Inflation uncertainty makes retirement planning harder

When I drive up the coast for a summer holiday, packing is easy. Shorts, t-shirts, thongs – done. It’s a bit different if I go snowboarding: my bags are packed full of a wide range of clothing to suit all the possible conditions I might encounter. The more unreliable the weather, and the more severe the consequences of poor packing, then the greater care I take in preparation.

The same is true for investing, when conditions are uncertain, investors should prepare their portfolios for a wider range of possible scenarios. For people about to retire this is critical: the closer you get to retirement the more any investing mis-steps matter. It has always been hard for retirees to work out how much money they need to retire as there are so many variables – investment performance, health, longevity, unexpected expenses – the list goes on. Now, with the cost-of-living increasing more quickly, and high uncertainty when inflation will return to normal levels, the sum of money people need to save to live comfortably for the rest of their life, is even harder to estimate.

Inflation and interest rate predictions keep changing

When inflation re-surfaced in 2021, many economists and central bankers thought it would be transitory. It wasn’t. Then they thought inflation had been ‘tamed’ and would soon head back to the 2-3% target range. Now, that’s looking less likely. The latest data shows that inflation has ticked up again recently, and the path back to 2-3% is looking anything but smooth.

Interest rates have followed a parallel path. At the start of this year US investors were expecting multiple rate cuts in 2024. Then in March the US Federal Reserve suggested three cuts were likely in 2024. Now, markets are pricing only one cut this year. The same dynamic is playing out in Australia. Six months ago, multiple rate cuts were expected this year, now most economists expect only one cut in Australia in 2024, with some even suggesting a rate rise is possible this year.

Global inflationary forces persist

The ultra-low interest rates of the 2010s were built on a base of deflationary globalisation, combined with a relatively benign geopolitical environment. In the 2020s this strong foundation has been steadily eroded. Covid forced companies to bring in greater, and more expensive, supply chain flexibility. War in the Ukraine and the Middle East, and increased tension with China, have further increased prices and decreased certainty, leading to more expensive on-shoring. The global push to reduce emissions and fossil fuel usage is expensive and will continue to add to inflation.

While goods inflation (eg buying clothes or household items) seems to have abated in Australia, services inflation (eg renting, taking a holiday) remains sticky and problematic. The Economist says Australia has the developed world’s most entrenched inflation. While there is talk about AI being the great hope for increased productivity and deflationary pressure, it hasn’t yet had that effect. In fact, it may increase inflation in the short-term as companies invest more in AI and fight for AI chips and data-centre space.

Higher, stickier inflation is retirees’ top investment concern

With inflation lingering like the last guest at a party, prospective retirees are understandably concerned. In a Natixis Investment Managers survey last year(i), more than half of Australian investors (54%) said that inflation was their top investment concern, and close to two thirds (63%) said it is significantly impacting their ability to save for retirement. Retiring now is more complicated than it was five years ago, as uncertainty around inflation has made the amount retirees need to save less certain.

Retirees are left with a problem:

- Take greater risk in their investments, to improve returns and stay ahead of inflation, but increase the chance of losing money.

- Invest more conservatively, but earn lower real returns, and hope that inflation will come down more quickly and so maintain quality of life.

We think there is a third way: focus on sustainable income, rather than returns.

A greater focus on income reduces the likelihood that retirees will need to use their investment capital to fund their lifestyles during times of poor investment performance.

Higher, sustainable income can smooth out investment volatility

There are a number of different ways of generating income from investments including rental properties, coupons from fixed income, interest from term deposits and dividends from equities. All have their advantages and disadvantages but offer important diversification, and greater income for investment portfolios.

While equities, particularly Australian equities, deliver solid income returns (more than half of the returns from the ASX200 over the past 20 years come from dividend income(ii) equities are more volatile than many other asset classes. Dividends are inherently less volatile than share prices as dividends are paid based on the underlying profitability of the company, whereas share prices fluctuate depending on the whims of the market. Investors can also reduce the volatility of equities by focusing on higher-quality companies, and increase income by investing in companies that pay consistently high levels of dividends. This is what we do in IML's Equity Income Fund. We also further increase the level of income through conservative options trading.

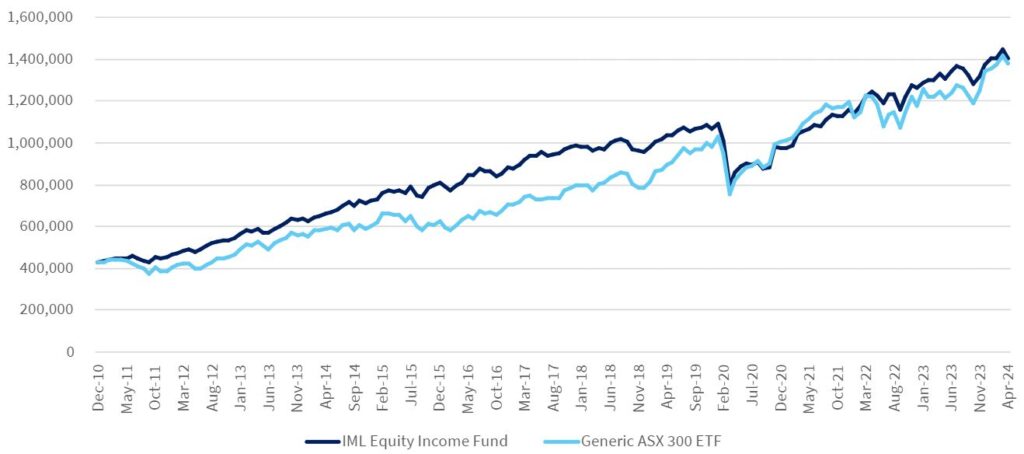

To show the impact higher income can have let’s look at a hypothetical scenario where someone retires at the end of 2010 with a lump sum of $430,000 and invests the entire amount in either:

- An income-focused equity fund (IML’s Equity Income Fund – EIF)

- Or a generic passive ETF(iii) which replicates the ASX 300, with quarterly distributions

From 1 January 2011 to April 30, 2024 the annualised total return (see footnote under graph) for both funds is very similar (7.9% for EIF and 7.8% for the generic ETF), so if no withdrawals are made then the investment performance is very similar as you can see in the graph below.

Cumulative value of income versus growth investment

Source: IML, Factset. Returns are calculated after fees and assume all dividends and frankingiv are reinvested in the funds. Past performance is not a reliable indicator of future performance.

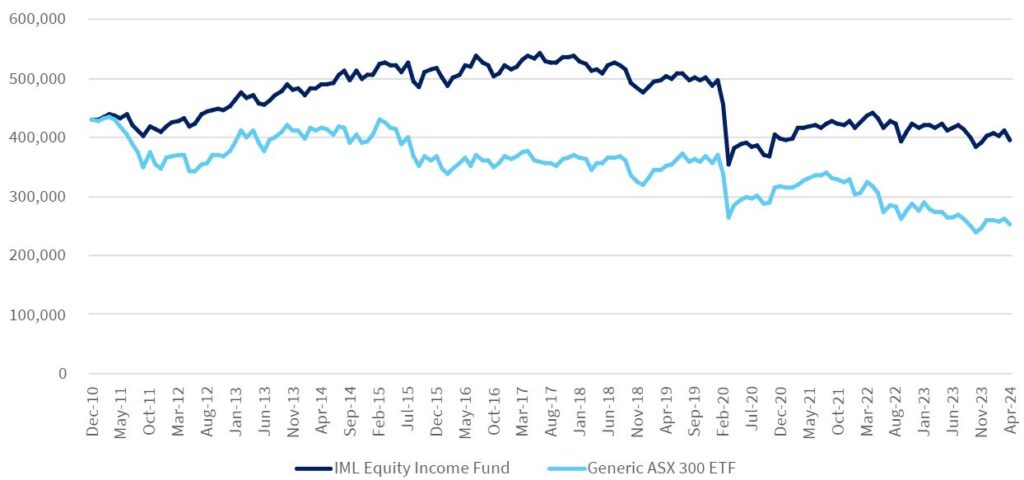

However, if you add in monthly withdrawals to pay for a comfortable lifestyle (starting at $3,300 per month and rising with inflation), things change significantly.

Cumulative value of income versus growth investment with monthly withdrawals

Source: IML, Factset. Lump sum and monthly withdrawals based on ASFA’s Retirement Standard for a ‘comfortable’ life for a single person. Returns calculated after fees and including franking(iv). Past performance is not a reliable indicator of future performance.

On the 1st of May this year the amount invested in the IML Equity Income Fund back would have been worth $396,000, whereas the amount invested in the generic ETF would have fallen to $252,000 – a difference of around $144,000.

The main reason for this stark difference, despite similar investment performance, is the higher income, from the Equity Income Fund, which is distributed regularly. This regular income gives investors money to live on, making it less likely they will be forced to sell shares for living expenses when performance is poor, and so lock in losses and permanently deplete their investment capital. This is called sequencing risk, which is a key risk retirees face, unlike accumulators who typically add to their investments in periods of weak markets rather than withdrawing money and locking in poor returns.

To be clear: we would never recommend someone invests their entire portfolio in one investment option – diversification is a critical component of successful long-term investing. There are also many differences between the products investors should be aware of before considering investing, including the higher fees of EIF compared to the passive ETFs, and the different risk profiles of each fund. This is not meant as a broad comparison between the funds, it is simply intended to show the difference income and capital growth ratios can make for long-term investments. Please consider the EIF PDS and TMD before deciding to invest.

Focusing on income can make retirement planning less stressful

While financial planning for retirement is complex, there are ways to make things easier – even in a volatile and uncertain investment climate. We believe that if retirees focus on generating enough income from their investments to stay ahead of inflation, then they are more likely to be able to enjoy their retirement and less likely to be worrying about their finances.

I jointly manage the IML Equity Income Fund with Tuan Luu, Portfolio Manager, IML.

2 topics

1 fund mentioned

1 contributor mentioned