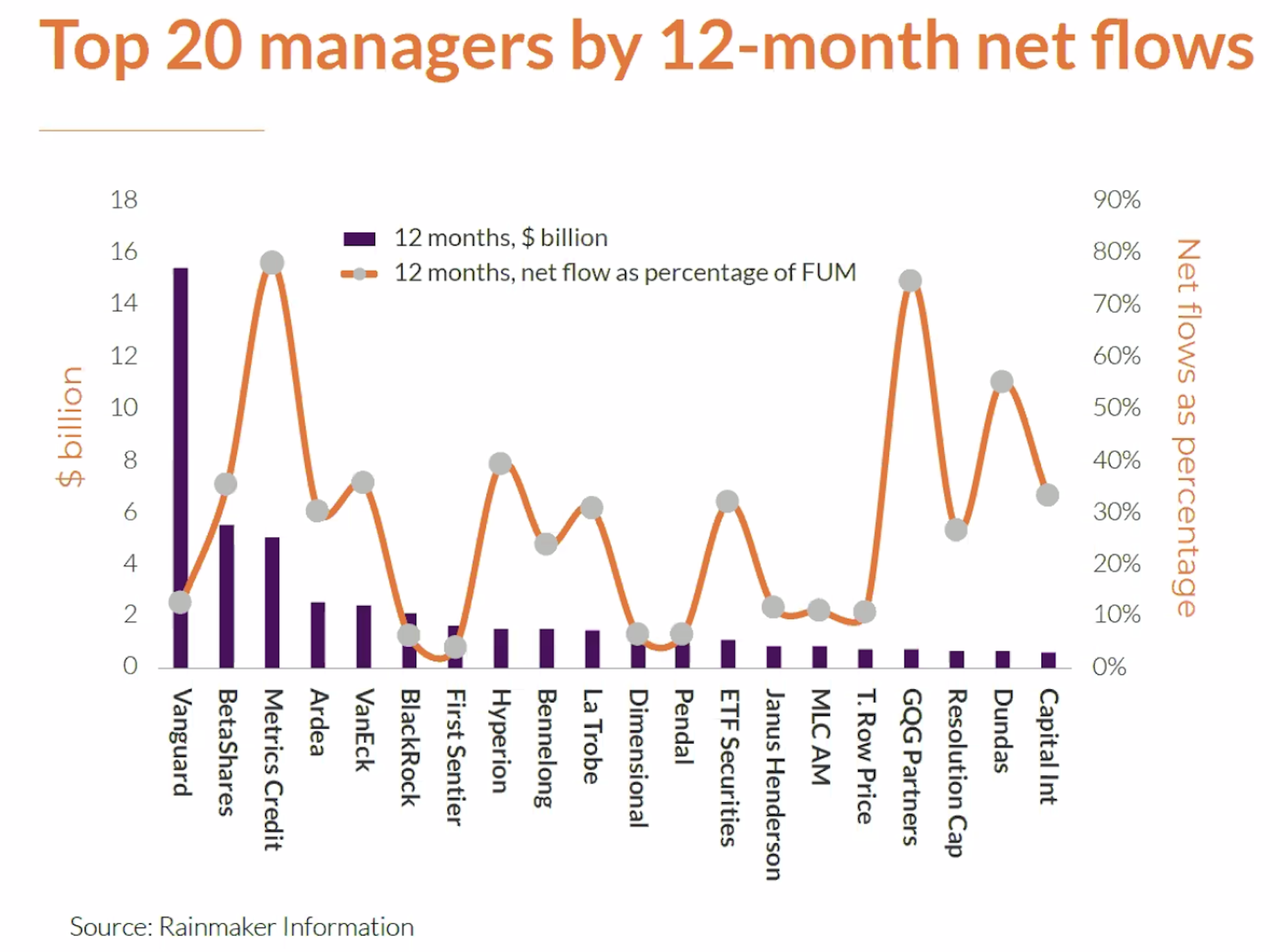

Ten years on, Metrics now has more than $13 billion in funds under management. So how did they do it? For one, Private Debt has become more recognised as an asset class, and exchange traded products as an access vehicle have continued to be popular. These two trends were identified by analysis from Rainmaker Information based on fund flow data for FY22.

The Rainmaker analysis shows that Metrics ranked third overall based on net fund flows and was the top-ranked active manager behind ETF providers Vanguard and Beta Shares.

We recently spoke with Andrew Lockhart to get an update on the growth of Metrics, how the current business cycle impacts the firm's lending activities, and how investors are protected in a rising interest rate environment.

You can watch the interview by clicking on the player or by reading an edited transcript below.

Topics discussed

- 0:00 – Introduction to Metrics Credit Partners

- 1:00 - Opportunity in Private Debt

- 3:08 - Benefits of scale for credit investors

- 4:26 - Where are we in the market cycle for real estate?

- 8:03 - Inflation or Interest Rates – what has had the biggest impact?

- 10:15 - Is the property sector still appealing for lenders?

- 11:36 - How Metrics navigates a rising rate environment

- 13:43 - An explanation of how floating rate exposures work

- 14:51 - Outlook for defaults in the loan market

- 18:14 – Opportunities in the current market

James Marlay: Hi there, Livewire readers and viewers. It's James Marlay here, co-founder at Livewire Markets. I'm joined today by Andrew Lockhart, who is a Managing Partner at Metrics Credit Partners, one of the original and best, private lenders in the country. He's got a wealth of experience in private lending. Established Metrics about 10 years ago?

Andrew Lockhart: Yes, almost 10 years.

James Marlay: And about five years ago, we sat in this very room, discussed the IPO of MXT, which is one of the two listed vehicles that Metrics run. Today, we're going to be speaking with Andrew about what's happening in the lending space and get his temperature check for how that market's looking. Andrew, great to catch up and thanks for your time.

Andrew Lockhart: Thanks, James. I appreciate it.

James Marlay: Your experience goes way back beyond that and MXT passing a five-year anniversary. The business has come a long way and continues to grow. I'm constantly hearing about the scale that you guys are developing. Can you give me a sense of where you're up to with the business now? How it's been growing? And where you still want to get to?

Andrew Lockhart: We started back in June of '13. We started with one single investor for $75 million. Now nine years later, we have 17 different funds, two ASX-listed vehicles, and we now manage in excess of $13 billion. Importantly, each of our funds have delivered for our investors. We've managed credit risk and people have been able to see that track record develop over that nine-year period. So, certainly from our perspective, we think the market opportunity is still very significant. We certainly believe there are benefits to investors from size and scale. And we certainly believe that you're able to be more relevant to a borrower if you're a large private debt manager. Our market is very much dominated by banks, so we need to be able participate and lend and compete with the banks, but also work with the banks to provide funding to clients. As a result, I think the market opportunity for us continues to be very strong.

Our focus is very much around looking to attract new investors and to raise additional capital. Obviously, we as a business, need to continue to demonstrate that we're a sound business, that we've got a good investment product for clients that are looking for the features that are available in private debt. And I think provided we continue to deliver good returns, manage the risk appropriately, then, I think we will continue to see good, strong support from our investors.

But equally, we're very proud of the fact that we provide a very significant source of non-bank finance to Australian companies to support those companies in terms of their growth and their activities, and pleasingly over the last nine years, we've been very successful in building those relationships and continuing to be very supportive of our clients that are looking to borrow funds from our business.

James Marlay: You mentioned earlier that with scale comes certain benefits or advantages that can flow through to investors. What are some examples of that?

Andrew Lockhart: It's important from an investor's perspective that they're able to get diversification. And so, in credit, you don't want to be concentrated. You need to reduce your exposure to individual borrowers or counterparties. And so, if you're a large fund, then the capacity to be able to be relevant to the borrower is very important. For instance, if you think about our market, it's not uncommon to lend 50 to 100 million dollars in an individual transaction. If you're a small manager and you're not managing significant volumes of capital, then obviously the concentration risk of your fund will be greater, or you just wouldn't be able to provide the funding to that company –therefore you would not be relevant to that company. But equally, as you become larger, you have capacity to drive the terms and conditions, and negotiate the pricing to deliver better outcomes for investors. Importantly also, you are looking to lower costs for investors. As our funds have grown larger, the costs for an investor have come off as well, improving returns.

What are the trends in real estate?

Andrew Lockhart: You would expect a slowdown of activity and that's largely to do with uncertainty. We've had over the last 12 -18 months, a fairly significant increase in the cost of construction. As a result of that, together with rising interest rates, it puts pressure on the viability or profitability of particular projects unless people can achieve higher sales. What we're actually seeing, though, is that demand remains quite strong from consumers looking to buy apartments, or from businesses looking to buy industrial sites, tenants looking to take up new areas. Certainly from our perspective, when I look at our portfolio, we don't have any exposures that I'm concerned about from a risk perspective.

Again, if property prices were to fall or decline in value, that is really something that is first borne by equity. So, the owner of the property will be perhaps more concerned about the valuation of the property than us as a lender.

Say a property's worth $100 million. As a lender, you might be lending, 60 or 65 million. The property can fall a significant way before we as a lender would be exposed to potential risk of loss. And so, it's important that people distinguish between where you sit in the capital structure, the rights and the protections that are afforded a lender, a lender that has security over the property, and the kind of clients that we're looking at. We're wanting to ensure that there's strong cash flow because at the end of it, it's the cash flow that can service and repay the debt. So, when you look at a project, you're looking at the viability and the feasibility of a project, and you want the cost to be locked down before you start funding.

In markets like this, many people have entered fixed-price contracts for contractors to build but then they become subjected to variable costs, which then flow through and impact the viability of the contract that they've won. From our perspective, what we are looking to do is to take away that variable cost risk. So, you're financing against a known profitable project with cash flows being from the sale of the asset.

Like all things, it’s not without risk but we have a significant exposure, and importantly, we have a well-diversified exposure across all of Australia where we're active with our clients. Our clients have demonstrated long track records in property and activities associated with development of property transactions.

Our clients expect a deterioration and a slowdown of activity. Projects, cranes that are in the sky today often take some years to be able to get development approval, planning approvals, and be able to move through with a project that's viable. So, what I would expect is, in the current environment, is that people will assess the viability of projects. The return expectations of a developer will increase to compensate for the rising cost. I would expect that either costs will decline over time, or people will be paying more for property in the future to justify the cost of undertaking the development.

What’s hit hardest: rising costs or rising rates?

Andrew Lockhart: Over the last two years, it's been a market where people have been able to achieve sales and pre-sales, but that doesn't necessarily mean you've got a viable project until you've locked in the cost to deliver that. And so if revenues increase, but your cost to deliver the project increases more rapidly, then the viability or the profitability of that project becomes tested. It's very important that when we assess the viability of a project, and the financing, that not only do we look at the cost to develop the project and to ensure that those costs are locked down (so that there's fixed prices or fixed tenders that have been entered into), but equally that we make sure that revenue and the presale level is also increasing to cover that cost to make it viable.

From our perspective, we've seen clients achieve higher prices to negate some of that increase in cost that's occurred. Ordinarily as a lender, you would want to have a minimum acceptable development margin to ensure the profitability of the project. Not only are you looking for your developer to contribute equity to the project to reduce your risk as a lender, but you want to know that the project is viable and that they're incentivized to complete the project. And so, when they get squeezed by rising interest rates or rising costs, then people will look at it and say, "Is it worth pursuing and progressing with this project today? Or will I just reassess it in another market cycle?" And you'll see that naturally occur through the market as well.

James Marlay: How do these dynamics and observations impact the appeal of lending in the space for you?

Andrew Lockhart: We've got clients that are active in the market and have been through multiple cycles, just as we as a lender have gone through multiple cycles. We're dealing with professional, skilled, experienced property people. What we want to know is that the client that we're financing has a track record and has financial wherewithal so if costs rise, or there were to be some uncertainty in the delivery of the project, we know that they have the ability to sustain and complete. We're not looking to lend to part-time developers. Jimmy, if you were to come to us and say, "I'm going to build a block of apartments", we probably wouldn't finance you . In fact, I'm sure we wouldn't finance you. It's about ensuring that you've got a track record, demonstrated track record, and a skillset for delivery. And then working with our clients to ensure that they've got good projects that are being financed and that we understand their source of cash flow to support and repay the debt. But it's also about ensuring that there's a very strong alignment between their interests in terms of completing the projects and financing, and our investors' interests in terms of receiving an appropriate return and ensuring that they get their money back.

James Marlay: With your existing pool of loans, can you give me the 101 on how you manage for rising interest rates and how that flows through to investors? What do they feel?

Andrew Lockhart: If you think about it in the context of most of our loans would be floating rate. So, as interest rates rise, each time the borrower resets their interest rate, the higher margin or the higher base rate is passed on to the borrower immediately. But as a lender, what you're looking to do when you enter a transaction, (say, we're lending for, say, three or five years), is to have a forward view in terms of where interest rates might go over that period of time in order to structure the loan to not only accommodate rising costs and higher interest expense, but to also build in buffers. For instance, you would never provide funding based on a current position today without having some degree of stress test or sensitivity built into your forward cash flows. That would include rising costs in building through contingency for construction costs. It would include a rising interest rate environment where you have a buffer for interest rate increases over the term of your facility. So, all of those things have to be demonstrated to be considered before we as a lender would provide funding.

Construction funding is very important, in the context of you provide a contingency for construction costs, you have a contingency for time, and you have a contingency or buffer for interest rate rises that may occur over the time of your financing. The financing structure that you've put in place has to be able to withstand that.

In equity investing, people are looking to see the growth in the company's earnings and to profit from that. As a lender, what we're looking to see is, is there any potential risk that might impact the viability of the project or the company, and therefore, have we got a sufficiently conservative debt structure, which means more equity might be required to be put into the transaction.

James Marlay: So, typically, within one of your loans, does the rate get revisited monthly or quarterly? How does that work?

Andrew Lockhart: The bulk of our borrowers would reset their base rate every 30 days, but they have the right to elect either 30, 60, or 90 days under the term of the facility agreement. When interest rates are rising, and say, the three-month rate is higher than the one-month rate, you'll find that borrowers will want to borrow for the one-month rate and roll each month. But what happens is each month is interest rates rise. So, you think back to June and we're 135 on the RBA cash rate. Today, we're 285 basis points on the RBA cash rate. Those RBA cash rates and the market rate through BBSW or BBSY is immediately reflected in the higher cost of funding. This is one of the benefits of investing in floating rate, short-dated exposures - as interest rates rise, the higher base rate is immediately charged to the borrower, delivering a higher total return for our investors.

James Marlay: I note that the two listed investment trusts, MXT and MOT, have been trading at discounts to NTA. Last time this happened, there was a big dislocation in 2020, they traded at significant discounts, it took them some time to come back and I was surprised to see them trade at discounts. Do you think investors were anticipating higher defaults? What was the feedback that you got? And what do you think you're going to see with regards to defaults?

Andrew Lockhart: There was a period of nervousness and a search for liquidity that occurred during the pandemic and most recently when the market started to forecast rising interest rates. As people adjust to uncertainty, all we can do as a lender is say, "We manage the lending activities that we do to preserve and protect our investors' capital by having appropriate loan terms, conditions, covenants, controls, security, and taking a conservative view in terms of how the company will generate cash flow to service and repay the debt." So, we as a lender haven't changed the way in which we lend in terms of the approach to the due diligence work that we undertake and the way in which we structure and negotiate transactions with our borrowers. We look through the cycle and we look to provide a view and provide a consistent form of financing for our clients.

In terms of defaults, if you look back now over nine years of our track record, we've not exposed our investors to any negative months. It's been consistent monthly income distributed to investors month in, month out. And the returns have reflected the fact that we've not had any credit losses.

Now, if you look at the data that's produced by the banks through their APS 330 disclosures to APRA, the most significant level of write-offs that the banks had incurred was in March of 2009. And that was 0.67 of 1% in terms of their loss rates, so their net write off. So, we would expect our track record and the kinds of exposures that we hold to, again, have demonstrated to the market that we consistently lend with very low loss rates.

Now, I think importantly, where we differ from the banks is that we're not geared, we're not regulated. And so if you think about the banks, they have a very difficult time going through any restructure or change to the nature of a facility. They can't convert debt to equity without incurring a large capital impost. As a private markets lender, what we're interested in is ensuring that our investors' capital is protected and preserved. If that means working through a restructuring event, and we needed to renegotiate where we sit in the capital structure and take or convert the debt to equity, we would do that. Because, not only would it mean that we’ve got a means to preserve and protect our value of our capital, but we may have the potential to profit and participate in upside gains if the company’s returns or fortunes improve down the track. Whereas a bank will often have to be a forced seller of the loan at a discount. For us, we can look through that. We're not in that same position because we're not required to hold regulatory capital against the loans that we make.

An exciting opportunity looking forward

James Marlay: I thought we might finish the interview on a bright note and a positive sentiment. I'd love to hear you discuss an opportunity that you think looks exciting over the next year or so.

Andrew Lockhart: I think we've got a lot of opportunities within our funds. We're very close to our clients and we look to support them. We have a range of flexible mandates that actually allow us to be relevant to support our clients, and that might be providing debt, but it also might mean that we can negotiate some equity participation or upside for our investors through warrants or preference shares or some form of profit participation. And so from our perspective, what we're looking to do is to use our networks and our relationships to continue to originate good transaction opportunities for our investors, but at the same time being supportive of our borrower clients in delivering them an important source of financing and capital.

We see a lot of very interesting opportunities day to day. And importantly, we're very selective about the transactions that we do complete, but in total, again, I'm very confident around our funds and the performance of our funds for our investors. And I'm confident in the performance of the companies that we provide funding to and the management teams, and we're keen to support them and assist them with the growth of their businesses. From our perspective, we see a lot of opportunity in and across the market. And importantly, we want to ensure that we've got sufficient capital to be able to support those clients with access to financing as required to ensure that their businesses continue to grow.

James Marlay: Okay. Great. Well, Andrew, thanks for coming in. Always good to catch up and appreciate you taking us inside the private lending space and giving us an update on what activity you're seeing.

Andrew Lockhart: Thanks, James.

James Marlay: To all you viewers out there, thanks very much for tuning in. I hope you enjoyed the update from Andrew. Remember, hit subscribe on the YouTube channel. We're adding fresh content every week.

Looking for higher-paying income rates than the major banks?

Metrics Credit Partners is a leading Australian non-bank corporate lender and alternative asset manager. Metrics provide regular and consistent income to investors through its portfolio of corporate loans. Visit their website for further information.

1 topic

2 stocks mentioned

3 funds mentioned

2 contributors mentioned