How to invest for growth... defensively

Below is a summary of the highlights of the session.

Overview of the Janus Henderson Global Research Growth Fund

The strategy is fundamentally driven, focusing on bottom-up research and top-down risk management. The fund has been operational in Australia for 15 years and is part of a broader suite of research funds totalling over $30 billion across five strategies.

The analysts on the team have an average tenure of 17 and “my co-portfolio manager, John Jordan and I, have really never done anything else except investment management.

“We're both old folks… we've been doing it for almost 30 years”, quips Cummings.

Investment philosophy and process

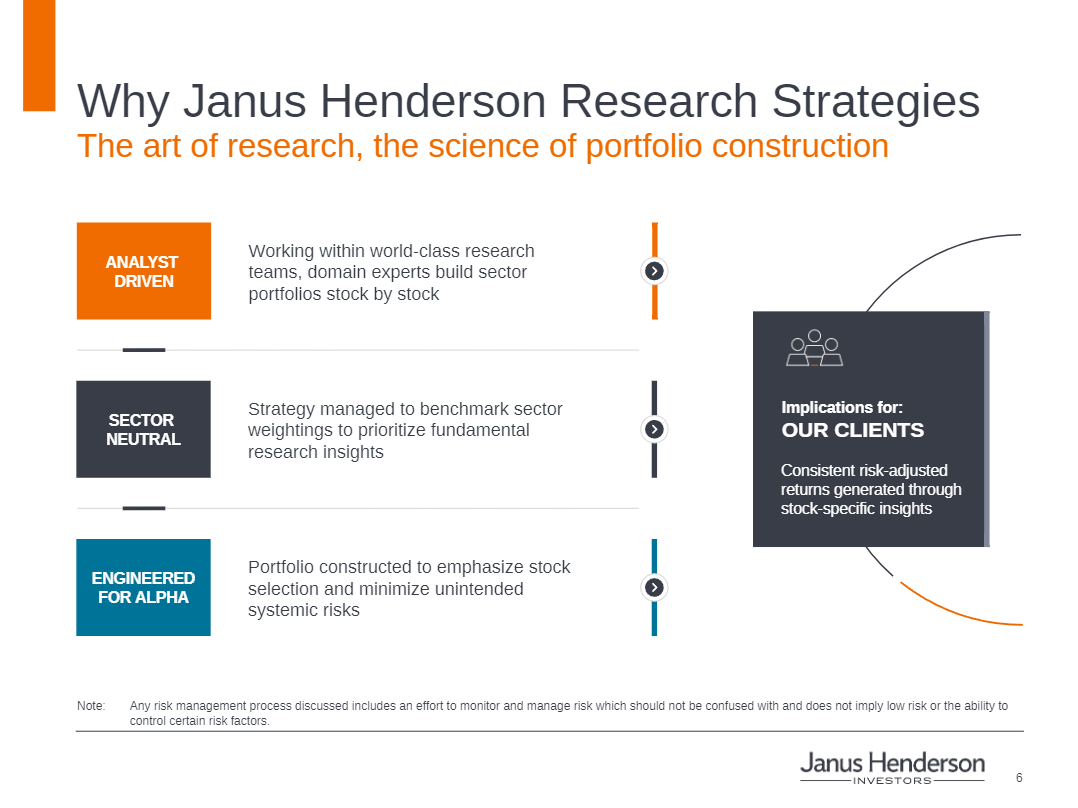

The fund is analyst-driven, with ideas originating from analysts who are business model experts and bottom-up stock pickers.

“This is an analyst-driven product”, says Cummings.

“First and foremost, the ideas come from the analysts. One company at a time, we're business model analysts. We're bottom up stock pickers”.

Each sector team, led by experienced sector leads, is responsible for the names in their respective sectors.

The fund is constructed to be sector-neutral, ensuring that beta is free and investors pay for stock selection and idiosyncratic risk.

“We think that's really important, and it's part of the overall philosophy of the fund, which is that beta should be free”, says Cummings.

“You shouldn't really pay for style exposure in any portfolio, let alone a growth portfolio.

“What you should pay for is stock selection. Idiosyncratic risk is the risk that you ultimately want to pay for and get compensated for”.

Lessons from market corrections

“Investors had been used to essentially zero cost of capital for quite some time”, notes Cummings, adding that “the recognition that all of a sudden there's going to be a real cost of capital caught a lot of people by surprise.

“What it exposed, more than anything, is what I would deem unworthy business models - business models that didn't have a path to profitability, business models that maybe only made sense in a zero interest rate world, maybe didn't make sense in a 5% interest rate world”.

Cummings went on to add that abrupt regime shifts in the market like that are difficult and that despite faring better than other growth managers, he and his team were not immune from the shake up.

“Part of the reason for that, is the team has gotten better over the last several years at utilising the tools that we have at our disposal to understand when market regimes might be shifting, what internal factors are really driving performance in the market”, says Cummings.

“We can see this real time, whether that's momentum or valuation or earnings quality. So, we were able to identify that shift quickly. It did take some portfolio movement though for sure, and it was a challenging year”.

Defensive qualities of growth investing

A focus on business models and business model quality, in particular, has also served the Fund well.

“We didn't own a lot of those profitless hope stocks”, notes Cummings, adding that the Fund’s low turnover rate allows it to benefit from the power of compounding, a key competitive advantage.

The focus is not on growth versus value but on understanding and investing in strong business models.

Cummings notes that the Fund's process is unique due to the depth of experience within the team and the strong working relationships with the management teams of the companies it invests in.

“Seeing cycles of fear and greed in your particular part of the equity market is really important. And going through that as a team is important,” notes Cummings.

“We build working relationships with the management teams of our companies, many of whom we've known for 20-plus years. That is really helpful, particularly when things aren't going particularly well”.

The team views themselves as owners of businesses rather than traders of stocks. This long-term perspective allows them to benefit from cumulative learning and the power of compounding.

Impact of AI on investments

While technology and AI have driven significant performance in recent times, the promise of AI extends beyond just the tech sector, notes Cummings.

He highlights insurance company Progressive (NYSE: PGR), and Vista Corp (NYSE: VST), which is mostly a regulated electric utility.

“We're having conversations around structural change around AI, and what that means more broadly for the economy and the businesses that we invest in all of our sectors”, says Cummings.

Market outlook

In discussing the outlook for the US, Cummings highlighted the contrast between the political environment and the economy.

“The range of outcomes is pretty wide with Mr Trump back in the White House. No one's quite sure what's going to happen or what's rhetoric and what's going to end up being real.

“But as uncertain as the US political environment might be today, the US macroeconomic environment is actually, it's been remarkably well behaved”, says Cummings.

He punctuates this by adding that economic data has been pretty good and that it is still pointing to a soft landing, whilst inflation is tracking in the right direction.

When it comes to market concentration in the US, Cummings says that it’s “the work that active investors need to be doing today” before drawing parallels between the current environment and the 1998-2000 tech boom.

“During that time, there were many popular stocks that retail investors were playing. They were the only stocks we hear about, very similar to the dynamic today - it seems we only hear about six or seven stocks every day”.

“What happened is the internet itself proved to be multiples more important than anyone could have conceived of in 1999.

Yet the companies, the actual tickers that people were owning to play that theme turned out to, for the most part, not be the names that were the most important stocks the next decade or so” says Cummings.

“I think AI is going to play out in a similar way, meaning investors don't yet know and can't really know who the next winners are over the next 10 or 20 years because of AI”.

Performance

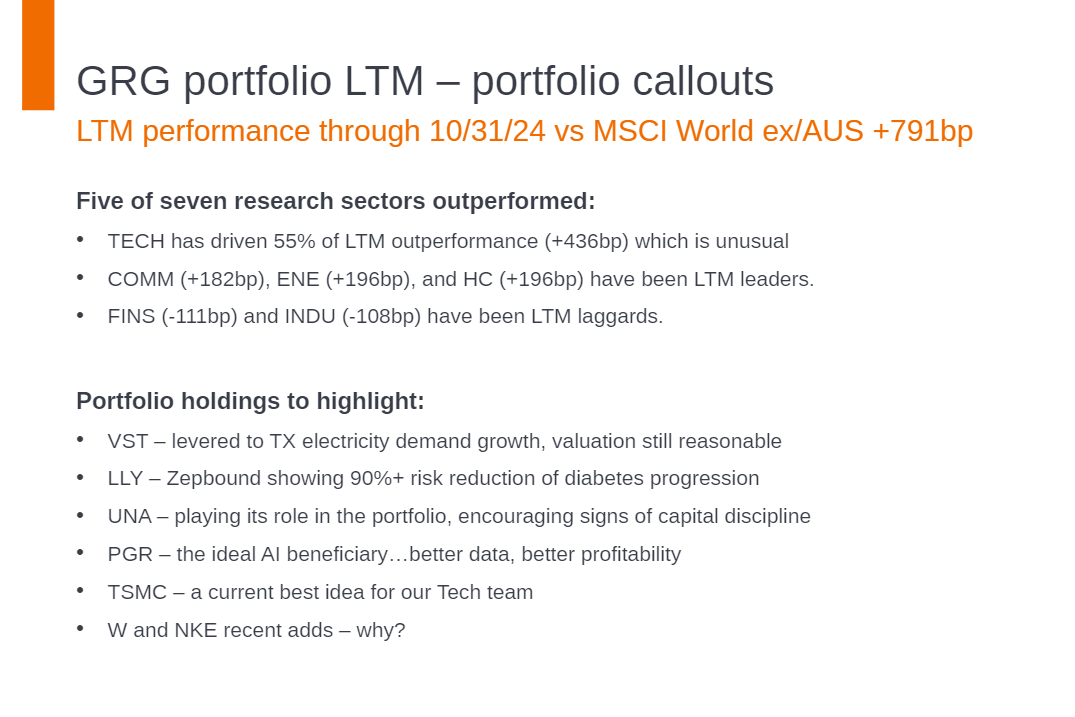

The fund has shown impressive performance, with a balanced contribution from various sectors.

Technology has been a significant contributor, but other sectors like communication services, energy, and healthcare have also played meaningful roles.

The fund's ability to deliver balanced outperformance across sectors is a testament to its robust investment process, notes Cummings.

3 topics

2 stocks mentioned

1 fund mentioned

1 contributor mentioned