If you love Woolworths, then ....

In Australia, Woolworths is a household name known to everyone due to its brand and its presence in our daily lives. 20 years ago Woolworths was focused on expanding the number of supermarkets, then came the productivity loop and Walmart like every day low pricing, then came the new formats in addition to Big W, Petrol Stations, Dick Smith etc. These days the profitability of the business is predictable as the market is known and margins or same store sales dont change much. However, if we replay the past and add a massive young population, underpenetration of supermarkets, with significant swing towards organised retailing to come, then we have the ingredients for a strong and sustainable growth business for the next decade.

Thriving on Opportunity

The fundamentals of India’s large, youthful, and significant working age population are resulting in strong and sustainable growth opportunities across many industries. The increasing attention of global heavyweights such as Walmart and Amazon would hint that retailing is one such industry. The market size of retailing in India is expected to grow at 12% p.a. to around US$1.4trillion by 2024. The drivers of growth for this industry are numerous and include:

- India’s average age of 27 across a population of 1.3bn

- A shift from unorganised retailing towards organised given reforms such as Demonetisation and GST placing pressure on smaller businesses (unorganised was as high as 90%)

- Consumer preference in urban locations towards malls / format experiences

- Rising ticket sizes per person i.e. increasing preference for aggregated purchasing

- Increasing smartphone and internet penetration as well as increasing digital acceptance by customers is leading to e-tailing growing at circa 30% p.a.

- Technology evolution in connecting with the consumer

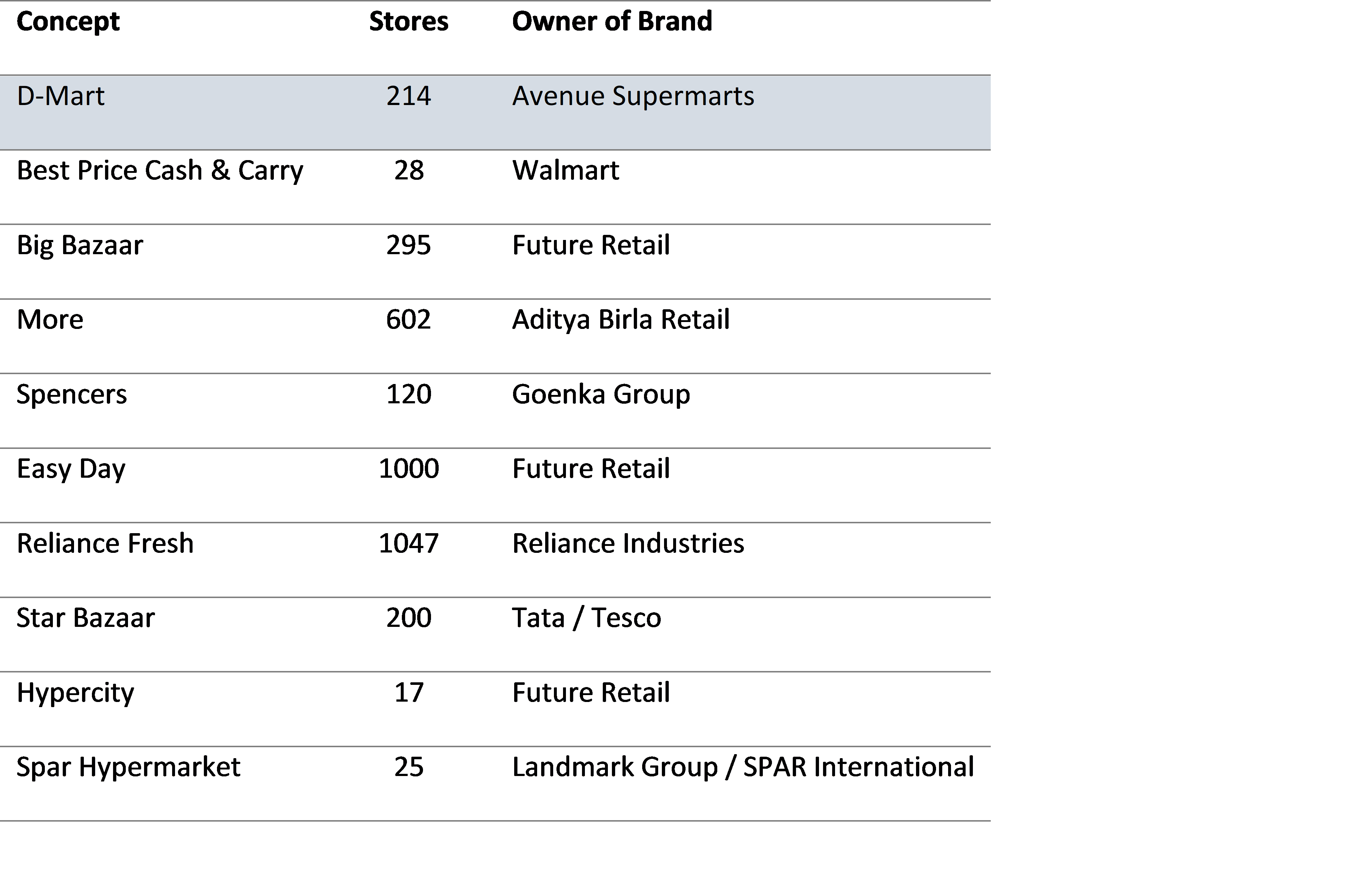

One of the formats thriving over the last decades have been the rise of supermarkets/hypermarkets in India. There are now several players and close to 4000 Supermarket/Hypermarkets in India, with several players continuing to enter the fray. Previously this was the domain of India’s Kirana stores i.e. single store, family operated, small business.

Avenue Supermarts, listed on India’s stock exchanges in March 2017, with an IPO price of around Rs.300. It now trades three years later at close to 8x that price (market cap A$29bn). Through its main brand D-Mart, the company is focused on the supermarket/hypermarket concept as an owner/operator. The company was founded in 2000 and from its first store in 2002 to operating 214 stores by end of FY20. Its focus has been on value retailing and the Walmart concept of “everyday low prices” for its consumers by procuring goods at a competitive price, using both operational and distribution efficiency.

Dmart is 52% Food (Groceries, Food & Veg, Beverages and Snacks), 20% Non-Food (Home, Personal Care and Toiletries) and 28% General Merchandise (Bed, Bath, Home, Toys, Garments and Footwear).

Profitability is not just being driven by new stores, but also by increasing store sizes and sales per square metre. Profit margins are also high relative to most retailers globally as the company benefits from operating leverage.

At a population of 1.3bn, today it works out to about 370,000 people per store across the industry. Compare that to Australia’s < 10,000 per supermarket. As the company continues to drive its store openings in clusters, witnesses continued rise in its sales per square feet and benefits from its “D-Mart on Wheels” strategy (home-delivery), profitability should grow substantially (expected to double in the next 4 years from A$260m in FY20).However, given competition from significant players such as Walmart, Amazon and India’s own Reliance and Future Retail will mean that this opportunity will eventually mature over the next decade and companies in the space will go from trading at 50-60x multiple to a market multiple. However, for now the multiple seems more rational given the steep ascent of profitability.The company also uses WalMart’s playbook by operating in clusters where it has a strong understanding of customer behaviour in that cluster. Globally what might be accepted as a cluster could be a 200-300km radius. However, in India that reduces to 50km given logistical issues (travel time). The opportunity for Avenue Supermarts is through continued roll-out of stores in clusters. After an initial focus on urban based clusters, the potential for roll-out to smaller towns and cities is significant as organised retailing continues to penetrate.

As India’s GDP per capita rises from just over US$2,000 towards China’s $10,000 plus, it should underpin growth for organised retailing for the next two decades. However, the survivors will be those who can embrace technology, consumer preferences and build strong logistics and efficient supply chains. Avenue Supermarts is well poised to participate!

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

1 stock mentioned