How Morgan Stanley Wealth Management is investing through uncertain times

We’re in a late-cycle environment, with headwinds for risk assets blowing even stronger than before war broke out in the Middle East. That’s the overarching view Morgan Stanley Wealth Management (MSWM) outlines in its latest Asset Allocation Insights report, which is appropriately subtitled “Hunkering down.”

The report, released on Monday 23 October, was authored by a cross-disciplinary team headed up by Alexandre Ventelon. Contributors also included equity strategists and investment strategists Simon Clark, CFA, Wayne Chatterjee, CFA, Amogh Ramesh, CFA, and Sharmeel Suka.

“Consistent with our late-cycle view, we remain defensively positioned but monitor developments. In the next few months, the market could either move up or down within potentially a wide range,” says MSWM.

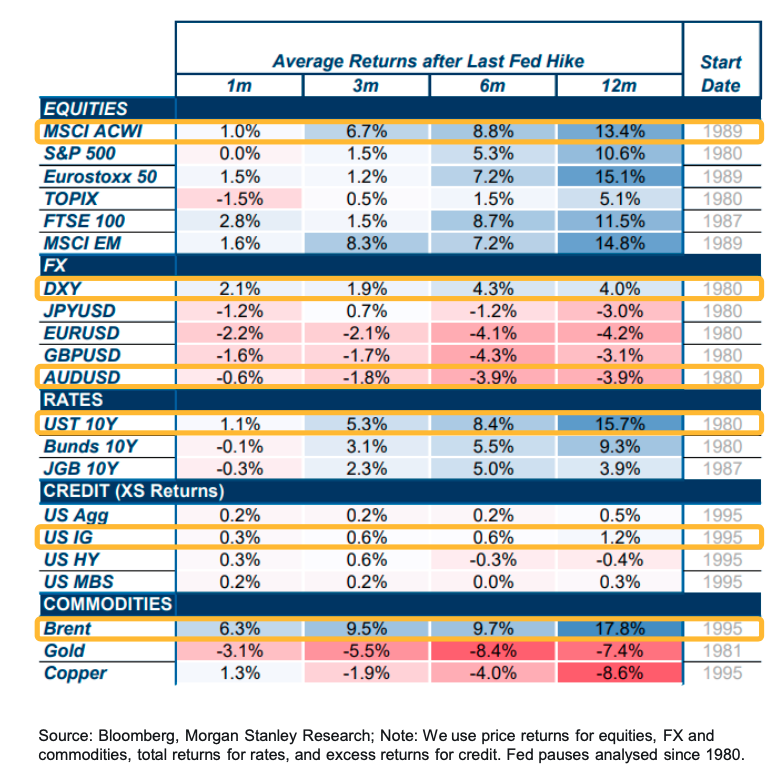

MSWM’s broad view is that the world’s three largest central banks – the US Federal Reserve, the European Central Bank and the Bank of England – have finished hiking rates.

“In the US the Federal Open Market Committee (FOMC) meeting struck a hawkish tone in September…A further hike this year remained an option, and the message of higher for longer was made clear: the dots for 2023 became more centred around the median 5.625% as a peak rate,” says the report.

“Taken at face value, if sustained, these tight conditions will restrain economic activity over time. Essentially, the market is doing additional tightening for the Fed.”

The US Fed hiking cycle is (probably) done

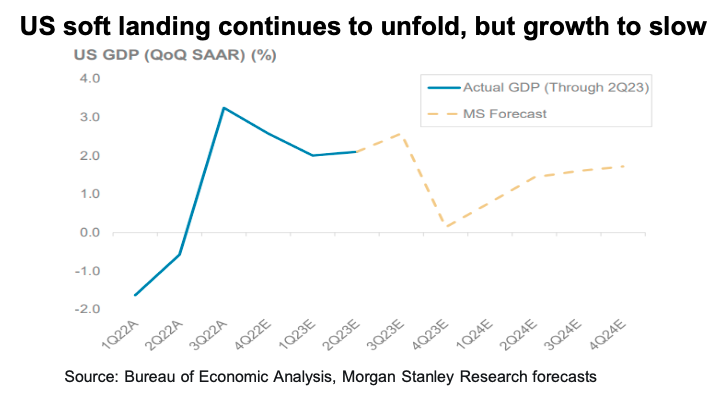

MSWM’s base case assessment for the US is a soft landing and no recession, “Partly because fiscal policy has been unusually strong, although there is still no clear rebound next year.”

While noting that US growth has been more resilient than expected, underpinned by ongoing consumer spending, the team believes this is changing.

With a view that a significant portion of the economic slowdown lies ahead, it doesn’t anticipate further rate hikes from the US Federal Reserve

“The headwinds to consumer spending are increasingly outweighing the tailwinds and will likely continue to do so in the coming months,” says MSWM.

“Morgan Stanley economists believe that the Fed has finished raising rates in this cycle at a peak Fed funds rate of 5.375%.”

Where is inflation headed?

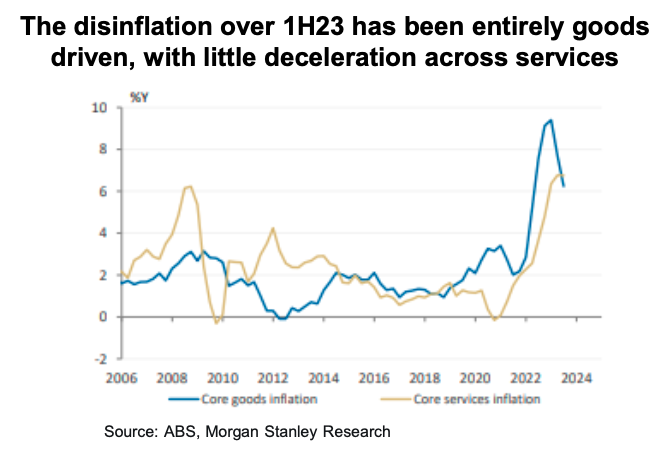

“Inflation is still coming down, but the concern is the reacceleration in core services,” the report says.

“On a 3-month annualised rate, core CPI has reaccelerated to 3.1%, from 2.4% in August.”

The report recognises the effect renewed conflict in the Middle East has had on oil prices but regards this as only “a small pass-through to CPI".

Asia

In Asia, the report notes that inflation across the region more broadly – in 78% of Asian markets – is back within the respective central bank comfort zones. The outliers here are:

- China

- Korea and

- Thailand.

MSWM expects weaker GDP growth in these markets to weigh on corporate revenue growth and profits, setting the scene for a sharper slowdown, “potentially leading to a continued rise in debt to GDP ratios.”

The big risk for China

“We see the risks to nominal GDP growth as being skewed to the downside, given that the risks of China falling into a debt-deflation loop,” the report says.

Japan and India are Asia's bright spots

The report notes Japan’s nominal GDP growth is now on an upward trajectory, hitting “a high not seen since 1981.”

In the case of India, MSWM notes “stronger real GDP growth is helping to sustain nominal GDP growth at relatively high levels.”

Commodities

The recent outbreak of war between Israel and Palestine is a tragic event with broad ramifications for not only the region but globally. But markets don’t appear to be heading toward a repeat of the 1970s energy crisis.

“At this stage, we see limited impact from the recent geopolitical events which escalated in early October, as neither Israel nor its direct neighbours are large oil producers,” says MSWM.

Iron ore, it notes is holding at US$120 a tonne on the back of China’s “robust” steel output and other demand drivers, including weaker Chinese iron ore output. These prices may “soften modestly (to around US$105 a tonne) in 4Q23 if China’s steel production falls” – but MSWM believes such a scenario would be short-lived.

“We could see a rebound into 1Q24 toUS$120/tonne, as China's steel output returns and El Niño brings supply risks to Australia and Brazil,” the report says.

Australia caught in cross-currents

The MSWM report was released just days ahead of the latest consumer pricing index update, which showed annual headline inflation slowed by less than forecast, to 5.4% in the September quarter, from 6% in the June quarter. The team anticipated further upward pressure and the increased likelihood of a further rate hike from the Reserve Bank of Australia.

“We believe this [fuel inflation], combined with still resilient labour demand and signs of wage growth accelerating, will be a concern to the RBA. Morgan Stanley economists have retained their expectation for a rate hike at the November RBA forecast update meeting,” the report says.

What does this mean for investors?

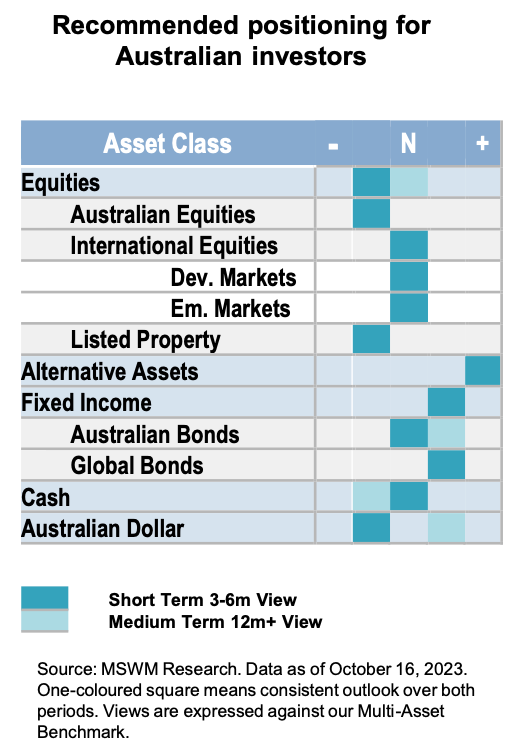

In global equities, MSWM is maintaining a defensive “barbell” approach within its model portfolios. This combines large-cap defensive growth/quality and late-cycle cyclical companies.

The team particularly likes the valuations of companies in the Utilities and Consumer Staples sectors, with both currently in the bottom quartile of historical relative valuations.

In regions outside the US, India and Japan are MSWM’s preferred countries for equities investment currently.

“Japan’s secular tailwinds remain intact, with positive economic growth, accommodative monetary policy and strong momentum in corporate profits,” says the report.

“In other regions, India is our preferred Emerging Market (EM), while Europe remains Underweight.”

Australia “searching for direction”

Noting ongoing uncertainty, the report says AGM season and a handful of company results will have a strong influence on sentiment and how MSWM’s portfolios are positioned into the end of 2023.

The team believes Australian equities appear to be fully priced at current valuations, “while bond yields push higher and Industrials earnings growth has likely yet to trough”.

“The macro backdrop remains influential with the next two Fed meetings seen as key, while incoming local data on employment and inflation will also remain in focus for the RBA's two final meetings of the year.”

Fixed income

“We still expect bond yields to fall from current levels and consider current yields as attractive, whilst providing downside protection in the period ahead when we could likely see growth moderating markedly,” says the report.

Recommended positioning for Australian investors

The MSWM team is positive on investment-grade credit, noting it offers yields of 6% plus in US dollar terms, alongside moderate volatility “and higher total returns if Morgan Stanley rate forecasts are realised.”

“From here, we see IG spreads moving sideways and High Yield (HY) spreads wider, as the market prices more dispersion in operating strength and greater financing flexibility in IG.”

2 topics

1 contributor mentioned