How Schroders would put $1 million to work in multi-asset investing right now

Please note that this interview was filmed on 12 March 2024

Fund profile

- Name of fund: Schroder Real Return (Managed Fund)

- Asset Class: Multi-asset

- Investment objectives: To achieve a return of CPI plus 4% to 5% p.a. before fees over rolling 3-year periods while minimising the incidence and size of negative returns in doing so. CPI is defined as the RBA’s Trimmed Mean, as published by the Australian Bureau of Statistics.

- Link to fund pages: GROW

A changing landscape

By his own admission, if I had asked Sebastian Mullins, Head of Multi-Asset Australia at Schroders, for his take on markets only three months ago, his answer would have been decidedly different.

Three months ago, he would have said that "we were bullish on short-term rallies and equities, but fundamentally cautious over the medium term".

Fast forward to today, and it's almost the opposite, according to Mullins:

"We're seeing that now turn 180. We're seeing signs of improvement in economic variables in the US - sustained earnings in the US for example - so we're more fundamentally supportive of equities.

But everyone is in the same boat; so structurally positive, short-term negative".

That view sees Mullins and the team that manages GROW considering raising cash to buy equities, believing that "we might get a better chance to add to equity positions".

Where would that capital come from? Mullins is prepared to sell credit, to which GROW had previously had a large allocation.

The $1 million question

One of our favourite questions at Livewire is asking a fund manager how they would allocate $1 million, given the prevailing market environment.

Before sharing how GROW would allocate, investors should understand some important elements of the product.

First and foremost, GROW is benchmark unaware. Rather, it uses an objective-based approach, focused on delivering absolute returns (i.e. positive returns regardless of market direction) throughout the market cycle.

Given that approach, Mullins acknowledges GROW is "quite apt for a total portfolio solution for someone in the pre or post-retirement phase". That said, it can also be suitable as a "nice slice to have within a portfolio that can help someone, even in the accumulation phase, move asset allocation around".

Regardless of who uses the product, Mullins sees flexibility as one of the key features of GROW and highlights the period from 2020 onwards - a period punctuated with volatility and uncertainty - as evidence of the usefulness of such a strategy.

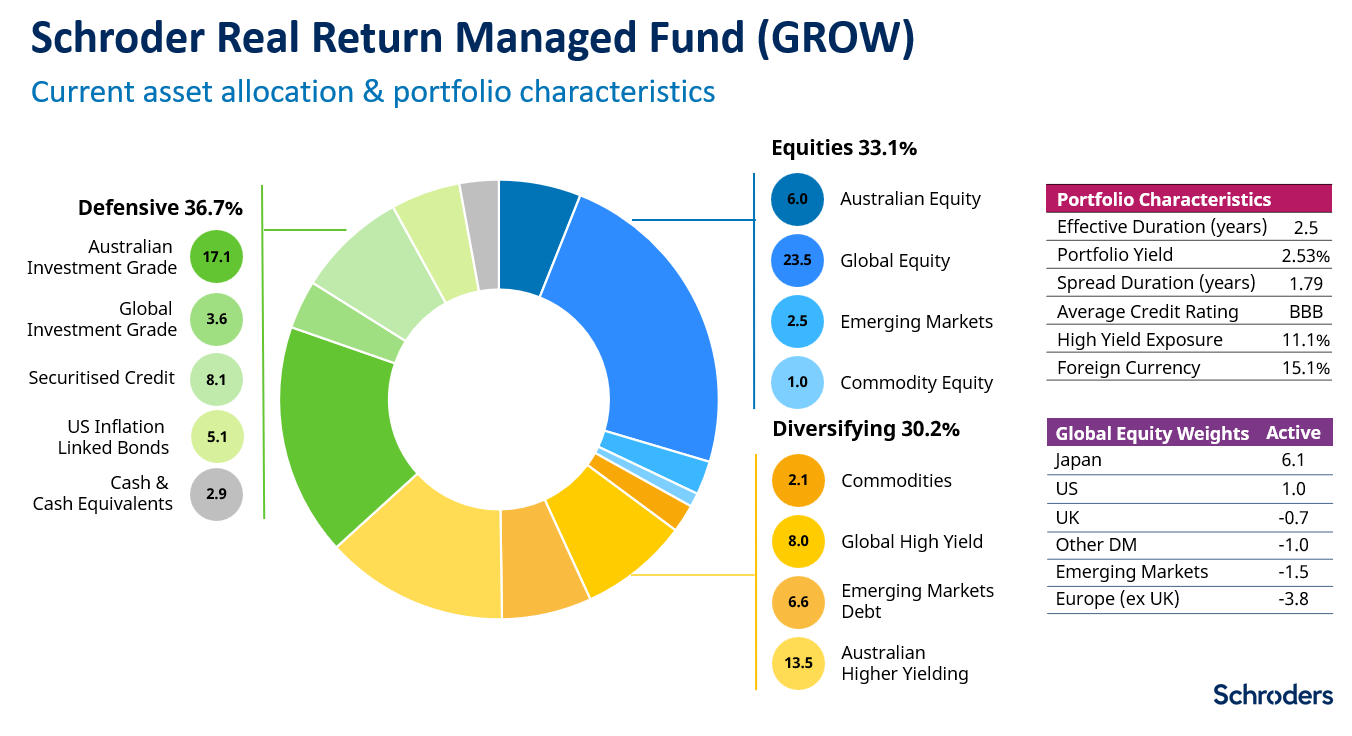

All that said, GROW is now described by Mullins as "quite well diversified", noting that while it is not always like this, currently about one-third (give or take) of the portfolio sits in equities, just over one-third in defensive allocations, and just under one-third in diversifying assets.

Mullins also points out that whilst GROW had a higher cash level (over 45%) in 2022, that cash level is now much lower (below 3%) and the fund is fully invested.

When pressed for why the cash level is low, Mullins was unequivocal;

"We think assets will outperform cash over the medium term".

For the full allocation breakdown, watch the video

In the video above, Mullins further breaks down the allocations in GROW and shares how they have changed over time.

In particular, he explains why the equities allocation over the past three years has ranged between 15% and 40% and why he is "waiting for a pullback, which would then be a buy-on-dip opportunity to increase to say 40 or 45%".

Mullins goes on to explain how such an increase in equities would be funded, how he and the team prioritise fixed income opportunities, and how some of the smaller allocations - such as commodities, emerging market bonds, and Asian credit, both add diversification and contribute to overall performance.

Finally, Mullins shares insights into Schroders' base case over the coming 12 months and how allocations might be expected to change if that base case plays out.

Unlock potential to grow your wealth

By investing across a broad range of asset classes, GROW aims to achieve its return objectives with lower volatility of returns. Find out more by visiting the Schroders website or the fund profile below.

2 topics

1 stock mentioned

1 fund mentioned

1 contributor mentioned