How the Rio Tinto-Arcadium deal could seal the bottom for lithium stocks

Earlier this week, Rio Tinto (ASX: RIO) announced that it would buy lithium producer Arcadium, for $9.9 billion in an all-cash deal.

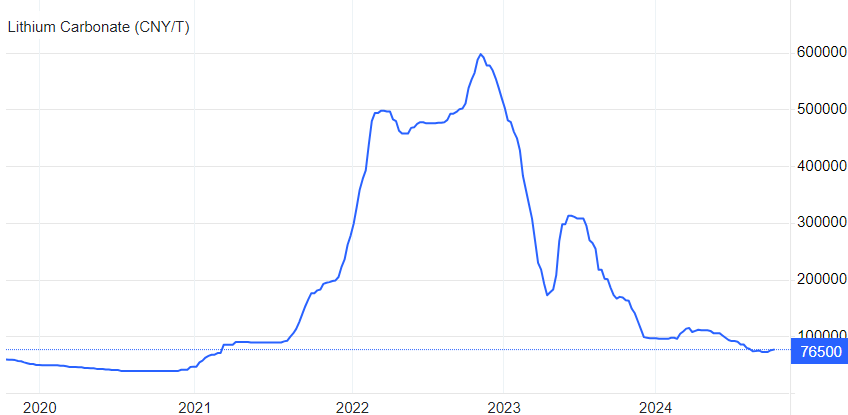

The move comes at a time when lithium prices are depressed (see chart below), having rolled off the EV-fulled fever pitch highs in late 2022.

The deal immediately throws up a handful of questions.

Has Rio picked the eyes out of the bottom in lithium prices? Has it paid the right price for the right asset? Or is this another clanger for a company that has a long history of value-destructive acquisitions?

Investors with long memories will recall that in 2011, RIO purchased Riversdale Mining for $3.9 billion, only to sell it in 2014 for $50 million. And who could forget the $38 billion paid for Alcan in 2007, in what some have labelled the worst mining deal ever?

To answer these questions and more, I engage Katana Asset Management's Romano Sala Tenna, for his take on the deal and what it could mean for investors.

.png)

On face value, do you like the deal - has Rio Tinto paid the right price, and are they acquiring at the right point in the cycle?

Sala Tenna: Yes, I like the point in the cycle.

It is hard to get more pessimistic about the lithium price, so it's a good time to strike if you are ever of the mind to.

At first glance, the price looks high as:

- Consensus analyst valuation on LTM prior to the takeover was $5.17

- This represents a 129% premium to the 30-day volume-weighted average price (VWAP).

However, countering that, it is worth remembering that the stock dropped 65% over the calendar year and that when Livent and Allkem merged to create Arcadium, the stock traded at $A11.20/share.

Also, analysts view the replacement cost of the Arcadium assets in the vicinity of US$8 billion versus the initial bid valuation of $US6.7 billion.

Is the deal a good fit for Rio Tinto - does it complement their existing assets and/or add suitable diversification?

Yes, it is a good fit.

Arcadium complements their Rincon assets perfectly, which are ~3 months away from the first brine production nearby in Argentina.

RIO gets Tier 1 assets and substantial expertise in lithium processing at every stage of production.

Do you think this deal rings the bell for the bottom of lithium price weakness… or is there more pain to come?

Our view was that the lithium price had bottomed in any event, as production was being closed down, for example, lepidolite in China (which is around 5% of global production.)

We think this deal now also seals the bottom for lithium stock prices as it has fired the starters' gun on M&A.

Rio has a chequered past of paying too much for assets it never extracts full value from. Is this time different?

Yes, very different. They are buying established, Tier 1 assets in safer jurisdictions at the bottom of the price cycle.

Is there anything else investors need to know about the deal?

Due to the number of countries in which Arcadium operates, the approval process is extensive. This means that the deal is not likely to be consummated until the middle of 2025.

Accordingly, even though the cash bid equates to around $A8.65, the stock is trading around $A8.20 due to the long lead time.

Are you BUY, HOLD, or SELL on Rio Tinto right now?

HOLD

5 topics

1 stock mentioned

1 fund mentioned

1 contributor mentioned