If a timeline is long, it’s wrong

In Walter Isaacson’s wonderful biography of Elon Musk, he recounts two Twitter IT infrastructure managers informing Musk that a data centre in Sacramento needed to be moved, and that it would take six to nine months to do so. “Does this timeframe seem like something that I would find remotely acceptable?” Musk asked. “Obviously not. If a timeline is long, it’s wrong.”

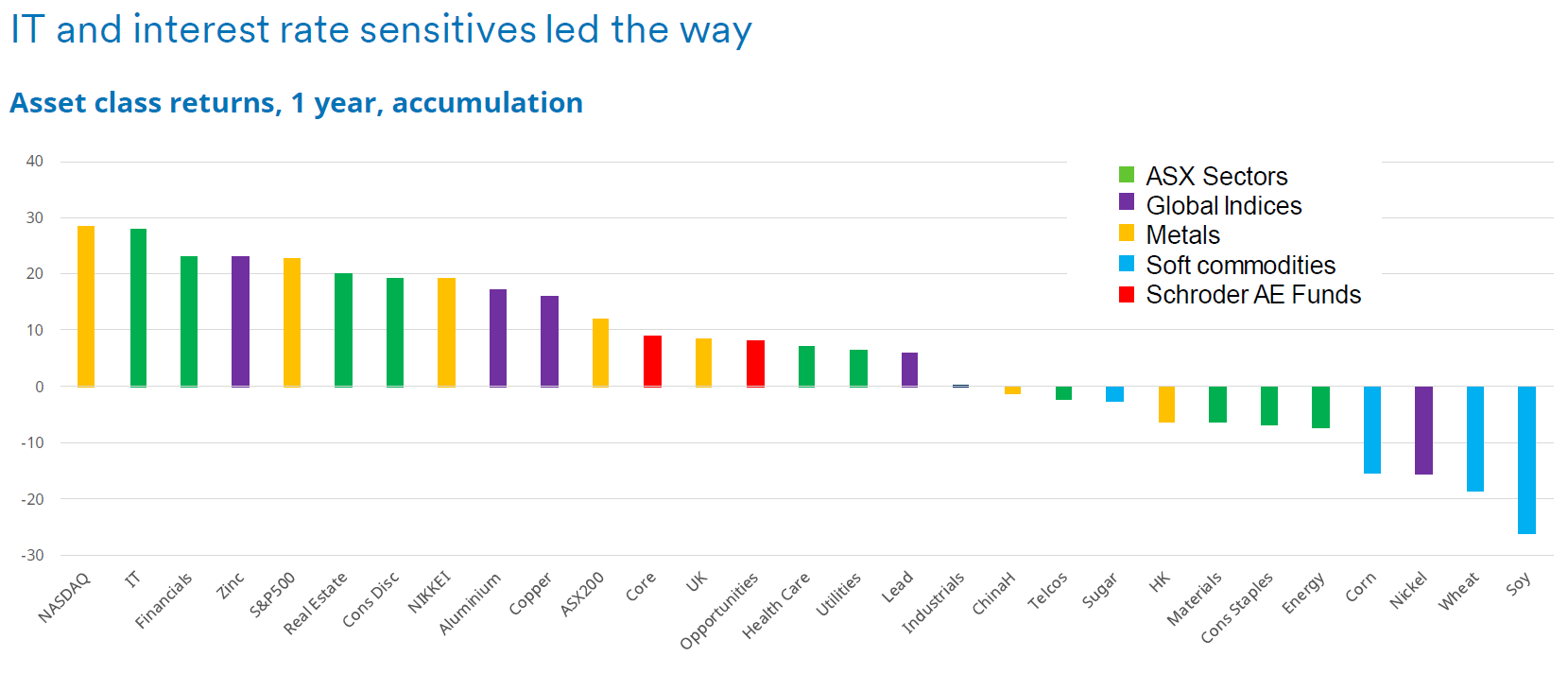

A long timeline in investment is what’s required when asset multiples are high; like now. The only certainty, amidst the plethora of assumptions behind these high multiples – inflation, equity risk premia, idiosyncratic risks and their magnitude, growth in free cashflow – is that, as Musk says, they will, collectively, be wrong. Across sectors, across timeframes, what seems like a sure bet today, can morph into the equivalent of a financial instrument laced with polonium tomorrow. Not that those buying assets are showing any fear; in the face of persistently higher inflation and interest rates through FY24 than had been forecast at the start of that year, asset prices have been immensely strong almost without exception, and the highest multiple assets have been strongest.

FY24 was a great year for asset prices

Source: CITI, LSEG, Aladdin

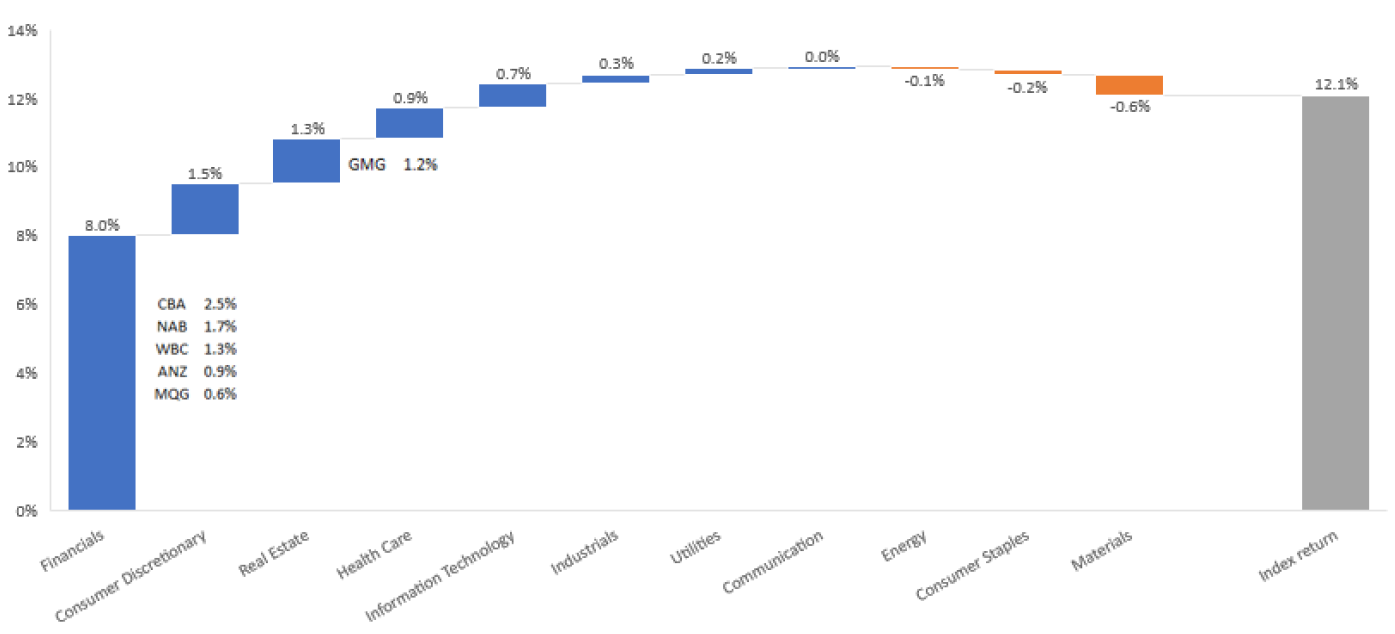

Whilst asset prices broadly have been strong, two standouts have driven the ASX through the past year.

Contribution to index returns

30/06/2023 - 30/06/2024. Schroder Aust Eq

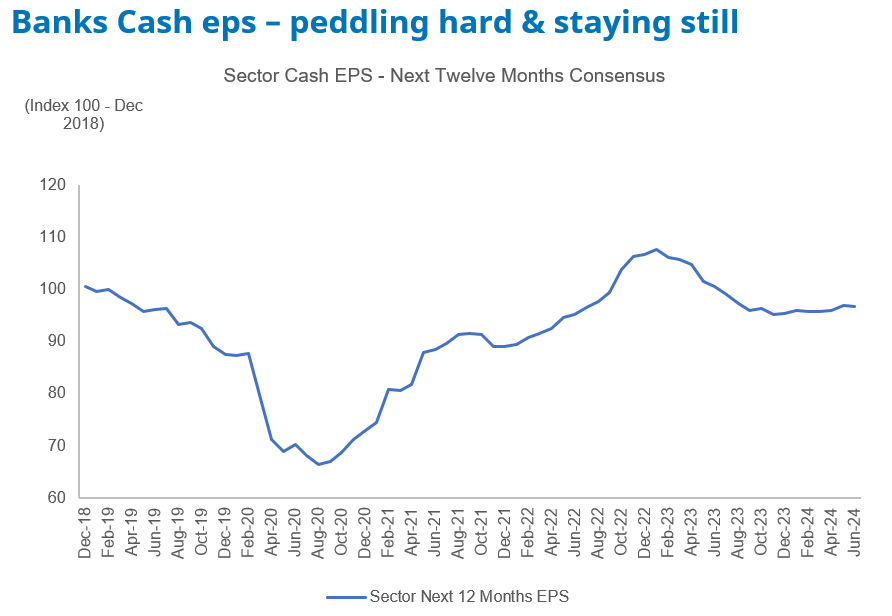

The rise and rise of the Australian banks through the past year, notwithstanding no earnings growth, has been well documented (as we did, for example, in a recent monthly commentary;). We remain underweight the sector and see little to change the view that an improvement in long returns for the sector remains challenging, even if nearer term margin pressures have abated. The best that can be said for bank performance in the context of the ASX is that the sector has not had downgrades through the past quarter, which in the context of a strongly rising market is a surprisingly good outcome. At record multiples, and with CBA (ASX: CBA) trading at the highest multiple of a developed market bank in the world, the timeline required for an investment today in the Australian banking sector has never been longer.

2024 ASX bank rally not fuelled by earnings growth

Earnings growth is muted and multiples are high

Source: Barrenjoey, Schroders as at 14 June 2024

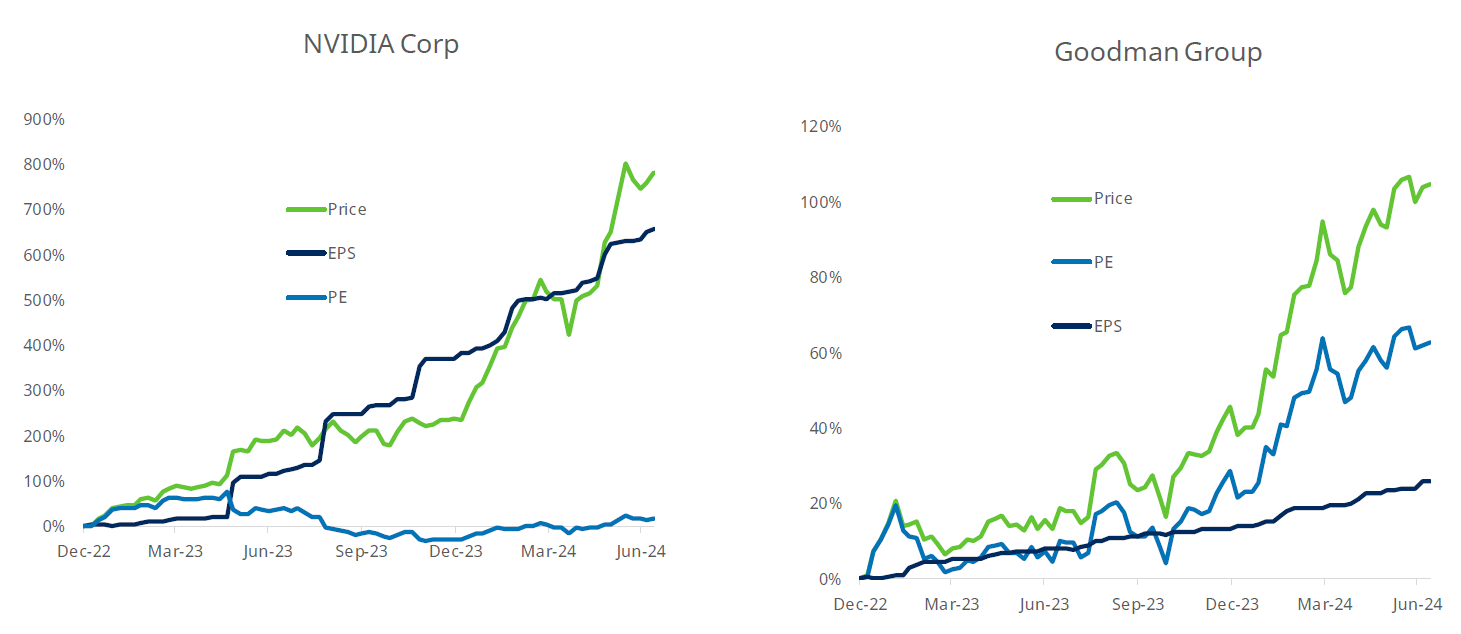

In Australia through the past quarter, however, the timeline has mattered most of all. As can be seen in the chart below, if the rise and rise in the market capitalization of NVIDIA (NASDAQ: NVDA) was purely an earnings phenomenon, with the multiple attaching to the stock being unmoved (albeit not decreasing as would be natural if the current earnings boost was seen as unsustainable), that’s not what has happened with the ASX stocks that have most aggressively performed in reaction to the AI phenomena. Goodman Group (ASX: GMG), for example, provides a great contrast to NVIDIA in contrasting the extent to which market gains have been driven by earnings as opposed to rerating. This re-rating of Goodman has seen it as a material contributor to the index performance through the past year – only CBA added more points to the index returns through FY24.

Data centres - EPS growth or P/E expansion

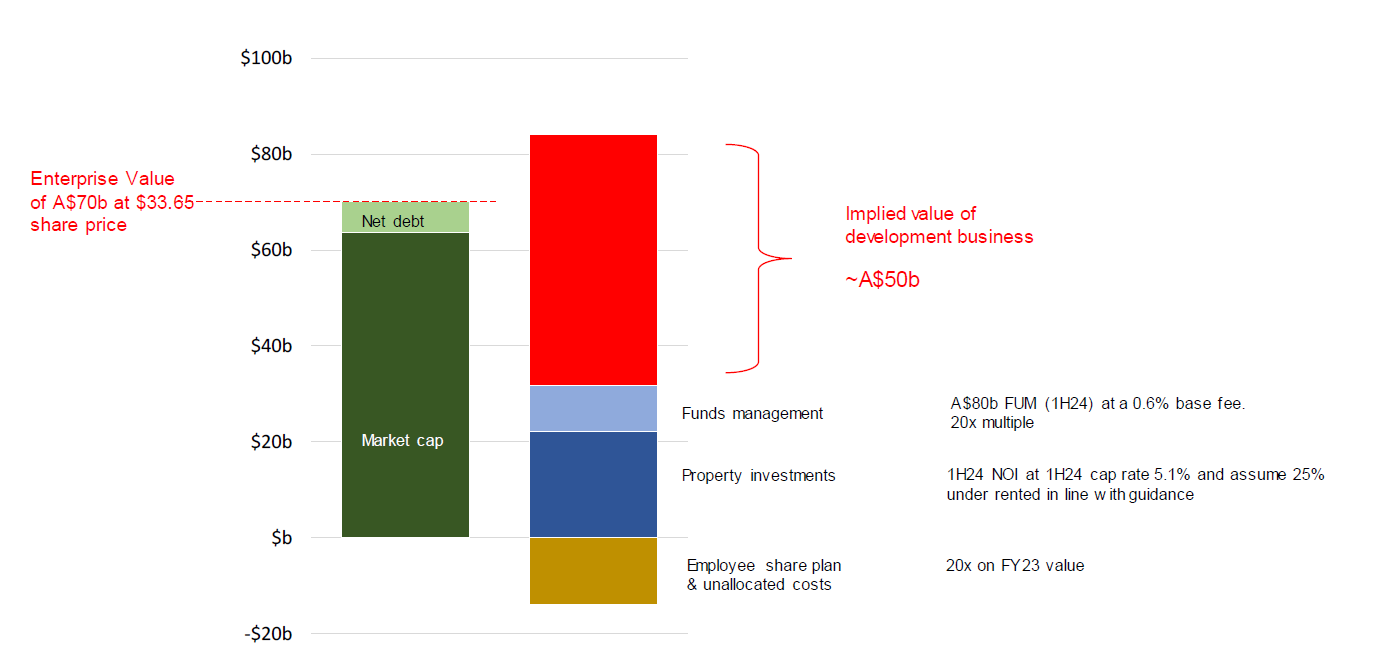

It is not as simple as contrasting NVIDIA as a flow company, that is selling a consumable item, with Goodman as a stock company, that is as the developer and owner of long term rental streams. NVIDIA is at pains to explain now why it is a platform company, especially with the release of the Blackwell platform. Whilst time will tell on that front, there is little doubt that very little of the Goodman valuation is due to its status as a landlord, with the property investment and funds management segments collectively representing far less than half of Goodman’s current market value.

Current share price implying big number for development

We estimate approximately $50 billion of implied value for future development earnings

Source: Schroders

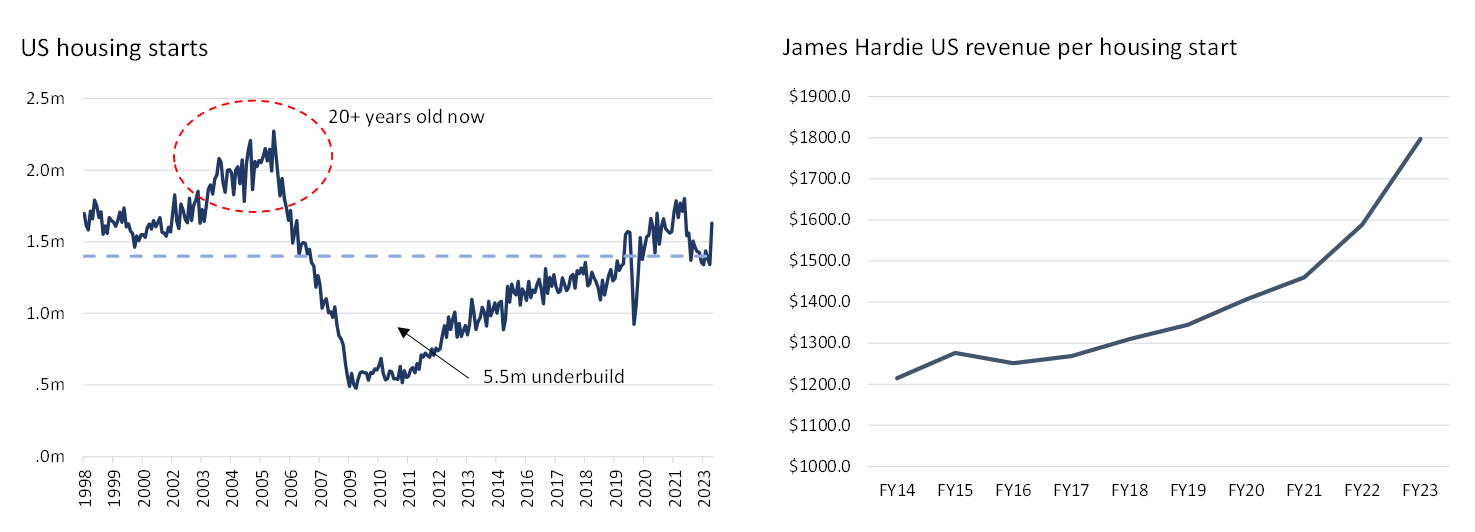

If Alan Joyce was the high priest advocate of running a business for the short run, those legitimately doing the contrary must often be frustrated by the lack of recognition they receive for running the business. An example of a change in philosophy in this regard is James Hardie (ASX: JHX), where in recent years due to a cacophony of unrelated circumstances, much institutional memory has been wiped from the board and management. A new chair, CEO, CFO and now head of IR, each with a US base and mindset, has led to a different strategy and risk profile. As can be seen in the slide, Hardie has released the pricing lever in the past three years, lifting prices more in that time than had been the case for the past decade. A margin frenzy has been the obvious reaction, with the “beats” provoking the predictable market response. As shareholders in Hardie, long may it last. However, we are not blind to some of the potential costs of this strategy. A former, long-standing and highly successful CEO of Hardie, once asked us to hold him to account were he ever to allow margins to reach levels much lower than have been recorded in the past two years for the very reason that it would jeopardise the potential terminal penetration of fibre cement as a product in the US market, which was, and is, the major value driver for the group. Interestingly, for the first time on record, the US Census recorded fibre cement as losing share in completed single-family houses in the US in 2023 (23% to 22%). It is of course true, as Hardie management now maintains, that the group’s margins and returns are so high that allowing laxness in OPEX and CAPEX does not now matter too much; but that does little to acknowledge that it is only an asset that can be exploited because of the eternal vigilance on both fronts by those that preceded them. The long-term benefit of a disciplined operating cost base, and capital expenditure, can easily be underestimated. Without such recognition and care, such an asset can readily be diluted or worse.

James Hardie – supportive conditions and growing share

Profit history has generally been delivered in challenging cyclical conditions

Source: FactSet

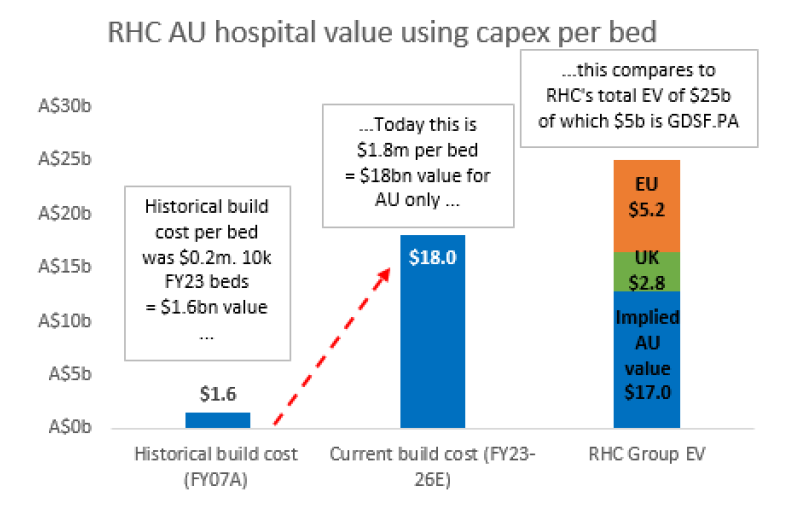

Natalie Davis has been appointed as the new CEO of Ramsay Health Care (ASX: RHC) upon the retirement of Craig McNally, who has been in the business for almost four decades and led it for seven years. Since 2014, Ramsay has increased its asset base fivefold, or A$16 billion, and yet eps has declined by 20%. Growth has been misdefined; the timeline was long, and unfortunately was wrong. The task now confronting Ramsay is twofold; firstly, much of the expansion in assets has been in the northern hemisphere, which has proven that being the champion private hospital operator in Wagga counts for little in France.

The confounding aspect of this has been that Ramsay’s own accounts define the northern hemisphere operations as having lower returns and higher risk than its domestic operations and yet it continued to invest aggressively into the UK and French markets. Such expansion is now in the past, if only because the balance sheet has forced an interruption to what was becoming a series of unfortunate events, and with a new chair and now CEO the opportunity arises for Ramsay to realise its under-earning assets (even at prices below book value), and focus upon harvesting returns from its domestic asset base.

The privileged position of Ramsay’s local hospital assets should not be underestimated; they do have pricing power if managed adroitly and sustainably, and recent replacement value metrics across the market support the view that even if they were only average assets in their industry, their current replacement value is in excess of the market value. We have presented to the Board of Ramsay in recent years highlighting this as our preferred path for the group to create value, albeit to a mixed reception.

A new chair and CEO creates the opportunity for a fresh assessment of the real value to be had as Ramsay metamorphosizes from the profitless prosperity of the past decade. Here’s hoping the timeline for this isn’t long at all.

CAPEX per bed underpins value

To build RHC’s AU hospital asset portfolio alone today has an approximately $18 billion replacement cost.

Source: Schroders, Ramsay Company data, APRA, ABS. EV as at 7 May 2024

Market Outlook

Whilst pressure upon consumers continues to mount, with rents, mortgage rates and general living expenses all remaining stubbornly higher year on year, consumption remains strong at 4% yoy growth, and the impact is aggressively demographically skewed, with the lower income and wealth cohort (notably the young) being impacted to a great extent than others (notably, the not so young).

The RBA has made it clear that persistent inflationary pressures are such that interest rate reductions are still some time away in Australia. We expect the earnings growth of 11% currently expected for the market in FY25 to be revised lower as the reporting season progresses.

Beyond 2025, large shifts in value are likely to globally arise as a consequence of several structural themes; fiscal pressures, redistribution of wealth and decarbonisation. Whilst it is tempting to add AI to that list no company we have spoken with, even those assessed as being AI has yet been prepared to nominate a material economic benefit likely to be seen in the next few years.

Whilst cognisant of Musk’s warning – if a timeline is long, it’s wrong - we continue to believe that Australia will be affected by each of these factors at least as much as most countries and that those forces are all still nascent.

Learn more about investing in Schroders' Australian Equities.

5 stocks mentioned