How to build an all-weather portfolio

The all-weather portfolio was developed by famed investor Ray Dalio and launched in the mid-1990s after decades of study. As the name suggests, it is designed to be able to withstand all environments and economic situations.

Fast-forward to today, and the principles that underpin the all-weather portfolio are practised by many investors, including Helge Skibeli, managing director, portfolio manager and CIO for the Research-Driven Process (RDP) for International Equities at J.P. Morgan Asset Management.

.png)

So, how has Skibeli taken the concept of the all-weather portfolio and made it his own? I was fortunate enough to put some questions to him recently to find out.

Fortune favours the well-researched

Whilst the all-weather portfolio was launched by Dalio in 1996, the idea was borne for him in 1971, when the US dollar departed from the Bretton Woods system of fixed exchange rates that had tied the dollar’s value to gold. As noted above, the launch came after years of research for Dalio and the situation for Skibeli is similar. As he himself notes, “Our common valuation approach has been in place for over three decades and has been successful in both positive, negative, growth, and value market environments”. He goes on to add,

“The beauty of having almost four decades of proprietary research is that we have built a database second to none, and a great investment in data science allows our investors to harness those insights through a variety of lenses”.

As well as a treasure trove of data, the J.P. Morgan Global Select Equity (ASX: JGLO) strategy is backed by a team of more than 80 fundamental research analysts. This power in numbers has delivered around 2.8% alpha (gross) and 2.3% (net) vs. MSCI World Index (as of end March 2024) since lead PM inception (Nov. 30, 2015), and the fund has been able to add value, historically, in both growth and value-led markets.

While J.P. Morgan’s Global Select Equity strategy does not guarantee outperformance regardless of the market, the portfolio has managed to outperform the majority of the time since December 2015, when Skibeli took over responsibility.

The strategy has outperformed the broader market 67% of value-led quarters and 70% of growth-led quarters since December 2015 (Data as of end March-2024), making it a truly all-weather portfolio”, notes Skibeli.

More than just America

While the US stock market dominates the global equity conversation, Skibeli and his team are mindful that there are fantastic investment opportunities beyond US borders.

He argues that investors have been hyper-focused on the performance of just seven US companies, nicknamed the “Magnificent Seven” in the recent past. This is rightfully so, given their outsized returns, earnings growth, and long-term tailwinds. However, concerns are growing about being overly concentrated in a few names.

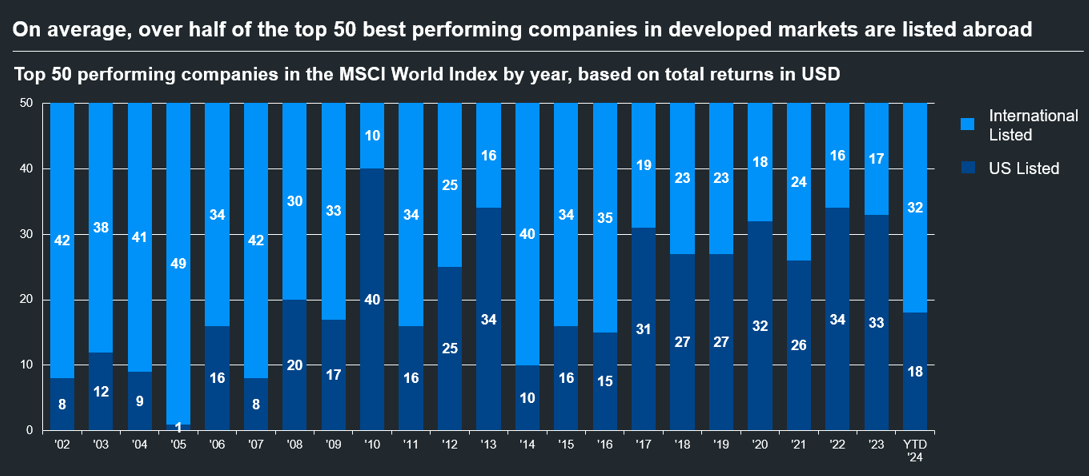

With this in mind, Skibeli believes investors should not ignore investment opportunities beyond the US, and that current deep underweights to developed markets outside the US could leave opportunities on the table.

"As you can see from the above image, 32 out of 50 best-performing companies in developed markets are listed outside the US" says Skibeli.

We believe that not all structural themes can be accessed through one geographical market and having the flexibility to pick the winners from a global opportunity set is a key for alpha generation.

Skibeli goes on to add that going global provides breadth and depth to the opportunity set, highlighting –a large French multinational holding and conglomerate specializing in luxury goods – as a prime example.

Furthermore, investing globally means Skibeli doesn’t have to compromise. “For example, in the semiconductors sector, large language models running on Nvidia GPUs require 8x as much memory as a regular server. This creates a compelling opportunity for SK Hynix (KRX: 000660), a Korean company leading the High Bandwidth Memory (HBM) space”, says Skibeli.

Finally, Skibeli points to valuation disparities between stocks trading in different regions as another reason for taking a global view. Take, for example, the newly emerging market for obesity medication, which is currently dominated by Novo Nordisk (NYSE: NVO) and Eli Lilly (NYSE: LLY).

"While both are well positioned to grow in this market, the valuation multiple investors are required to pay for one compared to the other is at a notable low currently", says Skibeli.

"We believe there is clearly one that is relatively more attractive to own globally".

The J.P. Morgan analyst team covers more than 2,500 companies and conducts over 5,000 contacts per year as part of their review and assessment process. They assess each stock’s earnings forecasts, focusing on normalised earnings and growth rates, and then rank the stocks based on their expected returns. Finally, a proprietary valuation model translates the forecasts into global sector valuation rankings.

That process is remarkably exhaustive, whittling down the 2500 companies in its coverage to between just 70 and 100 firms that are in the portfolio at any one time. Skibeli says three key elements underpin this process:

- Fundamental research: Create a sustainable, proprietary information advantage via our analysts, which includes leveraging systematic frameworks used across the globe.

- Valuation framework: The scale of our platform, in terms of the number of people and size of our budget, is a powerful asset but we need a way to translate this into differentiated stock-level insights. The investment framework used by our analysts is critical to driving stock recommendations.

- Portfolio construction: Investment decisions are made by the portfolio managers, who seek to maximise a set of uncorrelated micro research-driven insights, while minimising those risks where we do not have an edge, for example, macro risks.

All of this research allows for what Skibeli describes as “one of the key differentiating characteristics of our research methodology”—the focus on long-term earnings and cash flows.

The J.P. Morgan research “emphasises sustainable earnings, providing us with the opportunity to add value by focusing on the under-researched intermediate to longer-term periods to identify investment opportunities”, says Skibeli.

“Since sell-side analysts on the “street” are focused on the short-term outlook, we can achieve a greater information advantage in focusing on the intermediate to the longer term”, he adds.

All-weather? What about when there is a cyclone?

Markets don’t perform how investors want them to, even for an all-weather portfolio. So, what risk controls does Skibeli employ when things turn nasty?

Skibeli believes risk management “to be central to the investment management process”. Don’t forget, anyone can buy stocks. It’s those that can manage risk that outperform over the long term.

“Our goal is to derive the majority of portfolio risk from stock-specific factors and portfolio managers monitor the deviation of final sector weights in the portfolio versus the benchmark weights, which contributes significantly to managing tracking error and overall risk”, notes Skibeli.

J.P. Morgan has developed an in-house application aptly named the Investor Toolkit, which allows portfolio managers to see, in real-time, sector weights, active positions and risk factor exposures.

"It provides a comprehensive way to analyse stock-specific data, liquidity, and potential business failures covering all companies within a portfolio’s investible universe", says Skibeli.

How are you investing now?

With all the data and tech at his disposal, Skibeli was happy to share some insights about what he is seeing in markets currently.

First and foremost, he sees the market consensus of corporate margin levels as being too optimistic and is subsequently cautious on earnings.

He notes that the long-term average of EBIT margins pre-COVID was around 11%. Whilst margins saw a sharp drop during 2020, there was a sharp rebound in 2021, which was mainly due to both the supply and demand side of dynamics – central banks provided lots of liquidity and demand into the economy on the one hand, whilst there was a huge constraint on the supply side due to the supply chain issues on the other.

All these factors helped boost the margins, which was around 14% between 2021 and 2023.

"If you look at today’s environment, it is the opposite - central banks have increased interest rates sharply in order to fight inflation, liquidity became much tighter, supply chain normalised," says Skibeli.

"All these factors should ideally lead the margins back to long-term averages, but the market consensus continues to remain high".

With that in mind, Skibeli and his team have been focused on selecting high-quality companies whose earnings growth is more sustainable, as well as asset-light service companies with good cash flow generation.

Conclusion

Given JGLO is designed to be an all-weather portfolio, it potentially solves numerous problems for investors, namely diversification across global equities, and consolidation of regional equities into one global strategy that has delivered alpha in various market environments.

The strategy has outperformed its benchmark over one, three, and five years and since Helge assumed responsibility for the strategy in 2015. He remains confident it will continue to do so.

"We are of the opinion that the process which we leverage in the strategy is sustainable and repeatable and therefore confident that we would be able to generate similar (or better) results going forward", says Skibeli.

For more information about JGLO and the hedged version (JPMorgan Global Select Equity Active ETF (Hedged): JHLO), please visit the J.P. Morgan website here.

2 topics

4 stocks mentioned

2 funds mentioned