How your top-tipped stocks are faring so far

Every year, we here at Livewire ask you, our dear readers, what stocks you are backing for the year ahead.

In previous years, these picks have gone full throttle, with your top ten stocks across small caps, large caps, and global stocks revving past the finish line to well and truly beat their benchmarks.

Three quarters down into 2021, and your picks seem to have, well, stalled.

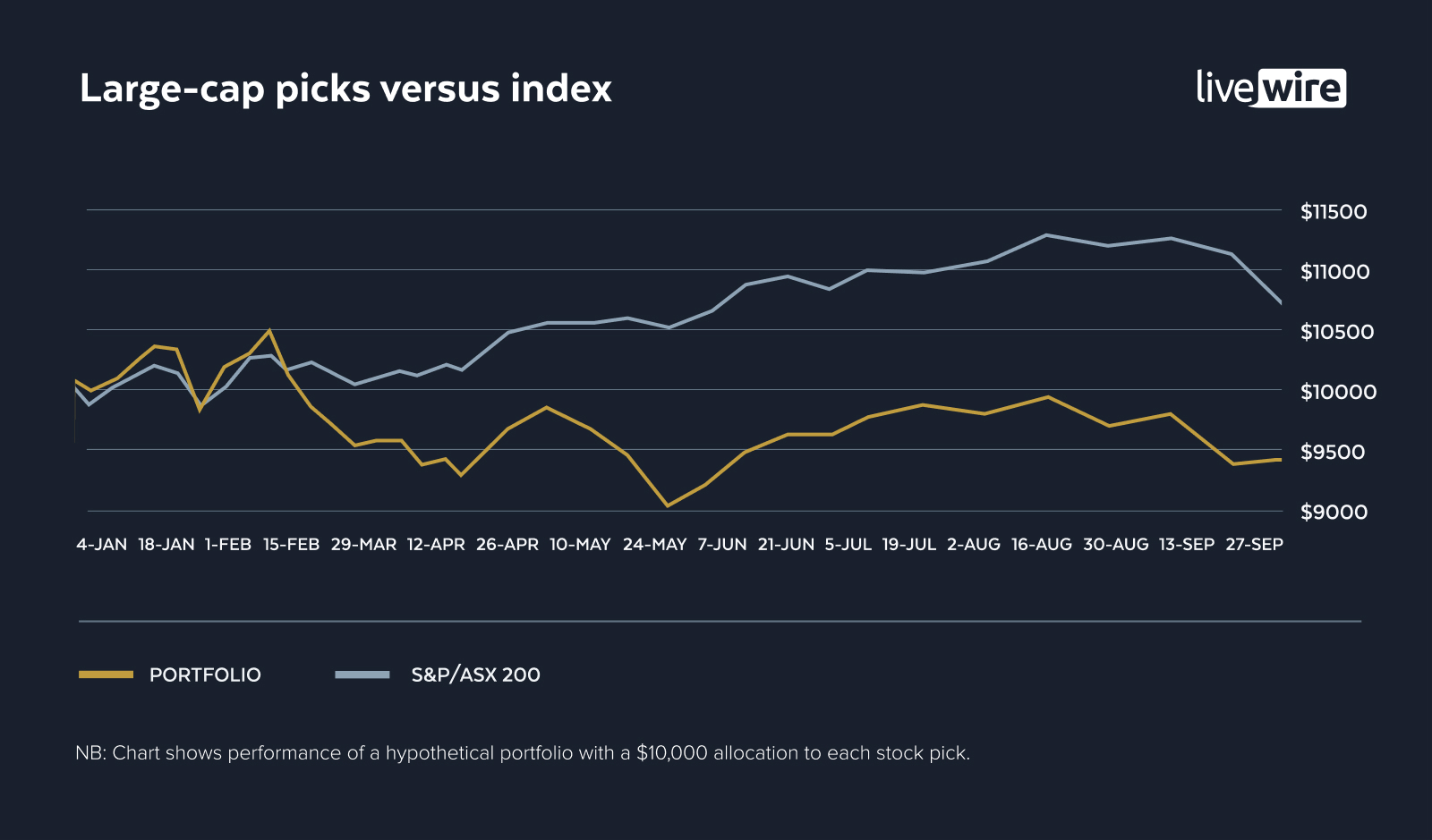

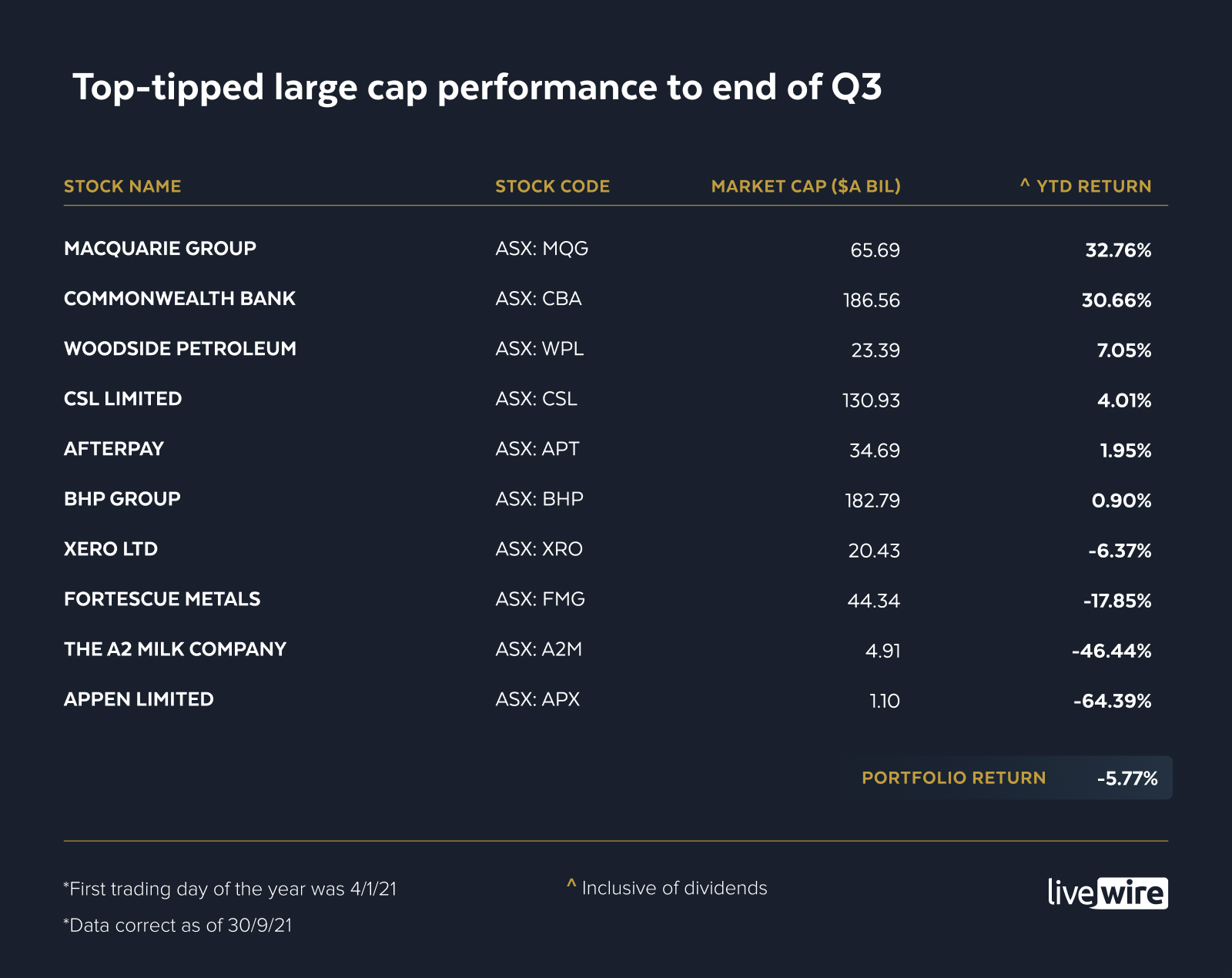

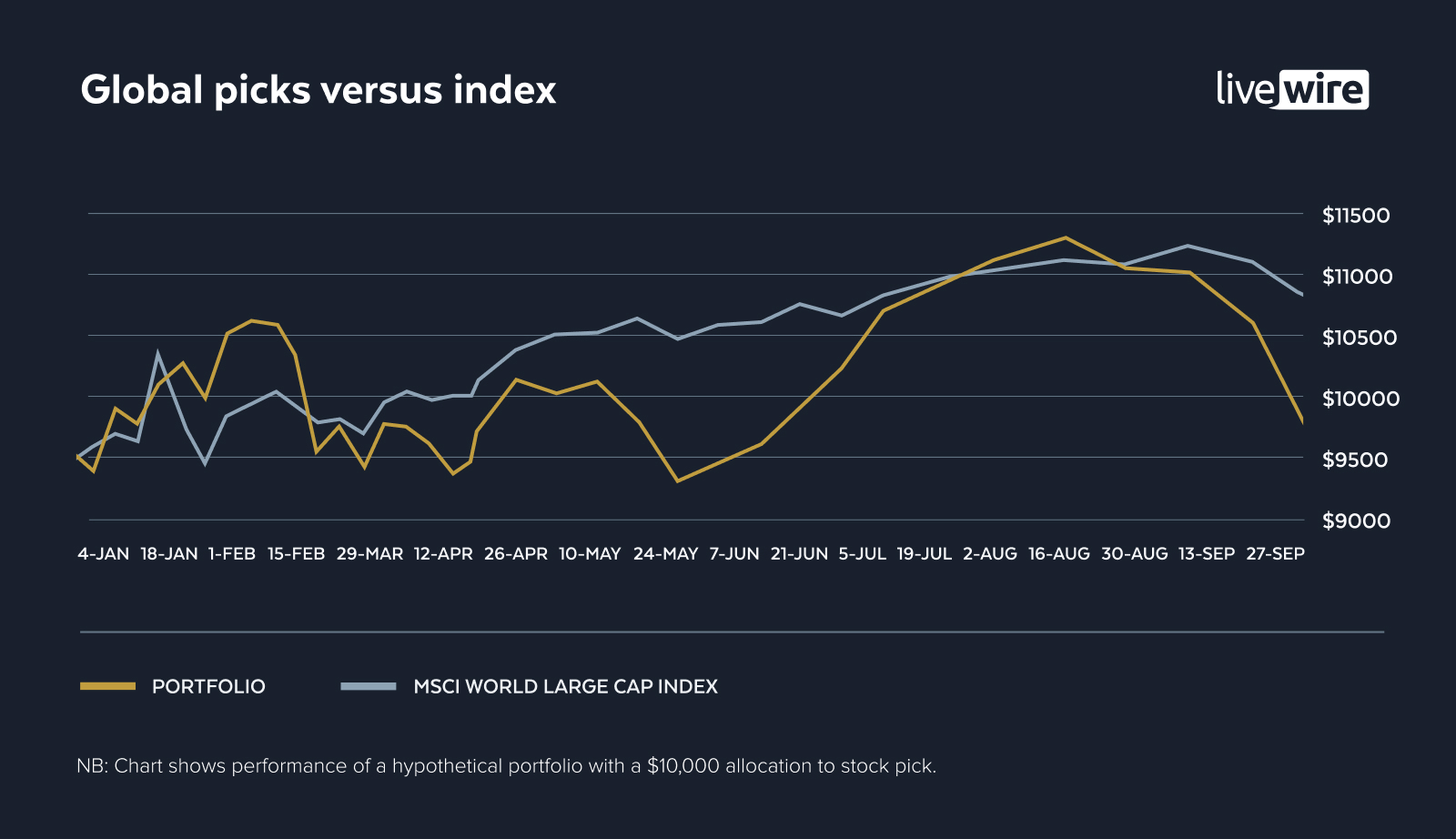

Your top-tipped small caps have returned -3.09% since the beginning of the year, while your favourite large caps have delivered a return of -5.77%. Meantime, your global stock picks for 2021 have performed slightly better, returning 3.82% by the end of the third quarter.

While the majority of these tipped lists have gotten off to a false start, it hasn't been all bad news for your favourite stocks. Lynas Rare Earths, for example, returned more than 60% in the first three quarters of the year, while Macquarie Group has delivered investors returns of nearly 33%. Alphabet (Google) has also shifted into overdrive, with its share price lifting nearly 55% in the same time period.

So in this wire, we'll take a look at the best and worst of the bunch.

If the Santa rally from previous years is anything to go by, I'm crossing my fingers that we will all be celebrating at the finish line. Whether our fortunes improve or not, I'll be popping a bottle to us all making it through the highs and lows of 2021 either way.

Note: All data is correct as of 30th September 2021.

Most-tipped small caps

Best performing small-cap: Lynas Rare Earths (ASX: LYC)

Market cap: $5.8 billion

YTD return to end of Q3: 60.53%

Battery material and rare earth miners have had a stunning 2021, and Lynas hasn't been exempt from the sector's success. Notable events from earlier this year include US President Joe Biden calling for US$174 billion to be spent on electric vehicles in March, and later (also in the US) a $1 trillion bipartisan infrastructure bill, which saw stocks in the sector storm higher.

Lynas recently reported that it had achieved a record annual net profit after tax of $157.1 million, while its revenue increased to $489 million during the financial year.

In its annual report, Lynas chair Kathleen Conlon said the company had benefited from the growing demand for its products.

"Globally, demand for electric vehicles and wind energy has accelerated and high growth in demand for NdFeB magnets contributed to growth in demand for Lynas’ NdPr product family and mixed Heavy Rare Earths," she said.

Fundies are feeling pretty bullish on the rare earths producer's trajectory too. In fact, following its result in August, Eiger Capital's Victor Gomes dubbed the miner the "most valuable strategic asset in Australia".

"It's such a unique asset. It's the only material producer of rare earths outside of China. It's at the bottom end of the cost curve globally," he said.

"It's the second biggest globally; there's only one Chinese producer that's bigger and they're a state-owned enterprise. It's got a very long life, low-cost mine in Mount Weld, and they haven't even really drilled that out significantly."

Similarly, Firetrail's Blake Henricks believes the rare earth miner will continue to be in hot demand.

"You think about electric vehicles (and) wind turbines - rare earths go into permanent magnets which are used in those applications," he said.

"In fact, we see the market growing three times by 2030."

However, given China has established itself as a leader in the EV supply chain market, WaveStone Capital's Catherine Allfrey believes that investors should exercise caution when investing in battery material producers like Lynas (as, if China were to dominate ownership, they could flood the market and control market prices for rare earths).

"In our view, Chinese involvement in the sector is driven by not only a wish to satisfy future demand, but also to avoid the industry concentration issues that have arisen in iron ore," she said.

"By encouraging the oversupply of upstream raw materials, Chinese downstream sectors can enjoy an economic advantage through cheap feed costs."

Worst performing small-cap: Polynovo (ASX: PNV)

Market cap: $1.2 billion

YTD return to end of Q3: -50.89%

Burns and trauma treatment provider, Polynovo, in comparison, has not had a great three quarters. Its share price cascaded in the first few days of the year after several directors sold down their holdings. Since then, despite entering new offshore markets and kicking off two trials, Polynovo has continued to be sold down by investors.

Also, not a great sign: There have been no articles penned by our fund manager contributors on Polynovo since the beginning of the year. The biotech only appears in Livewire's quarterly updates on your top-tipped lists.

However, that might be because its result in August missed broker expectations, with FY21 revenue lower than anticipated.

The firm's NovoSorb BTM product saw its sales lift 34% during the financial year, with stronger growth in the US and the "DACH" region (Germany, Austria, Switzerland) than in Australia.

"COVID-19 in FY21 had a significant impact on hospital trauma, burn and elective surgery activity," Polynovo chair David Williams said.

"Notwithstanding limited hospital access, lockdowns, and travel restrictions, we adapted our business and had continued material sales growth with global BTM sales up by 33.8% (AUD), US BTM sales up by 29.0% in local currency (USD) and the Group achieved a small underlying profit (excluding non-cash items) of $258,756."

Looking forward, the biotech said that FY22 had already begun with "positive sales momentum, continued sales force expansion," as well as the commencement of an animal trial for its hernia solution. From what I can see from its 84-page report, the firm did not provide an outlook statement for FY22.

Most-tipped large caps

Best performing large-cap: Macquarie Group (ASX: MQG)

Market cap: $65.7 billion

YTD return to end of Q3: 32.76%

Investment banking powerhouse Macquarie has had a steady ride in 2021, with its share price rising 32.76% in the first three quarters of the year (and without very much volatility too). It's now trading at an all-time high of circa $193 a share.

Last month, Macquarie provided forward guidance for the first half of 2022, which was above broker consensus (and the stock therefore rallied) despite predicting weaker times ahead.

Market Matter's James Gerrish put the news simply:

"To put that in context, Macquarie reported net income of $2.03b in 2H21 (up from $985 million in 1H21) and current expectations were a number down around $400 million half-on-half, which given the rhetoric today is too conservative, particularly given they usually under-promise and over-deliver," he said.

"Strength in commodities and global markets division, plus the sale of the UK commercial and industrial smart meter portfolio, (have also contributed)."

That said, Gerrish believes that Macquarie is expensive, particularly when compared to its global peers. It's currently trading on 20 times FY22 earnings, while JP Morgan is trading on 12 times, Bank of America on 13 times, Goldman Sachs on 8 times and Morgan Stanley on 14 times.

Plato's Dr Don Hamson agreed in a recent episode of Buy Hold Sell, arguing that while the firm has been a long-term holder of the investment banker, it's far too expensive at the moment.

"We wouldn't be buying it at these levels, but we do think it's a great company," he said.

Also appearing on Buy Hold Sell, Merlon Capital's Neil Margolis said the stock was a sell.

"Over the last two years, they've raised $2 billion each year, and they've paid out about $2 billion in dividends, so net/net there's no underlying dividend," he said

"Obviously, it's a fantastic company, (with) lots of smart people and a great growing funds management business. So you could get good capital growth, but they need to raise capital to keep paying dividends."

Worst performing large-cap: Appen (ASX: APX)

Market cap: $1.1 billion

YTD return to end of Q3: -64.39%

Things haven't been great for the once-darling of the ASX, Appen, since its share price peaked back in August 2020. Since then, it has cascaded around 77%, wiping off more than two years worth of share price gains in the process. In the first three quarters of the year alone, its share price has fallen more than 64%.

Recently appearing on the Rules of Investing podcast, Yarra Capital Management's Katie Hudson described Appen as an example of a company with an interesting product but relatively short duration revenue.

"That's like paying forward 10 years of sales for a company that doesn't have a lot of visibility out beyond 12 - 18 months for its revenue. That relationship just didn't make sense to us. For that reason, we didn't own that company," she said.

Recent Buy Hold Sell guests, Chris Stott of 1851 Capital and James Gerrish from Market Matters, also dubbed the stock a sell.

"Its earnings were disappointing in the recent release. We think the guidance they provided for the full year is a bit of a stretch. It needs a huge second half to get there. The last few earnings results have been disappointing from this company, so we'll sit on the sidelines and sell," Stott said.

"What the last 12-18 months have shown is the lack of visibility in earnings for this sort of business," Gerrish added.

"Some technology businesses have really strong abilities to forecast. These guys don't, and that's come home to roost. So for me, Appen's a sell. Even though it's around the $10 dollar level. It's been whacked, but it's a sell."

Most-tipped global stocks

Best-performing global pick: Alphabet (NASDAQ: GOOGL)

Market cap: $1.8 trillion

YTD return to end of Q3: 54.89%

Google parent company Alphabet has had a surprisingly great nine months considering the performance of the FAANGs in 2020 and the newly inflationary environment, with its share price rising a further 55% in 2021. According to Statista, Alphabet is now the fifth-largest company in the world by market capitalisation.

In August, Claremont Global's Bob Desmond penned that high-margin, asset-light businesses like Alphabet are the best defence against inflation, particularly given the revenue growth generated by the company over the past two years.

"It just makes no business sense for us to sell some of the world’s most competitively advantaged businesses, pay capital gains tax and then reinvest in slower-growing, more cyclical businesses based on a macro prediction ― which may or may not be correct," he said.

Inflation or not, Magellan's Hamish Douglass believes that the company "doesn’t need much to go right for it to deliver bumper returns for its investors for many years".

"Every company has challenges and many of Alphabet’s risks stem from its success," he said.

"Regulators are questioning whether Google’s dominance in search, digital advertising technology, and Android give the company too much market power. Google has been fined for anti-competitive behaviour in Europe. Media reports say the US Justice Department plans to file anti-competitive charges against Google soon. Australia’s government plans to introduce a mandatory code of conduct aimed at improving the bargaining power of traditional media against Google (and Facebook) for displaying their news reports, something other governments could copy."

That said, Alphabet is also investing in exciting new areas, such as artificial intelligence (DeepMind), drone delivery (Wing), internet access via high-altitude balloons (Loon), self-driving cars (Waymo), quantum computing, urban innovation (Sidewalk Labs), and ‘moonshot’ programs (Google X), he said.

"Alphabet owns some of the world’s best businesses and it could one day own other businesses that are as dominant within their spheres. Alphabet is well placed to provide investors with compounded returns for years to come," Douglass said.

Alphinity Investment Management's Trent Masters agrees, noting that the power of the firm's core Google business could see it expand into "tangential markets" over the years ahead.

"Alphabet is positioned to develop key businesses exposed to some of the most fundamental global disruptions, with transport and health key among them," he said.

"Alphabet generates more than 25% operating margins, more than 20% ROE and ROIC, has more than $100bn of cash on the balance sheet and trades on 28x PE."

This enviable combination of "momentum, positioning, return outlook, positive earnings momentum and valuation makes Alphabet a compelling high conviction long term structural growth investment," Masters added.

Worst-performing global pick: Alibaba (NYSE: BABA)

Market cap: $390 billion

YTD return to end of Q3: -35.02%

Alibaba's share price has fallen 35% in the first three quarters of the year, making it the worst-performing global stock in your top-tipped list.

This Chinese technology giant has seen its share price slide since October last year after founder Jack Ma criticised China's financial regulators and subsequently disappeared. Since then, Ant Group's highly-anticipated IPO was postponed and we have seen a major crackdown on the country's tech giants (and other major businesses).

And in case you were wondering, Reuters recently reported that Ma has reappeared in Hong Kong (literally last week), after only making a few public appearances on the Mainland since October.

But back to the recent regulatory reset in China, which has also seen Alibaba's share price suffer. It's for this reason that Alphinity's Mary Manning believes investors should avoid the region.

"When people are looking at this regulatory reset in China, it's hard to tell whether we're 10 months in and this is only going to last for 12 months, or whether this is going to last for many years," she said.

"The combination of those two things; the ubiquitous nature across all sectors, and the fact that the timing could be quite prolonged, makes it quite difficult to invest in China right now."

That said, global growth investor, Heath Behncke from Holon, has been adding to his positions in the region off the back of recent weakness.

"We've got a strong view that China is leading the game when it comes to technology and innovation. Nearly a third of our portfolio is there now. We've added to that, taking advantage of the weakness," Behncke said.

Similarly, Frazis Capital's Michael Frazis believes that now valuations have come off, the future returns of these stocks are likely to be much higher. However, he recommends investors take a three to five-year view when investing in Chinese companies.

"If anything, it's increasingly clear with each regulation that comes out, what the final landscape is going to look like. In many ways, you've got clearer risks, but much higher returns going forward," he said.

Want more content like this?

Follow my colleague Mia Kwok to see how the fundies picks for 2021 have performed so far (spoiler alert, the overall performance of their picks outperformed your own). Stay tuned for our coverage at the end of the year to see how your picks fared.

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

20 stocks mentioned

12 contributors mentioned