How to sidestep the potential pain from passive investing

Investsmart

In part one we showed how being contrarian can produce huge returns, while in part two we explained how buying companies with owner-managers can also give you an edge.

In this, the last of our three-part series on how you could beat the market, we’ll show why a passive investment strategy based on a broad index of the US market is risky, and how sensible active management can increase your returns and reduce risk.

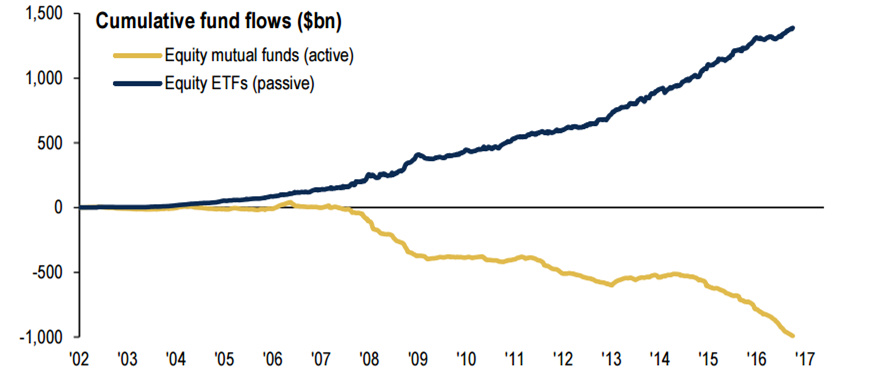

Chart 1. Funds flows into active and passive funds

Source: BofAML Global Investment Strategy, EPFR Global

Fed up with lousy returns and high fees, a tidal wave of frustration has seen billions flow from active managers to ETFs and index funds (see Chart 1). Unfortunately, the timing may prove lousy.

If you lucked out buying the S&P 500 on 9 March 2009, you would’ve more than tripled your money to date without ever having to know what businesses you owned or which were the best bargains. That’s an incredible annualised return of 17%.

But in the same way a retailer can boost current profits with a sale at the expense of future profits, today’s high valuations ensure that the overall market returns over the next eight years will pale next to the 17% per annum achieved since March 2009.

In March 2009, the price-to-earnings ratio (PER) of the S&P 500 was 11. To produce the 17% annualised return mentioned above, earnings have grown at just 5% per year while the PER has increased 150% to 27. In other words, despite tepid earnings growth, investors are now prepared to pay 2.5x more at or near a cyclical peak for a dollar’s worth of earnings than they were in 2009.

Take McDonald’s for example. In 2016 revenue was only 8% higher than in 2009, and net income is virtually flat. Despite a large helping of share buybacks, earnings per share has only increased 5% per year. Yet the PER has nearly doubled from 15 to 27, which contradicts the company’s inability to grow.

It’s not surprising then that on several measures the US market’s current valuation is only surpassed by 1999 right before the tech wreck and the period that ushered in the great depression.

Like our retailer’s sale, the long period of high returns since the GFC has stolen returns from the future, so being highly diversified across hundreds of over-valued stocks is not going to help you achieve your financial aims or protect your savings.

A better way

Fortunately, all is not lost. The gap between the most expensive stocks on the market and the cheapest has rarely been larger, suggesting that a portfolio of undervalued stocks could outperform the major indexes by a large margin once the current momentum in growth stocks and passive strategies (which are mathematically poised to produce poor returns over the medium term) wanes.

It’s worth highlighting the poor performance of the S&P 500 during the periods 1966-82 and 2000-2003, so a long period of poor performance holding a diversified portfolio of stocks is nothing new.

Let’s analyse three stocks in our current portfolio that potentially offer attractive returns and safety through a mix of dominant market positions, trustworthy and entrepreneurial management and favourable valuations.

SiriusXM

SiriusXM is America’s only satellite radio service. Due to its long relationships with auto manufacturers its devices now reside in about three quarters of all new cars rolling off production lines. That means instead of being forced to listen to AM or FM radio, you can choose from around 150 channels of ad free music, sports, news and entertainment, including shock jock Howard Stern, for just $13 per month.

Despite the increase in online music services, SiriusXM’s subscriber base continues to grow. Free radio, replete with advertising, remains the company’s major competitor, but there are no other satellite radio services. That’s because SiriusXM spends over $300m per year on content, which makes it unprofitable for another competitor, and you’d be a decade behind even if you could convince the auto manufacturers to add your receivers to their cars.

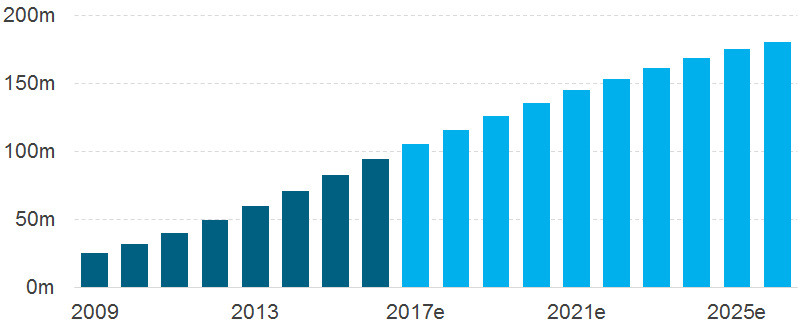

Chart 2. SiriusXM enabled vehicles to nearly double by 2025

Source: SiriusXM, Morgan Stanley Research estimates

The company’s free cashflow multiple of 17 suggests earnings won’t grow that quickly, yet its market is expected to almost double from 90m cars currently to 175m by 2025 (see Chart 2), mainly due to an explosion of second hand cars fitted with its devices.

With operating margins expected to increase above 40% and a service that is insulated against economic downturns due to its low price and great value, we intend to own this compounder for a long time to come.

Even better, if you buy the holding company Liberty SiriusXM (as we did), whose only asset is a 67% stake in SiriusXM, you’ll enjoy a further 19% discount and the benefit of both companies buying back shares.

ING Group

The European banking industry has largely been a trap for investors since the GFC, with problems taking longer to sort out than they did in the US. Finally, there are signs of progress. Embattled Deutsche Bank has raised €8bn in a rights issue, and Italy’s largest bank, UniCredit, raised €13bn to cushion against bad debts.

That’s helping make the entire sector safer, but ING Group rid itself of its GFC-related problems some time ago. What’s left is a vanilla retail bank with dominant market positions in Luxembourg, Belgium and Germany. Quite remarkably, ING has built a €100bn deposit franchise in Germany from a standing start in 1994.

You likely recognise the ING brand from its TV commercials featuring comedic actor Isla Fisher. As the bank doesn’t have a large branch network (in Australia at least), it can offer more attractive online savings rates to grow deposits. Once its base of customers is established, it can then sell additional products, such as mortgages.

ING has been at the forefront of digital banking, and by investing nearly a billion Euros over the next four years it should stay there. The stock is currently trading at a price-to-tangible book value of 1.2, and with a sensible strategy to increase profits steadily, along with a 4.3% dividend yield, this high-quality bank nestled in the wealthy bosom of northern Europe could produce total annualised returns (dividends plus capital gains) above 15% as sentiment turns more positive across the sector in the same way it has recently in the US.

NVR Inc

Homebuilders aren’t usually a happy hunting ground for investors. Their returns in the good times are often lousy due to intense competition, but during a recession they often go broke taking on too much debt to buy land.

After going broke around two decades ago NVR solved this problem. Instead of buying land, NVR pays a 10% premium for an option to buy a parcel of land in the future. This means the company operates with next to no net debt, allowing it to survive recessions and buy back shares. In fact, this company is a cannibal, buying back 75% of its shares over the past twenty years.

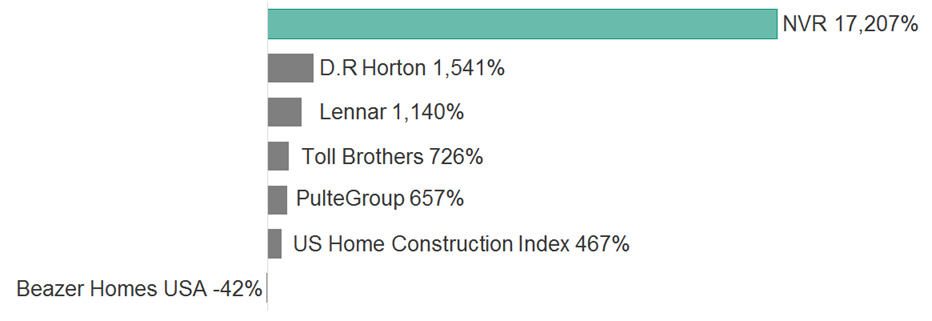

Chart 3. US homebuilder stock total returns between 1 May 1997 to 30 April 2017

Source: Morningstar Direct

That’s led to unheard of returns for a homebuilder operating in such a cyclical industry. NVR’s total return over the last 20 years is 17,207% (see Chart 3 for comparison to its peers), and it was the only US homebuilder that turned a profit during the GFC.

Chief executive Paul Saville may shun quarterly earnings discussions with analysts, but his $270m stake in the business should benefit from several tailwinds blowing behind the industry.

The millennial cohort is America’s largest ever, and they’re reaching an age that involves marriage, babies, and the inability to keep living at home. Not only is this bullish for home building, which is stuck at barely 50% of the peak in 2007 and 20% below the long-term average, but the inventory of homes available for sale is also reaching a near record low. In most of the areas that NVR operates, it’s also cheaper to buy than rent, in contrast to Australia, for example.

So Plan A is that NVR builds lots more homes and increases its earnings, but our confidence in a satisfactory outcome is increased by Plan B, which is that the share price languishes and the company buys back shares hand over fist. We also note that homebuilders currently represent 0.1% of the S&P 500 index, which means their stocks aren’t influenced by value-agnostic ETFs.

In summary, this is a remarkable company operating in an unpopular sector with insiders that have skin in the game. As we’ve explained, that trio is a very promising starting point for any investment.

Activate your portfolio

The key point from this analysis is that there’s always value somewhere. And unlike index funds and ETFs that will eventually face major headwinds when investors reassess valuations, the potential returns for the businesses we’ve described are much higher and, in our view, offer far more safety.

Passive strategies play an important role in portfolios, but they make the most sense when valuations are low. At current valuations, many of these products are priced to produce lousy returns over the next decade but, as we’ve shown, with a little effort you can find great businesses that will protect and grow your portfolio for decades to come.

Nathan Bell is Head of Research at Peters MacGregor Capital Management.

Disclosure: Peters MacGregor Capital Management Limited holds a financial interest in ING Groep, Liberty SiriusXM and NVR through various mandates where it acts as investment manager.

4 topics

Nathan has over 20 years' investment experience. Before joining Peters MacGregor, he worked for 9 years at Intelligent Investor, including 4 years as a Portfolio Manager. Nathan is a CFA charterholder

Expertise

Nathan has over 20 years' investment experience. Before joining Peters MacGregor, he worked for 9 years at Intelligent Investor, including 4 years as a Portfolio Manager. Nathan is a CFA charterholder