How small-cap fundie Chris Stott is positioned as volatility returns

Chris Stott, the head of Australian small-cap fund manager 1851 Capital, has shifted the fund to its most defensive positioning since COVID struck in March 2020 but remains “sanguine” in his outlook for the local equity market.

In a recent investor webinar, the co-founder and CIO of the flagship 1851 Emerging Companies fund joined his portfolio manager Martin Hickson in discussing a range of topics including:

- Their expectations for the RBA’s next move on interest rates

- The sectors they expect will outperform – and lag – over the next 12-18 months

- A handful of stocks they either hold currently or that are firmly on their watchlists.

“Over the last six months we’ve been progressively positioning for weakness in equity markets,” Stott said, noting cash levels were lifted to 18% earlier this month. They were already elevated to 12% at the end of April.

From a local economic perspective, he noted that investors are now at a point where the cash rate that equity and fixed income markets are pricing into forecasts vary widely.

Stott said he expects additional rate hikes, both in Australia and abroad, over the next few months: “I wouldn’t be surprised if the RBA puts up rates by 50 basis points in June."

“If we see higher interest rates in a short period of time, it will detract from equity market returns. We’re already seeing that so far this calendar year,” Stott said.

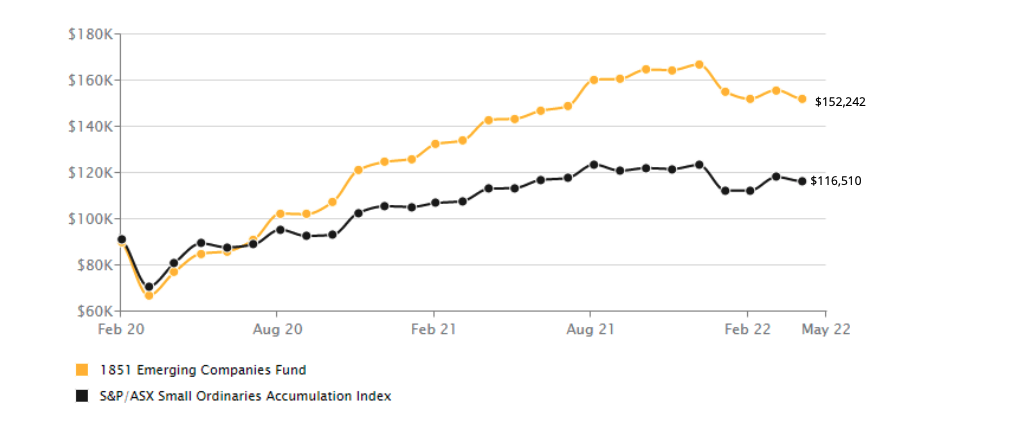

Discussing the performance of the 1851 Emerging Companies fund, Stott noted it has outperformed its benchmark by 13% p.a., after fees and expenses, in the almost 2.5 years since it was launched. He conceded the fund lagged its benchmark slightly over the month of April, though given the short time frame he’s not reading too much into this. But Stott notes the fund’s avoidance of commodities stocks in the last six months – particularly lithium companies – is a key reason for this.

How $100k invested would have performed since the launch

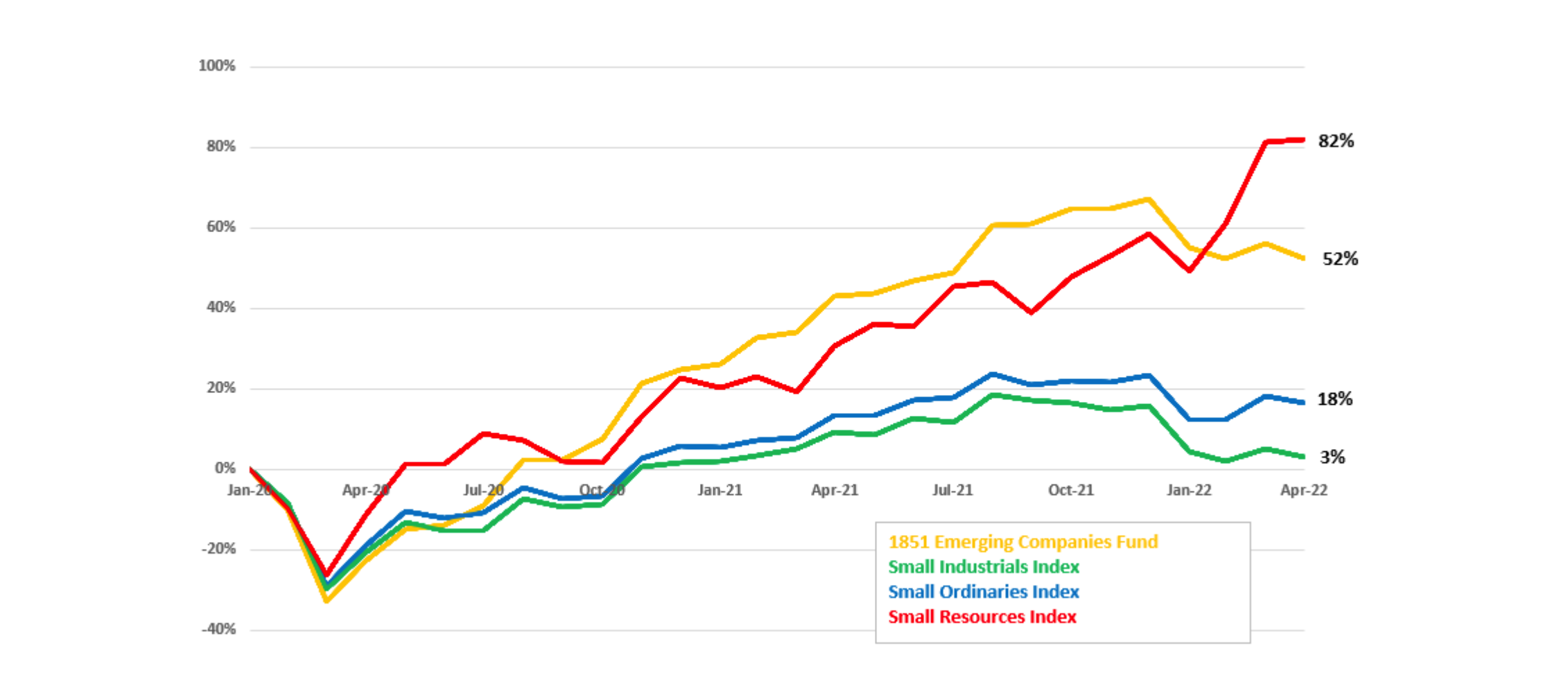

“I’m pleased to say we’ve strongly outperformed the small industrials over the last six months but not the small ordinaries,” Stott said.

The Small Industrials benchmark is down 13% over this period, versus a 22% increase from the resources index – almost a 35% outperformance.

Turning to a discussion of the sector and stock performances, the fund’s portfolio manager Martin Hickson explained how the team’s firm decision not to invest in resources had affected performance.

“We don’t invest in resources – it’s not our background or our expertise," he said.

He described current global investment in commodities companies as the most overweight it’s been in 15 years. “So, we think it’s a very crowded trade, and we expect those strong gains we’ve seen from the market are likely to slow from here,” Hickson said.

Resources sector strength

How some of 1851's top stocks have fared

Turning to some of the companies that have featured in the 1851 Emerging Companies fund’s portfolio, Hickson discussed the following – though he emphasised they don’t currently own each of them.

Nick Scali (ASX: NCK) - The furniture retailer that benefited from a surge in purchase during COVID lockdowns is one not currently on the books, “though it has done quite well for us in the past,” said Hickson.

The Reject Shop (ASX: TRS) – Shipping costs had increased five times, which saw an earnings downgrade announced in February and the exit of the CEO last month.

Autosports Group (ASX: ASG) – A retailer of prestige and luxury cars, with dealerships across NSW, Queensland and Victoria, Hickson tips new vehicle demand will exceed supply throughout 2022.

Cedar Woods Properties (ASX: CWP) – A residential housing builder with projects across Western Australia, Victoria, and Queensland. “Strong demand and prices for properties has seen strong growth in the order books for these companies,” said Hickson.

Johns Lyng Group (ASX: JLG) – A construction firm that includes an insurance building company with a national business, has been a beneficiary of more than $2.3 billion insurance claims due to east coast rain events.

Corporate Travel Management (ASX: CTD) – Company management of the business travel specialist has indicated corporate travel transactions have now recovered to 90% of the pre-COVID levels.

Three of 1851’s top holdings

1851’s senior equity analyst Matthew Nicholas also discussed some of the fund’s top holdings, among the 68 positions and the current cash level of 18%.

OFX Group (ASX: OFX)

A specialist in cross-border foreign exchange, the investment thesis for OFX is that it’s close to the lowest-cost operator in the space compared to domestic and global banks, Nicholas said.

Some of the highlights of the firm include:

- a broad path for growth, with only a 0.1% share of the total global market.

- the firm’s repositioning from a purely consumer-facing operation into business-to-business

- Strong balance sheet, having recorded profit and transaction volume growth in five of the last six quarters.

“The stock has performed well for a long period and on the back of earnings upgrades, it trades on 11 times one year forward EBITDA. It’s definitely a beneficiary of the volatility,” Nicholas said.

“The business is in its best position since listing, it trades at a very good multiple, but we wouldn’t be surprised if it’s subject to more corporate interest.”

Monash IVF (ASX: IVF)

Another of the fund’s top holdings is the Australian fertility services firm, whose services have been a beneficiary of the pandemic. Nicholas noted that COVID-19 had seen a step up in demand for IVF services, as thousands of locked-down couples reconsidered their priorities.

He also referred to the high barriers to entry for new competitors and the strong industry structure. And additionally, IVF services are often not provided in a single course of treatments, with the success rate of the first cycle generally in mid-30%. Nicholas estimated that around 50% of its business over the next three years will be driven by people coming back for another attempt, “and that’s not being factored in by consensus expectations.”

“From our perspective, the Monash investment case stands up quite well,” said Nicholas.

Praemium (ASX: PPS).

The third stock holding discussed, the financial services software platform provider was added to the portfolio early in the pandemic, at around 40 cents a share, before exiting in March at around 80 cents – the stock has since fallen to around 60 cents.

“But it’s fair to say, performance relative to our expectations six months ago certainly undershot,” Nicholas said.

With a high share of the market relative to competitors, he also highlights the firm’s share price discount relative to competitors, including Netwealth.

“And with some management changes and a rejigging of the portfolio, we thought there was a strong case for a rerating of the stock,” said Nicholas. But as it turned out, the offshore business was sold – albeit at a slightly underwhelming price.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

1 topic

8 stocks mentioned

1 contributor mentioned