How to value one of Australia’s great success stories

Macquarie floated on the ASX back in 1996 with 1,700 staff supporting an asset base of $5 billion. Since then an additional 13,000 staff have been employed and the asset base expanded to $219 billion.

This growth has helped drive an 18%pa total return for shareholders over the past 24 years. We are confident that Macquarie can continue to thrive over the years ahead.

One of Macquarie’s key strengths has been its ability to adapt to the changing nature of asset markets. Macquarie has always seemed to be a step ahead of the competition; it was an early adopter of quantitative applications, was one of the pioneer investors in global infrastructure and has been an early embracer of digitalisation.

We are therefore confident that Macquarie will once again re-position itself for the post-COVID-19 world, and continue to be one of Australia’s great success stories.

The state of play today

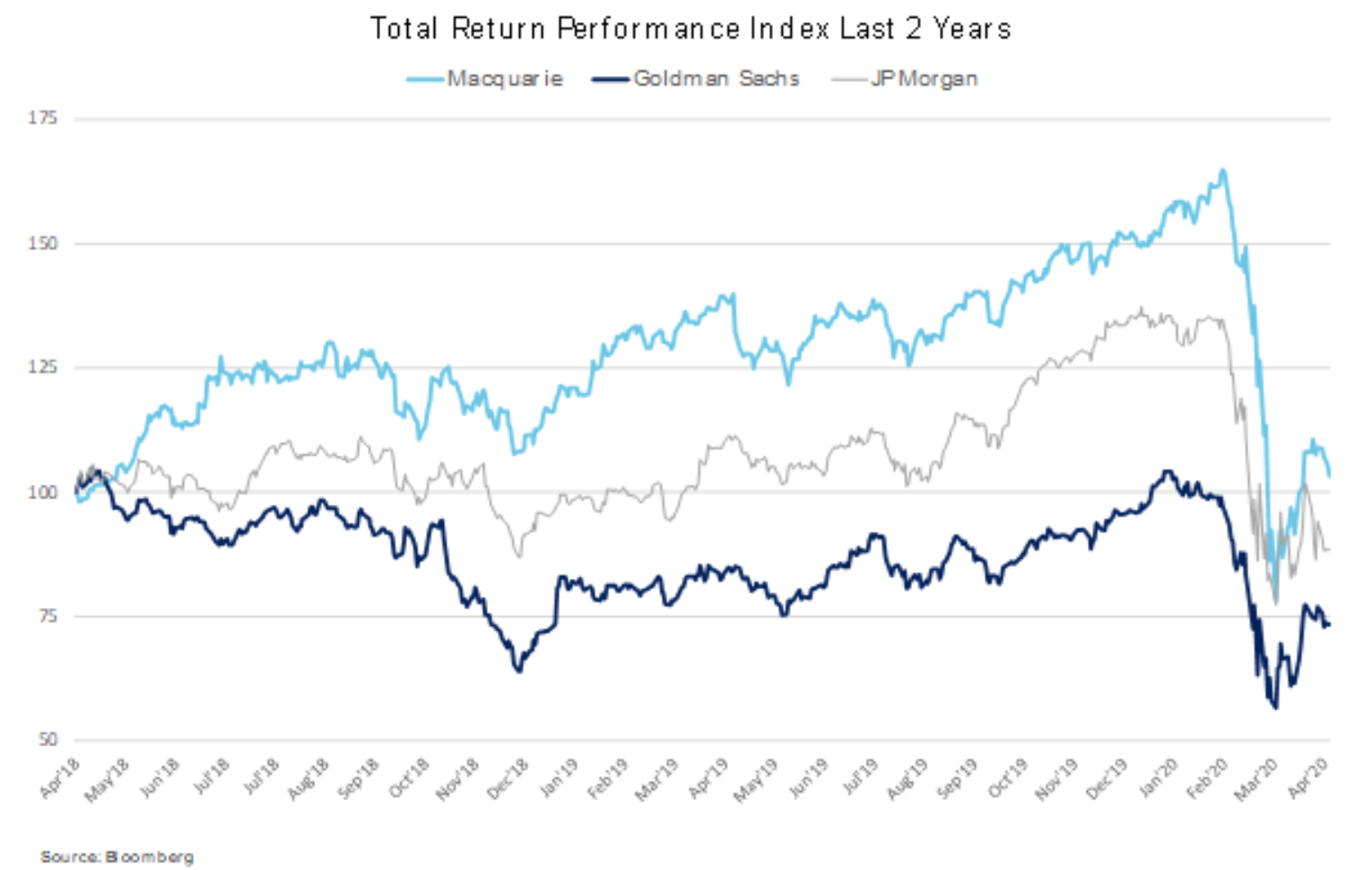

There is little doubt that COVID-19 has had a dramatic impact on investment bank valuations. In the 22 days between 21st February and the 23rd of March 2020, Macquarie’s share price collapsed more than 50% underperforming global peers such as Goldman Sachs and JP Morgan who both declined about 40%.

Macquarie’s underperformance partly reflects the fact that a number of its businesses will be directly impacted by the COVID-19 pandemic.

As COVID-19 spread around the world, most countries gradually shut their borders and suspended international airline travel. Macquarie has a large investment in an aircraft leasing business, AirFinance, that it acquired in 2015 for US$4 billion.

Unfortunately, grounded airlines do not tend to prioritise lease payments so Macquarie will most likely need to write-down the value of this investment. Fortuitously, last year Macquarie sold down half of its AirFinance investment to two pension funds.

Over the past decade Macquarie has also acquired numerous global energy operations. As a result, today Macquarie is the 2nd largest physical gas marketer in North America. Although this business has traditionally had a high level of recurring income that has tended to be less correlated to Macquarie’s other operations, lower economic activity across North America will ultimately lead to a contraction in the movement of natural gas. When coupled with significantly lower energy prices, it is hard to see how Macquarie can avoid a significantly lower profit contribution from its Commodities and Global Markets division in FY 2021.

Macquarie Asset Management (MAM) will also experience weaker profitability in the year ahead. The business has $580 billion of funds under management and has generated significant performance fees over the past 8 years; since 2012 MAM has generated an average performance fee of $260m every half. Given the collapse in market prices of listed property and infrastructure assets, MAM will struggle to realise performance fees in the foreseeable future.

Another obvious source of profitability weakness comes from the impairment of Macquarie’s loan assets. Back in 2009 Macquarie suffered net loan losses of 1.9% within its loan asset base of $47 billion. Today that loan asset base has expanded to $85 billion. It seems plausible that, if economic hibernation continues into the back end of CY2020, Macquarie could suffer impairment costs of more than $1 billion in FY2021.

Although there are clearly near-term profitability issues, historically similar episodes have highlighted the strength of Macquarie’s risk management framework.

The responsibility of risk tends to lie with the businesses. This approach allows business heads to understand worst-case scenarios and act decisively. Macquarie’s Risk Management Group is a second line of defence that also assesses risk in an independent nature and can hence provide a supporting voice during times of upheaval.

The benefit of this risk framework is that the individual businesses within Macquarie have a real sense of ownership which reinforces strong cultural alignments. We are comfortable that Macquarie’s experience, discipline and diversity of operations will ensure that shareholders can sleep at night.

The critical question: How to value Macquarie

The current unprecedented economic conditions require some common-sense approaches when considering investment opportunities. Hence, when corporate profitability is extraordinarily volatile, we initially start our valuation process using more traditional metrics like the price to book ratio. This is especially important when assessing leveraged companies like banks and insurers. So, the first assessment that needs to be made is whether the existing balance sheet structure of Macquarie is suitable.

Post the Global Financial Crisis, banking regulators around the world have worked tirelessly to ensure that financial intermediaries facilitate a smooth flow of funds between savers and investors. As a result, banks have been required to carry significantly higher levels of capital, reduce leverage and improve liquidity. Over the past decade, Macquarie has doubled its tier-1 capital base, reduced its leverage from 13.1x to 10.8x and has a Liquidity Coverage Ratio (LCR) that is 70% higher than required. Given these capital improvements over the past decade, we believe that Macquarie is unlikely to require additional capital over the near term. It should also be noted that Macquarie completed a $1 billion equity placement in August last year at $120.

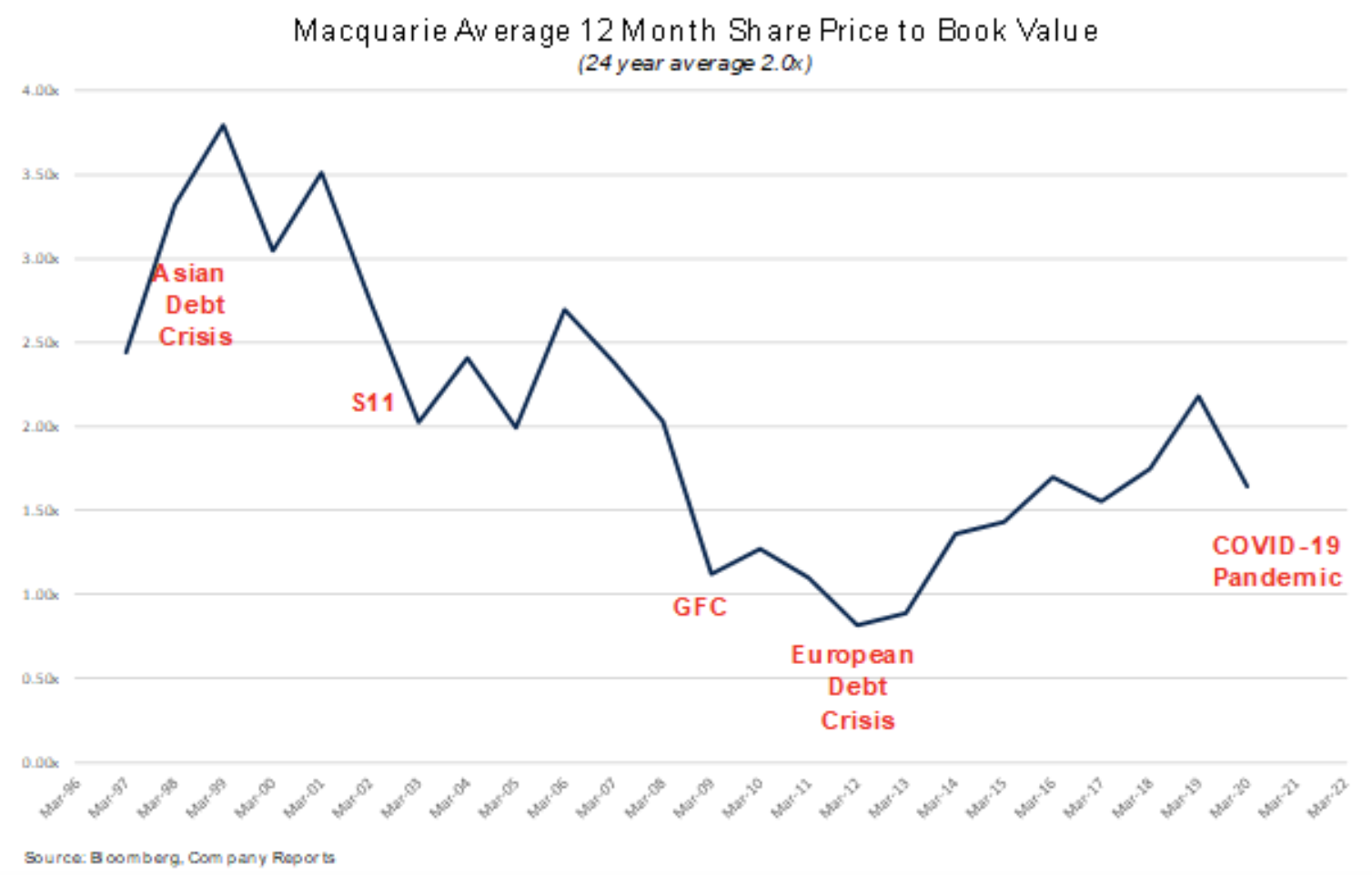

Now that we have established some confidence that Macquarie’s capital structure is suitable, we can assess today’s share price relative to the book-value per share. To our mind, this provides a simple measure that allows us to compare the current pricing environment to historic periods of market stress.

As can be seen from the graph above, Macquarie is currently trading at close to 1.5x book value which is 25% below the long-term average. However, during the GFC and the European Debt Crisis, Macquarie traded at a discount to book value. So, we need to ask ourselves will Macquarie trade below book value during this COVID-19 phase?

The COVID-19 Pandemic has created an environment that is very different to other turbulent periods that Macquarie has needed to navigate through. The economic fall-out from restrictions on activities may be comparable to the depression era of the 1930’s. However, advancements in medical applications and research should ensure that treatments and ultimately a vaccine will emerge. Hence, the dire economic climate could retreat rapidly and be replaced with a long, gradual improvement in activity.

$130 is a reasonable target

We believe that Macquarie is significantly better prepared for this environment and as a result, we believe that the share price will maintain a premium to book-value.

The quality of Macquarie’s book-value today is meaningfully better than at any time during the last 24 years. In addition, governments around the world have provided extraordinary levels of fiscal stimulus to offset the immediate impact of self-imposed activity restrictions.

Central bankers have also reduced interest rates globally and have committed to keeping them low for a considerable period of time. We would point out however that Macquarie is unlikely to trade to the price to book levels experienced pre-GFC. During the decade leading up the GFC, Macquarie delivered an average ROE of 18%. Today those returns will be difficult to replicate; regulators have required a 50% reduction in leverage. Accordingly, we feel that Macquarie will struggle to trade beyond 2.5x book value.

Macquarie will be releasing its second-half profit result for FY2020 on the 8th of May. The result will only include one month of COVID-19 weakness so there will be very little operational insights for the coming year. Hence, we believe that it is highly unlikely that Macquarie will give any profit guidance for FY2021. Sell-side brokers continue to promote Macquarie as a consensus buy and the average target price for the next 12 months is about $120.

We have tapered our expectations for Macquarie however we still believe that $130 is a reasonable target within the next 3 years.

We have confidence that Shemara Wikramanayake will successfully lead Macquarie into the post-COVID-19 era and have little doubt that the business will adapt to the volatile environment ahead.

Never miss an insight

With market volatility an increasing fact of life we know that capital preservation is paramount. Stay up to date with our latest content by hitting the 'follow' button below.

--

Macquarie is a top 10 position for the K2 Australian Fund.

1 stock mentioned