How to boost your share holdings with dividend reinvestment plans

What if I told you there was a way you could boost your holdings in your favourite companies without touching an extra dime from your bank account or doing much at all? I’m not living in fantasy land. There is a way you can do this – though it isn’t completely cost-free.

I’m talking about dividend reinvestment plans (DRPs), a scheme offered by many companies listed on the ASX allowing you to buy more shares in a company using the dividends you earn.

Whether or not you currently embrace DRPs, or are even aware of their existence, a refresher on the basics never hurts. In this wire, I’ll explain how they work, the tax implications, along with the pros and cons. I'll also tell you where to find out if your holdings have a DRP option.

What is a dividend reinvestment plan (DRP)?

A DRP allows you to automatically reinvest the dividends you receive from a company into additional shares, rather than receiving the cash payment into your bank account. You don’t pay brokerage or other transaction costs on these purchases.

There’s also the potential for you to purchase these shares at a discount to market price. The reason for this is the DRP price is usually calculated at a market average over a period of days.

To show how this works, look at Commonwealth Bank (ASX: CBA) in February this year.

- The DRP price was A$117.19, to be issued on 28 March 2024.

- That price was based on the weighted average price of shares between 26 February and 22 March 2024.

- According to Market Index, Commonwealth Bank fully paid shares were trading on the ASX at A$120.34 on the 28 March meaning you received a discount of $3.15 per share. Of course, it also traded at cheaper values in the lead up to that issue date, but that is the nature of markets.

In some instances, though it seems to be quite rare, companies will also specifically outline a discount on market price. For example, Telstra’s DRP document notes it *may* offer a discount but this would be announced in results and will vary.

If your holdings offer DRP, you can typically opt in by completing a form through your share registry. You can also opt out down the track the same way—that is, choosing to participate now doesn’t mean you are stuck for the entire time you hold a particular company.

How do I receive my entitlement?

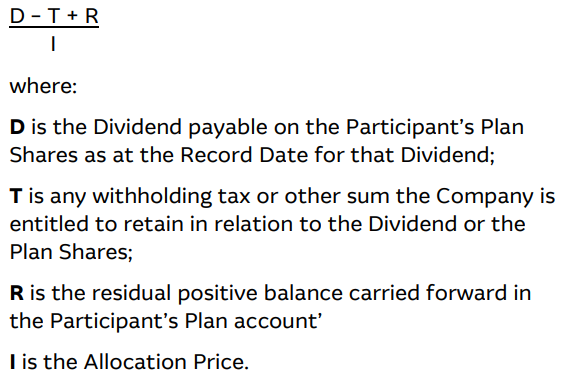

If you have elected to participate, the company will generally calculate your entitlements using the following formula.

If you have any dividend balance left after the reinvestment, it is held as a positive balance for you to put towards reinvestment next time. If you cancel the plan, your balance is paid to you in cash.

Your tax reminder

You still need to pay tax when you participate in DRP.

When you fill out your tax statement, you declare the amount you would have received in cash for the dividends as part of your income in your tax return. All shares acquired by DRP are subject to the same capital gains tax as the rest of your holding.

The pros and cons of DRP

Some of the benefits of using a DRP follow:

- It can act as a dollar-cost averaging strategy: that is, you are regularly investing in your holding regardless of market conditions, so it smoothens out your cost price over time. You also take advantage of compounding returns.

- It allows you to boost your holding without brokerage costs over time.

- In some instances, it may mean you are purchasing at a discount pending how the DRP is calculated and what the market price is on the day of issue.

- Set and forget – aka boost your holdings the lazy way.

Some of the cons of participating include:

- You have no control over the price at which you purchase the shares – if the company is trading at a price you view as above intrinsic value, then you may be overpaying based on this assessment.

- It is still treated as a separate share purchase for tax purposes which can add complexity to record keeping. Remember that capital gains is based on the market price rather than the DRP price.

- It may not be in your best interests to boost your holding. Perhaps those dividends would be better put to investing in different companies which would add diversification to your portfolio.

So, should I opt in?

To decide, it helps to answer a few extra questions.

- Would I want more shares in this company over time, regardless of market prices?

- What is the level of diversification in my portfolio? That is, would it hurt my portfolio to put my dividends towards boosting this holding.

- Do I need the income from dividends, or can I afford to reinvest instead?

At the end of the day, don’t forget that you don’t have to keep participating. If you reach a point you are happy with the size of your holding, you can always opt out. You can also choose to opt in down the track.

If you want to see which companies offer DRP, Market Index offers a handy list that you can access here. You’ll need to read the full details of each individual company’s schemes to understand how they work and decide whether you want to take part.

1 topic

1 stock mentioned