Insider Trades: Directors are buying and selling shares in these 7 ASX 200 companies

Welcome back to the Insider Trades Series – A summary of on-market ASX 200 director transactions valued at more than $10,000 over the past week (September 8 to September 15).

Top Insider Sells

Code |

Company |

Date |

Director |

Type |

Price |

Value |

|---|---|---|---|---|---|---|

Goodman Group |

15/09/23 |

Sell |

$22.85 |

$11,425,000 |

||

Goodman Group |

15/09/23 |

Sell |

$22.85 |

$7,745,990 |

||

Santos |

08/09/23 |

Sell |

$7.76 |

$1,552,624 |

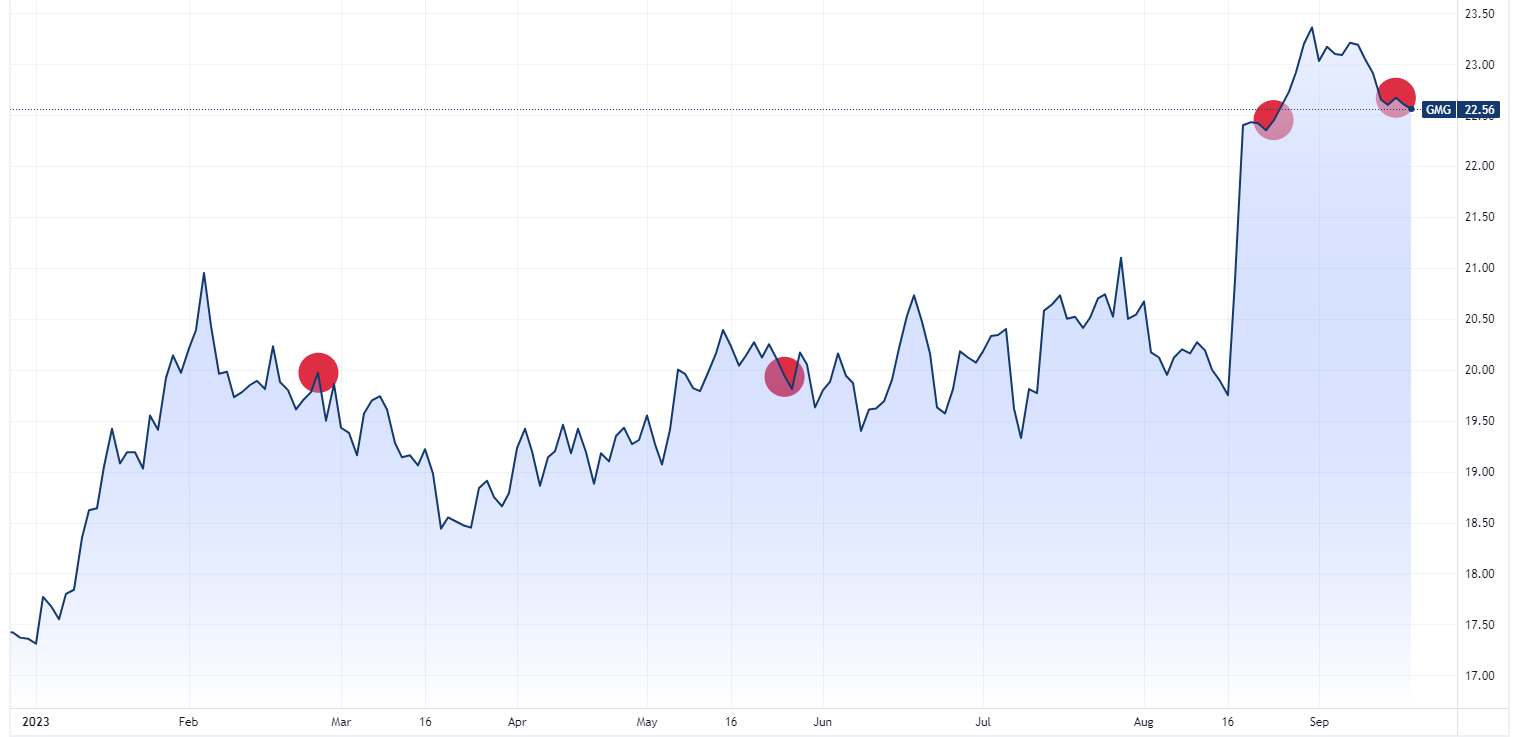

Goodman co-founder offloads some shares: Gregory Goodman has been the CEO and Executive Director of the company since 1998. He sold $19.1 million worth of shares, which reduces his exposure to:

- Direct shares: 0 (not including 3.4 million GMG performance rights)

- Indirect shares: 38.9 million

On 24 August, Goodman's Deputy Group CEO Anthony Rozic also sold $12 million worth of shares.

Historically speaking, we have seen both directors offload some shares post earnings. We've plotted all the major insider sells for 2023 below:

Source: TradingView

Top Insider Buys

Code |

Company |

Date |

Director |

Type |

Price |

Value |

|---|---|---|---|---|---|---|

Magellan |

12/09/23 |

Buy |

$9.47 |

$236,750 |

||

Santos |

12/09/23 |

Buy |

$7.82 |

$156,400 |

||

Goodman Group |

08/09/23 |

Buy |

$23.20 |

$134,560 |

||

National Australia Bank |

13/09/23 |

Buy |

$29.04 |

$99,839 |

||

Bluescope Steel |

12/09/23 |

Buy |

$20.73 |

$99,482 |

||

Bapcor |

11/09/23 |

Buy |

$6.67 |

$50,025 |

||

Reliance Worldwide |

12/09/23 |

Buy |

$3.86 |

$46,437 |

Magellan's first insider buy: Magellan CEO David George bought 25,000 shares ($236,750) last week, which breaks a two-year dry spell for insider transactions. The last time an insider bought shares was in September 2021, where former CEO Brett Cairns bought 10,000 shares at $37.20 per share.

Magellan shares rallied 13.3% on the day of its FY23 results (18 August). The result was largely in-line with analyst expectations but operating expenses came out as a sizeable beat:

- FY23 opex of $121.3m vs. $125-130m guidance and Goldman Sachs expectations of $129.7m

- FY24 opex guidance of $95-100m vs. Goldman Sachs forecasts of $128.4m

Bapcor's post earning season buys: Bapcor has seen 8 buys since late February from insiders including CEO Noel Meehan and number of non-executive directors.

The stock dropped as much as 15% after February reporting season, in-line with broader market conditions (the ASX 200 fell around 9% between early February and late March).

Whereas the current set of buys have been rewarded, with the stock up around 6% since the start of September to a 7-month high.

This article was originally published for Market Index on Wednesday, 20 September 2023.

2 topics

6 stocks mentioned