How to find resilient, high-performing small caps

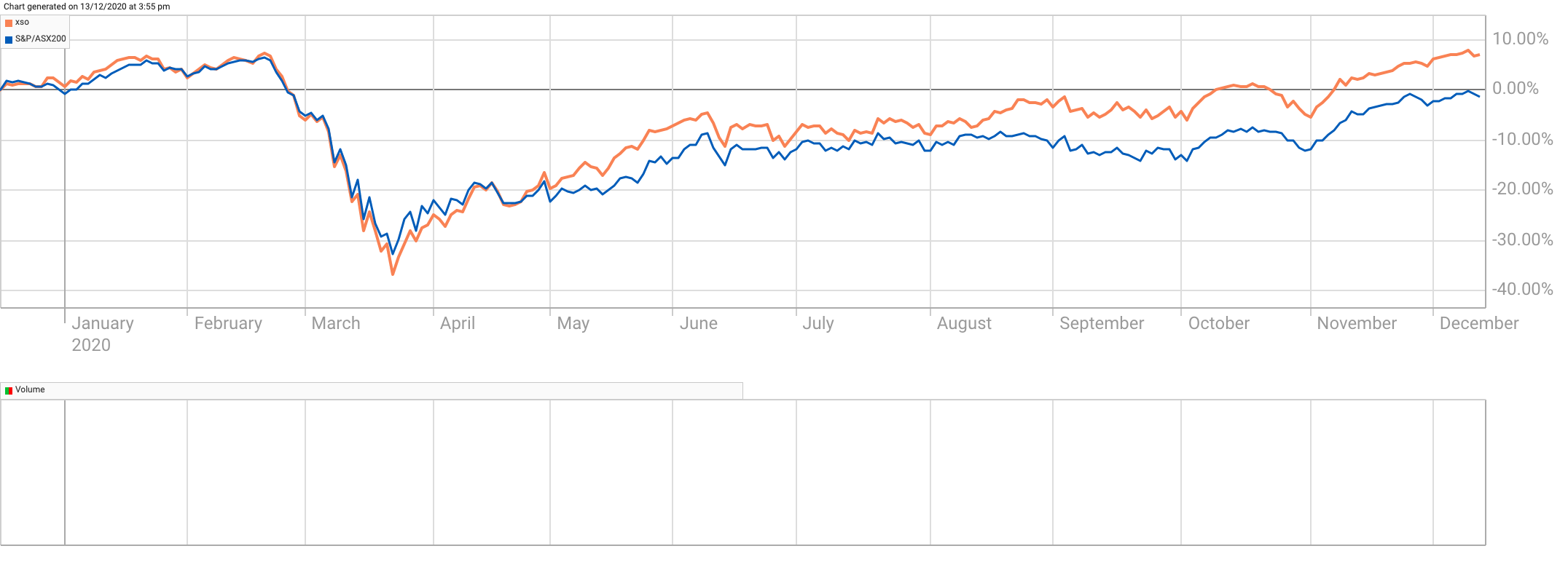

Up just under 70% since the market’s mid-March nadir, the Small Ords is back to pre-pandemic levels. The index that tracks listed companies with market caps starting at around $390 million and topping out around $1.5 billion fell in step with its big brother the S&P/ASX200 earlier this year, but bounced back quicker and further.

Often written-off by defensive investors and lumped in with speculative stocks, Aussie small caps’ performance in recent years – and particularly since the pandemic – has shown sustainable, resilient outperformance. And there’s good reason to believe this will continue into 2021 and beyond.

S&P/ASX Small Ordinaries versus S&P/ASX200 YTD

Source: ASX

Of course, there are risks and various nuances investors need to be aware of in seeking out the best opportunities in the space. In the following wire, the first of a three-part series, we asked a selection of Australian small cap equity managers how they decide which companies make it into their portfolios:

- Simon Conn, senior portfolio manager, mid- and small-caps, Investors Mutual

- Matthew Booker, portfolio manager, Spheria Asset Management

- Dawn Kanelleas, senior portfolio manager - Australian small caps, First Sentier Investors

- Harley Grosser, CIO, CEO and founder, Capital H Management

Q. How do you weed out the speculative stocks and find successful micro- or small-cap companies?

Quality is what works for micro, small and large companies

Simon Conn, Investors Mutual

We use the same criteria to identify small-, micro-, and large-cap companies to invest in. We focus on “quality” factors because we believe that companies with these characteristics are most likely to produce sustainable cashflows over the long-term for the owners of the business – including both the operators and the shareholders.

We define a quality company as one with a strong competitive advantage – generally the number one or two in its industry. Such companies have a sustainable competitive advantage, operate assets or have characteristics that are difficult to replicate.

Other common features include being the lowest-cost provider, or having pricing power through ownership of well-known brands, which increases barriers to entry for competitors.

We also like companies that have recurring, predictable earnings and strong or improving balance sheets, and that can grow these earnings over the next three- to five-years – underpinned by solid asset backing and cash generation. We identify resilient companies run by experienced and capable management teams, and which our research indicates are trading at reasonable valuations and prices.

Many investors are lured into buying the latest fashionable stock or sector, such as chasing those in the currently popular technology and medical technology sectors.

Many of these are trading at what we consider extremely inflated valuations, despite not having reliable earnings records.

But we’ve consistently found that a carefully selected portfolio of good quality stocks will show more resilience and recover more quickly from market downturns than an assortment of speculative, often loss-making companies – many of which are promising a lot of “blue sky”.

Our experience – and that of our investors – has been that investing in profitable companies with sound fundamentals and defensive characteristics has over the longer-term consistently proven a more prudent and risk-controlled approach to investing in small-caps than chasing the latest “exciting” company or sector.

Show me the cashflow

Matthew Booker, Spheria Asset Management

Put simply, our process is based on buying businesses that generate predictable free cash flows at an appropriate multiple for the forecast growth profile.

By default, this lends itself to screening out companies that don’t generate cash, lack sustainability or are being priced nonsensically by the market.

Freedom Foods (ASX: FNP) is an example of a company we avoided after analysing the financials and identifying extremely poor cash flow characteristics. It has since come very unstuck.

On the other hand, as a result of our screening, we ultimately find we are buying companies with enduring characteristics.

We have a team that can focus on identifying key metrics; individual investors don’t.

This means it can often take time before the wider market catches on (particularly in small caps with little coverage outside of reporting season). This was illustrated during the August reporting season when, as we anticipated, the majority of our companies reported outstanding results and were finally rewarded by the market. We believe there’s more of this to come.

"It's not about investing in the next big thing"

Dawn Kanelleas, First Sentier Investors

We are looking for next 3- or 4-bagger stock, of course. But we are as cognisant of downside risks as of upside potential. We invest in the small- and mid-cap space where many companies are single industry, high growth companies that need capital to grow. We are seeking to invest in those companies that can create sustainably competitive businesses that deliver strong financials and can fund their growth aspirations.

Where companies make acquisitions to further enhance the value of their business, it is because they are creating more valuable businesses or shoring up their existing competitive advantage and strong financials for many more years into the future.

Pure EPS accretion is not that interesting to us as it can be manipulated via accounting tricks and may (and often does) lead to decreasing returns and a worse business.

I’m a scientist by background – all I can do is act as a rational person making rational investment decisions. And my whole team is geared that way.

We own Australian software company Nuix, and

we’re also one of the largest shareholders in mining company IGO. And that’s because

we can pre-empt where management is going and know they’re not companies just

making acquisitions because the market rewards momentum. Because the market

only rewards momentum in the short-term, not in the long-term. It’s not about

investing in the next big thing simply because you think it’s going to go up a

lot – even though it doesn’t make sense but is just purely a market factor.

Test and try before you buy

Harley Grosser, Capital H Management

Test the product yourself. If you can’t, then try to talk to customers to get their opinion. Talk to competitors and see what they are doing. Even if the company already has sales traction, understand the pricing structure to ensure there is economic viability to what they are doing.

Research the past experience of management. Have they built real companies or been part of “fad stocks” before? Have they put their own cash on the line? Do others in the industry speak highly of them?

The great thing about micro caps is that while they’re generally viewed as higher risk than mid- and large-caps, you can still find very solid, revenue generating, even highly cash generative companies with a relatively long history of success. If you know what you’re doing, this is not speculative at all – it is sound investing, so long as you are paying a reasonable price for them.

Conclusion

If your intention is to find consistent and resilient returns, these three managers agree that chasing fad stocks isn't the way. Here are a few of the consistent themes that they believe are important for building a portfolio of small caps.

- Quality filters apply in small companies, as they do in large companies.

- A track-record of earnings and a strong balance sheet is a good starting point.

- Look for companies with strong market position in their industry and listen to what their customers are saying or try the product yourself.

- Try to identify well regarded management teams who are aligned with shareholders.

Stay up to date

Don't forget to follow my profile to read the upcoming wires in this three-part series, and give this article a like if you enjoyed it. The next instalments will look at the fundies' favourite sectors for small caps and their top stock selections in the category.

7 contributors mentioned