Inside the explosive growth of ASX-listed products

It’s easy to forget how much change happens in a relatively short period of time. Even in the past few years, we’ve gone through a pandemic, major natural disasters from bushfires to floods, wars have started overseas, companies have risen (and fallen) and rising interest rates have become the barbecue topic of choice.

So, imagine if we just focused on the changes in the world of investments. Specifically listed products on the ASX. Looking back over the last five years, the growth in the world of exchange-traded products (ETPs) can be described as explosive.

The performance in this space contrasts quite starkly with the slow starts for the Australian market. The ASX Investor Survey in 2020 found that 20% of investors held ETFs, while the ATO SMSF Quarterly Report September 2022 found ETFs featured in 39% of SMSFs. That number is only growing. After all, the same survey noted that 45% of investors aged 18-25 years were considering investing in ETFs in the next year.

Would anyone have guessed only a few years ago that an investor could build their perfect portfolio using listed products on the ASX? It’s unlikely.

In the following wire, I look into the extraordinary growth of listed products on the ASX.

ETPs by the numbers

- 18.7x: the growth in assets under management (AUM) of ETPs between January 2013 and January 2023

- 0.56%: the average fee for an ETP. It was 0.44% in 2013.

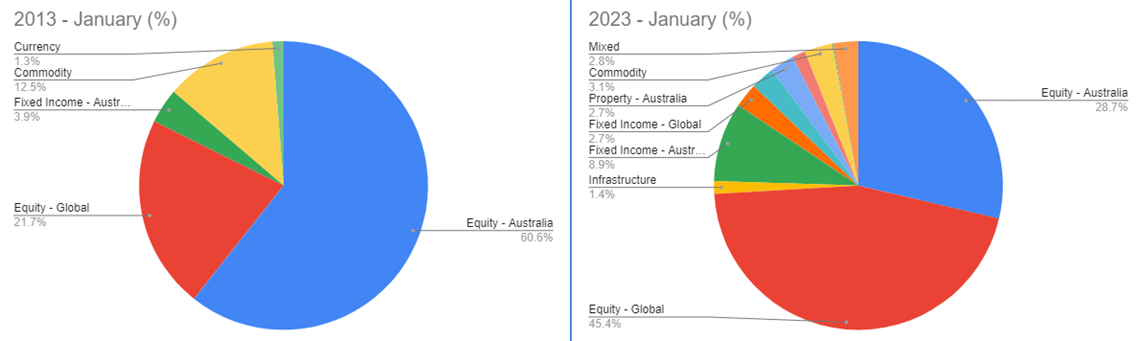

- 45.38%: the largest allocation by FUM was to international equities in 2023. It was 60.65% to Australian equities in 2013.

- $12.47bn: the size of the largest ASX-listed ETF, Vanguard Australian Shares Index ETF (ASX: VAS). It has grown 391x since 2013.

- 52.6%: the portion of ASX ETP listings offered by just three issuers: BetaShares, iShares and VanEck.

A short history

The first ETF was listed on the ASX in 2001 – the SPDR S&P/ASX 200 Fund (ASX: STW). To some extent, Australia was already late to the game. After all, the first ETF in the world, the SPDR S&P 500 ETF Trust (ASX: SPY), had been listed in 1993. Interest in ETFs had been a slow burn, but SPY was gaining significant traction towards the end of the 90s. State Street hoped that launching in Australia would be a similar success.

While STW can objectively be called a success over its life, it took a while for the ETF market to gain any traction. By 2013, there was only $6.86bn in assets under management across 90 products. Investing was more focused on the intermediary market – that is, financial advisers using the products for their clients where relevant and little effort to market towards the retail investment space. Even then, only around 27% of advisers were using ETFs with their clients.

But then something changed.

The ETF market nearly tripled in value between 2017 and December 2020 and today’s numbers stand at $136.2bn in assets under management with 283 products listed on the ASX. There are 1.9 million Australian investors using ETFs based on BetaShares Investment Trends ETF Report 2022, and 59% of financial advisers use ETFs with their clients. In reflection of the interest, 41 new ETFs were launched last year alone. This was almost double the number of any previous year.

Behind the popularity of ETPs

The popularity of ETPs has come down to their structure and typical characteristics. In their base form, ETPs are considered to be:

- Low cost

- Transparent

- Easy to use and understand (for the most part…)

- Accessible broadly to anyone using an investment trading platform

- Lower entry threshold than most managed investments

- Liquid, depending on the asset class

- Diversified.

It's worth noting this isn't necessarily true of all ETPs.

Thematic ETFs, for example, are commonly criticised for being expensive, while some in the industry have expressed concerns about using passive vehicles for niche industries where active expertise can make a significant difference.

- Diversification also ranges and tends to be more applicable to broad-based index trackers.

- There are ETPs listed with a single asset and others in the equities space that may have as few as five stocks.

- Transparency and liquidity also vary. Particularly as more active managers enter the space.

- The idea of ETFs being simple and easy to use can also be a misconception.

After all, this is a space where we are seeing increasing issues of leveraged and synthetic ETPs that need a more sophisticated understanding of markets to use and constant monitoring - that is, products that are designed for industry experts rather than the average retail investor.

Despite these concerns, there are many who still find it a valuable product. Some examples include Ladies Finance Club founder Molly Benjamin and Stockspot's Chris Brycki who suggests investors only need five ETFs to outperform in the longer term. To be clear, neither recommends the more complicated structures with both tending towards broad-based index trackers in their suggestions.

But what was the catalyst that saw the money really start to flow?

Rory Cunningham, senior manager of investment products for the ASX, points to increased awareness of the benefits.

“Ultimately the key benefits of ETFs, such as convenience, liquidity, transparency, and cost-effectiveness resonate with investors and are leading them to allocate greater amounts of their portfolios to ETFs than ever before,” he said.

If you think back to the environment of 2013, investors were jaded post-GFC. No doubt, the transparency of ETFs would have been appealing. It’s not the only factor for success, though.

Arguably technology and the rise of trading apps for the average retail punter would have been highly supportive of ETFs. Suddenly, you didn’t have to find a broker to buy shares or ETFs for you. For those unsure about buying company shares, ETFs were an easy dabble.

This was also an environment where the Australian financial advice industry was undergoing significant change and reform. For some investors, concerns over financial advice made the option of DIY trading, with ETFs an easy in, a valuable option.

More recently, COVID had a dramatic effect on flows to ETFs. Retail investors flocked to the market.

Average retail trading climbed to $3.3 billion at the end of April 2020, before returning to more normal levels in later months. Investors thought there was an opportunity to buy the dip and they wanted in. While all investment products benefitted, ETFs surged at this time, as many investors preferred the instant diversification and convenience of ETFs over researching stocks.

The ASX found 900,000 new investors intended to enter the market in 2020, with 28% intending to buy ETFs. Even more interesting was the finding that 45% of 18-25-year-olds intended to buy ETFs.

Changing space

ETFs started out as passive vehicles, also referred to as 'vanilla' ETFs. These were investments designed to follow an index and match its performance, either by physical or synthetic replication of the investments held in a particular index.

They’ve come a long way since then.

Newer generation ETFs range from smart-beta, thematic and even actively managed funds. What does this mean?

- Smart-beta ETFs incorporate certain additional filters or rules such as dividend yield. These are tailored. They still follow an index but are designed to offer certain qualities for investors or be more protective in certain market cycles by exclusionary stock filters.

- Thematic ETFs follow particular trends or themes, such as robotics or carbon trading. These have been particularly popular in recent years as investors seek to access the potential returns of the biggest themes of our times.

- Actively managed ETPs see the active strategies of fund managers listed on the ASX in an exchange-traded format. These are strategies that seek to beat an index rather than match it. ASIC placed a temporary suspension on these in 2019. The lifting of the suspension has seen a large volume of actively managed funds listed on the ASX. This has opened access to many retail investors who may previously have found minimum investment thresholds on the unlisted forms a barrier to entry.

ETPs cover a range of asset classes and sectors.

While initially a long-term design, some of the actively managed options are designed for short-term trading by using leverage, such as the BetaShares Australian Equities Bear Hedge Fund (ASX: BBOZ) or the Global X ETFs Ultra Short Nasdaq 100 Fund (ASX: SNAS).

The ways we use ETFs have evolved to an extent too.

Looking back to 2013, the bulk of funds in ETFs were to Australian equities. Today, it’s international equities.

Asset composition of ETP FUM 2013 v 2023

This makes sense, after all, direct international equities are often far more difficult to access for the average investor – or if they are accessible, then the management and tax efficiencies can be more complicated. Investors are also increasingly aware of and keen for exposure to sectors that are less prominent in Australia, such as technology.

Investors have also started to look at using ETFs to create tilts to their portfolios, such as adding thematics as satellite exposure.

The increasing numbers of actively managed ETPs are a game-changer as well.

Those who are less keen on passive exposures may now have the option for an actively managed portfolio completely based on ASX-listed products, while taking advantage of some of the perceived benefits of this structure.

Can the ETF market continue this growth?

Cunningham believes there is more to come, and we haven’t reached a saturation point yet.

“There is still a lot of room for ETFs to grow their market share - the percentage of assets held in the ETPs structure is still a small percentage compared to the overall size of investable assets in Australia and compared to the amount held in managed funds,” he says.

BetaShares Investment Trends ETF Report 2022 noted that there are around 1.9 million Australians invested in ETFs and predicted that number would increase by more than 200,000 across 2023.

Cunningham also points to a few other growth opportunities for the space.

The SMSF space has continued to grow and take up listed ASX investments while the financial advice space may see continued growth. Around 59% of advisers in 2021 used ETFs with clients. Only 21% of advisers surveyed by Adviser Ratings and Vanguard in their 2022 Adviser Landscape Report do not intend on using ETFs – this leaves some flex for continued growth.

ETFs are also benefitting from the expanded use of managed accounts.

“Research from State Street found that 64% of managed account users prefer to hold ETFs within a managed account,” says Cunningham.

It’s also worth factoring in the interest of younger investors, who are more inclined to use ETFs as they begin to invest. As their wealth base grows, this could become increasingly lucrative for the industry.

Check out the Australian ETF Directory on Market Index

Visit Market Index for a comprehensive list of ASX Exchange Traded Funds. From broad index exposure through to commodities and specific thematics. The Australian ETF Directory helps you discover and research hundreds of ETFs.

1 topic

6 stocks mentioned

2 funds mentioned