How we are investing for a changing and more complex world in 2025

The world is changing – and changing fast. With this rapid pace of change comes increased complexity for investors. Gone are the days of a rising tide lifting all boats – and of relying on passive index allocations to provide positive returns.

In the many conversations we have with clients around the world, one thing is clear: most expect to see increased volatility in markets in 2025 and beyond. We share that view and acknowledge the complexity in positioning portfolios for the macroeconomic drivers shaping the world. Interpreting the impacts and actively positioning at a company and security level is what our 340+ investment professionals do every day.

Macro drivers matter

There are three instrumental macro drivers accelerating change. These are long term in nature and ever present in the world around us, so they are not surprising in and of themselves.

1. Geopolitical realignment

We believe it is impossible to invest successfully without understanding the political environment. Investors must ask themselves:

- Am I investing in a country that is pro-business?

- Is this industry supported by policymakers?

- Does the political backdrop allow for access to private capital markets, and where are the most compelling opportunities?

- Is a company structured to fairly benefit shareholders, is it able to adapt to regime changes, and can it thrive regardless of the political backdrop?

These are just a few of the questions that in-depth active research can help answer on behalf of investors.

2. Demographic shifts

This is not a new theme, but it is an important one, because it is happening now. We know populations in higher- or middle-income countries are getting older, and we know birthrates are slowing to the extent that some forecasters have the world population actually shrinking in the not-too-distant future.

In 20 to 25 years – well within the time horizons of investors we serve – the growth engines and consumption patterns of the world will look very different to today, which in turn will impact investment opportunities and allocation strategies.

3. Cost of capital

The cost of capital is significantly higher than it was through the last decade, and we expect it to stay that way. This, of course, has major investment implications.

For one, fixed income as an asset class is attractive again, offering compelling yields and return potential along with renewed diversification benefits to suit different risk profiles. Within private markets, investment teams with the right expertise can now capitalise on opportunities as banks retrench, downsize, or divest assets amid higher rates.

But the higher cost of capital is not just about the returns available - it also means quality companies and challenged firms will increasingly perform differently. Alternative strategies can also be deployed to capture performance from companies and structures that struggle in this new environment, and overlays can be applied with the intent of realising gains from volatility and adjusted trading patterns.

With many investors looking to again put cash to work, complexity can be daunting. But with the right expertise, it presents exciting opportunities for active investors.

A more dynamic playing field for equity investors

Evidence of the market’s broadening has grown increasingly apparent in recent months. The S&P 500 Equal Weight (EW) Index, an equal-weighted version of the large-cap benchmark, outperformed the cap-weighted S&P 500 in two of the last seven quarters – both of which occurred in the last 12 months. Non-U.S. markets have also been positive, with some regions delivering double-digit returns year to date.

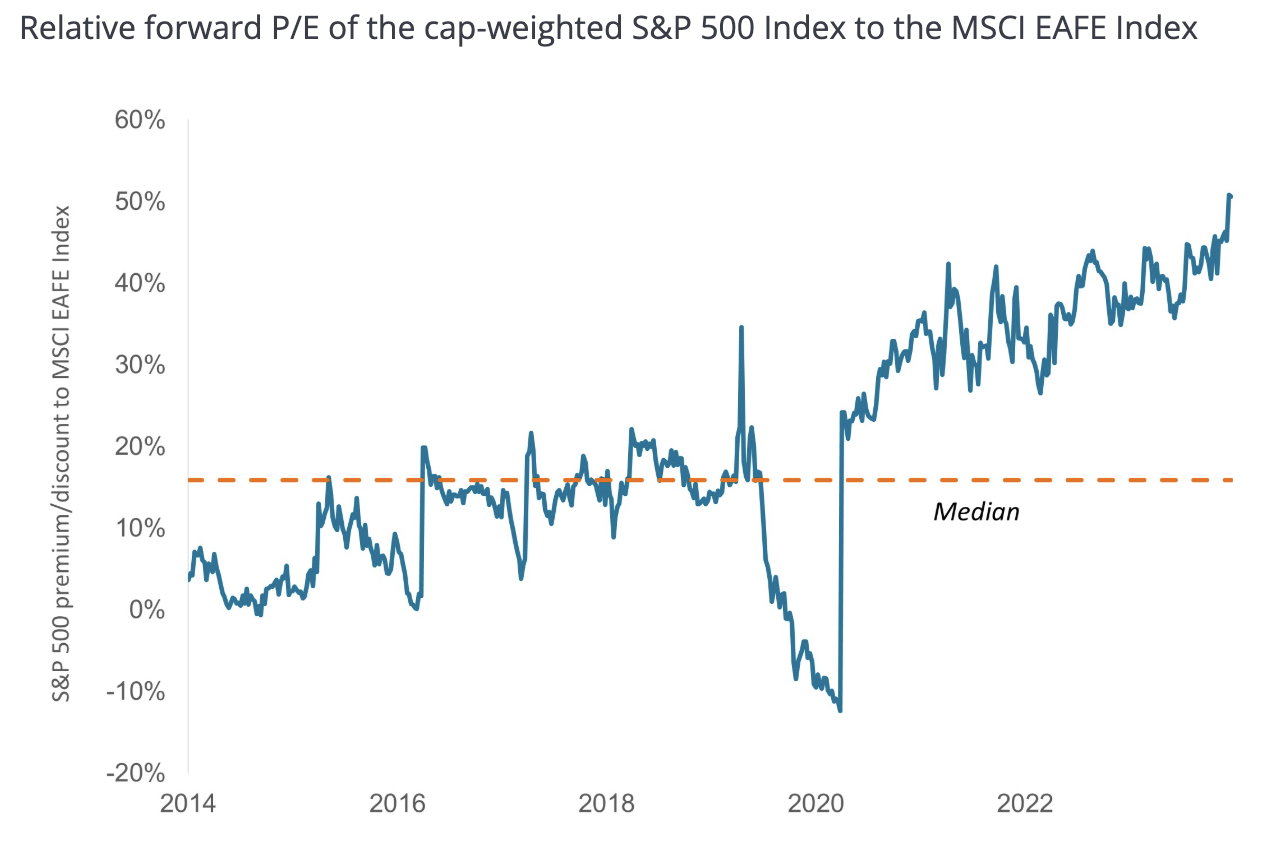

U.S. equities have grown increasingly more expensive compared to the rest of the world

Source: Bloomberg; data reflect forward 12-month price-to-earnings (P/E) ratios. Data are weekly from 28 November 2014 to 15 November 2024. The MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada.

We agree rates should continue to trend lower in the U.S., barring the passage of extreme policy proposals. But at the same time, many non-U.S. markets are also pursuing policies to drive growth and/or anticipate geopolitical changes. In addition, we are beginning to see the impacts of artificial intelligence (AI) on the broader economy, creating investment opportunities that go beyond the Magnificent Seven.

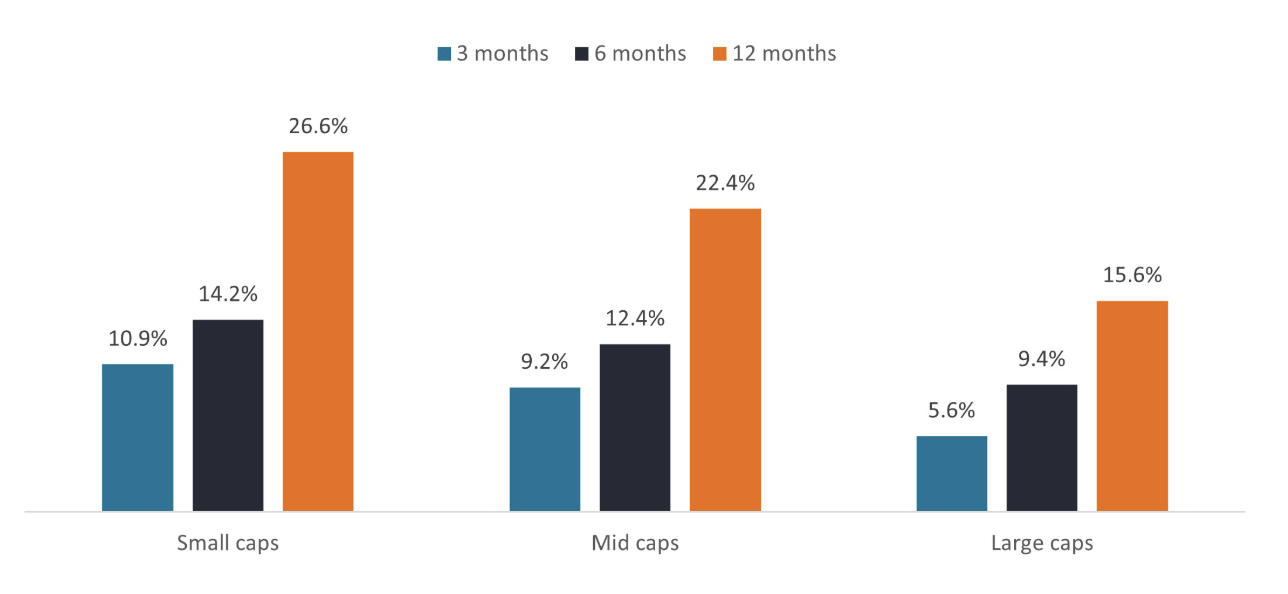

Rate cuts and the return of small caps

One area to look is small caps. Historically, small- and mid-size firms tend to outperform during periods of declining rates since these companies often have levered balance sheets and therefore benefit from lower interest expense, boosting earnings. Reduced borrowing costs can also spur mergers and acquisitions or help minimise concerns about company liquidity.

Average returns three, six, and 12 months after the first Fed rate cut

Source: Federal Reserve Board, Haver Analytics, Center for Research in Security Prices, University of Chicago Booth School of Business, Jefferies, Janus Henderson Investors. Data based on the federal funds rate from 1954 to 1963, the Fed discount rate from 1963 to 1994, then the fed funds rate from 1994 onward. Past performance does not predict future returns.

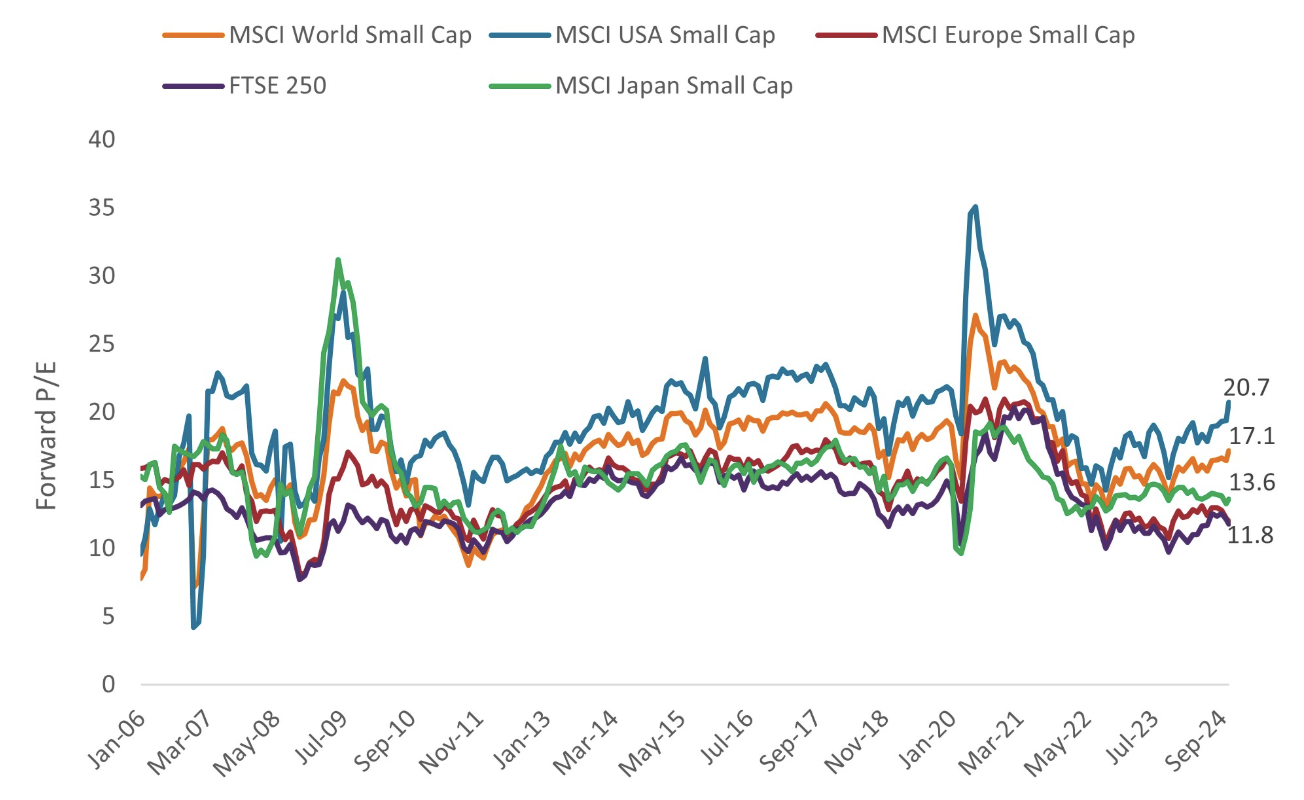

The relative outperformance of large caps could also be getting long in the tooth. Historically, cycles of large- and small-cap outperformance typically alternate every six to 14 years. The current run of large-cap dominance is butting up against the far end of that range. Small caps also have large weightings in industrials and materials and could benefit from the on-shoring of supply chains. And globally, small caps now trade at relatively attractive valuations.

Source: Datastream, MSCI regional small-cap indices, Janus Henderson Investors. Data from 30 January 2006 to 14 November 2024. Forward price-to-earnings (P/E) ratios based on estimated 12-month forward earnings. There is no guarantee that past trends will continue, or forecasts will be realized.

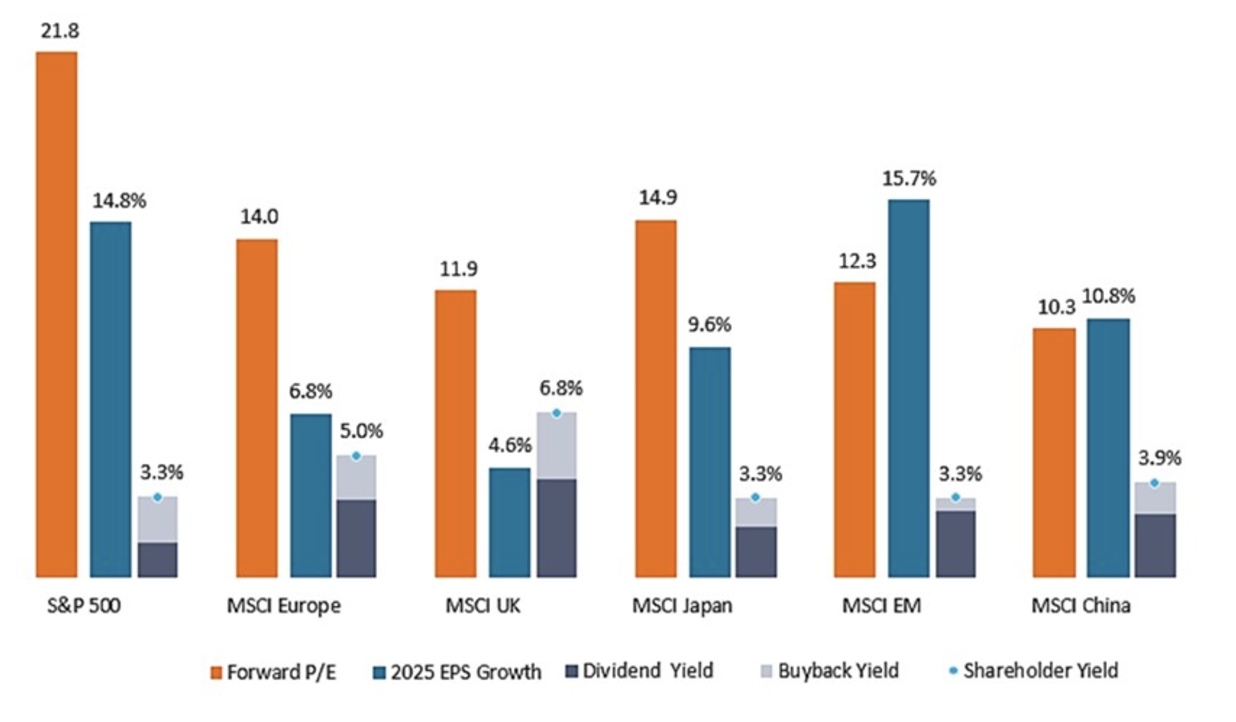

Low valuations could be an advantage for non-U.S. stocks generally in 2025. Many ex-U.S. markets are deeply discounted relative to the U.S. Slower growth in some regions could justify that spread.

Earnings should be another guidepost for investors. Globally, profits look set to rise in 2025 amid a generally positive economic backdrop. But we think productivity gains driven by new AI applications, as well as innovation, could be key to determining which companies meet or exceed these expectations – and which don’t.

Estimated earnings growth and shareholder yield in 2025

Source: Bloomberg, FactSet, LSEG Datastream. Yield data as of 30 September 2024. EPS figures are as of 28 October 2024. Forward price-to-earnings (P/E) ratios are based on 12-month estimated earnings. Earnings per share (EPS) growth for 2025 are projected.

In the U.S., labour productivity has expanded an average of 2.5% year over year for the past five quarters, well above the 1.6% 10-year average. At the same time, S&P 500 revenue per employee has steadily increased since 2021 after flatlining during the 15 years prior. Companies that capitalise on these trends could continue to realise efficiencies and pull ahead.

Meanwhile, innovation is also opening up new end markets, including in non-tech sectors such as healthcare. There, dramatic improvements in scientific understanding and research tools are leading to the launch of ground-breaking products, such as GLP-1s for obesity.

Already, these drugs – which are yielding weight loss levels in patients once achievable only through surgery – are annualising more than $50 billion in sales and growing by 50% annually.

Stargazing for fixed income opportunities

Our own star – the sun – provides us with warmth and energy. We are not about to advocate worshiping bonds as the ancients did the sun, but bonds have advantages – namely reliable income and diversification. Yields are at attractive levels relative to history, and government bonds could offer a potentially useful counterweight against equity market volatility.

- Central bank easing will provide an important support for bonds, but our view is that rates will remain higher than they have been. We believe investors should be overweight interest rate duration.

- We also believe investors should diversify their fixed income holdings, taking advantage of appealing yields. The role of bonds as a portfolio diversifier should reassert itself and provide ballast to portfolios in this new environment. In our view, it is important to think broadly in terms of asset allocation.

- We expect corporate default rates to stay relatively low in 2025. Nearly every part of the story is supportive of credit: Fundamentals are strong, private credit is providing an additional source of financing, and central banks are cutting policy rates.

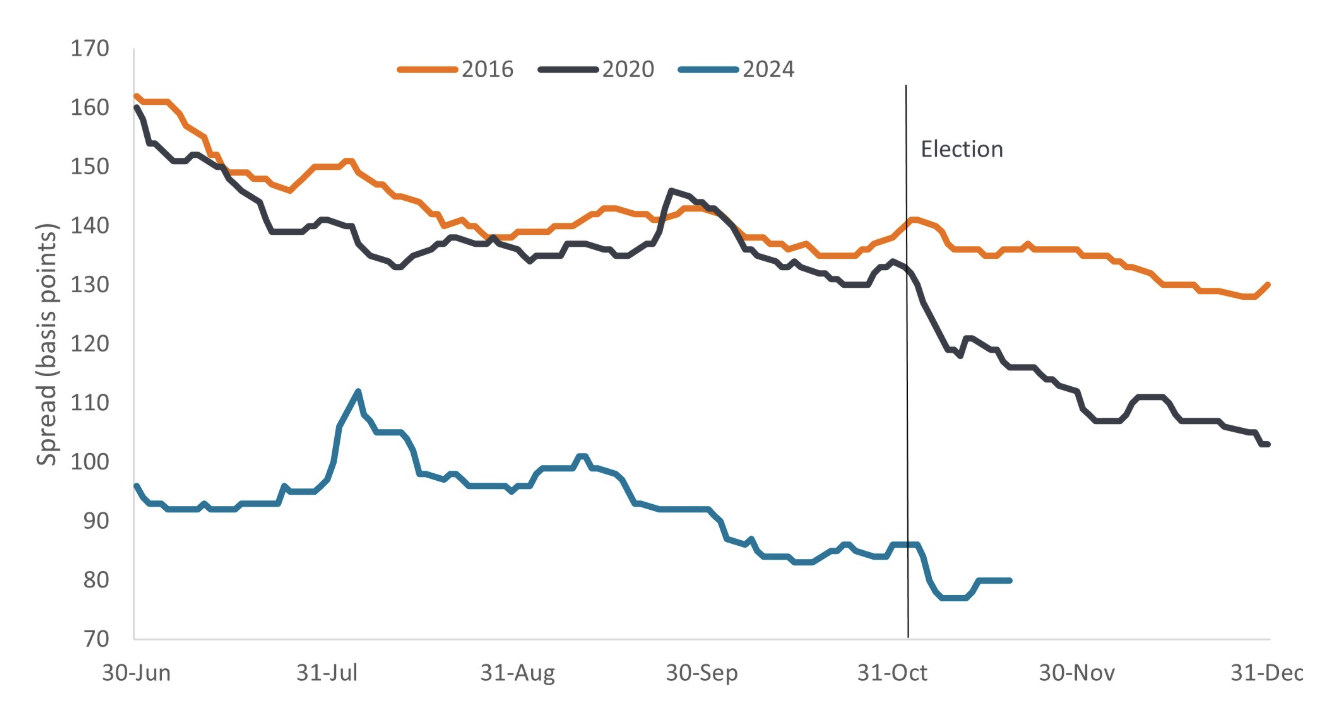

Investment grade spread tightening post U.S. elections

Source: Bloomberg, ICE BofA US Corporate Index (C0A0), Govt option-adjusted spread (Govt OAS), final six months of election years. 2024 is to 19 November 2024. Basis point (bp) equals 1/100 of a percentage point, 1bp = 0.01%. Past performance is not a guide to future performance.

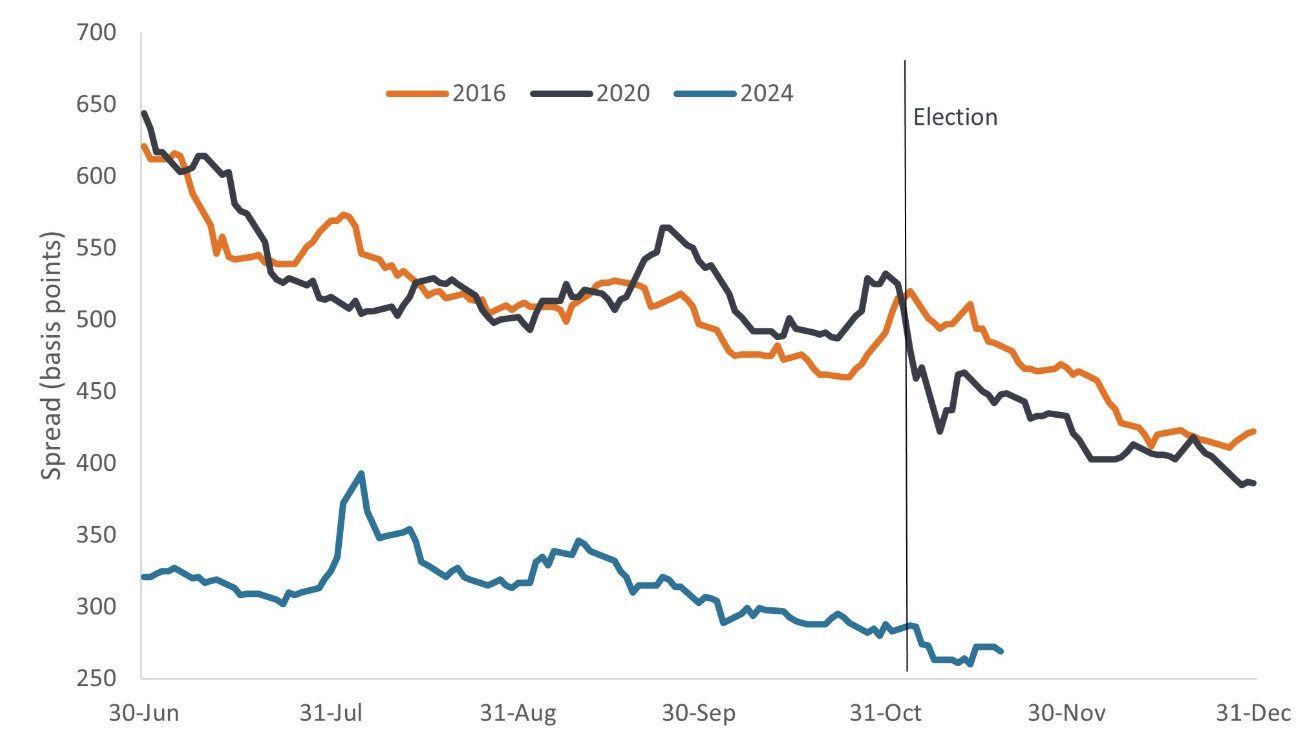

Should the full weight of tariffs unfold, Europe, China and Mexico are most at risk. Deregulation will be good for profits but will also encourage more shareholder-friendly (and less bondholder-friendly) activity in the year ahead. An acceleration in merger and acquisition activity is highly likely.

Sadly, however, there is no free lunch. Credit spreads (the additional yield a corporate bond pays over a government bond of the same maturity) have moved to near cycle tights in U.S. corporate bonds, although less so among loans and mortgage-backed securities or in European corporate debt. There is therefore limited prospects for capital gains from spreads moving tighter, but also little danger of credit stress in the near term.

At this stage, history suggests the spoils will accrue more to equity holders than to creditors. We look for calm in early 2025, but the evolution of the credit cycle (as higher refinancing costs overwhelm some of the more indebted borrowers) will likely cause issues later in the year.

High yield spread tightening post U.S. elections

Source: Bloomberg, ICE BofA US High Yield Index (H0A0), Govt option-adjusted spread (Govt OAS), final six months of election years. 2024 is to 19 November 2024. Basis point (bp) equals 1/100 of a percentage point, 1bp = 0.01%. Past performance is not a guide to future performance.

Access our 2025 investment outlooks

Market GPS investment outlook 2025 provides expert views to help navigate the year ahead. Explore macro drivers, asset class opportunities, portfolio construction themes, and sector specific outlooks from our portfolio managers. Find out more here.