Industrial REITs – Shifting gears from tightening yields to growing rents

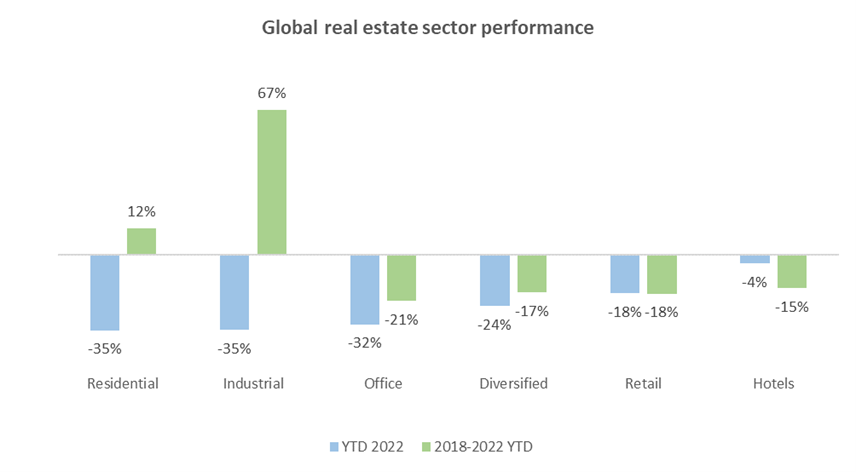

Delivering a total return of -23%[1] to the end of October in local currency terms, this hasn’t been a great year for Global REITs.

Whilst disappointing, it is also unsurprising. With US 10-year treasury yields increasing by two-and-a-half times and inflation at levels not seen in four decades, the material decline in REITs is a current source of pain and a potential source of opportunity.

Industrial REITs have felt the worst of it, underperforming by over 10 percentage points. This is despite delivering impressive operating results that suggest demand for high-quality, well-located, state-of-the-art logistics and industrial facilities outstrips supply. In our view, the sell-off is overdone. While investment yields are softening the global industrial REITs are shifting gears and rental growth will be the major contributor to total returns.

Even as interest rates rise and the potentially harmful effects of a global growth slowdown develop, cyclically low industrial market vacancy rates are driving market rents up. Beyond a prolonged global recession, select global industrial REITs with specialist management teams, solid capital positions, urban portfolios and the ability to add value through development are trading at attractive prices.

There are five factors supporting this view:

1. Industrial REITs have significant structural tailwinds

The last few years can be summarised thus: pandemic lockdowns, record fiscal and monetary stimulus, supply chain constraints, reopening, pent-up demand release, the war in Ukraine, inflation, especially in energy prices, interest rate tightening and, as of now, recessionary concerns.

Amid lockdowns and rapid online sales growth, global industrial REITs outperformed. Since 2018, the annualised total return is a sector-leading 11% p.a[2]., well ahead of global REITs which delivered -1% p.a. On an absolute basis, Industrial REITs have delivered a total return of 67% since 2018 whilst the broader global REIT sector declined by 5%.

The recent share price performance, therefore, needs to be seen against this wider backdrop, and include a recognition of the sector’s attractive fundamentals. The demand for space to facilitate speed in online retail fulfilment is still growing; the supply of logistics premises in high-value urban locations is becoming increasingly constrained; and tenants are increasingly building out supply-chain resilience and onshore operations, further adding to strong incremental demand.

2. Amazon is a special case and not the canary in the coalmine

Macroeconomics aside, the acceleration of negative industrial sector performance occurred in late April when Amazon announced excess capacity in its fulfilment network. Since then, global REITs have returned -30%[3]. In retrospect, Amazon’s retreat from leasing new industrial premises was viewed as a bad omen for the sector.

Our research indicates this belief is misplaced. Amazon doubled its global logistics footprint through the pandemic, beating all comers when competing for space. Its slowdown now offers the chance for those tenants that struggled to build out their supply chains to secure premises in Amazon’s absence.

The demand for industrial space since Amazon's announcement supports this view. Occupancy and rental growth have continued despite Amazon’s withdrawal, with the UK a case in point. Despite leasing 40 million square feet of logistics premises in 2020 and again in 2021, the market vacancy rate remains at 1.2%.[4]

There is a healthy level of unsatisfied demand. Anecdotally, third-party logistics users have been happy to take up the slack left by Amazon to increase the resilience of their supply chains, often moving from second-grade, older facilities into newer, better-located and more productive facilities. The widespread belief that Amazon is a proxy for the sector is misplaced.

3. The move to e-commerce likely has further to run

In countries with high levels of e-commerce penetration like the UK, the share of retail sales is still well below 50%. Even if many markets hit a 20% share by the end of this decade, as many analysts expect, this implies a substantial increase in warehouse capacity requirements.

Retailers improving their omnichannel offer will accelerate this trend, as would demand from more traditional users in, for example, manufacturing where onshoring is gaining traction. A recent Deloitte report claimed 62% of manufacturers surveyed have started reshoring or near-shoring their production capacities whilst labour-cost pressures in Western Europe and the US “are being mitigated by advances in robotics and automation.”

4. Rental growth remains strong

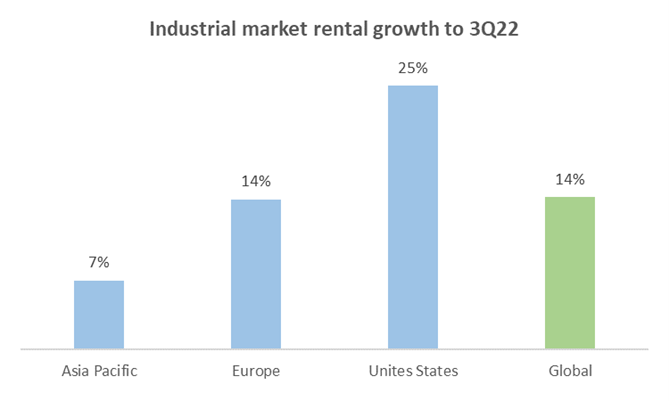

According to JLL Research, the US remains most resilient with leasing activity holding up in Q3 and about 75% of US industrial REITs increasing their earnings guidance. Limited supply in primary markets and softening demand in China dragged on performance in Europe and Asia Pacific respectively, although rents have continued to rise in all three regions, with the U.S. and Europe witnessing double-digit growth.

Rents, however, account for a relatively small proportion of supply chain costs. With a greater focus on operating costs, especially energy, the case for rental growth upside remains strong.

Indeed, rental rates for well-located logistics space continue to soar to record levels and the industrial REIT landlords are well placed to capitalise on recent earnings and business updates provided by industrial REITs showing strong rental growth and leasing demand.

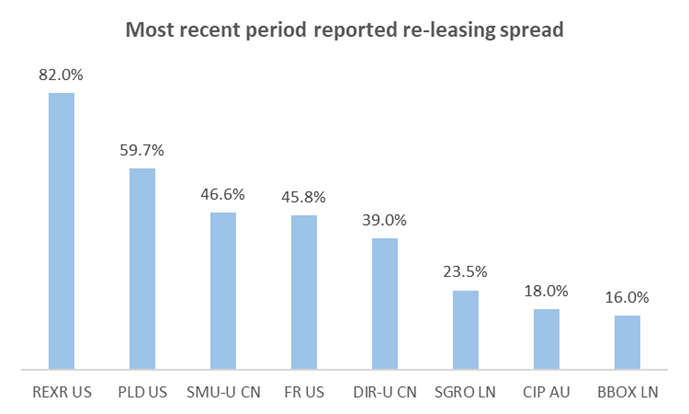

Market rental growth over recent periods has enabled industrial REITs to enjoy positive rental reversion across their portfolios (the difference between passing rents and market rents) and attractive re-leasing spreads (the difference between rent on the old lease and that on the new lease):

5. There are still some headwinds

While the logistics sector enjoys healthy levels of demand and strong fundamentals, we are not getting carried away. Our channel checks indicate some major industrial space users, in recognition of slowing global growth, are adopting a more cautious approach to operations and capital allocation.

Having invested across the sector for many years, and across multiple market cycles, we are acutely aware that, pandemic aside, the industrial property sector has been sensitive to economic cycles. A prolonged recession would likely temper levels of market rental growth as users look to hold fire on expansion decisions. While a recession is likely to slow rental income growth even for industrial and logistics premises, the prevailing low vacancy levels and structural tailwinds should act as a buffer to REIT landlords.

What this all means

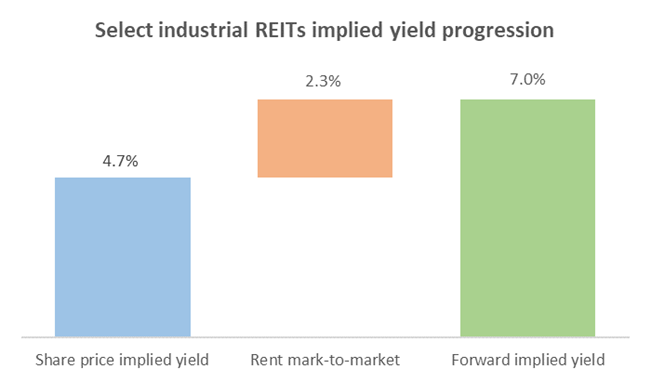

Inflation rate and bond yield increases are negative for real estate if top-line rental revenue isn’t also growing to offset the effects of the higher interest costs and cap rate softening, driven by higher expected returns. Over the calendar year, there has been a material increase in the global REIT implied cap rate of c.200-300 basis points, in response to macroeconomic factors.

Cap rates are now softening, with Goodman Group recently claiming that the 3% cap rates were an anomaly - “a tremendous amount of capital, an enormous amount of stupidity". The company went on to say that "rental growth is offsetting valuation movement in cap rates, expecting valuation uplift in FY23 across partnerships, driven by rental growth".

The current portfolio cap rates implied by share prices suggest selective opportunities exist. Our estimates indicate that select global industrial REIT portfolios, adjusted for embedded market rental growth, can deliver an estimated forward yield of about 7%:

This is not what market prices are telling investors right now, but the evidence for it is compelling, as is the yield, in our view. Whilst we acknowledge that macroeconomic weakness will affect some global industrial REITs tenants, the cyclical and structural forces driving demand are likely to benefit select industrial REITs that can drive the most rental tension across their portfolios.

Broaden your income horizons

With demand for industrial properties strong and vacancies at record lows, the outlook for rents and valuations remains attractive, a view reflected in our positioning within the Dexus Global REIT Fund. Inside the world of industrial REITs, things are better than their share prices imply. And therein lies the opportunity. Click here to learn more about our offerings.

2 topics

1 stock mentioned

1 fund mentioned