Hunting for global small caps in a mispriced world

Equity markets over the past year have been driven by exchange-traded fund inflows and factor investing leading to increasing valuations for the largest companies in the world, such as the Magnificent Seven in the United States and Commonwealth Bank in Australia (ASX: CBA).

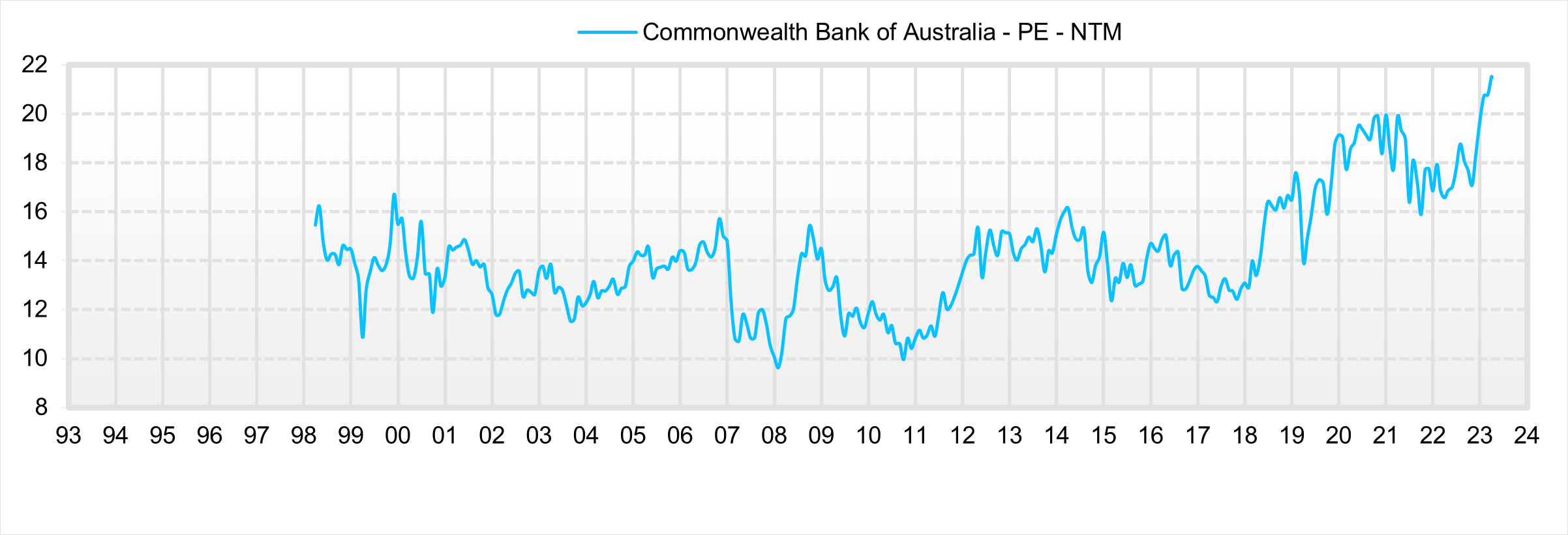

Benchmark-orientated funds also find themselves forced to own these companies despite seeing the fundamental reasons why they are overvalued. Just as a local example, the Commonwealth Bank of Australia is seeing its earnings decline this year and has not grown its earnings per share since 2017, yet its valuation has increased from a P/E ratio of 14x in 2017 to 21x, making it one of the most expensive banks in the world, even though it doesn’t have a growth profile.

This fascination with index and ETF investing does have its benefit to getting portfolio exposure, however, I think its benefits are now being offset by the fact that these investors are getting an over-exposure to overvalued large capitalisation stocks.

I would go as far as to say this is

becoming an index-hugging bubble. You can see CBA’s forward PE in the chart

below.

To use the US’s S&P 500 as an example, the magnificent seven (Microsoft (NASDAQ: MSFT), Nvidia (NASDAQ: NVDA), Apple (NASDAQ: AAPL), Alphabet (NASDAQ: GOOGL), Meta (NASDAQ: META), Amazon (NASDAQ: AMZN), Tesla (NASDAQ: TSLA)) make up close to 30% of the index. They also represent a big portion of technology ETFs and Nasdaq ETFs, so money flowing into these index ETFs continues to push these stocks up, irrespective of whether the valuations make sense or not.

This explains why the valuation of the S&P 500 is getting close to all-time highs, at 21x forward earnings. We tend to shy away from chasing momentum and intend to try to find high-quality growing companies that are mispriced by equity markets. At the moment this tends to be in smaller capitalisation companies around the world.

Worldline (EPA: WLN)

Worldline is an example of one of the many small-cap holdings we have been accumulating in Europe. Worldline is a fintech based in France with a market capitalisation of €3 billion. This is well below the €20 billion it was trading at just a few years ago.

We have watched the company for the past decade and always felt that Worldline is a high-quality company but the valuation was never attractive enough for us. Now it is!

Worldline is a leading merchant acquirer and one of the main online payment services providers in Europe. It was founded in 1990 and through a combination of organic growth and acquisitions it holds leading market positions in Switzerland, Austria, Luxembourg, Belgium, the Netherlands, Germany, Latvia and Lithuania and is present in over 40 countries. It is also a major merchant acquirer in Australia following its joint venture with ANZ (ASX: ANZ) in 2022. The joint venture has a 20% share of transaction volumes processed in Australia.

It provides payment devices and software covering the full retail value chain whether it be online or in-store. The company also provides payment solutions and processing for financial institutions for payment and card-related transactions.

Their market share in merchant acquiring in Europe is about 15%, with leading market positions in Germany, Belgium and Switzerland of about 45%. Their growth in merchant services is driven by winning market share off the major banks, which still have more than 50% share. Organic growth is also driven by retail sales growth and a continued shift from cash to card, where countries like Greece and Italy are still well behind developed markets in this shift. Wordline recently announced a joint venture with Credit Agricole to grow their share in France, which should deliver good growth in their home market.

Worldline is led by Gilles Grapinet, who has been its Chief Executive Officer since July 2013. Over this time he has quadrupled the company’s revenues through organic growth as well as acquisitions.

We don’t expect the company to return to the peak multiple of 40x earnings reached in 2020 but even a market multiple of 15x would see the stock triple from current levels.

1 topic

9 stocks mentioned