How this healthcare stock exemplifies steady compounding

Haleon (NYSE: HLN) may not be a household name on the surface, but we are guaranteed you've heard of them before. You may have even used some of its brands in the past. Sensodyne, Centrum, Voltaren and Panadol, to name a few.

We are active holders of Haleon in our Global Equity portfolios, including the Yarra Global Share Fund, and remain confident in the company's long-term prospects. I'll explain why in this wire.

Strong results

Haleon is a global leader in consumer healthcare and reported solid organic sales growth in its Q3 results, released at the end of October.

North America showed improved volumes after several slower months, and management remains optimistic that price growth is stabilising. They believe the strength of Haleon’s brands—underpinned by sustained investment and innovation—will continue to drive market share and volume growth both in the US and internationally.

Flagship brands such as Sensodyne and Paradontax posted mid-single-digit growth, reflecting the enduring strength of Haleon’s portfolio. It is also worth noting that the company is on track to meet its full-year guidance, with capital allocation priorities remaining unchanged.

Deleveraging objectives

Since spinning off from GlaxoSmithKline (LON: GSK) in 2022, deleveraging has been a key focus, and Haleon has successfully delivered on this objective. This disciplined approach has positioned the company for sustainable growth and robust cash flow generation.

By divesting non-core brands, such as lip balms and nicotine replacement therapies outside the US, Haleon has reduced debt and returned US$1.8 billion to shareholders since the demerger — further bolstering confidence in management’s ability to execute its strategy and enhance shareholder value.

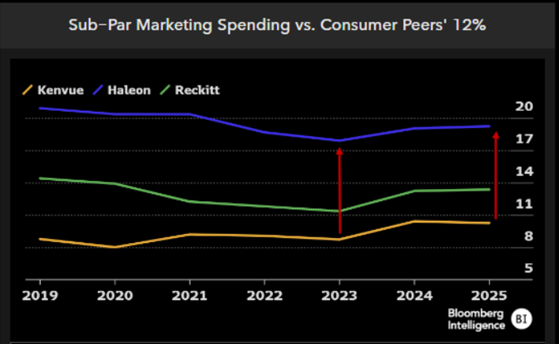

While not specific to the latest earnings, the chart below highlights Haleon’s significant investment in its brands, which stands out in comparison to its peers and has been a key factor in its market share gains.

Chart 1: Haleon’s marketing spend versus its peers

Source: Bloomberg. As of November 2025.

Trusted, established health-related brands are a priority in tough economic times

Consumer spending continues to face pressure, with shoppers increasingly seeking discounts and value-driven offerings. However, when it comes to health-related products, customers tend to prioritise trusted, established brands to meet their needs. This dynamic plays to Haleon’s strengths, as its portfolio of well-recognised brands positions it favourably in the competitive consumer healthcare space.

That said, Haleon’s growth trajectory is not without its challenges. Seasonality, particularly in its respiratory division, remains a key factor. The timing of cough and cold cycles introduces volatility that can impact short-term performance.

However, we believe Haleon is well-positioned to leverage long-term trends in health and wellness, ensuring continued growth despite short-term fluctuations.

Why we hold Haleon

With its strong brand portfolio, ongoing investment in innovation, and solid cash flow generation, Haleon is well-placed to remain a leader in the consumer healthcare sector and continue its path of growth and value creation. Amid market volatility and widespread macroeconomic, political, and geopolitical uncertainty, we are drawn to stable, steady-compounding businesses, and believe Haleon exemplifies this.

Learn more

The future return on investment and the growth of a company's cash flows are key focus points. We seek companies where the future is not reflected in today's valuations.

2 topics

1 stock mentioned

1 fund mentioned