How to dodge downside risk

“Rule number 1: never lose money. Rule number 2: never forget rule number 1” – Warren Buffett

In times of heightened market and economic uncertainty, investors must consider the level of downside protection offered by their investment portfolio. When economic downturns inevitably occur, protecting portfolio value and even allowing for potential risks to be mitigated or outsourced through the structuring of investments is crucial.

Many investors have the perception that investing in alternative assets is risky due to their illiquid nature and specific tangible characteristics, however, these are the features that drive considerable downside protection. The illiquid nature of alternative assets means these investments are valued periodically – either monthly, quarterly, semi-annually or annually – or on an ad-hoc basis in response to one-off events that may result in a material change in value. This means that valuations of alternative assets have considerably less volatility than their publicly listed counterparts, whose value often fluctuates drastically as they are traded daily.

While this does not mean that investments in alternative assets are immune to pressures and distress in the wider economy (if the underlying asset is impacted by these factors then the valuation will be revised to reflect that), they are less exposed to the radical day-to-day swings in sentiment and market noise that drive much of the volatility in more traditional asset classes. Instead, the valuations of alternative assets are based on rigorous and established practices for assessing the fundamentals of the underlying assets, with their valuations closely tracking the underlying fundamentals and tangible characteristics.

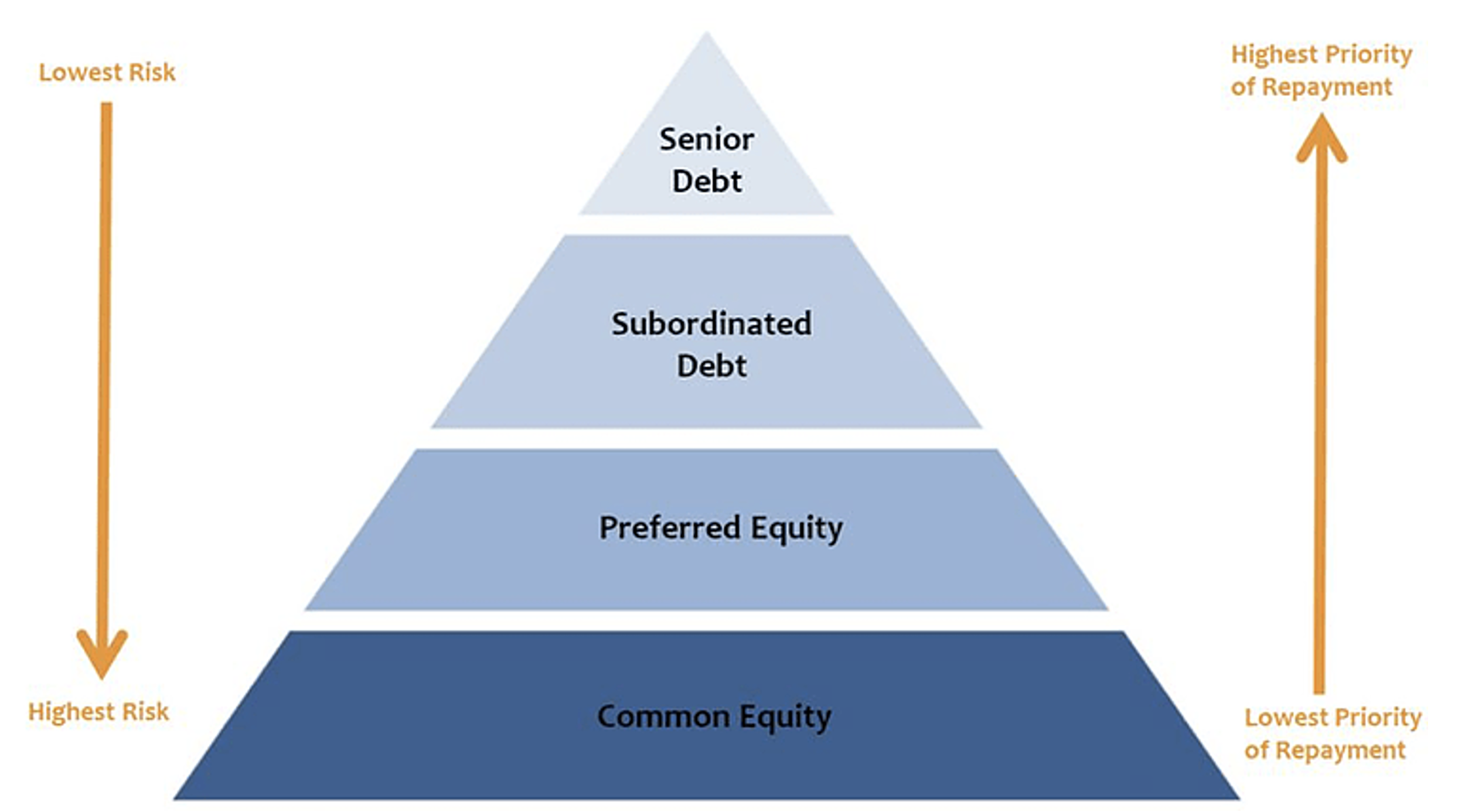

There are additional ways in which alternative assets can provide downside protection to an investment portfolio, due to the defensive nature of certain investments and the way an investment can be structured. Investments in senior secured lending, which is a strategy within the private debt asset class, have a key focus on downside protection, from when potential investments are initially screened, to when completed investments are being monitored.

Senior secured loans are typically characterised by lending to highly cash-generative businesses, extensive due diligence processes, first-ranking security (i.e. paid out first in the case of insolvency or bankruptcy), and bespoke structures. Senior secured debt investments are an example of how certain investments in alternatives can be structured to provide considerable downside protection to protect portfolio value and reduce volatility in periods of market and economic distress.

Source: Corporate Finance Institute

Alternative assets can offer considerable downside protection to an investment portfolio. WAM Alternative Assets (ASX: WMA), through its listed investment company structure, seeks to provide retail investors with access to a diversified portfolio of alternative assets which were previously only largely accessible by high net worth and institutional investors, allowing them to reap the benefits of added downside protection offered by many investments in alternative assets.

Learn more

WAM Alternative Assets provides retail investors with exposure to a portfolio of real assets, private equity and real estate. The company aims to expand into new asset classes such as private debt and infrastructure. For further information, please visit their website.

2 topics

1 stock mentioned