How to boost your returns from fixed income

Private debt consists of loans and credit extended to companies or individuals that are not financed or traded through public markets, unlike corporate bonds. This asset class is known for offering higher yields than public debt due to the increased risk and illiquidity associated with private lending and has grown rapidly; assets under management for the global private debt market topped US$2.1 trillion (A$3.15 trillion) in 2023.

There are several reasons for this rapid expansion. Put simply, “private debt offers attractive returns, can provide a hedge against rising inflation, and may help diversify a portfolio,” as noted by global credit debt ratings agency Moody’s. [1]

With Australian superannuation funds significantly increasing their bets in private credit, individual investors would be wise to follow suit in a bid to boost the income they receive from fixed income assets. With the typical growth portfolio allocating 60% to growth assets and 40% to fixed income, private credit could form a portion of that 40% proportion without significantly elevating risk for investors.

Yields on private debt outstrip those on corporate bonds

Notably, private credit investments can deliver investors yields of around 10% per annum, which is almost double typical yields on cash deposits and a 3%-4% premium to the returns on Australian investment grade corporate bonds, as measured by the S&P Australia Investment Grade Corporate Bond Index, which had returned 7.42% over the year to 15 August 2024.[2]

Since the Global Financial Crisis (GFC), direct lending (the most common type of private credit globally), has provided higher returns and lower volatility compared to both leveraged loans and high-yield corporate bonds, according to research from Morgan Stanley.

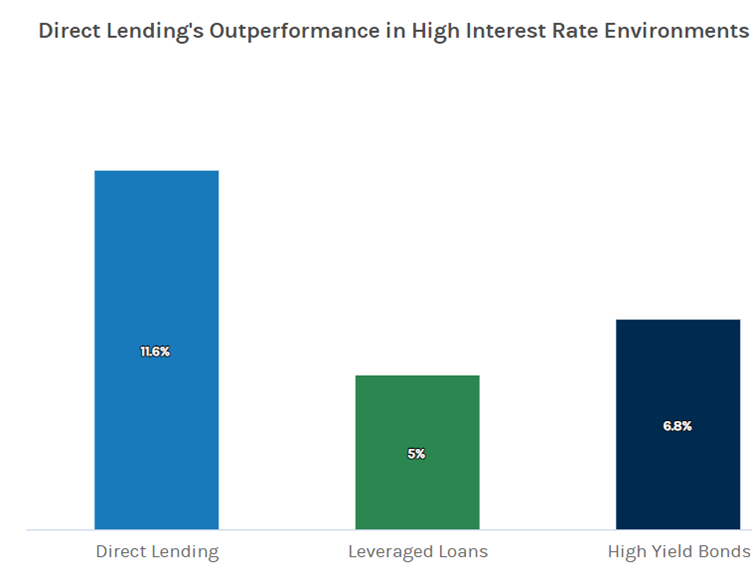

Importantly, direct lending outperforms in rising interest rate environments. When returns are measured from the first quarter of 2008 and the third quarter of 2023, direct lending yielded an average return of 11.6%, compared with 5% for leveraged loans and 6.8% for high-yield corporate bonds. The chart below from Morgan Stanely displays this outperformance. [3]

Source: Morgan Stanley. Data represents the period from Q1’08 to Q3’23. Calculated as annualised average returns divided by volatility. Volatility is measured using standard deviation. Direct Lending is represented by the Cliffwater Direct Lending Index (CDLI) and is calculated from quarterly data, which has been annualised. High Yield Bonds is represented by the ICE BofA High Yield Index calculated from annualized monthly data, except for the loss experience chart, where this is sourced from Moody’s. Leveraged Loans is represented by the Morningstar LSTA US Leveraged Loan Index calculated from annualised monthly data, except for the loss experience chart, where this is sourced from Moody’s.

Cushioning against volatility with private credit

Private credit may offer protection against share market losses, having demonstrated resilience during the COVID-19 pandemic. Between the outbreak of COVID and the third quarter of 2023, direct lending sustained losses of 1.1%, compared with greater losses of 2.2% for high-yield corporate bonds, Morgan Stanley finds.

Morgan Stanley’s research is backed by a recent IMF report on the private credit sector. The IMF finds that since the GFC, the private credit asset class has appeared attractive to investors, “with some of the highest historical returns across debt markets and appears to be relatively low volatility.”

Private credit returns vary with risk

Investor returns in private credit currently gravitate between 7% to 15%. While this is a large variance, varying risk-return profiles explains the range.

First, not all private credit managers invest in the same loans. Some loans are unsecured, and others are secured by a subordinated positions in the capital stack (for example a second mortgage) .The less risky loans are generally secured by a first mortgage. The lower risk profile on first mortgage loans translates into a lower borrower rate and reduced return profile to investors.

Second, not all real estate private credit managers are the same. Some lend with higher loan-to-value ratios (LVRs) while others are more conservative on how much risk they take on in lending. Apart from varying risk levels, investors should consider a fund manager’s performance and track record.

But if investors choose their fund manager well, private credit can potentially offer superior risk adjusted returns compared to corporate bonds and other fixed income assets, as well as boost diversification while delivering a consistent income stream. This is why it’s so important for retirees and other retail investors to consider investing in private credit to dilute their significant exposure to Australian property, shares and cash.

You can read the IMF report on the private credit sector at this link:

2024, The Rise and Risks of Private Credit, IMF Global Financial Stability Report

4 topics