How QVG nailed reporting season and why it matters (plus the ASX name that keeps delivering)

This week, I hosted a webinar with Tony Waters, Chris Prunty and Josh Clark from QVG Capital. QVG manage a Long-Short and an Opportunities Fund, both high conviction funds with a bias towards small and mid caps.

Both funds enjoyed a stellar reporting season, with the QVG Capital Opportunities Fund returning 7.3% in August, whilst the Long Short Fund delivered 6.82%.

And whilst QVG co-founder Tony Waters was quick to point out that one shouldn’t get too carried with any single month of performance, good or bad, I know from my days running money that nailing reporting season is critical to setting yourself up for a good 12 months.

If you have a shocker during reporting season, there is a risk that you spend the next 6-12 months chasing your tail and playing catch-up. Underperformance is difficult to make up.

All of that said, QVG invests for the long term, and over the long term the returns have been attractive. Since inception, in 2017, the Opportunities Fund has returned 13% per annum, 7.5% per annum ahead of the benchmark S&P ASX Small Ordinaries Accumulation Index.

The Long Short Fund, meanwhile, has a 15.4% compound annual growth rate since inception (May 2019) versus the S&P ASX 300’s 7.5% CAGR over the same period.

You can find the full interview here.

In this wire, I summarise 3 of the key takeaways from the webinar, including:

- Reporting season summary

- Why earnings will be the driver from here

- The ongoing thesis for a top 5 holding that continues to deliver.

Reporting season

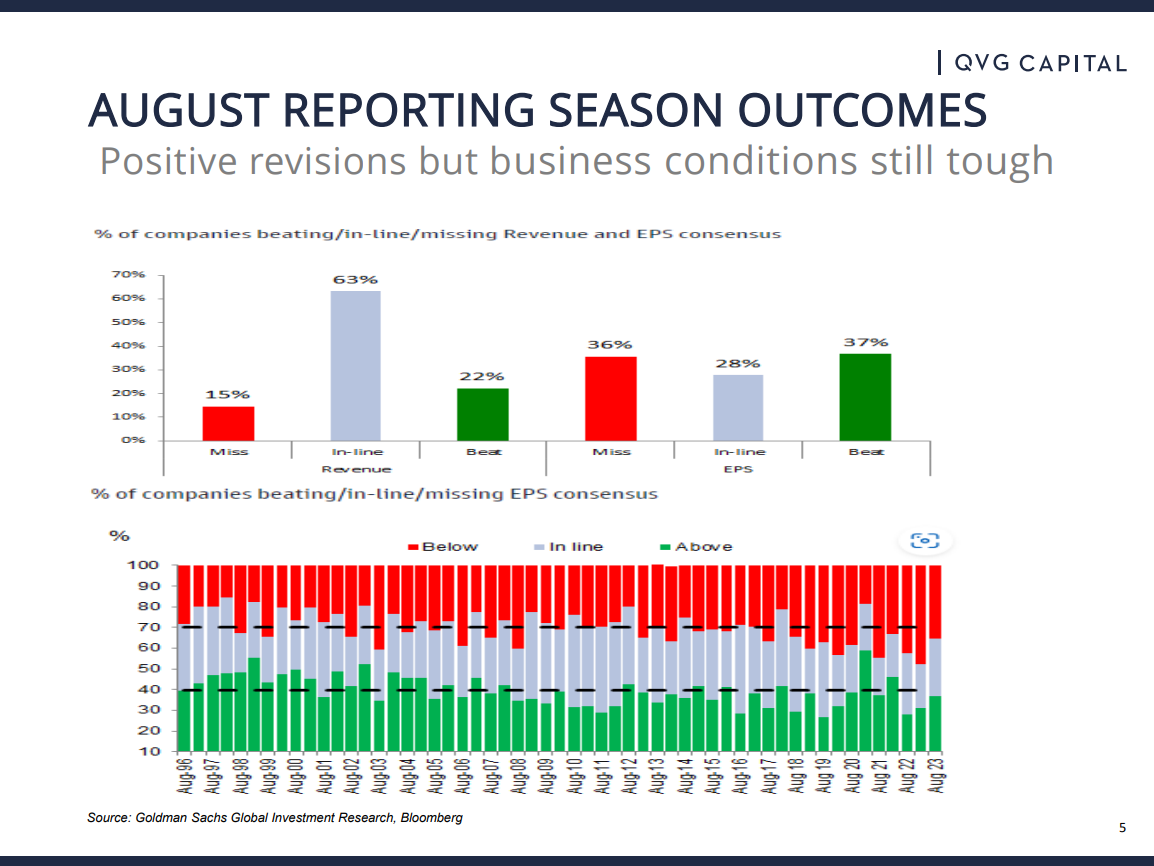

The graphic above is a snapshot of what the QVG team saw through reporting season.

“If I rewind six months ago, I talked about the worst season in over a decade in terms of downward revisions versus upward revisions and I did make the point that August reporting season wasn't likely to be any better given the outlook as we saw it”, says Waters.

In reality, the latest reporting season wasn’t that bad, because the market had revised downward over the last six months.

"When it came to the actual results, the market expectations were delivered", says Waters.

The interesting to note, according to Waters, is that “if you look at the beat on a revenue line versus an EPS line, there has been some benefit in terms of leverage”. Waters goes on to add that “we still haven't seen the effect of higher interest rates come through in gearing in business models yet, given that there's a delay in terms of rolling onto new terms”.

Waters uses the example of retail, pointing out that things “fell off a cliff somewhat in April through that last quarter to June 30”, and when the retailers reported, it was shown in the outlook that while things were still quite negative on same-store sales, they hadn't further deteriorated as they did in the final months of FY22/23.

“So we actually did get some small upgrades in some of those retail names”, says Waters.

Why earnings will be the driver from here

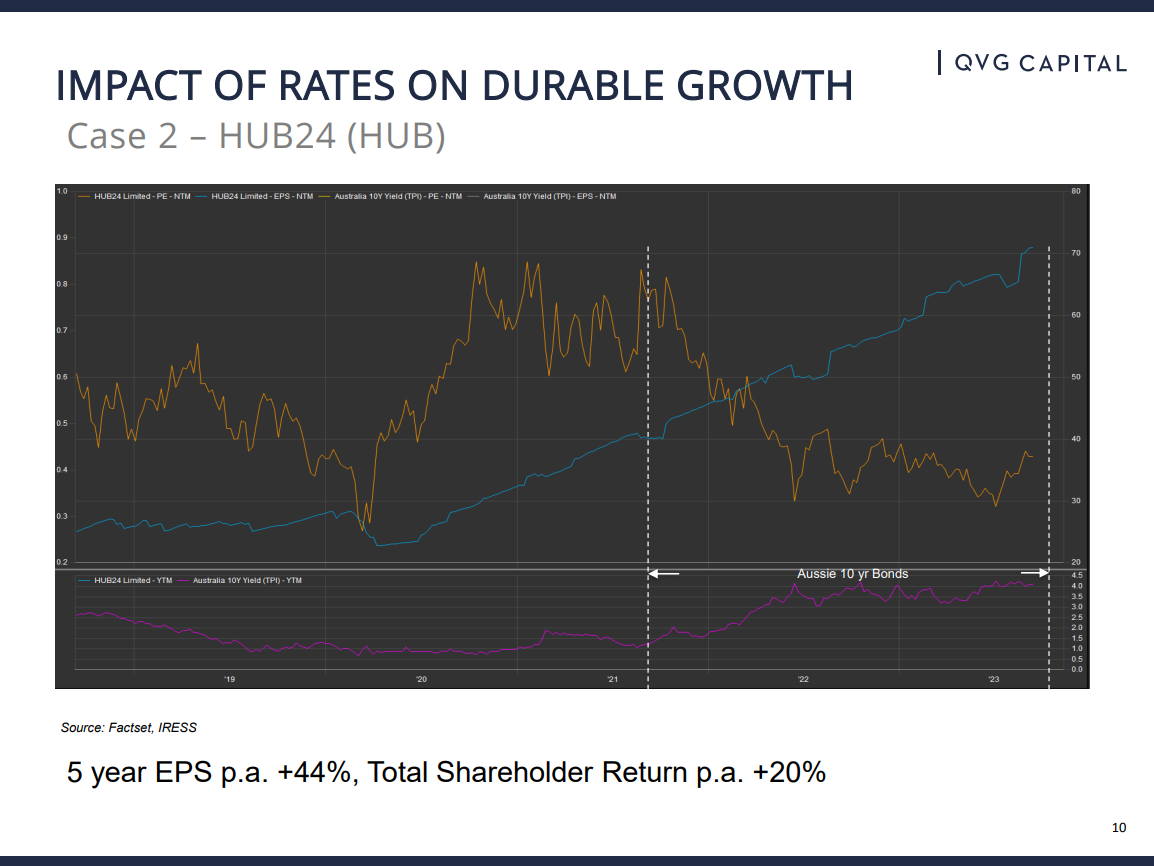

The image above can be broken down into three phases, says Waters, that help highlight why earnings will be the driver from here. Waters adds that the QVG performance has been somewhat correlated to the 10-year bond yield.

The first phase was the period of declining interest rates at the start of 2019, into the onset of the pandemic which was “great for us and our portfolio”, says Waters.

“We performed very well during that period and we performed very well on emergency low rates at the onset of the pandemic right through to the third quarter in 2021”.

The second distinctive period was the period where rates began to rise following the onset of inflation.

“We've never seen a point in the market where rates have gone up by a factor of four times from circa 1% to 4% - that was clearly difficult for ASX listed industrials, particularly small cap industrials”, says Waters.

And finally, the current stage.

“We have gone through that period and while we get to a point where the markets reached a point of moderation, albeit volatile moderation in terms of rates oscillating around about that 4% range, it means that we can start to breathe”, says Waters.

He adds, and this is the kicker, that companies with earnings per share growth can get a return in the market rather than that being washed away through the increase in interest rates and a corresponding decline in PE multiples.

The ongoing thesis for a top 5 holding that continues to deliver

We’ll cut right to the chase. The stock in question is HUB24 (ASX: HUB), which has been a key holding in both portfolios for some time, and continues to deliver for QVG investors.

Waters on HUB24:

This is our second-largest holding.

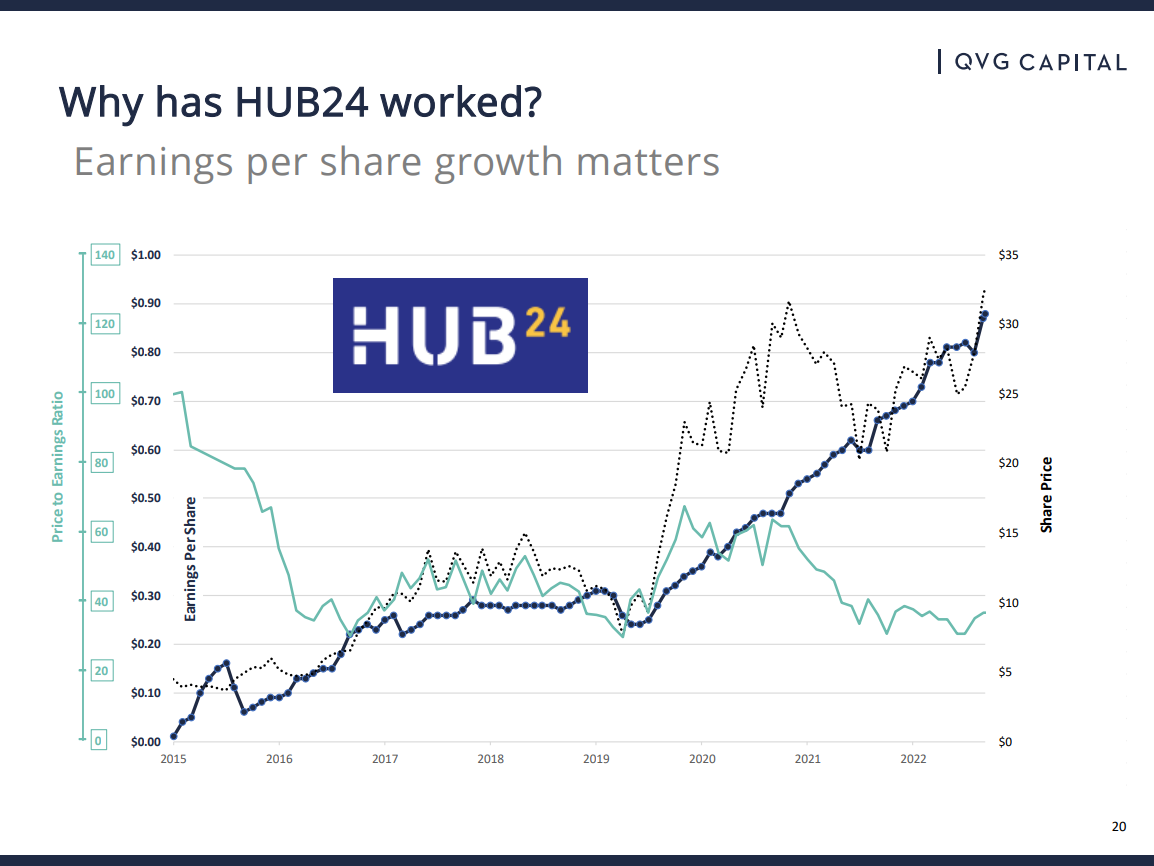

As interest rates increased through mid-‘21 to mid-‘22, we had a corresponding decline in the PE multiple. Yet earnings per share growth has continued unabated and it's a beautiful linear line in EPS growth which measures, on a 1-year forward, all the way through to where we are today.

This was one of our best performers during reporting season.

“We have had this stock in our portfolio for a while, it's been a top five stock for many years now, with five year EPS of 44% and total shareholder return of 20%.

Josh Clark on why HUB24 has worked as an investment:

The green line here is the PE multiple for HUB, the dotted black line is the share price, and what should stand out is the bold line in blue – that is the EPS growth and that's been really impressive and enduring for HUB24 since they went through breakeven way back on the left side of the chart.

The other thing that's interesting is that when we first came across the business and first bought it, the business traded on around a hundred times earnings. It's pretty difficult to make money if you're paying a hundred times what a business earns.

If you consider a scenario where that business beats expectations in year one or in year two, it's still not anywhere near enough to justify the multiple that you're paying for that business.

Really what a business has to do is it must continue to compound at higher rates in the outer years. So growing strongly in year four, year five, year six and so on. They're the years that are really difficult to forecast and that's where qualitative assessments become really important.

Clark again on why the QVG team still likes it:

HUB24 is one of the larger weights in the long book. It's also been one of the larger contributors to the fund since inception.

HUB24 is an investment platform.

The circular graphic on the right highlights just a few examples of the things the platform does, including investment monitoring and selection, automation of portfolio changes, admin, tax optimisation.

I've also included a few of the awards that HUB24 have won, one of which is Best Platform overall.

If you want a bit of extra evidence as to the level of investment that they've put into the product and where the product sits, the bar chart on the bottom left is from an advisor survey showing that 91% of those surveyed want to put more money into Hub.

That is, 91% said that they expect HUB to have inflows from them, which is the best statistic out of the peer group”.

4 topics

1 stock mentioned

2 contributors mentioned