If 24 LICs ran the Melbourne Cup, which would be our favourites

Here we go again, the eighth running of the Affluence LIC Melbourne Cup! As always, we’ve forensically analysed the entire Listed Investment Company market and the results are below.

To win the real Melbourne Cup requires a horse that is well trained, has a great jockey, and hasn’t been hit too hard with a weight handicap from the stewards. To win the Affluence LIC Cup, an LIC requires many of the same attributes. They require a great trainer (the investment manager), an opportunistic jockey (the individual portfolio manager responsible for investment decisions), and a favourable handicap (starting discount or premium to NTA). Get all that right, and a good result for the owners (shareholders) will surely not be too far away.

There is over $50 billion of gamblers (investors) money at stake in the Listed Investment Company sector, which makes it significantly bigger than the Melbourne Cup.

We mentioned in last years edition how the field had been shrinking as windups, mergers and conversions to exchanged traded managed funds had thinned the field. This trend has continued in 2024, with Partners Group Global Income (PGG), NB Global Corporate Income (NBI), Magellan Global Fund (MGF), Forager Australian Shares (FOR), and QV Equities (QVE) no longer in the race. In addition, this year will be the last running for Platinum Capital (ASX: PMC) and Platinum Asia ( ASX: PAI) which will head out to pasture with their existing exchange traded managed fund stablemates.

These race exits have delivered additional returns to punters who backed these LICs before the conversions occurred. We don’t believe that these will be the last to leave the race, as the stewards harsh handicaps have disillusioned some punters. The value on offer during this period is exceptional if investors can capture the discounts on offer.

There has only been one new entry into the field this year, Pengana’s Global Private Credit Trust (ASX: PCX). Another LIC from Whitefield is mooted to be joining the field soon, and we may see others in the next 12 months if punter confidence improves further.

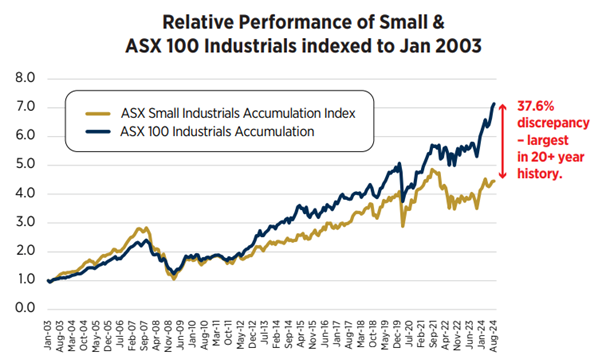

Another continuing trend from last year is the contrast in performance coming into the race between the bigger thoroughbreds and the smaller horses.

Large caps have continued to significantly outperform small caps, and we believe that this head start in terms of a better starting valuation for the small caps will give them a distinct advantage over such a long race.

Source: Salter Brothers

Who would make the cut?

We have analysed the field of over 100 LICs, and here, in no particular order, are our 24 starters for the “Race that Stops the Investing Nation”.

Pengana Private Equity (ASX: PE1)

- Starting handicap: 20% discount

- Form guide: This horse has US based private trainers and was heavily backed by racegoers early in its career in 2019. However after a period of softer runs and some turnover in the ownership structure, the discount has blown out to 20%. We are not sure if this horse has the outright speed to win, but at this sort of handicap we do believe its worth a punt.

Lion Selection Group (ASX: LSX)

- Starting handicap: 20% discount

- Form guide: A smaller horse that has been around for a long time. Very specialised training regime that has generally worked. This horse has recently seen the discount tighten on the back of increased punter interest, but we still think it looks very promising from this starting point.

WAM Strategic (ASX: WAR)

- Starting handicap: 7% discount

- Form guide: The training regime for this runner consists of buying up ownership stakes in last years laggards and trying to get them back into race shape. Performance over the past year has improved, and this has seen a small decrease in the discount. But it’s still a reasonable starting handicap, and if conditions go their way, then a superior performance is within reach.

NGE Capital (ASX: NGE)

- Starting handicap: 15% discount

- Form guide: Continues to outperform the vast majority of runners, however remains under most punters radar. NGE has a real advantage due to its small size and unconventional training strategy. Likes to take chances and could be a real challenger. Distantly related to the bigger and well backed LSF.

WAM Alternatives (ASX: WMA)

- Starting handicap: 15% discount

- Form guide: This horse is proving to be a little problematic for this blue blood stable. The trainers have tried hard to get the punters behind it, but the discount refuses to go away. Recent races have been solid but not spectacular. It is likely the trainer will give the owners the option of selling the horse and returning the proceeds in the next year. Its unclear which way the owners will decide.

Salter Brothers Emerging Companies (ASX: SB2)

- Starting handicap: 30% discount

- Form guide: Improved performance coming into this years race. Its ownership list may be holding it back in the short term, but does provide patient punters the chance of a cheap entry price. The trainer focuses their efforts towards the smaller end of the market which has been a treacherous space recently. However, the value on offer plus the very generous handicap means this is definitely one to watch.

Acorn Capital (ASX: ACQ)

- Starting handicap: 20% discount

- Form guide: Its been a tough couple of years for this runner as the trainers focus on small caps has been like running uphill. There has been some green shoots that things may be turning around, and the combination of a healthy starting discount and undervalued sector provide potential for a fast run.

CD Private Equity Series (CD1, CD2, CD3)

- Starting handicap: 30-35% discount

- Form guide: These three stable mates have been through a period of softer performance over the past couple of years. They have not been popular with the punters for quite a while, and the discounts have remained relatively steady. We have done very well backing them over the years, and we continue to believe between the handicap and US trainer they are worth a bob each way.

WAM Leaders (ASX: WLE)

- Starting handicap: Par

- Form guide: A rare rough year for this large thoroughbred, with the jockeys admitting they misread the track conditions. However a couple of slow races doesn’t mean this horse has lost its speed. We expect the previous speed and staying power to return from this quality runner.

MFF Capital Investments (ASX: MFF)

- Starting handicap: 15% discount

- Form guide: This big mare has been on a hot streak. Despite the race winning performances the discount never seems to tighten. The jockey provides the owners with an intricate assessment of performance each month, which can be difficult for the average punter to interpret. Will likely be there at the finish.

Australian Foundation Investment Co (ASX: AFI)

- Starting handicap: 10% discount

- Form guide: If you need any more evidence about the stewards awarding harsh discounts, here it is. Largest horse in the field and still a solid racer. Usually around mid-pack but struggles to have the top speed to win in any given year. Has not traded at this level of discount in the last 15-20 years.

Hearts and Minds (ASX: HM1)

- Starting handicap: 10% discount

- Form guide: This horse is still recovering from a tumble a couple of years ago. For the first couple of years HM1 traded at a sustained premium, however a shocking performance in 2022 bought them well back into the pack. Has been much more competitive recently and is starting at a more reasonable 10% discount.

Tribeca Global Natural Resources Limited (ASX: TGF)

- Starting handicap: 20% discount

- Form guide: Talk about flogging a dead horse. We have backed this horse quite a number of times but it is yet to hit its straps. The trainer uses a specific training method for this horse, however so far it has continued to run poorly. Has been a frustrating runner to back, despite the attractive handicap and likely favourable track conditions.

Platinum Capital (ASX: PMC) and Platinum Asia (ASX: PAI)

- Starting handicap: 5% discount

- Form guide: The trainer has made the decision to call time on the race, with PMC and PAI to merge with their exchange traded managed fund stablemates. While this is a welcomed decision for the owners, performance coming into this final race has been quite subdued. Expecting a fairly muted farewell from what was once a great trainer.

Future Generation (ASX: FGX) and Future Generation Global (ASX: FGG)

- Starting handicap: 10-15% discount

- Form guide: Both these stablemates have a collection of star trainers behind them, but they generally finish amongst the pack. Given the starting handicaps they are likely to be very solid performers, but it’s difficult to see them having the out and out speed for the win.

Ballador Technology (ASX: BTI)

- Starting handicap: 30% discount

- Form guide: The trainers and jockeys have continued to do a very impressive job with this runner. They have had some very strong wins in lead up races and remain very well placed for the race. Big potential here.

Pengana High Conviction (ASX: PIA)

- Starting handicap: 15% discount

- Form guide: This is a horse and trainer under pressure. There are a number of activist owners with a substantial stake in this runner that are not happy with how this horse is running. We expect this bubbling tension to explode at some point in the future. Despite the name, we do not have high conviction here.

VGI Partners (ASX: VGI)

- Starting handicap: 10% discount

- Form guide: A chequered history for this one. After an exceptional performance in the unlisted fund stakes, has struggled since joining the LIC Cup. A change of trainer has helped, as has a new jockey. A US owner with a reputation for impatience owns a sizable stake in the horse, so it could be an interesting year. Definitely one to keep an eye on.

Thorney Opportunities (ASX: TOP) and Thorney Technologies (ASX: TEK)

- Starting handicap: 30-40% discount

- Form guide: The stewards continue to give these two stablemates a very generous handicap. However, even at this handicap the punters refuse to back it. The trainer charges highs fees, and to date the performance has been mixed. TOP has had a year of excellent performance, however TEK has continued to disappoint. Both are roughies with an outside chance.

L1 Long Short Fund (ASX: LSF)

- Starting handicap: Par

- Form guide: This horse has been in incredible form for the last few years, with a string of wins through outright speed. Excellent pedigree with one of the best trainers and jockeys in the country. This has not gone unnoticed by the stewards, and is now carrying a handicap close to par.

PM Capital Global Opportunities (ASX: PGF)

- Starting handicap: 5% premium

- Form guide: One of the fastest horses coming into the big race, the recent races for this international runner has been extremely impressive. The jockey has read the track conditions perfectly, and there is no reason to believe they will slow down anytime soon. Heavily backed and carrying a big weight.

Ryder Capital (ASX: RYD)

- Starting handicap: 15% discount

- Form guide: After a couple of poor seasons, RYD has got back to the kind of performance we have come to expect. Recent conditions has been suiting this horse. The trainers and jockeys are very aligned and we believe things are on the up.

Touch Ventures (ASX: TVL)

- Starting handicap: 40% discount

- Form guide: While we thought we had seen the worst of this runners performance last year it has got worse. While it looks like an attractive bet, we are not sure whether it has the stamina to finish the race.

Hygrovest (ASX: HGV)

- Starting handicap: 50% discount

- Form guide: Raised and trained on an alternative farm out the back of Nimbin, this tiny horse is another that has been a disappointment since day one. Looking forward, it does have a lot of potential. The change of trainer last year, with a promise to move to more standard training methods may pay dividends. Worth a flutter.

Who would fill the top 3 places?

Like the Melbourne Cup, the field is wide open and we should always expect the unexpected. But we realise everybody loves a hot tip, so here are our picks. We’ve gone with three relatively unknown contenders this year.

Salter Brothers Emerging Companies (ASX: SB2)

SB2 listed in June 2021 through a combination of an existing Salter Brothers Fund and capital raising to the public. The Salter Brothers Fund, which formed the majority of the investor base, was set up to comply with the Significant Investor Visa (SIV) Regime. SB2 continues to aim to comply with the SIV Regime, as some investors continue to rely on the LIC to meet their visa requirements. This does make the investor register for SB2 quite different from the majority of LICs.

SB2's investment strategy is to own 25-30 listed and unlisted securities with market capitalisations under $500 million at the time of the initial investment. This sector of the market has materially underperformed larger stocks since 2022. We believe that, at current pricing, there is significantly more potential in the smaller end of the market.

In addition to investing in smaller companies, SB2 is one of the smaller LICs. It has a market capitalisation of approximately $60 million and net assets of approximately $90 million. SB2 trades at a circa 30% discount to NTA. It has also not yet paid any dividends to shareholders, which is perhaps one reason for the higher than usual discount.

There are two substantial investors in SB2. The first is the fund managed by Salter Brothers as part of the SIV Regime. It holds 27% of SB2. This shareholding is expected to continue to fall over the next 2-3 years, as these investors will no longer be required to hold SB2 as part of their visa requirements, though they may still choose to do so. This is likely to continue to result in more sellers than purchasers. The other substantial shareholder is WAM Strategic Value (ASX: WAR). WAR is Wilson Asset Management’s discount capture strategy. This shareholding creates an interesting opportunity in SB2. Wilson Asset Management, the manager of WAR, has been in this situation many times before. They take a position in a smaller LIC trading at a discount and eventually negotiate to merge it with one of their existing LICs.

SB2 has had a rocky ride since listing. The combination of small and microcap underperformance, rising interest rates, and a change in the investment team has weighed on performance. With a combination of mediocre performance, a large discount to NTA, no dividends, and an unusual investor register, it is not surprising that SB2 has not been popular with investors. However, we assess returns based on future prospects. All of these negatives have the potential to be rectified and provide strong tailwinds in the future.

There are two main ways to make profits from an LIC:

- Strong underlying portfolio performance, usually heavily influenced by market returns.

- Discount capture by buying at a large discount to NTA and selling when it reduces.

We believe that with SB2 there is an opportunity for a patient investor to achieve profits from both.

Ryder Capital (ASX: RYD)

RYD listed on the ASX in 2015. Ryder Capital pursue a value based investment strategy focusing on ASX small cap equities. They have an absolute return target of the RBA cash rate plus 4.25% over the medium to long term. RYD has a current market capitalisation of approximately $100 million. The net asset value (NAV) is approximately $120 million, making it one of the smaller LICs.

Performance was excellent up until mid 2021. Then, some missteps from the manager and the market wide underperformance of small caps versus large caps combined to deliver two years of very poor returns. Over the last year or so performance has recovered significantly. We retain a very positive rating on the managers ability.

We are very comfortable with the current RYD investment portfolio. Over time, we expect small cap equities to recover their underperformance compared to larger stocks. If this happens, the portfolio returns have the potential to continue to be very strong.

Our confidence in RYD is based on the following:

- A reasonably attractive discount to NTA, compared to history.

- A quality investment team.

- The portfolio managers are the largest shareholders in RYD, thus very aligned with other shareholders.

- We believe their small cap focused strategy can outperform the ASX 200 Index from here, over the medium to long term.

Lion Selection Group (ASX: LSX)

LSX specialises in listed and unlisted small resources equities. While they have previously invested extensively in global resource companies, they have refined their strategy to focus on Australian opportunities. They generally target companies in the pre-development stage. The current investments are focused around gold and base metal projects.

LSX has a market cap of $80 million and a portfolio value of $100 million. The portfolio is currently circa 50% cash and they have been carefully deploying funds into new opportunities. Based on Lion’s research the microcap resources sector is down 75% since April 2022, making this a very compelling time to be holding cash and investing into a discounted market.

Investing in small cap resources is a high risk strategy, however Lion have been running this strategy for a long time. The potential upside can be quite substantial, and given the current cash holdings, 20% discount and our enthusiasm for resource equities we believe LSX is worth a punt.

Before you invest, read this!

We encourage you to do your own research before investing in any LIC. Remember, a great LIC and a great manager is only part of the story. We also like to make sure they are trading at the right price and that the assets they are investing in are not themselves overvalued. We explain how we do this in our LIC Guide, but in the end it’s up to you to make the investment decision that’s right for you, in conjunction with your financial advisor if you have one.

If you’d like to know more about Affluence and our funds that bring together some of the best investment managers in Australia, visit our website.

Take care and all the best with your investing.

1 topic