How to invest $1 million in FY25

Note: This interview was recorded on Tuesday 4 June 2024.

If there was ever a good time for a portfolio reset, the new financial year is probably it. It's a time when the tax woes and painful positions of the previous year are now behind you; when you can take a good, hard look at the products, funds or stocks in your portfolio, figure out what worked and what didn't, and make a practical plan so that you can stick to your strategy over the financial year ahead.

If that sounds like you, you've come to the right place.

In this interview, Morgan Stanley Wealth Management's Head of Research and Investment Strategy, Alexandre Ventelon, and Wilsons Advisory's Head of Investment Strategy David Cassidy share their tips and tricks for navigating the new financial year.

For Cassidy, interest rates and inflation will still dominate our investment worlds over the next 12 months, although he still argues that inflation should come down later this year, allowing the US Federal Reserve to ease rates. He believes economic growth and earnings will be incredibly important to investors' success, and he warns that valuations are starting to look stretched in the US (so it may be time to take some profits).

Ventelon agrees that investors' inflation pains will ease over the months ahead, and expects it to return to the Fed's targets in 2025. Before you celebrate, he notes that politics and geopolitical risk should still be front of mind - and argues that this could create volatility throughout this year. Like Cassidy, he believes that valuations are "quite elevated".

So, which parts of the market have our asset allocators excited for FY25?

"I think within equities you can find a lot of interesting opportunities. There are underdogs within the equity markets... [our] latest upgrade was European equities," Ventelon says.

European equities are trading at historically cheap valuations compared to the US - and with the European Central Bank cutting rates last week, Ventelon believes investors can expect some catch-up in this region. And, as an added benefit, the Olympics in Paris will likely boost consumer sentiment.

Meanwhile, Cassidy points to fixed income strategies as an area of the market that is "more interesting than it has been for some time".

"From these levels, with a view that the US economy is probably going to be slowing from here, we think fixed interest looks interesting and also related to that, floating rate credit strategies with high interest rates around the world, including Australia," Cassidy says.

"There's quite a bit of income on offer in floating rate strategies, with various funds offering 7-8%, and in private credit land, it's more like 9-10%. So the income side of portfolios looks a lot more interesting than it has for a while."

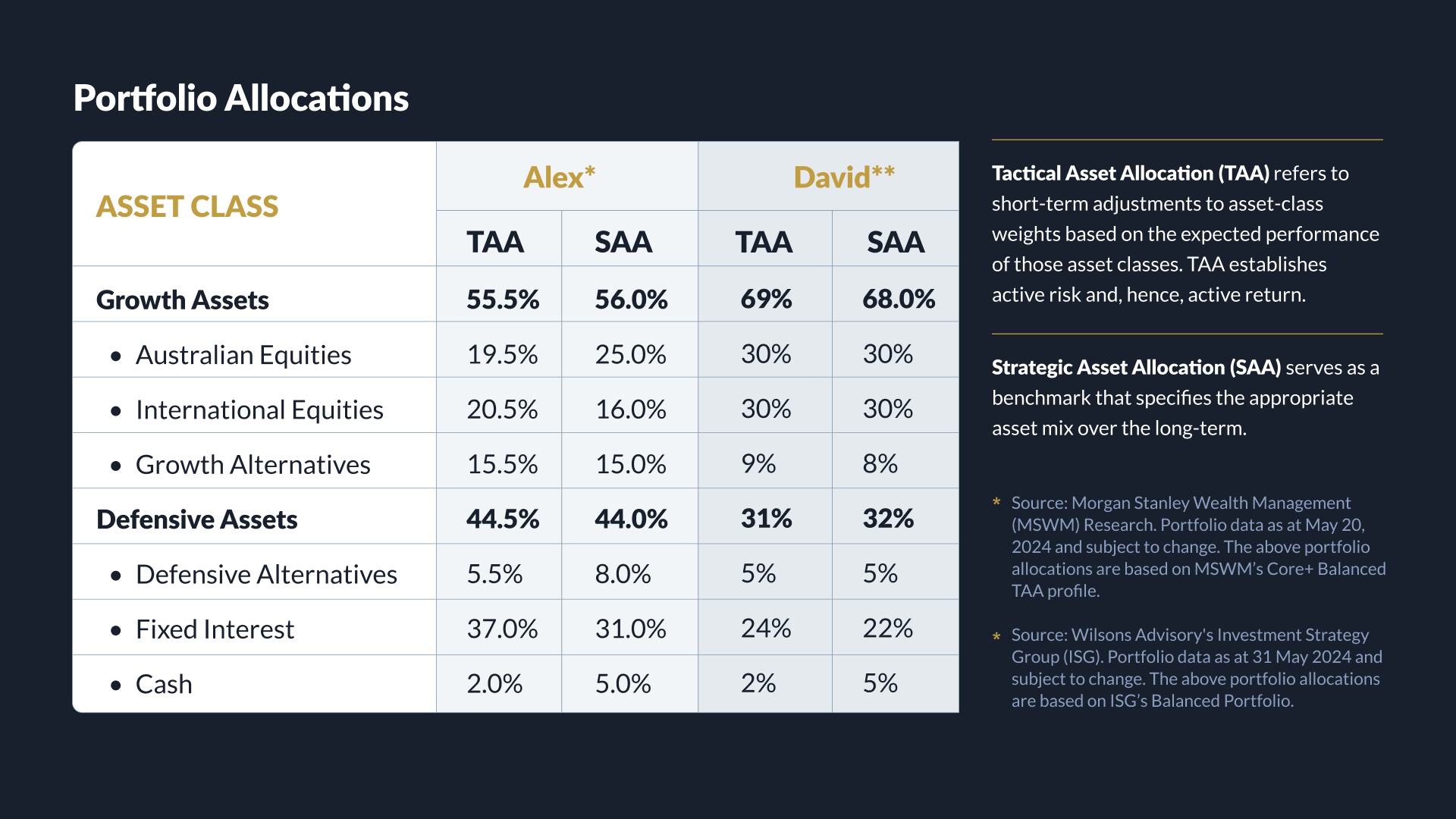

This translates into Cassidy being overweight fixed income for the financial year ahead, as is Ventelon - both believing there to be exciting yields on offer in the asset class right now. They are also both overweight alternatives, neutral on equities and holding hardly any cash (only 2%).

In fact, Ventelon believes FY25 will be a good year for investors, one where they can once again be invested in both equities and bonds and do well.

"In 2022, there was a lot of debate around the death of the 60:40 portfolio because both bonds and equities faired extremely poorly during the year," Ventelon says.

"This is the year where we see an inversion of that - where both bonds and equities do well because interest rates and inflation are going to come down."

In this interview, you'll learn which risks Cassidy and Ventelon believe investors need to be aware of to avoid any major blowups in FY25, the types of strategies they are using across a range of asset classes, as well as one asset class they wouldn't touch over the year ahead.

Time codes

0:00 - Intro

0:31 - The three most important factors influencing asset allocation in FY25

2:46 - How important is the macro environment to your process?

3:33 - What is the market under/overestimating for the year ahead?

6:58 - What asset class are you most excited about?

9:26 - Asset allocation: overweight alternatives

15:33 - Asset allocation: overweight fixed income - where are the opportunities?

18:39 Asset allocation: growth assets - Aussie and global equities

21:48: Asset allocation: focus on global equities

25:28: What areas of the market are you avoiding and why?

28:09 - Cash - what role does it play?

29:34 - Mistakes investors should try to avoid in FY25

Build your perfect portfolio in FY25

To learn more about how Alex and David create bespoke solutions for clients, click on the links below.

Morgan Stanley Wealth Management

5 topics

2 contributors mentioned