How we are thinking about the year ahead

At this time of year, it's only natural to spend some additional time reviewing broader market expectations for the year ahead and how that might impact current portfolio positioning or expected returns for Australian small and mid-cap investors going forward. We certainly enter the 2018 year at an interesting point in time. The global economic recovery continues to gain momentum, while global equity market returns in 2017 have proven to be both elevated and broad-based.

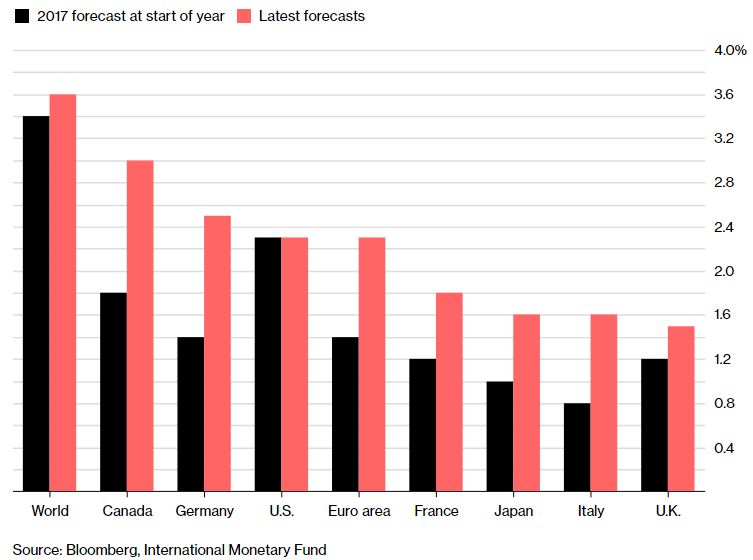

US equity markets, in particular, experienced an incredible expansion with the S&P 500 delivering +19.4% for the 2017 calendar year with only two of eleven industry sectors (energy and telco services) delivering negative absolute returns. Across the more concentrated Dow Jones Industrial Index, 13 of the 30 stocks in the index delivered returns in excess of +25%, a fairly incredible outcome in itself. For the first time in a long while, global growth forecasts have ended the calendar year at levels higher than where they first started, while both investor and business confidence levels continue to remain elevated.

Comparison of 2017 Consensus Global Growth Forecasts vs Actuals

Most significant this year has been the complete lack of volatility experienced across nearly all asset classes - the largest drawdown for the S&P 500 this year was just 3% (its smallest overall retracement in a calendar year since 1979). For US equity market investors and the vast bulk of global equity market participants, 2017 delivered a highly appetising combination of outsized and broad-based returns amidst an environment of excessively low price volatility.

While one would certainly be desirous of a repeat of these conditions into 2018, on the balance it would be hard to predict another year of such accommodative outcomes for global equities. While there are never any certainties in investing, there are a number of outcomes for 2018 that would appear far more likely than others. Global interest rates in aggregate, for one, will almost certainly rise this year and investors will face the reality that we are unlikely to see such accommodative and synchronised monetary policy settings again in this generation.

The US rates market will be most in focus in this regard as the Federal Reserve continues on its path of interest rate normalisation. If one is to take the Fed’s so-called “dot plot” (the interest rate projections for each of the 16 members of the rate-setting committee) as a guide, then a federal funds rate of 2.5-3.0% is expected by 2020, including a total of 1% in rate hikes by the end of 2018. While further tightening is broadly expected by the market consensus, the typical inter-market relationships that one would expect as a result of this haven’t quite yet played out, implying that not all markets are convinced.

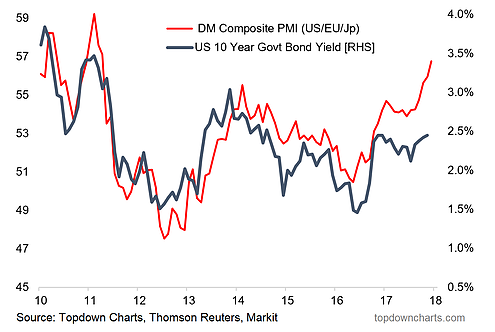

US 10-Year bond yields would be the most obvious example that, despite a fairly synchronised uplift in global growth rates, have continued to remain fairly flat. Longer term bond yields essentially reflect the markets expectation for longer term growth rates and the differential between improving growth indicators and a flat longer term bond yield is creating some investor uncertainties. What had been a fairly close relationship between global manufacturing PMI data (as a proxy for global growth) and 10-Year bond yields looks recently to have de-coupled somewhat. If one is believing that all long term inter-market relationships ultimately mean revert, then either global growth rates are set to slow or bond yields are set to rise. Our personal expectation is for the latter.

Developed Markets Composite PMI vs 10-Year U.S. Treasury Yield

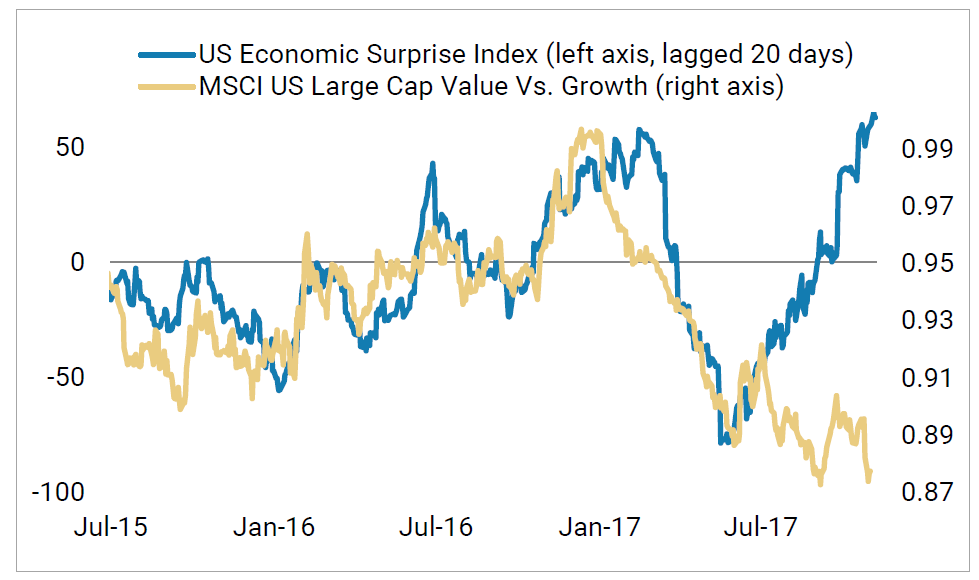

Of most importance to us will be to monitor how equity market leadership in the US adjusts in the face of a rising rates environment, in essence providing a preview for Australian investors as to how Australian equities will react when the RBA moves toward a tightening bias (admittedly still some time away). Historically, value as a strategy tends to perform best through periods of rising rates and we would not be surprised to begin to see some rotation toward more value/cyclical sectors in 2018 across the US and other developed markets where rates are on the move, particularly given the gross underperformance of value as a strategy. We don’t, however, expect to see a similar move in Australia just yet.

Source: Morgan Stanley Investment Research

At any rate, given the price signalling from bond and equity markets suggests some conflicting views on the outlook for growth from here, one would that expect the excessively calm waters experienced in 2017 will most likely begin to see some ripples through 2018.

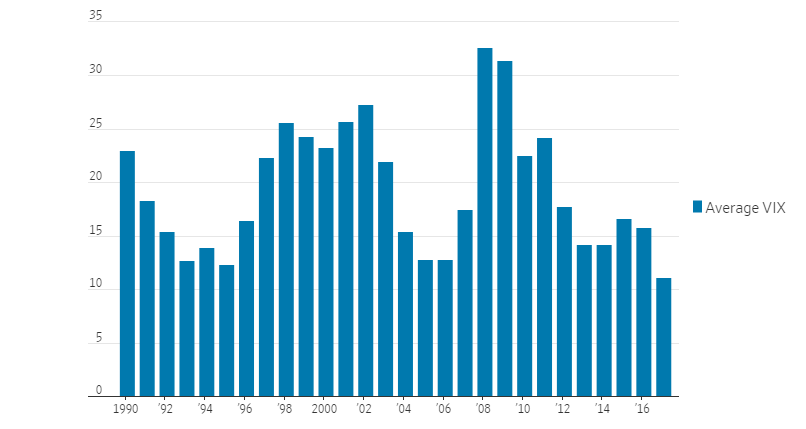

A combination of tightening financial conditions, higher equity market valuations and the return of inflation should combine to see an end to the recent period of ultra-low volatility experienced across most global equity markets this year. Given the CBOE Volatility Index, or VIX, recorded its lowest yearly average for realized volatility in history in 2017, it isn’t an overly brave call to suggest some reversion to the mean is likely.

History of CBOE Volatilty Index - Yearly Average

Source: Factset, Wall Street Journal

Source: Factset, Wall Street Journal

We should be quick to preface that increasing levels of volatility are not necessarily an outcome to be feared and, more often than not, it is through periods of heightened price volatility that active managers are able to capitalise on opportunities generated from short term price dislocations.

One might also argue that a period of such highly correlated, outsized and broad-based returns (at least across US and global equities) has certainly elevated the perceived value proposition for passively managed investment strategies and this perception may face its challenges in a period of higher volatility. In the US alone, ETF assets under management grew by US$874 billion this year, more than doubling the previous record of US$419bn achieved only the year previously. How a period of increased volatility will impact this investor cohort remains to be tested – however, with globally-listed ETF assets now sitting in the vicinity of US$5 trillion, even a small rotation away from these strategies has the potential to further add to volatility levels (and therein creating a virtuous cycle of further underperformance leading to further outflows leading to further volatility etc).

While the US and Eurozone equity markets continue to display the characteristics of being decidedly later-cycle in length, the Australian market has lagged both in performance and in its underlying economic recovery. While an +11.8% annualised total return for the ASX 200 is by no means unsatisfactory, the inability for larger Australian businesses at present to deliver meaningful growth has highlighted some structural issues facing larger-cap companies at present. One should also consider a larger degree of the ASX 200 performance has been generated out of the resources space, the majority of which was delivered in the final quarter of this year. Total earnings growth for the ASX 200 will likely wash up at around the ~17% mark for 2017 (using Citi Research numbers), however when excluding the resources space the figure falls to a fairly miserly ~4%.

That being said, the outlook for the Australian economy is broadly improving, though we estimate we are still some ~18 months behind the majority of developed markets in terms of economic and corporate recovery. While real GDP for the third quarter again underwhelmed expectations, the forward looking economic data has remained resilient. Australian composite PMI numbers rose from 54.3 in November to 55.5 in December (a five-month high), while employment numbers and business confidence readings continue to remain robust. We have yet, however, to see any meaningful signs of either inflation or wages growth and we are not expecting this year to see a scenario where the RBA moves to undertake an extended rate rise cycle.

Consequently, defensive growth businesses (i.e. those delivering earnings growth independent of the underlying economic cycle) in our view will continue to be well supported by the market, albeit some cyclical sectors are now beginning to see some sector tailwinds (with resources and mining services being the most obvious beneficiary this year). In our view, it is still too early to see a wholesale market rotation into broader cyclical and value-type businesses given the lack of underlying growth available, however we are expecting to see some selective rotation away from the ultra-high growth / ultra-high PE businesses that attracted significant share price momentum through 2017.

All things being equal, we continue to expect a broadly similar investment environment for Australian equities in 2018 as we have this year. We continue to feel that meaningful earnings growth remains difficult to find and those businesses that are demonstrating an ability to sustainably deliver ongoing growth will continue to attract a premium to market. The portfolios continue to maintain a fairly sizeable weighting towards businesses with more international growth options (given the favourable growth opportunities offshore), interspersed with a handful of high-quality, niche domestic-facing businesses that are demonstrating an ability to aggressively grow market share in their respective industries.

We are mindful of the fact that 2017 has seen further expansion in the earnings multiples for growth and smaller cap businesses and the successful execution of growth strategies is therefore paramount. With elevated multiples comes elevated earnings risks and we remain vigilant in ensuring a high degree of comfortability around our earnings forecasts for our current portfolio of companies heading into the February reporting season.

The above is an excerpt from the Ophir 'Letter to Investors' - December 2017

2 topics