Howard Marks: A time for caution

Mason Stevens

Howard Marks of Oaktree Capital has recently released his updated view on the current market environment. The view of Oaktree is interesting, as they invest across most asset classes and in every part of the capital structure.

That investment flexibility gives them front row seat to see how demand and supply dynamics are affecting various parts of the market. At the moment their overriding theme in their view is “too much money chasing too few deals”.

Their view (and mine) is that the extremely accommodative monetary policy settings around the world have flooded the markets with cash. That policy has caused investors to move into riskier investments to generate acceptable returns. As Marks puts it:

- "Investors may not feel optimistic, but because the returns available on low-risk investments are so low, they’ve been forced to undertake optimistic-type actions".

- "Likewise, in order to achieve acceptable results in the low-return world described above, many investors have had to abandon their usual risk aversion and move out the risk curve".

- "The combination of the need for return and the willingness to bear risk caused large amounts of capital to flow to the smaller niche markets for risk assets offering the possibility of high returns in a low-return world".

The increased willingness of investors to take risk (in order to get a higher return) has resulted in more money going to less traditional asset classes. As the Wall Street Journal (WSJ) highlights on the growth of private equity investments in private lending, “The influx of money has led to intense competition for borrowers. On bigger loans, that has driven [lending] rates closer to banks’ and led to a loosening of credit terms. For smaller loans, “I don’t think it could become any more borrower friendly than it is today,” said Kent Brown, who advises mid-sized companies on debt at investment bank Capstone Headwaters.”

The WSJ goes on to say “The market is poised to grow as behemoths and smaller outfits angle for more action… Overall, firms completed fundraising on 322 funds dedicated to this type of lending between 2013 and 2017, with 71 from firms that had never raised one before, according to data-provider Preqin. That compares with 85 funds, including 19 first-timers, in the previous five years.”

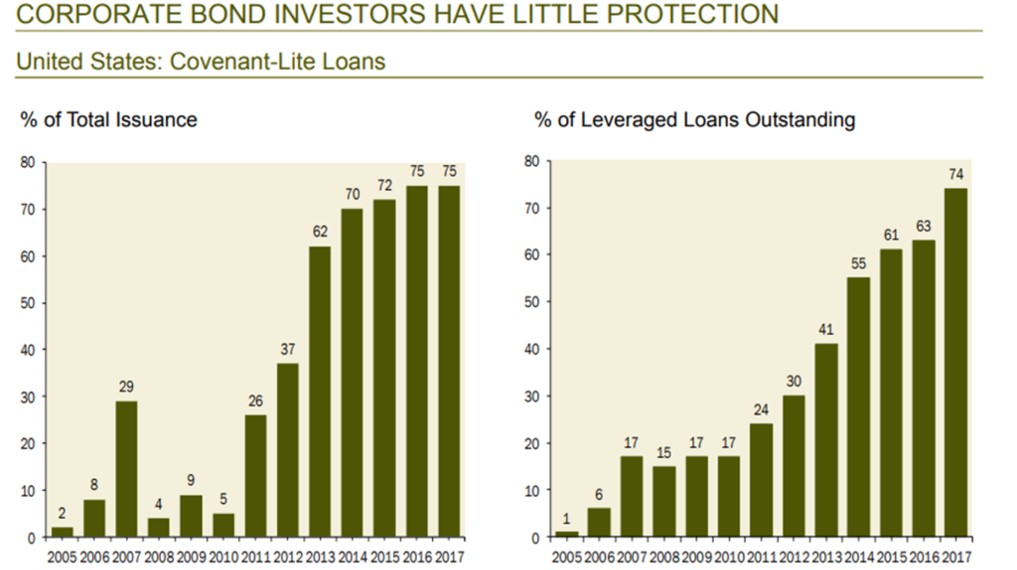

The effects of more money chasing the same deals are higher prices, lower prospective returns, weaker security structures and increased risk. Loan terms that have never been more accommodative in history. Not even in 2007 were there as high a percentage of “covenant-lite” loans written as there are today (see below).

Given that, Howard Marks rightly warns, “Lending standards and credit skills are seldom tested in positive times like we’ve been enjoying. That’s what Warren Buffett had in mind when he said, 'It’s only when the tide goes out that you learn who has been swimming naked'. Skillful, disciplined, careful lenders are likely to get through the next recession and credit crunch. Less-skilled managers may not."

Howard Marks also asked the wider Oaktree team for their observations on the market. The view across the team (globally) is consistent with the above (too much money chasing too few deals). Some specific examples showing that are:

- Capital equipment company A issued debt to finance its acquisition by a private equity fund. “While we thought the initial price talk was far too tight, the deal was oversubscribed and upsized, and the pricing was tightened by 25 bps. Final terms were highly aggressive with covenant-lite structure, uncapped adjustments to EBITDA, and a large debt incurrence capacity.” The company missed expectations in the first two quarters after issuance, in reaction to which the first lien loan traded down by as much as five points and the high yield bonds traded down by as much as 15.

- Company F earns substantial EBITDA, but 60% comes from a single unreliable customer, and its growth is constrained by geography. We arrived at a price where we thought it would constitute a good investment for us. But the owners wanted twice as much . . . and they got it from a buyout fund. “We are generally seeing financial sponsors being very aggressive, pricing to perfection with very little room for error, on the back of very liberal lending practices by banks and non-traditional lenders. We all know how this will end.”

- A year ago, a buyout fund financed the acquisition of company G by one of its portfolio companies with 100% debt and took out a dividend for itself. The deal was marketed with an adjusted EBITDA figure that was 190% of the company’s reported EBITDA. Based on the adjusted figure, total leverage was more than 7x, and based on the reported figure it was 13.5x. The bonds are now trading above par, and the yield spread to worst on the first lien notes is below 250 bps.

- Company H is a good, growing company that we were ready to exit, and our bankers sent out 100 “teasers.” We received 35 indications of interest: three from strategic buyers and 32 from financial sponsors. “The strategic buyers offered the lowest valuations; it’s always a big warning sign when financial sponsors with no hope of synergies are offering prices much higher than strategics.” We received four purchase offers from buyout funds, one with the price left blank. We ended up selling at 14x EBITDA, with total leverage of more than 7x.

- In 2017, investors bought over $10 billion of debt from Argentine and Turkish local-currency-earning corporates that now trades, on average, 500 bps wider than at issuance (e.g., at an 11% yield today versus 6% at issue).

- The high point in emerging market debt (or was it the low point?) was Argentina’s ability in June 2017 to issue $2.75 billion of oversubscribed 100-year bonds despite a financial history marked by crises in 1980, 1982, 1984, 1987, 1989 and 2001. The bond was priced at 90 for a yield of 7.92%. Now it’s trading at 75, implying a mark-down of 17% in 16 months.

The US economic expansion is now the 2nd longest in history. With the markets chasing returns, it may be time to review your downside risk. As Howard Marks finishes:

“Oaktree’s mantra recently has been, and continues to be, “move forward, but with caution.” The outlook is not so bad, and asset prices are not so high, that one should be in cash or near-cash. The penalty in terms of likely opportunity cost is just too great to justify being out of the markets… investors should favour strategies, managers and approaches that emphasize limiting losses in declines above ensuring full participation in gains. Just about everything in the investment world can be done either aggressively or defensively. In my view, market conditions make this a time for caution.”

3 topics

Paul is an experienced global credit portfolio manager, having recently held the positions of Global Head of Credit Solutions and Strategic Trading for Lloyds Banking Group.

Paul is an experienced global credit portfolio manager, having recently held the positions of Global Head of Credit Solutions and Strategic Trading for Lloyds Banking Group.