How much gold should you have in your portfolio?

Gold had a bumper year in 2024, hitting record highs, but can it continue its run? The election of Donald Trump as US President hit prices hard initially off the back of a surge in the US dollar and movement to risk assets, but it has since recovered towards the end of the year. The spot gold price is at US$2,647.07/oz as at Tuesday 7 January, according to goldprice.org.

Despite these highs, State Street argued in its Gold 2025 Outlook that there was the potential for the bull run to continue and prices to hit US$3,100/oz across this year.

It’s a big call, particularly considering an environment where the US dollar has been strong. There’s a push to cryptocurrencies and markets have otherwise been on a tear, but State Street’s gold strategists are pointing to secular demand trends to continue to propel prices.

Interestingly, Livewire’s own readers also argued for continued strength in gold markets this year, with 25% of respondents in the 2025 Outlook Series survey believing gold will offer the best returns this year.

There’s plenty of research to suggest that gold has a place in a portfolio, though debate continues over the size of the allocation.

In this wire, I’ll summarise State Street’s case for a continued gold bull run, views on portfolio allocations and options for investment.

State Street's trends to watch for gold prices in 2025

1. Central bank buying patternsState Street highlights that Central Banks are on track to purchase 2,700 tonnes of gold since 2022. China has been one of the biggest buyers of gold, despite high prices. This has been contrary to the usual inverse relationship between the strength of the US dollar and gold prices. Gold has appreciated 813% since 2000, while the US dollar has maintained its level.

State Street also argues that the pace of central bank buying increased during the first Trump administration with the view of reducing the US dollar’s dominance. Trump’s proposed tariff policies could accelerate buying behaviour too.

2. Funds management

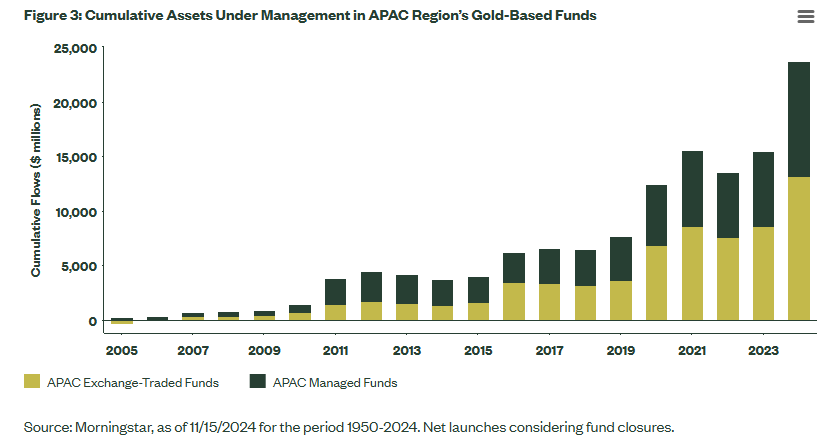

Issuance of gold funds have increased in the APAC region and supported demand for gold. Gold funds have attracted over US$23 billion in APAC since 2005.

Gold is also viewed as a hedge against inflation and a store of value. With the world in a global easing cycle, conditions favour demand for gold as a safe-haven asset.

3. Consumer demand

There is also demand for personal use, such as jewellery. India for example, cut the import duty on gold by 9% to support the jewellery industry. Jewellery demand has also been popular in China, though there are suggestions that the Year of the Snake may mute demand slightly because it is not a positive year for weddings.

Why investors use gold

Investments in physical gold, directly or indirectly, are often used as a safe-haven asset in volatile markets and uncertain geopolitical environments. Gold is typically a store of value which can mean it is protective against inflation and also tends to be uncorrelated to assets like equities or fixed income, making it an option as a diversifier in a portfolio.

While being a physical asset, the demand for gold means it is typically a liquid investment – meaning it is easier to sell compared to some assets.

It’s worth remembering that gold doesn’t generate income – returns come from growth in the value of the asset, and there can be a range of storage and insurance costs involved for those who physically purchase gold bullion. Like other investments, gold is also subject to capital gains tax.

How much to allocate in your portfolio

Gold usually sits in the alternative assets section of a portfolio and allocations can vary.

State Street’s research from a few years back considered allocations of 2%, 5% and 10% and found that all options improved the Sharpe ratios of the portfolios, minimised drawdowns and offered better returns compared to identical portfolios without gold allocations. In other words, gold improved the risk-return profile of diversified portfolios.

Harry Browne’s concept of a Permanent Portfolio suggested 25% in domestic equities, 25% long term bonds, 25% cash and 25% gold, with the view that it could offer protection from inflation.

Robo-advisor Stockspot’s allocations are currently as high as 14.8% across all of their portfolios based on their assessment of market conditions. Stockspot’s Founder and CEO Chris Brycki notes that the allocation to gold protected clients from 50-80% of market falls in March 2020 and has continued to offer strong returns.

“Gold is a proven defensive asset, and it’s a better diversifier than cash or any other readily investable asset class. That’s why Stockspot includes it as part of our portfolios,” says Brycki.

Options for investing in physical gold

Investors can generally look at direct purchases in gold, using a bullion company. They may be required to arrange for their own storage and insurance of the bullion, thus it can be a more complicated and costly process.

Managed funds and exchange traded funds (ETFs) can be an alternative for investors to consider, though also subject to fees and charges.

Some examples of unlisted managed funds are the State Street Gold Fund, AMP Gold Trust, Argonaut Global Gold Fund or Baker Steel Gold Fund. These are wholesale options and can have higher minimum investment thresholds and fees.

Exchange traded funds have been a popular option for investing in physical gold, as investors don’t need to manage storage and insurance costs themselves and there’s a lower entry threshold. There are 5 physical gold ETFs listed in Australia – please note there are 2 gold miner ETFs as well, but I’ve only listed the funds that invest in physical gold below.

It's also worth highlighting that a unit in each of the below funds may represent a different volume of gold. For example, GOLD’s metal entitlement was 0.09201821 troy ounces/unit and PMGOLD’s metal entitlement was 0.0099547 troy ounces/unit. Each ETF may have a different cost to purchase based on their underlying metal holdings and entitlements.

|

Fund name |

Ticker |

Fee (% pa) |

1 year return (%) |

|

Global X Physical Gold |

GOLD |

0.40 |

39.87% |

|

Perth Mint Gold |

PMGOLD |

0.15 |

40.24% |

|

Betashares Gold Bullion ETF – Currency Hedged |

QAU |

0.59 |

28.08% |

|

iShares Physical Gold ETF |

GLDN |

0.18 |

40.27% |

|

VanEck Gold Bullion ETF |

NUGG |

0.25% |

40.07% |

Source: Market Index as at 8 January 2025. Fees sourced from issuer websites.

Do you invest in gold? Let us know in the comments and what size of allocation you use in your portfolio.

2 topics

4 stocks mentioned