How to use ETFs for income (plus four different ideas)

Can you receive an income from an ETF? If you’ve been wondering this, you're not alone. It’s one of the more common questions ETF issuers receive from prospective investors. The short answer to this question is "yes". So, if you like the ease of trading via the ASX and want to build an income portfolio, this may come as some relief.

But where do you start? And how does an income payment from an ETF work?

In this wire, I’ll take a look at how to use ETFs for income and things to look for. I also challenged four ETF providers to put forward their best income idea for the coming year. You might be surprised by their suggestions.

Using ETFs for income

Generating an income from an ETF isn’t as complicated as you may fear.

Equity ETFs still pay dividends. Fixed income ETFs still pay interest. And across asset classes, ETFs still pay out capital gains. Better yet, you can still receive franking credits from Australian equity dividend payments.

Any payment you receive from an ETF is called a distribution and this reflects your portion of any income and gains generated by the fund. You’ll receive an annual statement breaking down the composition of distributions you’ve received from the fund, including any franking credits you might be entitled to claim, to assist with compiling your tax return statement.

The ETF market is vast in Australia. Your options are far from restricted to broad-based passive investments in equity indices or bond indices. In fact, if you prefer an actively-managed approach, many fund managers have listed their active funds on the ASX in recent years.

Key items to look for

The normal rules of investing for income apply equally to investing in ETFs as to any other investment.

- Consider the risk and return profile of the ETF and how this matches your own needs and requirements, along with how it might sit in your broader portfolio.

- Look at the costs involved with investing and what that might mean for your end returns.

- The frequency of distributions. Do you need your distributions monthly? Or can less frequently work for you? ETFs are managed funds so some may elect to pool income for set distribution timings, while others may simply distribute whenever possible. This will be outlined in the product disclosure statement.

- What’s under the bonnet? Look at what the ETF actually invests in so you can be sure that you are adequately diversified across your investment portfolio. You should be able to access a complete list of holdings from the ETF issuer.

- The index methodology. Some ETFs track indices that will specifically target yield for example, while others may be more broad and cover capital growth. Your strategy will help govern whether or not you need more tailored indices.

For those who rely on franking credits, the starting point might be Australian equities and then look for ETFs that are tailored to focus on dividends and franking.

You can find a range of ETFs to start your search in Livewire’s fund database.

Four ETF ideas from the issuers

Just as the world of income investing has come a long way from Australian bonds, so has the ETF marketplace evolved. Betashares, Global X ETFs, VanEck and Russell Investments pitched their income picks for the coming year.

.png)

Idea 1: US Treasury bonds

VanEck tipped US treasury bonds (aka T-Bills) as their pick for income, via the VanEck 1-3 Month US Treasury Bond ETF (ASX: TBIL). TBIL was only recently launched on 16 May 2023.

“Put your money where Berkshire Hathaway has more than US$100 billion,” says Arian Neiron, CEO and Managing Director, Asia Pacific for VanEck.

In bygone years, T-Bills were all but inaccessible to Australian investors, unless as a component of actively-managed funds. TBIL allows Australian investors direct exposure on the ASX.

So why T-Bills?

“T-Bills are backed by the US Government, which has high credit quality, and are considered one of the safest investment assets in the world. T-Bills are currently offering yields in excess of 5% p.a., which is high for a defensive asset and a difficult return to beat in current market conditions,” says Neiron.

He also points to the difference between Australian and US interest rates at the moment, an opportunity known as ‘carry’. US interest rates are sitting at 5.00-5.25%, while Australian rates are at 3.85%, resulting in an interest rate differential of 1.15-1.40%.

“While Australia’s rates are tipped to stay around where they are, in the US, its policymakers are still engaged in the fight against inflation. This means the ‘carry’ could continue to rise,” Neiron says.

Idea 2 – Senior floating rate notes from Australian banks

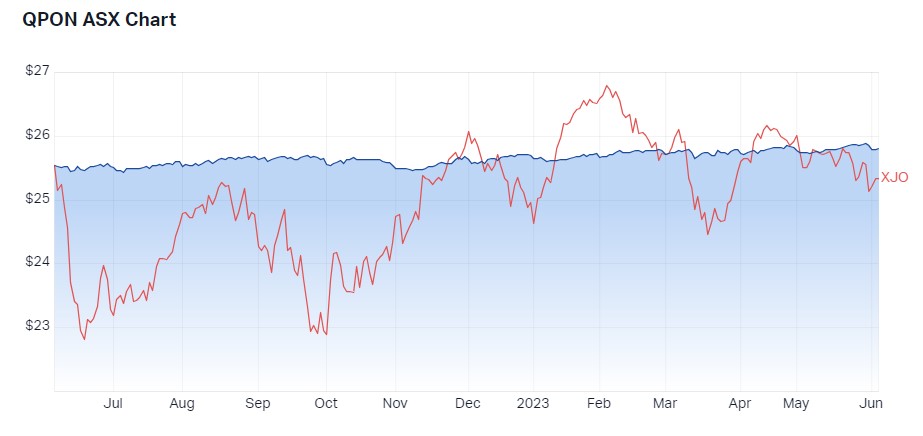

Betashares nominated senior floating rate notes from Australian banks as the income space to hold, via the Betashares Australian Bank Senior Floating Rate Note ETF (ASX: QPON). The ETF has a track record over five years and was launched 1 June 2017.

“With the present uncertainty about rates, QPON represents a compelling option for income that is insulated from further rate hikes or rate hike expectations, without stepping further out the risk curve,” says Tom Wickenden, Investment Strategist for Betashares.

But what makes senior floating rate notes from Australian banks compelling?

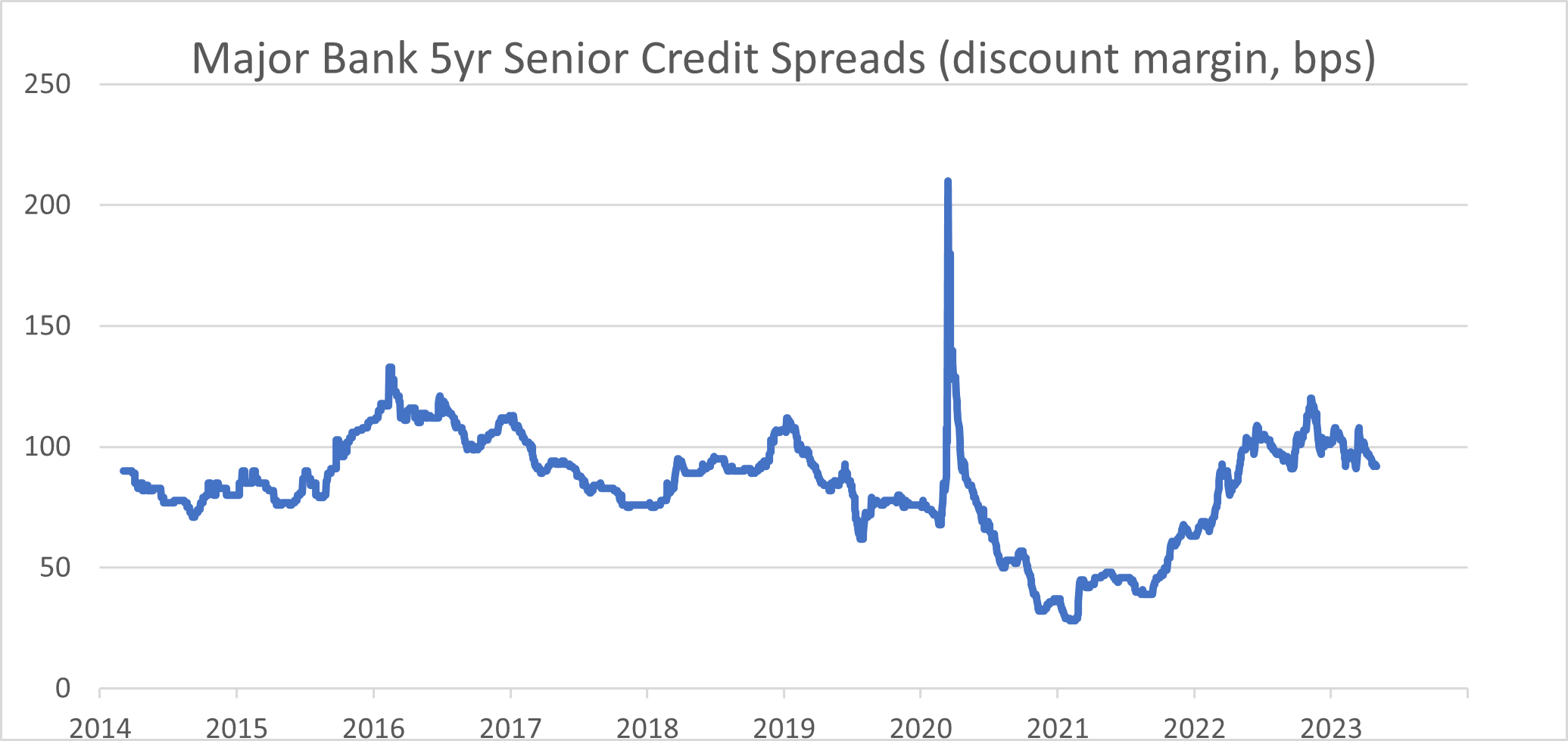

It comes down to the market environment and what that means for spreads.

“If rates continue to rise, this could be beneficial for floating rate notes (FRNs), as coupon payments increase as rates increase. By contrast, coupons for fixed rate bonds do not change, so the capital value typically decreases as expectations of future rates rise. Senior bank FRN spreads are once again trading in a favourable range, on top of elevated base rates,” says Wickenden.

Source: Westpac, Betashares. Data as at 1 May 2023. Past spreads are not indicative of future spreads.

Australian bank FRNs are typically hard to access for direct retail investors but are a large and highly liquid market.

Idea 3 – Dividend income

Dividend income has been a positive force for many investors over the past decade, and Russell Investments still believes it should be a top pick in the form of the Russell Investments High Dividend Australian Shares ETF (ASX: RDV). It has a track record of over a decade, having launched 11 May 2010.

“An allocation to RDV can play a dual role in a portfolio by increasing overall dividend income, while managing overall risk if required,” says Andrew Zenonos, Portfolio Manager for Russell Investments.

Russell’s index uses a proprietary composite yield score covering past and projected income earnings as well as growth projections and its assessment of yield is gross of franking credits to avoid unduly penalising companies on the basis of franking.

Why dividend income?

“Dividend income is an important part of an investor’s total return, and this is especially true when markets are volatile and the outlook for equity markets is uncertain,” says Zenonos.

He points out many active managers are underweight high dividend yield stocks in aggregate, especially where those stocks are large index weights like the banks.

Idea 4 – Covered calls

Covered calls are a more sophisticated tool which is often time-consuming to do yourself. It’s an older form of income investing that Global X ETFs has identified as its top pick, via the Global X S&P/ASX 200 Covered Call ETF (ASX: AYLD). The ETF was launched earlier this year on 30 January 2023.

“A broad consensus across strategists and commentators is that markets don’t have a clear direction this year and that is the sweet spot for a covered call strategy,” says Blair Hannon, Head of Investment Strategy for Global X ETFs.

That is, “historically, covered call strategies outperform broad-based indices in terms of income generation during uncertain market environments because the premiums earned by trading rolling covered calls produces income over and above flat market movement.”

But before we go into the ETF, what is a covered call?

It is a form of options trading where you own a stock and don’t expect its value to significantly increase or decrease over time so you also sell a call option (that is you short the stock as well). It can be a time-consuming, costly and risky activity to do as a direct investor, which is where ETFs can offer an easier alternative.

Why covered calls for income?

“This approach opens three potential avenues to generate income in a single ETF – via the premiums earned by trading covered calls, dividends and franking credits (depending on an individual’s tax situation),” says Hannon.

“This combination has powerful potential as the premiums and dividends are – to some extent – independent of each other. So even if dividends cuts occur, the covered call premiums may remain robust because they are priced on market volatility and time to expiry. Ultimately, helping to diversify portfolio income streams.”

It’s worth highlighting that covered calls come with higher risk compared to traditional income routes like bonds so investors should keep this in mind when planning their portfolio. Hannon suggests covered call ETFs may suit as a satellite allocation in a core-satellite portfolio.

What are your best ETF ideas for income? Let us know in the comments.

4 topics

4 stocks mentioned

4 funds mentioned

3 contributors mentioned