How to unlock a business's full potential - the Waislitz way

A resume filled to the brim with unique activities would undersell the experiences of Alex Waislitz. Having been a company director at VISY and Pratt, vice president of the Collingwood Football Club and even a movie producer, it seems as though investing would be the last thing on his mind. But Waislitz's Thorney Investment Group is one of the most accomplished investment companies in the country. With a dual approach of value and growth at the smaller end of the market, he applies the best of both worlds mentality perfectly.

"I realised that I love the variety of businesses. I decided I didn't want to become a super specialist. It didn't suit my personality because generally I'm a curious person. I think you can cross-pollinate from one business to another business and learn and improve. So I set myself the task of being sort of a well-educated generalist and then reach out to specialists as needed for the particular nuances of those business."

In this week's episode of The Rules of Investing, my colleague Patrick Poke spoke to Alex about his journey to the buy-side, the inception of Thorney's funds, and the stocks he thinks have long term potential.

.jpg)

A journey of insights

After studying law and commerce, Waislitz quickly realised the law was not for him. He ended up at investment house Prudential in New York, and this opened his eyes to the world of finance. After moving on to operate under Australian business legend Robert Holmes à Court, he returned to Australia seeking an entrepreneurial rush. This was provided by Richard Pratt of VISY group, where Alex learnt the ins and outs of business and fuelled his love of unlocking a business' full potential

A thorn in the side of sleepy small-caps

Having been exposed to the hustle and bustle of US markets, coming back to Australia was a significant change, particularly on the smaller end of the market. Waislitz saw the lethargy in the area and decided to turbocharge it.

"What I realised was in the micro and small-cap sector, there was not a lot going on. They were relatively unknown, undiscovered sleepy companies. I didn't have much capital to start with, but I wanted to be a thorn in the side of those companies that were sleepy. That was part of the origin of coming up with the name Thorney."

The approach seemed to work. In the first year, of operation, the fund turned $1 million into $4 million, and this was just the beginning of multiple years of 100%+ returns. Admittedly there was a lot of trading in these formative years however this was never a strategy Waislitz wanted to prioritise.

"I was more interested in building a stake in companies where I could engage with the management fundamentally or the boards or the decision-makers around the company and be part of really what was making the company the business tick."

Another core element of this strategy involved unlocking hidden assets within a company. Holdings such as real estate can sit untouched on balance sheets, and then upon revaluation can induce huge upside for comapnies.

"If you turned over the real estate, you (may) realise that the NTA was actually triple what the stated NTA was because it hadn't been revalued for years, and suddenly the share price would explode on the upside because investors realised that there was a lot more worth in those companies."

A similar principle applied to companies with underperforming divisions or assets. Selling those off, which can be hard for founders to rationalise, can be the key to liberating growth prospects.

Under Thorney, they operate two listed investment vehicles: Thorney Opportunity (ASX:TOP) and Thorney Technologies (ASX:TEK). Despite the names, they are very different strategies.

TOP is very geared towards the above strategy, as the inaugural fund Waislitz listed.

It's looking for value, for fallen angels that may be candidates for a turnaround and improvement. It's looking for companies that may have those assets that can be sold off to liberate the balance sheet and focus management on the core business."

The approach was very much aligned with Thorney's strengths, however investor focus on technology and innovation has ramped up recently. Accordingly, they launched TEK in order to target exciting and disruptive new names.

"We focus on the broad technology space, listed companies, pre-IPO earlier stage in the life cycle of a tech company investing primarily in Australia, but growing over the last couple of years as well in the USA and out of Israel as well... We play a broader range within (tech) thematics that we are confident in, such as a fintech, ag-tech, or the medical sector with devices or diagnostics, logistics."

This broader shift in investor focus has triggered some divergence in the returns of these 2 contrasting strategies. There have been minor missteps and Waislistz concedes it is likely they pulled the trigger somewhat prematurely on certain themes on the value side. But recovery is on the horizon as assets slowly begin to awaken.

"I always believe value comes through at a certain point in time, and we keep working those assets... We think there's a lot of unlocked potential in that portfolio, which we're working hard to achieve over the next few years. We need to explain that narrative a bit better because - relative to TEK - it's been an under-performer, but in its own right it's been okay."

Owning the tools of crypto

The fund is a big believer in thematics, and one of the most discussed is cryptocurrencies, more specifically blockchain. They have approached the space with a picks-and-shovels approach: investing in the tools required as opposed to the currencies themselves.

"We are a believer in blockchain technology which we think is going to be fundamental infrastructure for transactions... (We are) not so much in going directly into exploration companies, occasionally yes, but more so in a picks-and-shovel approach... I don't know which currency is going to be a winner in the long-term, and I don't want to be a speculator on behalf of other shareholders."

Holdings they have in the area include:

- Canadian listed (but Aussie-led) crypto exchange Banxa (CVE: BNXA). It has grown transaction volume dramatically and they have held them since pre-IPO.

- Bitcoin miners Cosmos (set to list on the NASDAQ) and Iris Energy, who use hydroelectricity to power their mines. As legitimate players, they believe the market will view them favourably, particularly given the disruptions occurring across China's crypto sector.

"I don't want to say one crypto is going to be better than the other, but we do think that the space will become more popular, more utility in terms of transactions. So we want to be in the infrastructure around it."

Ensuring ResMed sleep with one eye open

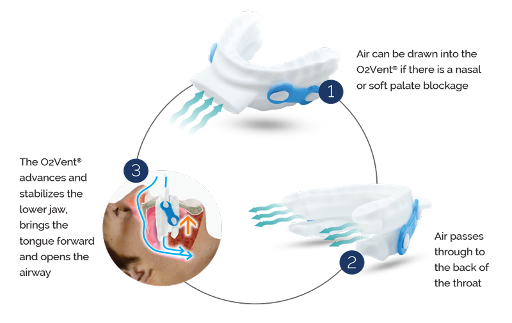

One of TEK's holdings is Oventus (ASX:OVN), which looks to find solutions to sleep apnea. If that sounds familiar, it is because that is also the area ResMed (ASX:RMD) is addressing. And it seems to have done so relatively successfully on its way to becoming a market darling.

The only caveat is the inconvenience of their product.

"With a machine that is very loud when you put the CPAP over your face, it's like wearing a mask...It's very uncomfortable and hard to lug around. It's a big unit if you're travelling."

Oventus looks to solve this through a much more compact design.

As an early company, patience and capital are essential. There has been some disappointment in the confirmation of effectiveness stages and COVID-19 has restricted access to dentists and sleep clinics. But the potential for the product to capture even a fragment of the total addressable market would be a huge boost to their current $20-25 million market cap.

We believe that the contrast is so significant relative to the cumbersome CPAP that it will capture some of the market. The market is so big... So what sort of sales and penetration would it take for this company to be a lot more valuable? We think even though it's taken a bit more time than we would've liked, the risk-reward from a company like this is terrific, and it's going to do fantastically well for people's health and lifestyle enjoyment.

Backing great management: Service Stream

Former market star Service Stream (ASX:SSM) provides network services to the telco industry. After a lot of momentum, it struggled to perform after being spun off as it endured poor contracts, imprecise management, and an expensive joint venture. The NBN was extremely profitable for them, and this confidence led to misguided expectations.

"There was a view that - because the perception was being badly managed - there would be rivers of gold forever. I think even though they were running the company well, it then got to be too expensive because the multiples of the market gave it were too high, on the basis that (the NBN benefits) would go on forever and achieving good margins while doing that."

In response, they have reformed their management team and diversified offerings.

"They introduced new (more active) management... recruited a new CEO and they went about turning around that big city business, exiting the bad contract, recapitalizing, and streamlining the business.

They've been a huge beneficiary over the last few years of the NBN rollout ... People didn't realise that they also started expanding also into utilities, smart meters, radio, gas and electricity, and those types of things which was a good diversification."

TOP ended up selling out at almost $3 per share, as even though they had "fantastic management, good contracts, the valuation had got ahead of itself." With the NBN continuing with maintenance and other roll-outs, the company's recent acquisition of Lendlease, as well as an excellent management team, Waislizt has confidence in their ability to bounce back.

"I believe that the market is valuing SSM too low now relative to the potential that this new business gives to them. We participated in the capital raising, and we look forward to them producing the results and the market understanding them better; that telco is only one part of their business and this is a further diversification for them to balance the business and smooth out the earnings much better going forward"

Long term winners: Environmentally conscious cement

When thinking about the one stock you would put your life savings into and if you had to leave it there for 5 years (as a thought exercise), it is important to reflect on the themes you are comfortable with, and that is exactly Waislitz's approach.

"I would do something that has a technology that could change and revolutionise something and let that technology play out...Maybe it's a life sciences company like an Imugene (ASX:IMU) or a Mesoblast (ASX:MSB), that if they get to the point of a particular drug that could be a game-changer within cancer imaging or stem cell applications respectively."

Calix (ASX:CXL) is the stock he settles on, an innovative company that specialises in developing products and applications from its wide range of patents and R&D. Its purpose is to use these products to provide a wide range of solutions across industries. They are currently leading in the area of cement, where they have created a process that heavily reduces the carbon burden.

"It's an industrial solution to achieve not only efficiency for the cost of the product being produced, but in particular the real cost of the product and real cost for all of us, which is in how it deals with the climate change, particularly through emissions and carbon capture. They're focusing on what we're calling green cement, and they've been supported with some of the largest cement companies in the world, investing in pilot plans with them and scaling up for full production.

The applications go far beyond just cement given they own that unique process. Their management team are also capable and heavily invested in the equity of the company as well.

I think this company has got star potential. It could have many applications and each one has got big market shares. It could lead to spinoffs of the technology or licencing, but I think it's a company that we certainly believe in.

Conclusion

Overall, a love of business and the range of opportunities constantly arising is what keeps Alex fascinated with the world of investing.

Anyone who thinks business is static shouldn't be investing, nothing is static and everything changes and can be challenged.

The dynamism of our world has been on full display and presented a challenging time for all, but also a chance to reflect on the power of individuals

I think the innovation of human beings, the ability to adapt is what we're seeing, and I think it's a pretty powerful message... We have to learn to be more compassionate, we have to be more understanding of individuals' workplace, environment, businesses who have genuinely out of their control being affected by what the world's thrown at them

With the world unlikely to normalise in the near term, heeding these lessons are essential.

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

8 stocks mentioned

1 contributor mentioned